Elevator pitch

To determine the full effects of taxation on income distribution, policymakers need to consider the impacts of tax evasion. In the standard analysis of tax evasion, all the benefits are assumed to accrue to tax evaders. But tax evasion has other impacts that determine its true effects. As factors of production move from tax-compliant to tax-evading (informal) sectors, changes in relative prices and productivity reduce incentives for workers to enter the informal sector. At least some of the gains from evasion are thus shifted to the consumers of the output of tax evaders, through lower prices.

Key findings

Pros

Understanding the effects of tax on the income distribution is a central concern of policymakers.

Standard tax incidence analysis does not adequately consider how tax evasion affects the distribution of income because the typical approach assumes that evaders keep all benefits.

Proper analysis of the incidence of tax evasion must recognize the general equilibrium effects.

Successful tax evasion may encourage others to enter the same occupation as the evader, and new entry will reduce the advantage of tax evasion.

Cons

Even research that incorporates general equilibrium adjustments omits some relevant issues.

No study has yet simultaneously explored the full range of general equilibrium adjustments, effects of agents behaving under uncertainty, and different degrees of competition and entry.

The administrative and compliance costs of taxation and other important considerations have not been fully studied for tax evasion.

Knowledge of the true incidence of taxes is incomplete.

Author's main message

Designing appropriate tax policies requires understanding the impact of tax evasion and its true effects on income distribution. Standard analysis assumes the main beneficiaries of tax evasion are the evaders. However, tax evasion causes broader market adjustments that affect income distribution. Any tax advantage from evasion diminishes as labor and capital move into the tax-evading sector and as competition and substitution possibilities in production increase. When tax evasion reduces some of the distorting effects of taxation, it can even increase the welfare of all households.

Motivation

A central concern of policymakers is the effect of taxation on income distribution. However, when individuals and firms cheat on their tax obligations through tax evasion (see Tax avoidance and tax evasion), that alters the true impacts of taxation, especially the income distribution effects. Yet most analyses ignore these impacts.

Tax evasion is central to fundamental issues in public economics. Its most obvious impact is to reduce tax collections, thereby affecting the taxes that compliant taxpayers face and the public services that citizens receive. Beyond the revenue losses, evasion leads to resource misallocation when people alter their behavior to cheat on their taxes, such as their choice of hours to work, occupations to enter, and investments to undertake. Governments have to expend resources to detect, measure, and penalize noncompliance. Noncompliance alters the distribution of income in arbitrary, unpredictable, and unfair ways. It affects the accuracy of macroeconomic statistics.

The standard analysis of tax evasion, based on [2], assumes that the offender keeps the evaded tax in its entirety and so is the sole beneficiary of tax evasion. However, this assumption is incomplete and misleading. The act of tax evasion sets in motion a range of general equilibrium adjustments (see General equilibrium versus partial equilibrium analysis), as individuals and firms react to the changes in incentives created by evasion. These adjustments lead to changes in factor and product prices, which generate movements in factors and products. All these adjustments affect the final prices of the factors and products that determine the true income distribution effects of tax evasion. A full analysis of the effects of tax evasion, and so of the incidence of taxation, must recognize and incorporate these general equilibrium adjustments. The failure of the standard approach to consider these effects leads to a wide variety of errors [3].

Once the general equilibrium adjustments are recognized, it is no longer obvious that the main beneficiaries of tax evasion are necessarily the individuals who engage in the evasion; indeed, they may not benefit at all. Because successful tax evasion generates immediate winners, comparable to a tax advantage generated by the tax laws, replication and competition through the mobility of factors and products should eliminate this advantage. This general equilibrium process of adjustment should affect the relative prices of factors and products as resources move into and out of the relevant activities, and these changes should eliminate or at least reduce the initial tax advantage of tax evasion.

Discussion of pros and cons

To anticipate the basic argument, consider the standard example of the individual who successfully evades the individual income tax. Now, suppose that successful evasion attracts other individuals into the same sector as the evader, driving down both wages and product prices. Then the ultimate beneficiaries are not the evaders but the consumers of the product or service produced in the evader’s sector. The true beneficiaries of successful evasion by, say, home care providers or day laborers are likely to be the consumers of these services, once market adjustments are recognized. The standard analysis of tax evasion ignores these adjustments and so gives a misleading or incomplete picture of the distributional effects of tax evasion [3].

The standard approach to tax evasion and some extensions

The originators of the standard approach to tax evasion applied the economics of crime model directly to tax evasion [2] (see [4] for a recent assessment). The basic model is essentially a portfolio approach in which a rational individual compares the expected utility of being detected and paying a penalty for tax evasion to the expected utility of being able to keep the evaded tax income. In this simple formulation, the successful evader is the exclusive beneficiary and keeps the entire gains [3].

However, the portfolio model and its many extensions assume that underlying “prices” (especially income in the simplest form of the model) are fixed and exogenous, and it ignores the broader economic context in which an individual makes the tax evasion decision, including how to spend the evaded tax income. This approach ignores market forces that work to eliminate the tax advantage created by evasion opportunities, as factors and products flow into and out of affected activities and thereby change both factor and product prices. These forces can be analyzed only in a general equilibrium framework [3].

Several studies have used a general equilibrium approach to examine tax evasion, but no single study has included all of the elements that are essential for a full analysis of the distributional effects of tax evasion (discussed below). One study uses a multiconsumer, multisector general equilibrium model to make qualitative and quantitative assessments of the effects of tax rate changes on evasion activity, relative output prices, and real tax revenues [5]. The study finds, for example, that higher tax rates drive resources out of the compliant sector into the evading sector if government consumes products from both sectors in the same proportion as households and if higher tax rates do not affect evasion costs. But if higher tax rates raise tax evasion costs for individuals who would otherwise comply and if government purchases are biased toward the compliant sector, then higher tax rates could lower tax evasion. Despite the many insights from this work, it is incomplete because it does not allow for uncertainty in individual evasion decisions.

Some other studies allow for uncertainty but have other missing elements. One study analyzes a model with two labor markets that offer differing evasion possibilities and looks at the effects of changes in tax, penalty, and audit rates on the allocation of labor across markets [6]. However, the study allows for labor markets but not capital markets and so cannot examine the full range of general equilibrium price and tax incidence effects that evasion may create, especially the effects of factor mobility on capital prices and the distribution of capital income.

Another study develops an expected utility model with two types of actors, evaders and compliers [7]. Individuals do not know the true audit rates but learn them over time by looking at the behavior of others. These information cascades are shown to explain the connections between a potential evader, the number of evaders caught in previous periods, and the total number of evaders. However, despite allowing for mobility between evaders and compliers, the study assumes that prices are not affected by this movement.

Pitfalls in the distributional analysis of tax evasion

The failure to consider all the general equilibrium adjustments invariably leads to incorrect conclusions about the incidence of tax evasion [3].

Empirical studies of tax compliance typically take the economic environment as fixed and unaffected by individual compliance decisions. This implicit assumption leads to a variety of errors. For example, a traditional exercise in public finance examines the progressivity or regressivity of a particular tax or of the entire tax system, and the study of the overall incidence of tax reform proposals is almost always part of the background work accompanying a reform. Frequently, findings are adjusted to take into account the impact of existing evasion, such as professionals who do not report income or unskilled workers who are employed in the informal (untaxed) sector of the economy. These adjustments are made under the assumption that the evading groups benefit exclusively and fully from the assumed tax evasion.

For example, a study using this type of analysis for Jamaica estimated the tax evasion that occurs through income underreporting and nonreporting and used these estimates to calculate the true burden of taxation [8]. However, because the study assumes that tax evaders retain all benefits from their evasion, the resulting estimates of the true burden of taxation are misleading. Similarly, another study of income tax reform in Jamaica posits that if labor income is more likely than capital income to be generated in the untaxed or informal sector, the existence of tax evasion makes the tax system more progressive [9]. However, this conclusion would be wrong if the advantages realized by workers get capitalized or competed away by market processes. For example, with easy labor entry in, say, the Jamaican tourism industry, it might not be undocumented workers in the sector who benefit from successful tax evasion but rather the consumers of tourism services, who benefit from lower prices for the services produced by workers who do not pay taxes.

Some essential elements of a model of the impacts of tax evasion

While these studies have added considerably to an understanding of the general equilibrium adjustments that occur with tax evasion, they do not fully address the main distributional effects. No single study has explicitly incorporated all of the elements that a model must have in order to capture these distributional effects.

What are these features? Three of them are particularly important and frequently neglected in the literature [3].

First, and most obviously, the model should be able to capture the potential general equilibrium effects of tax evasion that induce changes in the relative prices of factors of production and products. Any tax advantage from evasion will be reflected in expected factor income or firms’ expected profits; the potential mobility of resources, especially labor, will lead to the necessary price adjustments until the advantage is eliminated. This general equilibrium model should allow for differences in endowments and preferences, so that different groups may benefit differently from changes in relative prices.

Second, the model should incorporate uncertainty in an individual’s or a firm’s decision to evade taxes in at least one sector of the economy. This uncertainty may simply reflect tax evasion as an opportunity facing the agent. More broadly, it may reflect the possibility that at some point the agent may be subject to taxation.

Third, the model should allow for varying degrees of competition or entry across sectors, including the sectors in which tax evasion is prevalent. This includes factor mobility, such as labor in the case of income tax evasion; it also includes free firm entry, as in the case of sales tax or corporate income tax evasion. Mobility is critical for showing how much of the tax advantage is retained by the initial tax evaders and how much is shifted elsewhere through factor and product price changes.

A complete analysis of the incidence of tax evasion therefore requires the consideration of general equilibrium effects in a setting in which agents can differ in preferences and endowments, uncertainty is present, and mobility can vary across sectors. At one extreme might be a case of no shifting at all because, for example, there is no factor mobility or no free entry. In that case, successful evaders keep all unpaid taxes, and there are no changes in relative prices of factors of production or products as a result of the evasion activity. At the other extreme might be a case in which the tax advantage gets fully shifted because entry is unrestricted and the supply response is large enough to compete away any residual tax advantage. This could happen, for example, if there were a very elastic supply of potential taxpayers who had no choice but to work in the untaxed or informal sector.

Examples are the presence of a pool of unskilled laborers in a developing economy with limited opportunities for employment or of undocumented workers in a developed economy who also have limited opportunities. It is unlikely that these workers would be able to keep any tax evasion benefit from working in an informal sector. Instead, the likely beneficiaries are buyers of the products and services produced in the informal sector.

These guidelines are used in the following sections to illustrate weaknesses in several approaches that analyze the impacts of tax evasion in a general equilibrium framework.

Three approaches to general equilibrium modeling

This section presents three models from the author’s own work that use many of the essential elements for analyzing the general equilibrium effects of tax evasion. Nonetheless, the models are highly stylized, and they necessarily omit many relevant features. They maintain the basic features of the simplest general equilibrium model of tax incidence: factor substitution effects (the taxed factor bears more of the burden), factor intensity effects (the factor used intensively in the taxed sector bears more of the burden), and demand effects (consumers who purchase more of the taxed product bear more of the burden). These basic features determine the final pattern of the benefits of tax evasion.

A model with a single agent and no uncertainty

This study examines the impact of taxes that create an incentive for resources to flow from a tax-compliant official sector X to two tax-avoiding underground sectors: sector Y, whose activities are substitutes for those of the taxed sector, and sector Z, in which traditionally criminal activities take place, such as prostitution, gambling, and drug dealing [10]. Demand for the output of each sector is assumed to be a function of relative prices, and for simplicity all agents (including government) are assumed to have the same average and marginal propensity to consume each product. Each product is produced under competitive conditions with a linearly homogeneous production function that depends on the amount of capital and labor, which are assumed to be fixed in supply and perfectly mobile between sectors. Perfect mobility means that net factor returns must be equalized across sectors, adjusting for any risk premia in the untaxed sectors.

Since capital and labor in underground sectors Y and Z are assumed to be untaxed, there are only two taxes: a tax on capital and a tax on labor in the taxed sector X. Taxation of capital and labor in only some of their uses creates an incentive for resources to flow from the taxed sector (X) to the untaxed sectors (Y and Z). This movement has both allocative and distributional effects. The distributional effects are the focus here.

The crucial element of the model affecting the distributional effects is the assumption that the two untaxed sectors are labor-intensive. As a result, the taxation of labor and capital in the tax-compliant sector X generates general equilibrium adjustments that impose a greater burden on the factor used intensively in that sector (the factor intensity effect), which is capital. The model calibration, using US data, demonstrates that the tax rate is typically higher on capital than on labor, so the higher tax on capital relative to labor in sector X generates general equilibrium adjustments that always reduce the relative price of capital (the factor substitution effect). Finally, the movements of factors and products always increase the price of the product of tax-compliant sector X relative to the prices of the products of the two tax-evading sectors, thereby imposing a higher burden on consumers of product X (the demand effect).

The ultimate impact on the equity of the tax system then depends on how to evaluate the shift in the burden of taxation of labor and capital in tax-compliant sector X to capital and consumers in tax-avoiding sector X. For example, a typical simulation estimates that mobility lowers the price of capital relative to labor in 1980 by 41–55% over its initial price, depending on elasticities, raises the price of product X by roughly 50%, and lowers the price of product Y by about 2%, with both product price changes measured relative to the price of product Z. These results are largely robust to different model assumptions.

However, the model assumes a single representative agent, so it cannot fully examine the different distributional effects of the general equilibrium adjustments. It also does not allow for uncertainty in the agent’s decisions, preventing examination of the agent’s underlying tax evasion choices. Finally, there is the clearly unrealistic assumption that private agents and government have the same patterns of consumption for all products (legal and illegal).

A stronger model, but with constrained mobility and no provision for firm-level tax evasion

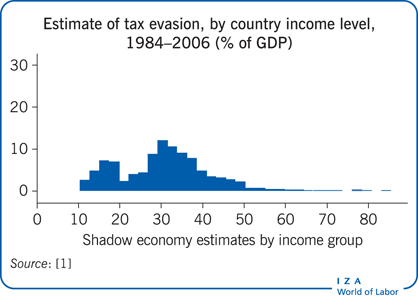

Some of these limitations are addressed in another general equilibrium model that describes a stylized small, static, closed economy with two consumers (poor and rich), two factors (labor and capital), and an official tax-compliant sector that produces output X and an informal, tax-evading sector whose output Y is a substitute for the taxed output [11]. The model incorporates the individual’s decision to evade and also allows for varying degrees of mobility through competition and entry across sectors. The focus is on measuring how much of the initial tax advantage from evasion is retained by income tax evaders and how much is shifted through factor and product price changes made possible by mobility. The model is calibrated with data reflecting the sectoral composition in a typical developing country.

Across all experiments, the tax evader is not the exclusive beneficiary of the tax evasion—and not even the largest beneficiary. The household that evades its income tax liabilities has a post-evasion welfare gain that is only 1.1–3.4% higher than its post-tax welfare would have been had it fully complied with the income tax. The household keeps only 75.3–78.2% of its initial increase in welfare, while the rest is competed away as a result of mobility that reflects competition and entry into the informal sector. The household that complies with income taxes experiences an initial negative welfare effect, but as a result of the reduction in the prices through competition and entry in the informal sector, its welfare increases 87.5–142.3%. Thus, the tax-evading household benefits only marginally, and the advantage diminishes with mobility through competition and entry in the informal sector. There are even some circumstances under which tax evasion increases the welfare of all households, because evasion reduces some of the distorting effects of taxation.

In short, at least some of the gains from tax evasion are shifted from the evaders to the consumers of their output through lower prices. As more workers enter the underground sector, their production pushes down the relative price of their output and consequently lowers their hourly returns; the movement of workers and capital between sectors also changes the relative productivity of workers in each sector. In equilibrium, the gains from evading taxes for the marginal entrant to the informal sector are offset by the relative price and productivity effects.

Despite some improvements over the simpler model described in the previous section [10], this model still does not incorporate all the essential elements: it does not fully allow for mobility, especially mobility that can be affected by the degree of competition in the production sectors, and it does not consider the potential for firm-level tax evasion.

A stronger model, but fails to consider individual evasion or to consider differential impacts across individuals

This model describes another stylized small, static, closed economy with an official taxed sector and an underground, tax-evading sector whose output is a substitute for the taxed sector output [12]. It also incorporates uncertainty and varying degrees of mobility across sectors. It differs from [11] by modeling tax evasion for a sales tax as well as a labor tax and by more explicitly incorporating different degrees of competition (perfect competition and a monopoly mark-up model). The focus is on measuring how much of the initial advantage from tax evasion is retained by the tax evaders and how much is shifted through factor and product price changes stemming from mobility.

Across various experiments, the benefits of income tax evasion remain with the evading sector and benefit the factor used more intensely there (labor) when there is little labor mobility. However, when the elasticity of substitution is increased to make factor inputs more like perfect substitutes, the benefits of evasion are competed away through replication and competition. Other scenarios (monopoly and sales taxation) tell much the same story. Overall, the benefits of evasion are replicated and competed away through entry or through the reallocation of factor inputs, depending on the relative competitiveness of the market. Industries in which one factor input is used more intensively than the other or in which there is market power, are able to retain the benefits of evasion.

While this approach is also an advance over the simpler model of [10], it does not consider individual evasion or allow for differential impacts across individuals.

Limitations and gaps

The three studies highlighted here are an advance over much of the previous work. However, each study has some limitations, and none incorporates all of the essential elements for the complete analysis of the distributional effects of taxes that policymakers need to inform their decisions. Specifically, no single study allows for the differential impacts on different groups of labor and capital owners required to account for all potential general equilibrium adjustments, requires agents to behave under uncertainty, and allows for different degrees of competition and entry across individuals and firms.

There are many possible extensions to this work, even aside from the usual sensitivity analyses. The underlying framework could be generalized to consider greater differences among taxpayers, a broader range of government activities, the impacts of an open economy, the potential for government corruption, and dynamic incidence factors. An important extension is to more fully incorporate expected and unexpected utility models of individual behavior. It would be interesting to examine whether traditional tax equivalences still hold in the presence of tax evasion, such as the presumed equivalence between a proportional income tax and a proportional consumption tax (with an equal rate on all products). Perhaps most important is the need to incorporate some other essential elements of the fiscal architecture, notably the administrative and compliance costs of taxation, as examined by [13]. All of these extensions are needed to provide policymakers with a complete analysis of how taxes affect the true distribution of income.

Rigorous analysis using a computable general equilibrium framework that sequentially layers different considerations until the full model captures all the relevant factors is needed to quantify (with a standard measure) the trade-offs that taxes necessarily create. Such analysis can indicate the areas where knowledge is incomplete and provide guidelines under specific country circumstances. Most relevant for studying the impact of tax evasion, it can provide vital information to policymakers on who actually benefits from tax evasion, information that is needed for the appropriate design of tax policies.

Summary and policy advice

Fully understanding how taxes affect the distribution of income requires accounting for how tax evasion affects factor and product prices. The standard analysis of tax evasion, which takes only a partial equilibrium perspective, leads to a wide variety of errors because it fails to capture the general equilibrium effects of factor and product mobility. Conclusions drawn from the standard approach are unsatisfactory because they ignore the fact that tax evasion is much like a legal tax advantage and therefore that replication and competition work to eliminate the advantage. The adjustment takes place through changes in the relative prices of products and factors of production, as factors move into and out of sectors.

Once the general equilibrium effects are appropriately modeled, it is typically found that the tax evader is not the exclusive beneficiary of evasion. Analyses indicate that any tax advantage from evasion diminishes with factor mobility into the informal sector, with greater substitution possibilities in production, and with more sectoral competition. There are even some circumstances under which tax evasion increases the welfare of all households, as evasion reduces some of the distorting effects of taxation.

The gains from tax evasion shift at least in part from the evaders to the consumers of their output, through lower prices, as general equilibrium changes in relative prices and productivity eliminate the incentive for workers to enter the informal sector beyond some marginal point. As more workers enter the informal sector, their production pushes down the relative price of the sector’s output and consequently the hourly returns of working in the sector. The movement of workers and capital between sectors also changes the relative productivity of workers in each sector. In equilibrium, the gains from evading taxes are offset by these relative price and productivity effects for the marginal entrant to the informal sector.

Additional extensions to the new general equilibrium models are needed, as described above, to provide policymakers with a complete analysis of how taxes affect the true distribution of income. More broadly, it is not possible for policymakers to understand the true impact of taxation without recognizing its general equilibrium effects, including the general equilibrium effects of tax evasion.

Acknowledgments

The author thanks three anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts. He is grateful to co-authors, Edward Sennoga and Sean Turner for their many contributions to his understanding of the distributional effects of tax evasion. The author is also grateful to Roy Bahl, Kim Bloomquist, Brian Erard, Erich Kirchler, Jorge Martinez-Vazquez, Michael McKee, Matthew Murray, Friedrich Schneider, Joel Slemrod, and Benno Torgler for many helpful discussions over the years. Previous work by the author, especially joint work with Keith Finlay [3], has been used extensively throughout this paper.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles and that no competing interests exist in relation to this paper.

© James Alm

Tax avoidance and tax evasion

Alm, J. “Measuring, explaining, and controlling tax evasion: Lessons from theory, experiments, and field studies.” International Tax and Public Finance 19:1 (2012): 54–77.