Elevator pitch

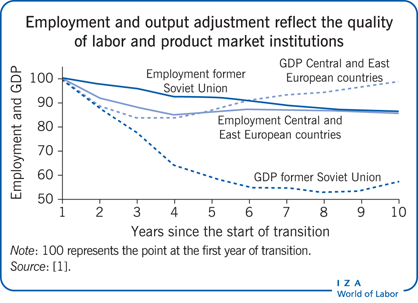

In the transition from central planning to a market economy in the 1990s, governments focused on privatizing or closing state enterprises, reforming labor markets, compensating laid-off workers, and fostering job creation through new private firms. After privatization, the focus shifted to creating a level playing field in the product market by protecting property rights, enforcing the rule of law, and implementing transparent start-up regulations. A fair, competitive environment with transparent rules supports long-term economic growth and employment creation through the reallocation of jobs in favor of new private firms.

Key findings

Pros

Entry of new firms boosts productivity growth in the transition from a command to a market economy.

Reallocation of market share from non-productive incumbents to dynamic new private firms may reduce employment in the short term but increases welfare in the longer term.

Sound labor market institutions enable job creation by new private firms and job destruction in state-owned enterprises.

By spurring employment in the medium to long term, property rights protection and rule of law enforcement encourage the entrance and survival of more firms and the creation of more jobs.

Cons

It takes years to formalize and consolidate property rights protection and rule of law.

In a weak institutional environment, the entry of small firms, which create most new jobs, is impeded by incumbent firms acting in collusion with state and local governments.

New firms’ entry rates in transition economies are comparable to international standards, but survival rates are lower in weak institutional settings.

Transition economies in the former Soviet Union trail others in labor market institutions, property rights protection, and rule of law enforcement, slowing long-term economic growth.