Elevator pitch

In the transition from central planning to a market economy in the 1990s, governments focused on privatizing or closing state enterprises, reforming labor markets, compensating laid-off workers, and fostering job creation through new private firms. After privatization, the focus shifted to creating a level playing field in the product market by protecting property rights, enforcing the rule of law, and implementing transparent start-up regulations. A fair, competitive environment with transparent rules supports long-term economic growth and employment creation through the reallocation of jobs in favor of new private firms.

Key findings

Pros

Entry of new firms boosts productivity growth in the transition from a command to a market economy.

Reallocation of market share from non-productive incumbents to dynamic new private firms may reduce employment in the short term but increases welfare in the longer term.

Sound labor market institutions enable job creation by new private firms and job destruction in state-owned enterprises.

By spurring employment in the medium to long term, property rights protection and rule of law enforcement encourage the entrance and survival of more firms and the creation of more jobs.

Cons

It takes years to formalize and consolidate property rights protection and rule of law.

In a weak institutional environment, the entry of small firms, which create most new jobs, is impeded by incumbent firms acting in collusion with state and local governments.

New firms’ entry rates in transition economies are comparable to international standards, but survival rates are lower in weak institutional settings.

Transition economies in the former Soviet Union trail others in labor market institutions, property rights protection, and rule of law enforcement, slowing long-term economic growth.

Author's main message

In the initial stage of transition, countries adopted labor market policies to tackle the soaring unemployment that accompanied the reallocation of workers and transfer of property rights from the state to the private sector. In the second phase, countries needed to focus on strengthening competition and property rights to enable long-term economic and employment growth. Product market institutions such as fair entry regulations and sound competition laws allow new firms to enter and then to expand. Central and Eastern European economies have scored much better than the economies of the former Soviet Union in shaping both types of institutions.

Motivation

The transition economies of Central and Eastern Europe and the former Soviet Union underwent a massive transformation of their economies in the 1990s and 2000s as they restructured from a command economy to a market economy. The patterns of job destruction in state enterprises, job creation in new firms, and job reallocation from failing and privatized state enterprises to the growing numbers of new private firms differed in these two groups of countries, reflecting differences in the nature and timing of institutional reforms in labor and product markets [2].

During the initial phase of the transition in the 1990s, these economies experienced a steady net destruction of jobs and rising unemployment. State enterprises were closed or converted into privatized but often still inefficient firms. Many would-be entrepreneurs had difficulty overcoming the obstacles to setting up a new business, while those who succeeded were unable to flourish in an institutional environment where competition laws and business contracts were weakly enforced. Labor market institutions were developed to help the unemployed find new jobs and support themselves in the meantime. In the second phase of transition in the early 2000s, deeper institutional reforms were needed to enable new private firms to become established and prosper, including protection of property rights, establishment of the rule of law, and promotion of financial development. Net employment growth and economic expansion rewarded the economies of Central and Eastern Europe, which implemented these reforms, while employment and growth stalled in the economies of the former Soviet Union, which have yet to create these institutions [3], [4], [5], [6].

Discussion of pros and cons

The transitional recession

In the early phase of transition in the 1990s, the creation of new private firms had a tremendous impact on labor market institutions and on job creation as well as job destruction [1]. To facilitate job reallocation, governments in some transition economies focused on creating good labor market institutions in this early phase. For countries that introduced the right reforms, this restructuring resulted in a brief period of high unemployment and low growth, known as the “transitional recession,” that was followed by high employment creation in the medium to long term. In countries that failed to reform their labor market institutions, employment growth slowed.

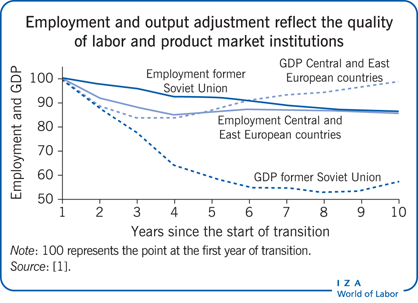

The dynamics of labor and output differed considerably in the Central and Eastern European economies and in the economies of the former Soviet Union. In Central and Eastern Europe, economies underwent real labor adjustment through high dismissal rates from inefficient incumbent state enterprises while maintaining relatively stable wages. In the economies of the former Soviet Union, the opposite happened. There was a sharp nominal adjustment in wages and a milder decline in employment, with little real labor adjustment. After about the mid-1990s, the more favorable labor market institutions in Central and Eastern European economies enabled much quicker employment growth than in the economies of the former Soviet Union (see the Illustration).

The process of creative destruction

In any economy, new firms need to enter the market to spur competition and productivity and ultimately to increase employment. Beginning with Schumpeter in the 1930s and 1940s, there is a vast literature on the role of entrepreneurial activity in generating wealth through a process of “creative destruction” [7], [8]. The productivity increases underpinning these processes can be decomposed into three distinct channels:

Firm entry and exit: As less productive firms shut their doors, more productive ones open theirs.

Reallocation across firms: More productive firms expand market shares at the expense of less productive ones.

Productivity growth within firms: Existing firms boost their productivity, through innovation and efficiency gains.

All the transition economies in Central and Eastern Europe and the former Soviet Union initially registered a massive drop in economic activity as the old state sector shrank dramatically and new private sector activity emerged slowly. In this phase, while ownership reallocation was under way, the important channels leading to an increase in productivity were firm entry and exit and reallocation of labor across firms. Only in the second phase would productivity growth within firms start to play an increasing role. This was all historically uncharted territory for these countries, because a genuine entrepreneurial culture was missing.

The reallocation of market share

To understand the progression in transition economies, first consider several general findings from the empirical literature on entry of new firms in countries across the world [9]. There is a remarkable difference between firm entry rates and market penetration rates, which also take a firm’s market size into account. When a new company enters a market, it incurs sunk costs, which are unrecoverable and proportional to the size of entry. Therefore, new companies tend to be small in order to minimize the sunk costs and reduce their risk since a company would lose fewer assets in case of a complete failure. Only later, if the company is successful, can it increase its market penetration. Entry and exit rates show similar patterns across industries, but rates of successful market penetration vary considerably. The entry of new firms is highly correlated with the exit of incumbent firms. Net entry is a tiny fraction of gross entry, and the survival rate of new firms tends to be low [8]. Entry is more common for start-ups, but these firms are less successful than firms that enter through such processes as mergers and acquisitions.

How does the experience in transition economies match up to these general findings on new firm entry across other economies? As expected, compared with industrial countries in the 1990s, transition economies registered a much larger role for creative destruction: new, smaller private and privatized firms expanded and generated jobs while larger, less productive state enterprises, with large market share, contracted. Because within-firm productivity growth was still muted at this stage [10], this combination of rapidly contracting large public firms and slowly emerging new small firms translated into a short-term drop in employment.

The quicker the process of ownership reallocation from the state sector to the private sector could be completed—a process that differs fundamentally from the market share reallocation that occurs regularly in developed economies—the more effectively the creative destruction mechanism would work and ultimately lead to higher growth. Transition economies had to close the private ownership gap and develop a solid base of private firms before they could enter the market competition phase and expand their market share. In other words, this initial phase of privatization and high unemployment was the first step in leveling the playing field for those countries in relation to market economies, spurring long-term economic and employment growth.

Sound labor market institutions

In the first phase of transition, firms’ entry was higher than firms’ exit, a result mainly of inertia within state enterprises [10]. In the economies of Central and Eastern Europe, employment growth was made possible during the rebound from the transitional recession by the introduction of favorable labor market institutions, such as unemployment support (passive labor market policies) and job search and training assistance (active policies). As a result, new private firms began to emerge and grow. In contrast, in the economies of the former Soviet Union, appropriate labor market institutions that could enable a dynamic labor market to develop failed to emerge. Thus, job reallocation remained anemic.

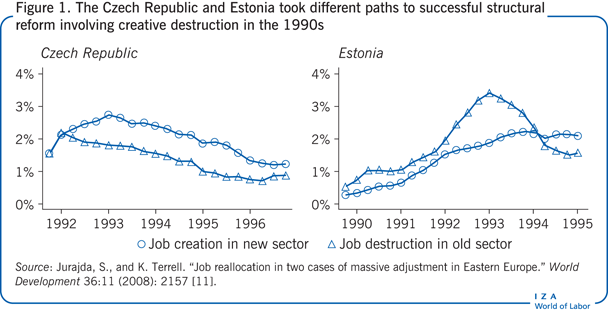

This massive structural reform needed in the labor markets of the formerly centrally planned economies required gradual job destruction in the old public sector, job reallocation to the nascent private sector, and buoyant job creation in private firms. Also vital were supportive labor market institutions that focused more on active labor market policies than on passive policies. This is the model followed in the Czech Republic [11]. Massive structural reform can also be accomplished more rapidly by fully opening product markets to competition and implementing loose labor market regulations (for example, with no barriers to dismissals and limited unemployment insurance). This approach initially entails higher unemployment and deep recession, but it enables job creation in the new private sector to catch up with and then surpass the rate of job destruction in the old state sector. This is the model Estonia followed [11], [12]. The different trajectories of job destruction and job creation in the Czech Republic and Estonia are shown in Figure 1.

Institutional reforms

In the phase of transition described so far, key reforms included dismantling the centrally planned economic system, imposing fiscal limits on governments and firms (“hard budget constraint”), stabilizing the macro-economy, liberalizing prices and trade, and—most important—allowing free entry of new private firms into the market [13]. This set of reforms was implemented in the initial years of transition at varying speeds in different countries. There was little to no focus on the institutional reforms needed to complete the transformation to a flourishing market economy—reforms in corporate governance, implementation of privatization, competition policy, financial sector regulation, and development of legal infrastructure.

These institutional reforms were introduced in the second phase of transition. Countries needed to protect property rights, ensure sound financial development, and establish rule of law to create a conducive environment to enable business activities to flourish. Fiscal discipline, market opening, and competition have fostered a culture of productivity growth over time. These institutions, through their positive impact on firm entry rates and competition (especially for new private firms), increased job reallocation by slowing job destruction and accelerating job creation, eventually leading to employment growth. The effects of this second type of reform will emerge fully only in the medium to long term, however, because institutions and new practices cannot be established overnight.

Formal rules take time to develop

There are large and persistent differences across transition economies in how thoroughly and how quickly they have implemented broader institutional reforms, such as easing business entry regulations, enforcing laws, enabling financial sector development, and establishing new business codes [13]. Even when state-controlled assets were transferred to private firms, many low-productivity incumbent firms continued to co-exist for many years with the new entrants, impeding their ability to boost productivity. The transition economies that succeeded in nurturing the institutions needed to create a level playing field and to establish and enforce property rights have unleashed the welfare-improving forces of creative destruction. Most of the countries in Central and Eastern Europe are in this group. In contrast, countries that have made only small changes in these competition-enhancing institutions in the product market have suffered from the long-lasting effects of low-productivity incumbent firms. Most of the economies of the former Soviet Union are in this group of countries, which have lacked the political and legal will to implement needed reforms.

The entry of new firms remained constrained in general in all transition economies, but in particular in the economies of the former Soviet Union, by industry-specific barriers such as preferential treatment of protected sectors and a lack of transparent and competition-driven industrial policies. The detrimental impact on economic growth and job creation was compounded by weak political and economic institutions, which may further enhance the market power of incumbents. One study that used the rate of firm entry, by industry, in developed countries as a proxy for each sector’s “natural” entry propensity found that regulations concerning the number of entry procedures and entry costs as a percentage of per capita gross national product can impede entry, especially of firms in naturally high-entry industries, such as computer services, communications, and some manufacturing industries [7]. Political and economic institutions can also affect the costs of setting up and running a business, as well as the likelihood that profits will be expropriated [3], [4], [5].

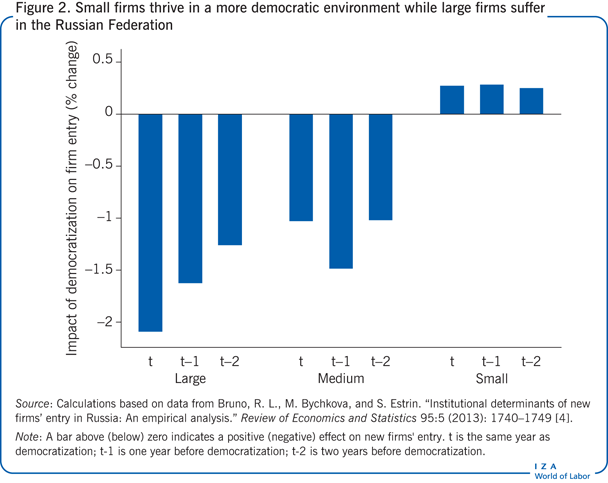

Small firms, which are the key drivers of job creation, are especially disadvantaged in trying to enter a market where the institutional environment is unconducive to new firms. Often, this hostile environment is a result of collusion between incumbent firms and state or local governments, which attempt to restrain competition to benefit long-entrenched firms at the expense of new firms attempting to enter the market. The Russian Federation, the largest country of the former Soviet Union, has a remarkably negative record of reform of competition policies and support for policies needed to create a business-friendly environment. Expansion of the private sector in Russia is adversely affected by non-democratic national and local political institutions, which systematically impede the entry of new firms, slowing long-term employment growth. When the effect of non-democratic political institutions is broken down by firm size, it becomes clear that smaller firms thrive in a relatively more democratic environment that protects property rights; put differently, non-democratic institutions tend to harm small businesses more than big ones (Figure 2).

The case of Russia is particularly revealing about the impact of the institutional environment on economic performance. An analysis of new firm entry into the market in response to different regional business environments (such as more or less democratically elected local governors) shows that high levels of formal regulation reduce new firm entry. They also encourage the emergence of informal business practices, such as tax evasion, weak corporate governance, and non-transparency in accounting practices. These findings indicate that the adverse effects of the political environment on the Russian business environment can be addressed only by installing truly democratically elected governments.

Firm entry and survival rates

Comparisons of entry rates across sectors and over time for recent years do not show stark differences between Central and Eastern European transition economies and more advanced economies. There is some evidence that a productive reallocation of both capital and labor resources from state enterprises to new private firms has taken place [5], [10]. However, the simple entry of new private firms does not necessarily generate more jobs, because many new firms fail. The institutional environment will shape the population of firms that survive in the market. An environment with weak institutions will let unproductive firms remain in business alongside more dynamic new firms, which will have a negative impact on jobs in the medium to long term. An environment with good supportive institutions will reward competitive firms and force large, inefficient incumbent firms to close or downsize to become more competitive. These forces will generate higher growth and employment over time.

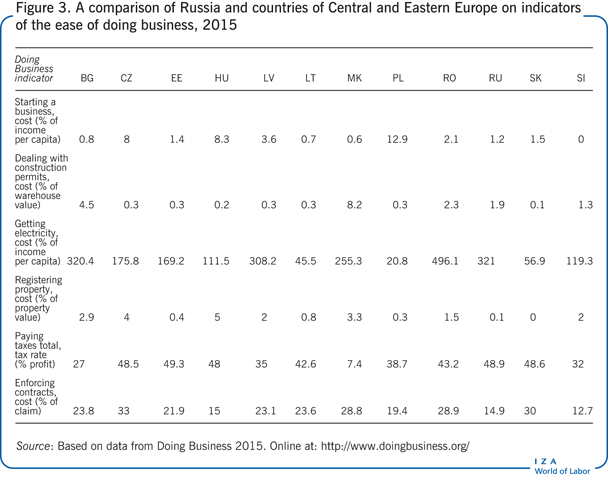

Effects on employment growth

The economies of Central and Eastern Europe appear to have developed good supportive institutions while the economies of the former Soviet Union have weak supportive institutions [3], [4], [5]. In that regard, the Central and Eastern European economies have benefited from their membership in the EU, which has helped them advance their reform agenda to improve their business environment in recent years. In contrast, the economies of the former Soviet Union seem to be stuck on a path of weak institutional reform. The World Bank’s Doing Business project provides objective measures of business regulations for local firms in 189 economies and selected cities. These show the differences between the business environment in economies in Central and Eastern Europe and in the former Soviet Union (Figure 3).

Limitations and gaps

The literature on the relationship between the entry of new firms and institutional development has begun to analyze how differences in institutions explain differences across countries in the entry rates of small private firms and their capability to generate jobs. In order to measure differences in institutions across countries and to improve the explanatory power of cross-country studies, measurements of institutions need to be harmonized across countries and over time. This is an area of cross-country research that needs to be expanded.

Moreover, cross-country studies need to take into account unobserved sources of heterogeneity, such as institutional variation, and their potential correlation with a variety of other country-specific factors (macro-economic policies, exchange rate factors and tariffs, and others) that are associated with differences in rates of firm entry across sectors. Doing this requires more individual country studies that examine the vast regional diversity in both formal and informal institutions in many transition economies.

Data quality and measurement are also a concern, particularly for the countries of the former Soviet Union. Most of the transition economies of Central and Eastern Europe have joined the EU, and these countries can now count on having more reliable statistics. By joining the EU, they are also much less affected by weak institutional infrastructure. However, for the countries of the former Soviet Union, reliable data on firm entry and exit are rare. In addition, researchers need access to matched employer-employee data—which link the data on labor and product markets—in order to explore the impact of firm turnover on job reallocation. Such matched data sets are also rare.

Summary and policy advice

Transition economies have undergone one of the most radical institutional transformations in recent history, having experienced a remarkable reallocation of ownership from the state to the private sector. The speed, efficacy, and mode of entry of new firms have been shaped by the institutional framework, initially (1990s) by labor market institutions and in a second phase (2000s) by enforcement of property rights and rule of law.

Different models of rule of law, vital to competitiveness and a level playing field, have emerged. The economies of Central and Eastern Europe seem to be converging on the Western European model of strong protection of property rights and ease of firm entry. As a result, firm entry and survival rates are much higher in Central and Eastern European economies than in the economies of the former Soviet Union. Weak institutions might limit job losses in the short term, but by retarding job reallocation from inefficient incumbent firms to more efficient new private firms, weak institutions result in slower growth and job creation in the longer term. Thus, the economies of the former Soviet Union are stuck in a “bad equilibrium” of excessive market power in the hands of incumbent firms and low-quality new entrants that tend to fail quickly.

For the slow-growing economies of the former Soviet Union, it is time to implement a set of sound rules for opening, running, and fostering business:

Protecting property rights and enforcing the rule of law should be at the top of policymakers’ agenda to improve the strength of the economy and the welfare of workers. Commercial law tribunals alongside regulatory bodies should be able to fairly and effectively apply the letter of the law, especially in situations where business contenders possess unbalanced assets, information, and power (for example, between big and small companies). Furthermore, minority shareholders in big companies should have full access to financial books, information, and board of directors’ decisions to monitor internal corporate governance.

Labor market policies such as unemployment benefits and income support schemes should be designed to help those who lose their jobs as a result of restructuring, in order to dampen the negative effects of increased unemployment. These passive labor market policies, meant to reduce the social costs of unemployment, should be properly designed to become progressively less generous (for example, after six months). Active labor market policies, such as job search and job training, are especially important to increase employment and stimulate growth by helping displaced workers acquire new skills.

To improve competition and facilitate the entry of new firms, governments should streamline regulations for business start-ups and replace anti-competitive laws and regulations with pro-competition laws and regulations. For example, regulation authorities should be very vigilant on cases of blatant abuse of market power when a limited number of firms raise the final product prices via collusion. In this case government should act swiftly in order to allow new firms to enter (for example, by allowing speedy and cheap licensing procedures). This in turn will translate to a transfer of the surplus from the producers to the consumers. In other words, dismantling or downsizing lobbies and cartels will have a welfare improving effect.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Randolph L. Bruno

Schumpeter’s concept of creative destruction

Source: Schumpeter, J. A. Capitalism, Socialism, and Democracy. 3rd edition. New York: Harper and Brothers, [1942] 1950; Part I, Chapter III, p. 31.