Elevator pitch

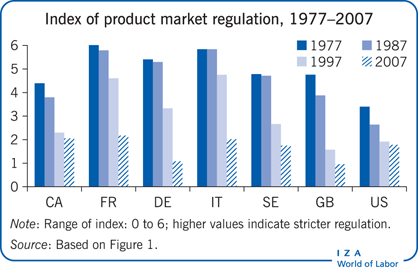

Most OECD countries have recently introduced product market reforms with the objective of lowering barriers to entry and increasing competition in many sectors, such as telecommunications, utilities, and transport. The timing and extent of regulatory reform have varied significantly, starting in the US in the early 1980s and in the mid-1990s in many European countries. Will these developments improve economic performance in terms of creating jobs, fostering investment, and encouraging innovations—all of which are important factors for policymakers?

Key findings

Pros

Pro-competitive product market reforms generate significant employment in OECD countries when labor market policies are tight.

Product market reforms generally lead to labor market reforms, enhancing the overall positive effect on employment.

Reducing entry barriers significantly increases the investment rate, which is important because investment often incorporates technologies.

Product market reform is likely to positively affect sectors that are close to the technological frontier, where incumbents, by innovating, can escape the threat of entry of new firms.

Cons

It may take time for the positive effects of product market reform on employment to be felt and short-term employment losses can occur, generating opposition to the reform.

With deregulation there are winners, but also losers. The concentration of losses may make reforms more politically difficult to implement.

Evidence on the effect of product market reform on innovation is mixed; in sectors that are far from the technological frontier (i.e. not technologically advanced), the reduction of expected monopoly profits can hinder innovation.