Elevator pitch

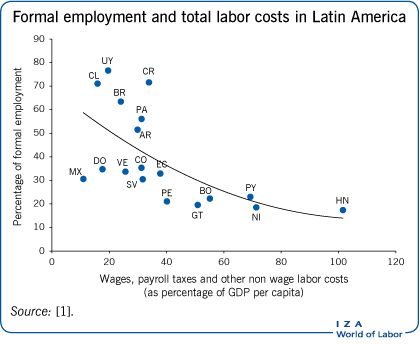

Informal employment accounts for more than half of total employment in Latin America and the Caribbean, and an even higher percentage in Africa and South Asia. It is associated with lack of social insurance, low tax collection, and low productivity jobs. Lowering payroll taxes is a potential lever to increase formal employment and extend social insurance coverage among the labor force. However, the effects of tax cuts vary across countries, often resulting in large wage shifts but relatively small employment effects. Cutting payroll taxes requires levying other taxes to compensate for lost revenue, which may be difficult in developing economies.

Key findings

Pros

Reducing payroll taxes can increase the share of formal jobs and reduce informal employment and/or unemployment, leading to positive impacts on social security coverage.

Part of the reduction in payroll taxes is shifted to higher wages.

Lower non-wage costs can increase employment of youth and low-wage/low-productivity workers.

A reduction in payroll taxes may have larger effects in developing countries with high minimum wages relative to income per capita.

Cons

In some countries, reducing payroll taxes has had no effects on formal employment.

Reducing payroll taxes can lead to lower tax collection if the positive effect of widening the tax base does not outweigh the loss of revenue.

When payroll taxes are lowered only for certain groups, regions, or industries, employment in the targeted groups may increase at the expense of non-targeted ones.

A reduction in payroll taxes will have less of an effect if skill gaps or geographical mismatches constrain the supply of workers to formal employment.