Elevator pitch

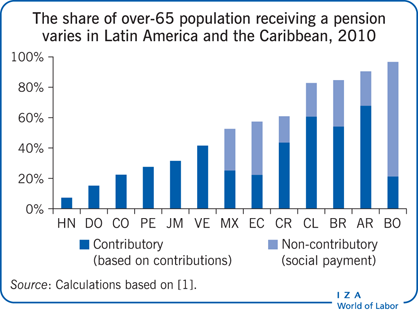

A large share of the population in emerging market economies has no pension coverage, exposing them to the economic risks arising from socio-economic and individual shocks. This problem, which arises from having large informal (unregulated) sectors, affects not only poor workers, but as many as half the newly or nearly middle class in some emerging market economies. With very little social protection coverage today, these workers will also be vulnerable in the future unless tax, labor, and social policies change to encourage formalization. While formalization would require substantial resources in the short-term, it seems financially sustainable.

Key findings

Pros

Formality can be fostered with stronger monetary and non-monetary incentives, backed with new technologies.

Substantial resources would be needed in the short-term, but formalization seems financially sustainable and could avoid future financial pressures arising if reforms are ignored.

Increasing formality through pension contribution subsidies and new savings channels would increase saving, notably among the middle class, and boost growth and equity.

Involving the emerging middle class in pension reform might ease the challenging political-economy obstacles.

Cons

If subsidies fail to move a substantial share of low- and middle-income workers into the formal economy, they would be regressive.

With multiple competing uses for scarce public resources and the high visibility of other pro-poor programs, there might not be adequate support for formalization policies.

Some pension reforms risk creating parallel schemes that can discourage formalization.

Too little is known about the effectiveness of monetary and non-monetary instruments in emerging market economies, so reforms should embed evaluation mechanisms.