Elevator pitch

Rising life expectancy and the growing fiscal insolvency of public pension systems have prompted many developed countries to raise the pension entitlement age. The success of such policies depends on the responsiveness of individuals to such changes. Retirement has increasingly become a decision made jointly by a couple rather than individually by one partner. The empirical evidence indicates that almost a third of dual-earner couples in Europe and the US coordinate their retirement decision despite age differences between partners. This joint determination of retirement has important implications for policies intended to reduce the burden of pension costs.

Key findings

Pros

Risks of insolvency of public pensions systems have prompted several governments to adopt measures to raise official retirement ages.

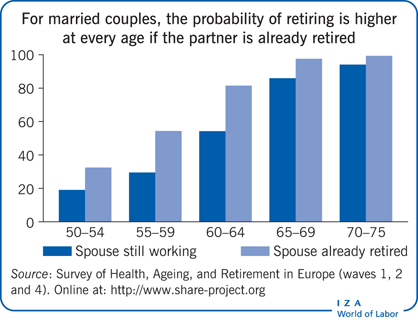

Nearly a third of dual-earner couples in Europe and the US coordinate their retirement, independently of the age difference between spouses.

The rising participation of women in the labor market increases the fiscal impact of the phenomenon of joint retirement.

A preference for shared leisure may increase the probability of partners retiring close in time.

Early labor market exits by women whose husbands have retired may increase inequality and reduce economic well-being among the elderly.

Cons

Raising the official retirement age may not reduce the fiscal burden if one spouse’s retirement encourages the other spouse to retire early.

Raising the statutory retirement age has a positive direct effect on female participation but a negative indirect effect on women who leave the labor market together with their husbands.

In some developed countries, gender differences in official retirement ages still persist.

One spouse may leave the labor market to take care of a sick partner or may postpone retirement to cope with increased medical expenses in old age.