Elevator pitch

Informal firms make up a major share of the economy in most developing countries. Expanding formalization could increase government tax revenues, boost firm profits and national income, and increase employee well-being by improving access to social security and health and workers’ benefits. Reforms to encourage firms to register include simplifying procedures, reducing the cost and time to register, and making more information available on registration procedures. Reforms might not result in higher registration and formalization. In some cases, better enforcement and wider development policies might be needed as well.

Key findings

Pros

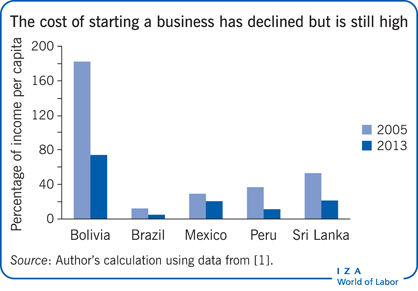

Firms can be encouraged to register by providing more information about how to register and by reducing the cost and time it takes to register.

Formalization helps firms get access to formal credit, comply with the law, and avoid paying fines.

Formalization can boost tax revenues.

Formal firms can more easily increase production and employment, moving to a larger, more efficient scale of operation and potentially bringing in higher revenues and profits.

Cons

Registration reforms may not prompt firms and employees to formalize.

Small-scale firms and workers with low skill levels may find that the cost to become formal is still too high for them to register.

Paying taxes might be perceived as a drawback to workers and firms, so formalization and tax revenues might not increase.

Enforcement might have a larger impact on registration than registration reforms.

Other barriers to registration might need to be addressed.