Elevator pitch

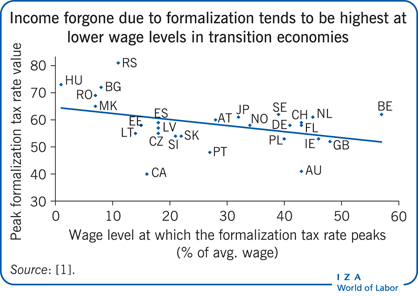

Evidence from transition economies shows that formal work may not pay, particularly for low-wage earners. Synthetic measurements of work disincentives, such as the formalization tax rate or the marginal effective tax rate, confirm a significant positive correlation between these measurements and the probability of informal work. These measures are especially informative for impacts at lower wage levels, where informality is highest. Policymakers who want to increase formal work can use these measurements to determine optimal labor taxation rates for low-wage earners and reform benefit design.

Key findings

Pros

Synthetic measures of taxes and benefits show the share of informal income that is lost when workers are formalized. They help quantify disincentives to formalization.

The tax wedge depicts certain costs in income forgone as a result of formal work, such as taxes and social security contributions.

The marginal effective tax rate is better than the tax wedge at capturing the relevant costs of formal work.

The formalization tax rate combines both the tax wedge and the marginal effective tax rate.

To increase formal work, policymakers can use synthetic measures to improve taxation at lower wage levels or reform benefit design.

Cons

Synthetic measures are purely based on legal obligations and claims for formal work.

Presently, entitlements of formalization cannot be properly valuated and included in disincentive measures.

Studies of tax and benefit systems currently focus on legal obligations and programs only at the national level.

Country comparisons often present the tax wedge for average-wage earners. However, accounting for low-wage earners may be better suited for developing countries with high rates of informal employment.