Elevator pitch

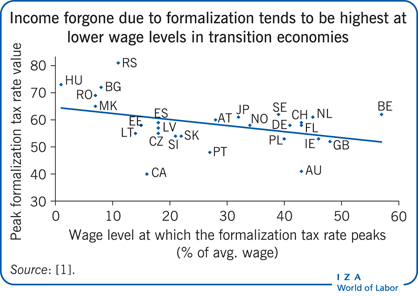

Evidence from transition economies shows that formal work may not pay, particularly for low-wage earners. Synthetic measurements of work disincentives, such as the formalization tax rate or the marginal effective tax rate, confirm a significant positive correlation between these measurements and the probability of informal work. These measures are especially informative for impacts at lower wage levels, where informality is highest. Policymakers who want to increase formal work can use these measurements to determine optimal labor taxation rates for low-wage earners and reform benefit design.

Key findings

Pros

Synthetic measures of taxes and benefits show the share of informal income that is lost when workers are formalized. They help quantify disincentives to formalization.

The tax wedge depicts certain costs in income forgone as a result of formal work, such as taxes and social security contributions.

The marginal effective tax rate is better than the tax wedge at capturing the relevant costs of formal work.

The formalization tax rate combines both the tax wedge and the marginal effective tax rate.

To increase formal work, policymakers can use synthetic measures to improve taxation at lower wage levels or reform benefit design.

Cons

Synthetic measures are purely based on legal obligations and claims for formal work.

Presently, entitlements of formalization cannot be properly valuated and included in disincentive measures.

Studies of tax and benefit systems currently focus on legal obligations and programs only at the national level.

Country comparisons often present the tax wedge for average-wage earners. However, accounting for low-wage earners may be better suited for developing countries with high rates of informal employment.

Author's main message

Disincentives to accepting a formal job often outweigh the incentives. Evidence from transition economies shows a significant positive correlation between measures of disincentives for formal work and the incidence of being informal. The formalization tax rate and the marginal effective tax rate are useful measures. The higher these measures are, the more likely especially low-wage workers will be informal. The tax wedge is an alternative measure; however it fails to adequately capture disincentives. To design policies that encourage formalization, policymakers need measures that help them understand the disincentives associated with formal work.

Motivation

Informal work is an integral part of the world of labor. In developing countries, it is often a substantial source of employment, production, and income. However, it comes with several undesired economic and social outcomes. In informal work, economic activities are undeclared; this lowers competitiveness and growth, renders incomplete the coverage of labor regulations and programs, weakens social cohesion, and is fiscally detrimental. These disadvantages may outweigh informal employment’s prospective positive contributions to job creation and poverty reduction.

Defining informal employment is complex. The detailed international statistical definition [2], [3] describes it as “the total number of informal jobs, whether carried out in formal or informal sector enterprises, or households, during a given reference period.” The definition comprises own-account workers, employers who own informal-sector enterprises, contributing family workers, members of informal producers’ cooperatives, or employees in informal jobs. From a legal perspective, these workers do not report their labor income or remit social security payments and personal income taxes.

Due to data limitations, this international definition cannot be used to identify informal self-employment in analytical work. Instead, a definition that relies on productivity (output in goods and services, per hour, per unit of labor) can be applied, although it is less precise. According to this definition [4], all employers who are not in formal professions (i.e. law, finance, engineering, architecture, etc.) and employ up to five or even no workers are considered informal. As a consequence, estimates of informality rates can be higher, particularly for the self-employed. However, analyzing subsamples of employment with and without the self-emloyed shows no particular difference [1]. The definition used to identify informal self-employment for synthetic measurements, therefore, does not conflict with the results of the internationally accepted definition for employees.

Labor taxation and the design of social benefits have received increased attention. Synthetic measurement approaches can be used to assess taxation and social benefits as both incentives and disincentives for informal workers to transit to formal employment. These measurements include the tax wedge, which measures the total labor costs that are taxed away when a worker or employer moves from informal to formal work; the marginal effective tax rate (METR), which measures the share of any increment in formal income that is taxed (changes in personal income tax, social security contributions, and benefit withdrawal); and the formalization tax rate (FTR) which measures the total costs associated with transiting from informal to formal work, including lost social security payments and family and housing benefits. Different work transitions and associated incentives and disincentives matter to varying degrees, depending on the labor market and country context. The research presented here focuses on transitions from informal to formal employment. It shows how measurement approaches can be used to identify incentive and disincentive effects of tax and benefit systems.

Discussion of pros and cons

Workers or employers might decide to not register their activities for several reasons. Regulations in the product and labor market, such as product licensing, employment protection legislation, and minimum wages, might be too stringent. Certain administrative procedures related to paying taxes, keeping accounts, and completing statistical questionnaires might deter people from operating in the formal sector. Workers and employers might want to avoid paying taxes on revenues, income, profits, or property, and social security contributions. Formal income might lead to a withdrawal of social benefits, such as social assistance or unemployment benefits, so that people might prefer informal, or no work, over formal work. Finally, weak enforcement of existing legislation on regulations and taxation might lower the risk of getting caught when circumventing these obligations [1].

Measurement approaches of the incentives and disincentives posed by labor taxation and social benefit design shed light on the question of whether it is actually prudent for the working-age population to engage in formal employment, register their activities, and pay taxes and contributions on income generated. This question is particularly relevant for policymakers who want to increase work formalization and quantify the disincentives workers face in this process. Measurements of incentives and disincentives can help the design of taxation and benefit systems, identify constraints, and lead to an understanding of whether these constraints are binding. In contrast, disregarding the issue of measurement will likely result in failed formalization policies because policymakers would not know whether formal work actually pays off, particularly at the lower end of the wage spectrum.

Different measurements

A first approach to this measurement issue would be to estimate the income forgone (or the disincentives) due to transiting from informal to formal work. Given the complexity of tax and benefit systems and the lack of direct measures, synthetic measures could be the preferred solution. The METR, the FTR, and the tax wedge are called synthetic because there is no straightforward way of measuring these concepts of work incentives and disincentives. These measures indicate what individuals are legally required to pay in taxes and social security contributions, and disregard the actual payments made. That is, these approaches look at taxes and benefits [5], [6] and can indicate the share of informal income that would be taxed away from individuals when being formalized, making it possible to estimate incentives and disincentives of formalization policies for workers and closely examining certain target groups, such as low-wage workers.

Each of the three measurements offer different approaches to quantifying disincentive effects. The tax wedge focuses on taxation; the FTR incorporates a broader set of reasons to forgo income; and the METR concentrates on the effect on income increments while also considering a wider set of reasons to forgo income.

The tax wedge

The tax wedge is the difference between the worker’s net pay (gross pay, minus deductions for taxes and social security contributions) and the employer’s total labor costs (employee’s wages plus the employer’s share of remittances for social security contributions). The tax wedge is zero in an informal work arrangement because neither the worker nor the employer pay taxes or contribute to social security. The income the worker receives for his or her labor is then equal to the employer’s total labor costs. Governments receive no payments.

The tax wedge is an approximate measure of total labor costs; it is often used to understand the incentives for informal employment. It expresses the monetary benefit of informal work for both workers and employers. That is, it shows how much more income informal workers earn and how much less informal employers pay for their labor than they would in formal employment. While it does not provide any indication on how this benefit is shared between workers and employers, it helps quantify the income forgone in formal work arrangements.

Social benefits

Social benefits are an important component of the income forgone from transiting to formal work. The threat of a withdrawal of these benefits may have a major influence on the decision between formal and informal work, particularly among individuals with lower earnings potential. Imagine an informal worker who receives a certain informal wage; employed in a formal work arrangement, the same worker and his employer would be subject to different types of costs that would be calculated as income forgone. Let us assume that labor in either type of work is equally productive, and, therefore, the total labor costs of both types of worker are identical. For the informal worker, the informal wage corresponds to the total labor costs. Were the same individual to be a formal worker, the total labor costs would be the sum of the net wage, the personal income tax, and the social security contributions paid by both the worker and the employer—in other words, the net wage plus the tax wedge. A comparison between the worker’s informal and formal wage shows that the tax wedge constitutes the cost of the formal work arrangement for both the worker and the employer, i.e. it is the amount of income the informal worker would give up by working at the same job for the same pay and the added cost the informal employer would incur by registering in the formal sector.

The tax wedge accounts for only part of the income forgone due to work formalization; also at risk is the withdrawal of income-tested benefits, particularly those related to housing and family or social assistance. When a worker accepts a formal job offer, these benefits can be fully or partially withdrawn. Thus, withdrawn benefits also need to be included in the calculation of the forgone income from work formalization [1].

Entitlements

The loss of entitlements is another cost of transiting to formal work. Unlike taxation and the withdrawal of social benefits, entitlements can be a strong factor that favors formal work in the decision-making process. When accepting a formal job, workers often obtain immediate or future rights to different types of entitlement, ranging from health, disability, and unemployment insurance, to old-age pension entitlements or other particular compensations. These benefits may need to be fully, partially, or not at all accounted for in the forgone income, depending on whether they are equally accessible to informal workers [7], [8].

Health insurance and old-age pensions are the most prominent of these entitlements. However, their valuation is often strongly discounted due to time-related factors, such as having to reach a certain age before receiving them. This phenomenon seems to be particularly pronounced among low-wage earners, a group traditionally more prone to accepting informal work and the lack of benefits this entails [9]. Workers at the lower end of the income distribution—especially the poor—tend to discount future payouts more as their situations compel them to focus on the challenges of day-to-day living. Furthermore, means-tested payments such as social pensions may additionally reduce the valuation of an entitlement to an old-age pension. Likewise, in developing economies, where institutions are often unstable and trust is low, people will reduce the valuation of prospective future payouts because they cannot necessarily count on receiving them. Also, the usually highly valued access to health insurance, in the case of formal work, is often free in transition economies, which further reduces the entitlement valuation.

At this juncture, there exists no viable measurement concept that appropriately quantifies the value workers assign to these entitlements. This applies to both immediate- and long-term social security benefits and less tangible entitlements, such as those related to employment protection legislation [1]. This finding points to an important deficiency that must be taken into consideration when measuring disincentives for formal work.

The formalization tax rate (FTR)

For an informal worker, the value of potential gains from accepting a formal job must surpass the income forgone due to formalization. When workers place greater value on the prospective social security benefit claims or employment protection over the costs involved in transiting from informal to formal employment, this gain can be seen as the positive residual after accounting for the costs. The FTR approximates this implicit cost of formalization to the informal worker. It constitutes a share of the worker’s informal income and measures the difference between the total informal income and the formal income net of deductions. The total informal income comprises the informal wage, and the social assistance and family and housing benefits that are received when no formal wage is declared. The formal income net of deductions includes the net formal wage, in-work benefits [10], social assistance, and family and housing benefits at the respective formal (qualifying) wage [1]. At some wage level, workers will not qualify for some or all of these social benefits.

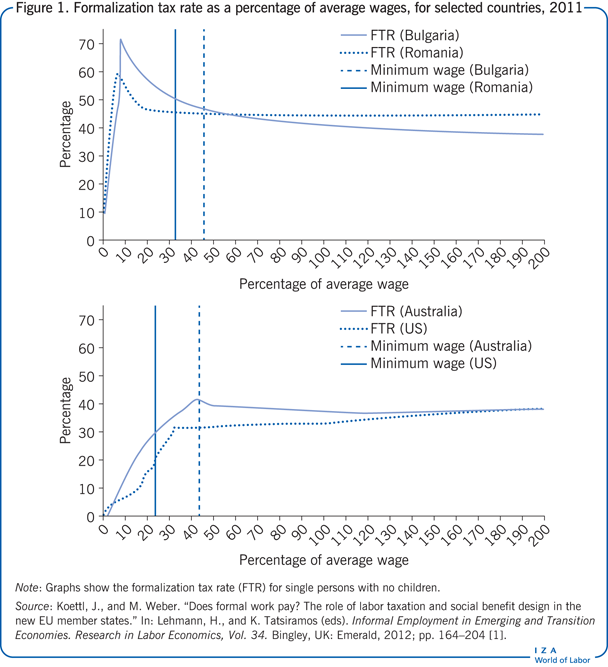

Figure 1 illustrates the FTRs in Bulgaria and Romania, two transition economies, and contrasts these with the FTRs in Australia and the US, two high-income economies. The figure shows that the FTR is higher at lower wages in the transition economies than in the two high-income countries. For an individual who lives in a single household, and has no children, the FTR reaches its peak at about 60% in Romania and 70% in Bulgaria. Following these results, the FTR derived for Romania shows that an informal worker, with no children, living in a single household, and earning slightly below 10% of the average wage would have to forgo about 60% of his or her informal wage in the case of work formalization. The FTR reaches its peak at about 10% of the average wage for these two countries. In Australia and the US, by contrast, the highest FTRs are at about 40% and 30%, respectively. Furthermore, these values are reached at higher wage levels than in the case of the two transition economies. They peak at about 45% and 30% of the average wage for the two high-income countries.

The FTR is also a synthetic measurement that rests on legal provisions for taxes and social benefits. It compares the change in the net income of an informal worker and the formal income the same individual would be theoretically earning in formal employment. The implied challenge to this approach is to derive the net formal income of the originally informal worker or his or her formal work twin. From the employer’s perspective, the two workers are not equal because of their equal gross wage, rather, because their total labor costs are equal. This implies that the output from each unit of their labor is the same. Thus, the comparison should be between the informal worker’s wage and the formal worker’s total labor cost rather than the (gross) wage. Therefore the net income of the formal worker must be net of the income tax and social security contributions both the worker and the employer pay but include the benefits the formal worker could claim (based on the formal gross wage).

The interpretation of the FTR is then as follows. The employer presents the informal worker with the possibility of formal employment. So far, the worker has claimed benefits under the assumption of “no income,” due to the informal work arrangement. Next, the employer and worker discuss the future income net of taxes and social security contributions; they also bear in mind the prospective changes in terms of benefits received. The FTR captures all of these considerations: It measures to what extent the payout to this individual worker would vary in the case of formalization, incorporating personal income taxes, social security contributions, and net (loss or gain in) benefits.

The marginal effective tax rate (METR)

The METR is a related synthetic measure that can lend to an understanding of disincentives to formal work. It describes at any given wage the share of any increment in formal earnings that is taxed; this incorporates changes in the personal income tax, social security contributions, or benefit withdrawal. As a measure, the METR captures to what extent it pays to earn more formal gross income through either earning higher wages or working more hours [5]. As with the other two synthetic measures, the METR is founded on the legal provisions of employment earnings and not on actual data on personal income taxes or benefits received.

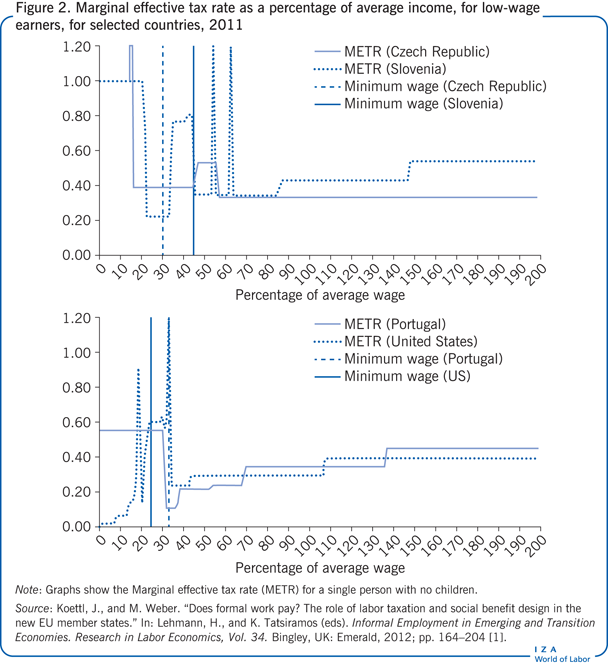

Figure 2 shows a comparison between the METR for the Czech Republic and Slovenia, and Portugal and the US. As in many other countries, in the Czech Republic and Slovenia every wage increment is fully deducted from potential social assistance claims at lower levels of labor income. This leads to an METR of 100% and can be observed, on the left panel of the figure, at about 20% of the average wage. In contrast, in Portugal the potential claim is reduced by only 50% for every wage increment at this low-wage level, while the US has an even lower METR. Thus, as measured by the METR, the disincentives for formal work are much higher in the Czech Republic and Slovenia than in Portugal and the US. In the US this is largely due to tax credits and in-work benefits for low-wage earners.

Labor market transitions and measurements

Both the FTR and METR can be used to indicate disincentive effects of labor market transitions from informal to formal employment. The METR can also indicate the effects of adding more working hours, i.e. moving from part-time to full-time work, as it measures the share of the additional gross income that is taxed. The average effective tax rate (AETR) and the net replacement rate (NRR) are two further synthetic indicators that help to understand the incentives for workers to transit to or from formal employment. The AETR measures the share of the formal gross income, including in-work benefits, that is taxed or the benefits forgone in the case of a formal job acceptance. Forgone benefits include social assistance, and family, housing, or unemployment benefits. Knowing their amounts can shed light on the incentives and disincentives of moving from unemployment or inactivity to formal employment. In turn, the NRR expresses the share of net income that is replaced by benefits when a worker loses or ends formal employment. Therefore, the NRR can be used as an indicator for the incentive and disincentive effects of transiting from formal employment to unemployment or inactivity.

Synthetic measures in practice—Do they actually matter?

In many European transition economies, taxes on labor income are relatively high at lower wage levels. This may already be hinted at in country comparisons where the tax wedge is used. Nevertheless, it remains an incomplete measure. While it expresses taxes, social security benefits, and the income forgone from formal work, it fails to capture other financial losses, namely the loss of income-tested social benefits, such as social assistance, and housing and family benefits. This shows that it is not precise enough. Synthetic measures also need to take the withdrawal of benefits into account. The FTR and the METR compensate for this shortcoming and are thus better disincentive measures. They are also positively correlated with informal employment in transition economies, particularly at lower wage levels where informality rates are highest [1].

The Illustration shows that workers in many transition economies face high disincentives for accepting formal work and these disincentives are highest for low-wage workers (e.g. those earning below 30% of the average wage), and particularly for those in low-paying, part-time work. For transition countries, such as Bulgaria, Hungary, and Romania, the maximum FTR values are exceptionally high, indicating that, as in many transition economies, for formal work to pay off, non-wage gains from formal employment (e.g. employment protection, social security benefits) would need to be very high. Figure 2 shows a similar analysis, using the METR, which also suggests formal work does not pay at lower wage levels [1]. This can be seen as an indicator that the measured disincentives for formal work actually matter.

Limitations and gaps

Synthetic measures, such as the tax wedge, the FTR, or the METR, are limited in their approaches because they are purely based on formal workers’ legal obligations to pay taxes and remit to entitlement programs. In practice, other constraints apply, for example, institutional capacity constraints. These may affect the enforcement or awareness of obligations and entitlements within or between countries. Furthermore, limitations apply to programs that are not coordinated on a national level, e.g. locally administered social assistance. As studies focus on national data, taxes and benefits at sub-national levels are not included in synthetic measurements.

An underlying implication of using these measurements is that the worker decides between formal and informal employment, a decision driven by the financial disincentives of the tax and benefit systems. However, this definition excludes other factors that may also influence the decision on the type of employment. Examples include time preferences or the value workers attach to social security, employment protection, or different types of risks. Given the data limitations, measurements for such preferences could not be used [1]. Further restrictions apply due to the lack of data or measurement concepts for taking into account the role firms play in the decision-making process, the relative incremental increase in labor productivity when workers move to formal employment, and the potential restrictions to switching from informal to formal work in labor markets that are often segmented. However, for the purpose of measuring the disincentives of formal work for workers, the concepts presented are sufficient for a meaningful analysis.

Summary and policy advice

Policies that aim to formalize low-wage workers in transition economies can benefit from synthetic measurements, such as the FTR and METR. These measurements investigate whether formal work pays in the face of taxes and benefits. The FTR and METR provide measures on incentives and disincentives of transiting from informal to formal work and can help policymakers devise reforms for tax and benefit systems. Research has substantiated the claim that measuring disincentives matters as there is a strong correlation between the FTR and the METR and the incidence of being informal. Controlling for the characteristics of both the job and the worker, the higher the disincentive measures for formal work, such as the FTR or the METR, the more likely the worker will opt to be informal. The tax wedge—another common measurement approach—does not yield the above results and cannot be used to adequately measure the disincentive effects of formal work across wage levels [1].

The FTR and the METR also allow for comparisons between countries and over time. In the past, the tax wedge has often been used in country comparisons of average-wage earners. However, for developing countries with typically higher informality rates and wage inequality, a tax wedge that is representative of average-wage earners does not seem to be appropriate. In the absence of the FTR or METR, a second best solution could be to calculate a tax wedge at only 33% of the average wage to better express the situation faced by the majority of low-wage workers. Evidence from the FTR suggests that this group suffers from high disincentives to accepting formal jobs and this is particularly true for low-paying part-time work [1]. This calls for policy reforms, as formal work does not seem to pay, particularly in this segment of the labor market. Policymakers can use the FTR or METR to help identify shortcomings in a country’s labor tax code and social benefit design. They can also test and compare reform options for the purpose of reducing disincentives to formal work.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Previous work of the author contains a larger number of background references for the material presented here and has been extensively used in all major parts of this article [1]. Special thanks goes to Johannes Koettl.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Michael Weber