Elevator pitch

Social security programs generally seek to provide insurance and to reduce poverty and inequality. Providing insurance requires little redistribution. But reducing inequality and alleviating poverty do require redistribution. To reduce inequality, programs must redistribute income, but redistributing income is not the same as reducing inequality. While some programs redistribute large amounts of income without noticeably reducing inequality, others reduce inequality with less redistribution and fewer labor market distortions. A non-contributory tier, which provides benefits without requiring contributions, is a key component for reducing inequality.

Key findings

Pros

A contributory social insurance tier with pensions that are proportional to contributions can reduce individuals’ exposure to risk.

Social security programs with an integrated non-contributory (solidarity) component reduce inequality and poverty.

A defined-contribution program complemented by a well-designed solidarity tier may reduce inequality with much less redistribution and distortions than many defined-benefit programs.

Program design and implementation as well as characteristics of the population and labor markets define how well social security programs reduce inequality.

Cons

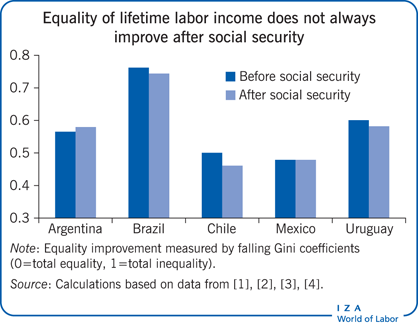

Social security may have little effect on inequality.

Social security reduces the incentive to work in the formal sector when expected benefits are disconnected from contributions.

Social security programs with demanding vesting conditions may compound the lifetime poverty of low-income individuals who are unable to meet the conditions and thus receive only a very small pension.

Because unfunded programs redistribute income to cohorts that are already old when the program begins, if mainly middle- and high-income workers participate at this early stage and low-income workers are covered only later, social security will favor the better-off.