Elevator pitch

Social security programs generally seek to provide insurance and to reduce poverty and inequality. Providing insurance requires little redistribution. But reducing inequality and alleviating poverty do require redistribution. To reduce inequality, programs must redistribute income, but redistributing income is not the same as reducing inequality. While some programs redistribute large amounts of income without noticeably reducing inequality, others reduce inequality with less redistribution and fewer labor market distortions. A non-contributory tier, which provides benefits without requiring contributions, is a key component for reducing inequality.

Key findings

Pros

A contributory social insurance tier with pensions that are proportional to contributions can reduce individuals’ exposure to risk.

Social security programs with an integrated non-contributory (solidarity) component reduce inequality and poverty.

A defined-contribution program complemented by a well-designed solidarity tier may reduce inequality with much less redistribution and distortions than many defined-benefit programs.

Program design and implementation as well as characteristics of the population and labor markets define how well social security programs reduce inequality.

Cons

Social security may have little effect on inequality.

Social security reduces the incentive to work in the formal sector when expected benefits are disconnected from contributions.

Social security programs with demanding vesting conditions may compound the lifetime poverty of low-income individuals who are unable to meet the conditions and thus receive only a very small pension.

Because unfunded programs redistribute income to cohorts that are already old when the program begins, if mainly middle- and high-income workers participate at this early stage and low-income workers are covered only later, social security will favor the better-off.

Author's main message

How well social security programs reduce inequality depends on program design and implementation and labor market and population characteristics. Studies for Latin America show that programs with pensions that are proportional to contributions have little impact on inequality from a lifetime perspective but can protect against adverse contingencies. Unfunded defined-benefit programs tend to redistribute without reducing inequality. To reduce inequality and avoid labor market disincentives, the best design appears to be a mostly proportional contributory program complemented by a well-designed non-contributory component.

Motivation

Social security is one of the largest public programs in many countries. Because of its size, nature (mostly transfers), and pension beneficiaries (dependent population), social security provides an opportunity for governments to redistribute income on a large scale. One of the goals is to reduce inequality. But are these programs effective at doing so? What economic distortions do they cause? The answer to these questions depends on program design, implementation, and institutional strength.

According to common wisdom, traditional defined-benefit pension programs reduce inequality, while defined-contribution programs do not (see Social security: Some basic concepts). Defined-benefit programs usually have built-in redistributive components, the argument goes, but defined-contribution programs do not. Common wisdom further claims that redistribution reduces the incentive to work or for companies to formalize, but these distortions are a necessary cost of reducing inequality.

While this characterization is mostly right in theory, real-world programs present a more nuanced landscape. Some defined-benefit programs seem to redistribute a lot without substantially reducing inequality. If this is so, there could be much distortion and little inequality reduction. Also, real-world defined-contribution programs are sometimes complemented by redistributive components. If well targeted, these components can be effective at alleviating poverty and reducing inequality, even if they are not large compared with the defined contribution component. This paper looks at social security programs in some countries in Latin America, to determine which type of program seems best at reducing inequality.

Discussion of pros and cons

What do we mean by social security?

“Social security” has different meanings in different countries. It includes the traditional old-age, survivors, and disability insurance programs, but it may also include other programs such as unemployment insurance, maternity leave, and family allowances. This paper focuses mainly on pensions, which have the largest effects on redistribution.

Old-age pensions, usually the largest social security component, insure individuals against the risk of running out of resources after retirement. Disability insurance replaces the income of individuals when they suffer temporary or permanent disability, and survivor’s insurance provides income to the dependent family of a deceased worker.

Most well-developed social security systems have incorporated a variety of other programs such as unemployment insurance, maternity leave, and family allowances. As their names suggest, the first two provide income to individuals who are not able to work because of unemployment and maternity. Family allowances provide income connected to the composition of the family, often with some means testing.

The roles of social security

It is often asserted that social security—and social protection more generally—aims at reducing inequality, alleviating poverty, helping individuals withstand adverse contingencies, and strengthening social inclusion [5]. Without government intervention, market economies—even if they worked efficiently—would not preclude high levels of inequality, something that most modern societies dislike. Governments thus usually receive clear mandates to reduce inequality.

Social security is not the only instrument governments have to reduce inequality, and it is probably not the most efficient one. But it is used extensively. One reason is that it is a big program involving large transfers, so it provides an obvious opportunity to redistribute income. Also, many beneficiaries of social security are socially vulnerable, so the program is naturally well equipped to reach part of the target population.

Social security can also help in reducing poverty, particularly in old age. This goal is connected to reducing inequality, but it is more specific: the concern is with protecting beneficiaries from falling below a certain income threshold in order to ensure them a minimum standard of living.

Social security provides insurance, helping individuals to deal with adverse contingencies, mostly through income replacement. Private insurance companies could in principle provide this service, but they often do it only partially and at a high cost. Insurance services are affected by information imperfections. In insurance markets, customers usually have an informational advantage: they know better than insurance companies the risks they face, and they can affect these risks through their own actions—actions that companies can observe only imperfectly. If a company prices insurance based on average risk rather than individual risk, low-risk individuals will find it too costly to buy. The pool of customers then shrinks and the pooled risk increases. Some individuals end up with no insurance, and the average cost of insurance increases. As a result, public social security has a role to play in social insurance.

While the goals of reducing inequality and poverty concern basically low-income individuals, the goal of improving insurance concerns middle- and high-income individuals as well. Therefore, social security is not just a social protection program for the disadvantaged but a social protection and social insurance program that should cover most of the population in different ways [5].

Finally, by reducing inequality, alleviating poverty, and helping individuals cope with adverse contingencies, social security should contribute to social inclusion and cohesion.

Coverage

In developing countries, social security programs usually cover only part of the population [6]. Even when statutory coverage is broad, effective coverage is often much lower. Small firms and self-employed individuals account for large segments of the labor force in these countries, and these sectors are often difficult to cover. Also, contributory social security programs are not well suited to protecting low-skilled, low-earning workers, who make up a large part of the population in developing countries. Governments often lack the capabilities needed to adequately administer social protection programs—to monitor and enforce contributions and to provide good services in return to contributions.

If social security cannot cover most of the population, it will not be able to fulfill its goals. This is particularly worrisome because low coverage is much more severe among low-income workers, the self-employed, and workers in small firms. Furthermore, social security programs that receive transfers from the general budget but that cover mainly the better-off can be regressive. At the very least, the progressivity that is usually ingrained in the contribution and benefit formulas can be partially undone by these transfers.

Distortions: Less employment, more informality

Social security is mostly contributory: individuals must contribute to the program while they are working in order to receive benefits later. The more people earn, the higher their contributions to social security. This progressivity reflects the income insurance role of social security: contributions are a premium on the insured part of wages, and pensions are the annuities that protect individuals from falling short of their income needs in contingencies such as disability and longevity. The requirement to contribute reduces the incentives individuals have to work, at least in the formal sector. In weak institutional environments, individuals are likely to be particularly responsive to these incentives.

Social security may thus compress formal work by both reducing paid work and inducing informality. It is not easy, however, to estimate to what extent social security contributions reduce formal employment. Estimates in the literature vary considerably depending, among other things, on the country and type of worker.

Redistribution across generations and individuals

As part of its insurance role, social security redistributes income over people’s lifetimes. It can redistribute income among individuals of different age cohorts—intergenerational redistribution—and of the same age cohort—intragenerational redistribution.

The role of social security in reducing inequality is concerned mainly with redistribution across individuals over their lifetime. Social security can be said to redistribute income if some individuals receive in benefits more than they pay in contributions over their lifetime and if others receive less than they pay in. In turn, social security can be said to reduce inequality if the winners are in general poorer than the losers in the social security redistribution. If that is the case, social security reduces lifetime net earnings inequality.

Intergenerational redistribution tends to be associated with the form of financing of the system. redistribute income from young to old cohorts. In this design, pension payments are financed by contributions collected in the same period. When the system is initially established, the first cohort to receive pension benefits will not have paid contributions into the system earlier in their lifetime. Therefore, these initial cohorts receive net transfers from the cohorts that follow. Because of intergenerational redistribution, unfunded social security may alleviate poverty of the cohorts that are already old when the system is set up. Moreover, as long as the economy grows at a steady rate, later cohorts do not lose, even if they finance the transfers, provided the system never ends. Each cohort finances the preceding cohort. In , intergenerational transfers do not take place because individuals contribute during their working lives to finance pensions when they retire.

There are several reasons why an intergenerational redistribution system may fail to alleviate old-age poverty or may be more costly than the ideal model suggests. An obvious reason has already been hinted at: the economy may not grow at a sufficiently high rate to enable an unfunded pension program to benefit all cohorts and not just the initial ones. Roughly speaking, the implicit rate of return to social security contributions in an unfunded system is the rate of growth of the wage bill. In modern economies, this rate is lower than the market interest rate, hence unfunded pension programs impose a loss on all generations after the initial one.

Another reason why unfunded pension systems might not be the best solution to old-age poverty is that only better-off segments of the population are covered in the initial stages of most programs. Usually, lower-income workers are gradually included as systems mature. But by the time this occurs, the initial phase of positive net intergenerational transfers may have ended. Low-income workers are then required to join a system that already imposes a heavy burden on contributors.

Intragenerational redistribution tends to be associated with the benefit formula. Traditional defined-benefit programs tend to redistribute more than defined-contribution programs. This is so because defined-contribution programs are usually designed to provide a closer link between the amount of contributions and the amount of benefits than are defined-benefit programs. Defined-benefit programs compute pensions as a percentage of average wages over part of an individual’s work history, often with a minimum and a maximum pension. Defined-contribution programs compute pensions as an annuity that can be paid based on the discounted value of contributions made.

Nevertheless, whether defined-benefit programs are more redistributive than defined-contribution programs is ultimately an empirical question. First, it is possible in principle to design a defined-benefit program that mimics a defined-contribution program. Thus, a defined-benefit program is not necessarily more redistributive than a defined-contribution program. Second, real-world programs are usually hybrids that combine different components, and the impact on redistribution depends on the specific mix. For example, minimum and maximum pensions are typical components of defined-benefit programs that make them redistributive, but defined-benefit programs are not defined by having these components. Besides, the specific level of these thresholds is obviously crucial for the redistributive impact of the program. Third, the results also depend on the interaction between the design and the characteristics of the population and the labor market. Fourth, results are sensitive to implementation details, which vary across countries and periods, particularly in developing countries, where there tend to be large gaps between policies on paper and in practice.

Empirical evidence: Redistributing is one thing—reducing inequality is another

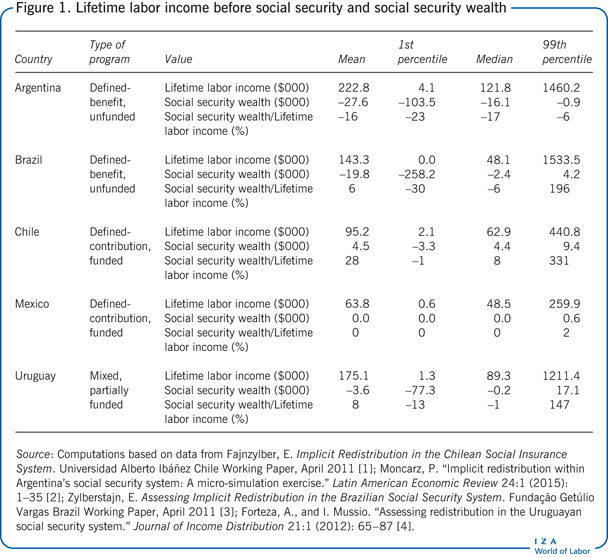

Programs that do not redistribute income cannot reduce inequality, but not all programs that redistribute income also reduce inequality. A recent series of studies conducted in five Latin American countries assessed the impact of social security on income distribution and inequality on a lifetime basis [1], [2], [3], [4], [7]. The studies focused on intragenerational redistribution and inequality by simulating histories of contributions and pensions based on panel data of actual contributions and computing expected lifetime labor income and net transfers to social security (called social security wealth). These instruments were used to build indicators of redistribution and income inequality before and after social security. The studies included two funded defined-contribution programs (Chile and Mexico), one partially funded mixed defined-benefit/defined-contribution program (Uruguay), and two unfunded defined-benefit programs (Argentina and Brazil).

Social security redistribution is found to be high in Argentina, Brazil, and Uruguay, low in Mexico, and somewhere in between in Chile. When individuals were sorted by their social security wealth—how much they gain or lose from social security over a lifetime—individuals in the 99th percentile (the “winners”) gain substantially more over their lifetime than individuals in the 1st percentile (the “losers”), though the amount of the difference varies considerably—about $260,200 more in Brazil, $100,200 in Argentina and Uruguay, $13,200 in Chile, and $600 in Mexico (Figure 1). It is not surprising that the defined-contribution programs redistribute less than the defined-benefit and mixed programs.

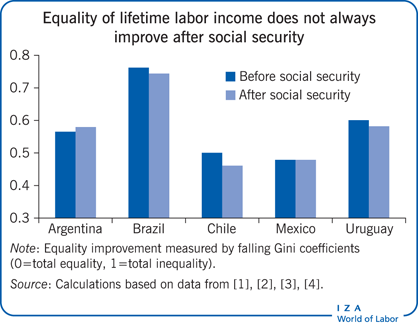

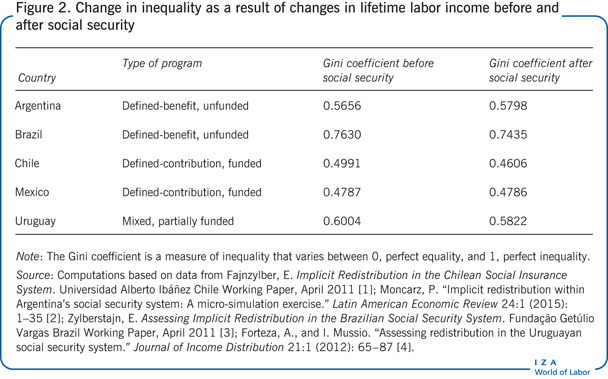

The impact of social security on inequality was assessed by comparing the Gini coefficients (standard indicators of inequality, where 0 equals perfect equality and 1 equals perfect inequality) for lifetime income distribution before social security (not computing contributions and pensions) and after it. The redistribution under social security reduces inequality if the Gini coefficient is lower after social security than before it.

The social security program in Chile reduces inequality more than the other four programs do, reducing it by about 0.04 (4 percentage points) (Figure 2) [1]. The Brazilian and Uruguayan programs result in about a 0.02 reduction [3], [4]. Almost no change is reported for Mexico, and no more than a 0.01 point increase for Argentina [2].

It may seem surprising that these analyses indicate that Chile’s social security program, which is based on , does more to reduce inequality than the other programs, some of which are unfunded defined-benefit programs. The reason is that Chile’s social security program is not a pure savings account program. Even when most pensions are financed by individual savings, the program has a well-designed non-contributory solidarity tier that supplements the pensions received by low-income workers. By design, there is no redistribution among individuals who do not benefit from the solidarity tier, which is why the program manages to reduce inequality so much despite so little redistribution.

As expected, Mexico’s program has no impact on inequality. By design, it does very little redistribution and thus does not alter income distribution.

The two defined-benefit programs and one mixed program redistribute income without doing much to reduce inequality. To a large extent, they seem to redistribute income among individuals with similar pre-social security income. Individuals with otherwise similar lifetime labor income may gain or lose in these programs, depending on their work histories.

What is more worrying is that some low-income workers seem to get a bad deal from social security in Argentina, Brazil, and Uruguay. These programs have some progressive components that should reduce inequality, such as statutory minimum and maximum pensions. But many low-income workers have long and frequent interruptions in their work histories [8], which keeps them from meeting the vesting period conditions and thus prevents them from benefiting from the programs. Workers who contribute for several years, but not long enough to be fully vested and thus to be eligible for an ordinary pension, tend to receive very little from social security in exchange for their contributions [9]. This shortcoming is not an issue in defined-contribution programs, in which vesting period conditions do not need to be so strict because the programs are mostly actuarially fair (based on the true risk involved).

Limitations and gaps

Most social security administrations do not have work history records that are detailed and long enough to assess redistribution and inequality reduction along the entire lifetime of cohorts of workers. Thus the studies discussed here use simulations to fill the gaps in work history records. While these simulations are based on econometric models that can replicate the missing work history records reasonably well, complete records of lifetime contributions and benefits would be preferable.

In addition, these studies are based on the assumption that social security administrations grant pensions strictly according to accrued rights. But in developing countries, the gap between norms on paper and policies in practice is often large. In Latin America, for example, there are many reports of social security administrations granting pensions to individuals who have not met the vesting period conditions. Because of a lack of complete work history records, administrations often recognize years of contributions based on the testimony of witnesses. There are indications that these procedures are used mainly by low-income workers. Therefore, in practice, social security might be more progressive than the simulations indicate.

Another limitation of the analyses reviewed here is that individuals whose work histories are simulated are assumed to work exactly the same with and without a social security program. But, as argued above, the requirement to pay contributions to a social security system might induce workers to reduce the number of hours they work. It is not easy to estimate how such indirect effects might modify the estimated impact of social security on inequality, and the studies reviewed here make no attempt to do so. This is a standard practice based on the notion that the direct effects captured in the studies are an order of magnitude larger than the disregarded indirect effects. Nevertheless, it is a limitation that must be acknowledged.

Intergenerational redistribution, which is touched on only briefly in this paper, may not be progressive in low-coverage environments such as those prevailing in developing countries. Estimating this type of redistribution is important to better assess the impact that social security has on inequality in countries with large and mature programs, like Brazil. But it might be even more important to anticipate the distributive impact of expanding coverage in countries that have smaller and less mature programs.

Summary and policy advice

Social security programs vary considerably in how much they redistribute and the impact they have on income inequality. The results depend on design, but also on implementation and characteristics of the population and labor markets. The finding that not all social security programs reduce inequality is not that surprising, but detailed computations show that the usual suspects are not necessarily the culprits and that some programs that are considered progressive may be less so in practice.

Defined-benefit programs tend to redistribute more than defined-contribution programs, but this does not mean that they contribute more to reducing inequality. Some defined-benefit programs that redistribute a lot do not seem to benefit low-income individuals. Pure defined-contribution programs tend to redistribute little and are not well equipped to reduce inequality. But a defined-contribution program complemented by a well-designed solidarity tier, like Chile’s system after the 2008 reform, may do a better job of reducing inequality. And it may do so with much less redistribution and distortions than many defined-benefit programs.

A good practice in policy design, as proposed in a celebrated finding by the Nobel Prize winner Jan Tinbergen, is to use separate instruments to achieve separate goals. As briefly mentioned above, social security programs pursue multiple goals, but at least two of them are probably worth distinguishing when contemplating the main architectural design of such programs.

The first is to provide insurance. It is widely accepted that private insurance markets tend to work poorly, due mainly to information problems. Social security can potentially improve on private insurance because of the government’s legal capacity to mandate risk pooling. To perform this function, social security should have a social insurance tier. And as with any insurance, individual realized benefits would likely differ from contributions, but expected benefits should be similar to expected contributions in this tier.

A second important goal is to reduce poverty and inequality. Achieving this goal requires that expected benefits and contributions differ, with low earners receiving on average more and high earners receiving less in benefits than they contributed to the programs. There is growing consensus that this task is best performed through a non-contributory tier. International institutions that analyze and advise countries on social security have similar recommendations in this regard, with minor variations. The World Bank has incorporated a non-contributory “zero-pillar” in its traditional multi-pillar social security design [10]. The International Labour Organization (ILO) and the World Health Organization (WHO) have proposed a social protection “floor” [11]. The Inter-American Development Bank has proposed a universal non-contributory tier [12].

In summary, social security can effectively alleviate poverty and reduce income inequality mostly through non-contributory pensions and protect individuals from adverse contingencies through mandatory contributory pensions.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Previous work of the author contains a larger number of background references for the material presented here and has been used intensively in all major parts of this article [4], [7], [8], [9].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Alvaro Forteza

Social security: Some basic concepts

Defined-benefit: A guarantee by the insurer or pension agency that a set benefit based on a prescribed formula will be paid.

Defined-contribution: A pension plan in which the periodic contribution is prescribed and the benefit depends on the contribution plus the investment return.

Full funding: The accumulation of pension reserves that total 100% of the present value of all pension liabilities owed to current members.

Individual (or savings) accounts: Accounts in which individual contributions are deposited in fully-funded defined-contribution pension programs. The amounts accumulated are capitalized and then used to finance pensions when individuals retire.

Unfunded or pay-as-you-go: A method of financing whereby current outlays on pension benefits are paid out of current revenues from an earmarked tax, often a payroll tax.

Sources: Definitions from Alvaro Forteza; and, World Bank. Averting the Old Age Crisis. New York: Oxford University Press, 1994.