Elevator pitch

Informal firms make up a major share of the economy in most developing countries. Expanding formalization could increase government tax revenues, boost firm profits and national income, and increase employee well-being by improving access to social security and health and workers’ benefits. Reforms to encourage firms to register include simplifying procedures, reducing the cost and time to register, and making more information available on registration procedures. Reforms might not result in higher registration and formalization. In some cases, better enforcement and wider development policies might be needed as well.

Key findings

Pros

Firms can be encouraged to register by providing more information about how to register and by reducing the cost and time it takes to register.

Formalization helps firms get access to formal credit, comply with the law, and avoid paying fines.

Formalization can boost tax revenues.

Formal firms can more easily increase production and employment, moving to a larger, more efficient scale of operation and potentially bringing in higher revenues and profits.

Cons

Registration reforms may not prompt firms and employees to formalize.

Small-scale firms and workers with low skill levels may find that the cost to become formal is still too high for them to register.

Paying taxes might be perceived as a drawback to workers and firms, so formalization and tax revenues might not increase.

Enforcement might have a larger impact on registration than registration reforms.

Other barriers to registration might need to be addressed.

Author's main message

Formalizing informal firms and jobs in emerging market economies has the potential to benefit governments, the economy, firms, the self-employed, and employees. But the costs of formalization often outweigh the benefits. Changing the cost–benefit balance to encourage formalization can be achieved through a combination of registration reforms such as simplifying procedures, reducing the cost to register, and providing more information on how to register. But a substantial increase in formalization will likely also require enforcement and other development policies.

Motivation

Formalization entails registration of the job and the firm with the government. There can be many reasons why firms do not formalize. Firms and employees may not have enough information on how to register or on the benefits and costs of registration. For many firms, the number of procedures and the cost and time required to register may be barriers to formalization and to entrepreneurial activity.

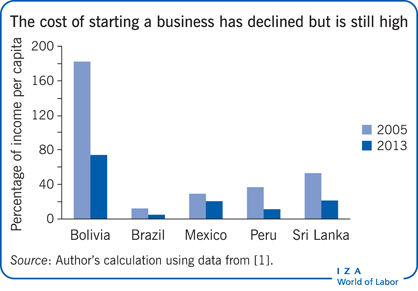

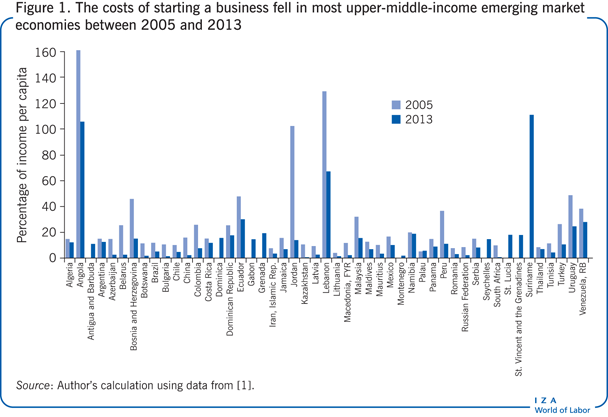

For example, to start a business in Brazil in 2005, an entrepreneur had to spend 152 days, nearly 12% of income per capita, and complete 17 different steps. In 2013 that entrepreneur would spend 119 days, less than 5% of income per capita, and complete 13 different steps [1]. These simplifications and cost reductions in registering a business occurred not only in Brazil but in other emerging market economies as well (see Figure 1).

Governments in emerging market economies have implemented reforms to facilitate doing business, improve the investment climate, and encourage growth and development. As part of this agenda, governments are encouraging formalization of informal jobs and firms (see Informality and formalization).

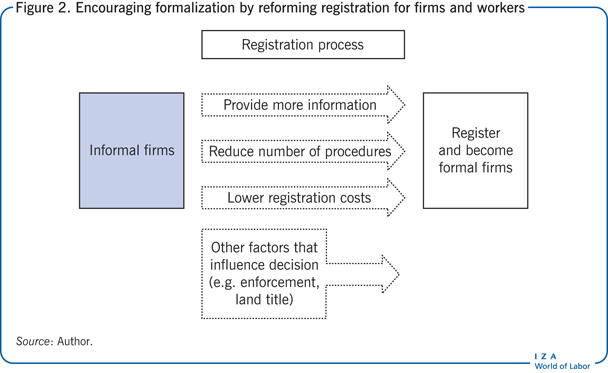

To encourage more firms and workers to regularize their status, the government could take several steps, including simplifying registration, lowering the cost and time to register, and making more information on registration readily available (see Figure 2). This paper looks at how effective such measures are.

This paper looks at formalization, in particular at reform of the registration process. Evidence from policy reforms already implemented and from experiments in some emerging market economies highlights the impact of registration reforms on firms and workers, revealing both the benefits and shortcomings.

Discussion of pros and cons

Benefits and costs of formalization

The process of becoming a formal firm or job, primarily through registration (see An example of the registration process in Bolivia), has many perceived benefits and costs to firms, individuals, and governments.

In a survey by the International Finance Corporation of firms in 65 municipalities in Bolivia, Brazil, Honduras, Nicaragua, and Peru the firms were clear about what they saw as the main advantages and benefits of registering and about their concerns about the disadvantages and costs of formality [2].

The relative importance of the benefits and costs of formalization will vary with firm and individual characteristics, including firm size and productivity, and the skill level of individuals [2]. The survey firms perceive the main benefits from formalization to be complying with the law, avoiding the fines and bribes they currently pay because they lack the protection of being registered, and realizing the potential for expanded operations and additional customers. In identifying the most important benefits of formality, 47% of surveyed firms say that the top reason would be to comply with the law, 29% want to avoid fines or bribes, 14% are motivated by the desire to expand or seek new clients, 8% mention access to credit, and 1.5% mention access to the courts [2]. Among the costs of formalization, surveyed firms identify the requirement to renew licenses every year and to pay taxes as the main costs.

A study of the impact of formality on firm profits finds that tax registration leads to higher profits for mid-size firms but lower profits for small and large firms [3]. The main benefit of formalization was found to be expansion of the customer base through the ability to issue tax receipts. Firms that issue tax receipts are able to attract more customers because the customers can use the tax receipts to claim tax refunds. No effect was found on increased access to finance due to registration.

Some of the differences in impacts by firm size could be due to differences in entrepreneurial ability. Large informal firms often have greater entrepreneurial ability than formal firms of the same size and have managed to grow to a large size without being detected. Having figured out ways to avoid inspection, large informal firms might be able to access many of the benefits of formality without paying the price of formality, in registration fees and taxes [3]. Thus, formalizing could cause profits to decline for large firms. For small informal firms, which on average have lower entrepreneurial ability, the costs of registration outweigh the benefits. Moreover, large informal firms have gained a large customer base through their own business skills and did not have to rely on tax receipts for the expansion of their customer base, while small firms might be too small to benefit from the issue of tax receipts.

Empirical evidence

Policy reforms and their impacts: Experience in Brazil, Mexico, and Peru

Reforms in Brazil and Mexico to simplify business registration and bureaucracy and lower taxes provide empirical evidence on the impacts on formalization and firms.

The Brazilian government started the Integrated System for the Payment of Taxes and Social Security Contributions of Micro and Small Enterprises (SIMPLES) in 1996 to reduce taxes and simplify the tax system for micro and small enterprises. Firms were identified as micro or small based on their annual revenue. The program streamlined six federal taxes and social security contributions into a single monthly payment, varying from 3 to 5% of gross revenues for micro-firms and from 5.4 to 7% for small firms. This was both an administrative simplification and a tax reduction for these firms.

Two studies assessed the impact of SIMPLES on the formalization of firms. One study found that the effect of SIMPLES on formality varied across economic sectors [4]. For the retail sector, SIMPLES implementation led to an estimated 13 percentage point increase in formalization (defined as possession of an official license). There was no increase in formality in the construction, transportation, services, and manufacturing sectors after the introduction of SIMPLES.

Another study examined the effect of the introduction of SIMPLES on a range of formality dimensions: license to operate, legal entity, micro-firm registration, registration with tax authorities, paid taxes, and paid social security [5]. The study employed two estimation approaches, which yielded slightly different results, but the overall message remained the same. The SIMPLES program had an effect on formalization across all the dimensions measured under both estimation approaches: an 11.6% or 7.1% increase in licensing rates, a 7.5% or 6.4% increase in the number of firms registered as legal entities, a 6.3% or 5.7% increase in micro-firm registration, a 7.2% or 2.8% (not significant) increase in tax registration, a 3.1% or 4.6 % increase in tax payments, and a 4.3% or –1.4% (not significant) change in social security contributions [5].

The study also looked at the relationship between firm characteristics and formality. It found that the effect of SIMPLES on formality was twice as large for firms with employees, compared with all micro-firms or own-account workers, but with less consistent results. In addition, formalization was greater for firms whose heads were male, older and more educated. Consistent with [4], formality rates were highest for firms in the retail sector. In addition, after the introduction of SIMPLES, formalization increased among transportation firms, restaurants, and lodging facilities and declined among manufacturing, construction, and personal services firms [5].

The study found a large effect of formalization on firms’ performance under both estimation approaches: 57% or 55% more revenue and 49% or 45% higher profits [5]. This effect was even larger for firms with employees: revenues increased 70% or 60%, and profits rose 64% or 55%. These increases were partly due to a rise in the number of paid employees; sales to larger firms and access to credit did not seem to explain the improvement in firm performance. In larger firms, capital stock increased following formalization, and the firms were more likely to operate from a fixed physical location.

An investigation of the channel through which formalization affects firms’ performance found that, contrary to expectations, access to credit or to more customers did not seem to be the main reason for increases in profits; rather, the likelihood of a fixed location for firms seemed to matter much more [5]. The study was unable to determine which component of the SIMPLES reforms—lower registration costs, fewer registration steps, or lower taxes—was behind the observed effects on profits. The empirical studies discussed below shed more light on the policy mechanisms that could lead to the effects on formalization and the economic outcomes.

Mexico also reformed its business registration system, simplifying entry regulations but not reducing taxes, as Brazil had done. Mexico implemented reforms in business entry across municipalities beginning in May 2002. The Rapid Business Opening System (SARE) simplified local business registration, reducing the number of days, procedures, and office visits needed to register a firm [6], [7].

The SARE program led to a 5% increase in registered firms, but most of the increase was attributable to registration by new firms rather than by existing ones [6], [8]. Thus the reform encouraged new business start-ups but had no formalization effect on existing informal firms. The increase in formalization was also temporary, and most of it occurred at the beginning of the reform [8]. The reform also led to an estimated 2.2% increase in employment, but the increase in formalization was due to former wage earners opening businesses and not to informal business owners registering their business [6]. That the reform encouraged informal business owners to become wage workers seems to explain why there was no overall effect of SARE on informal firms [7].

Contrary to the Brazilian case, the Mexican program does not seem to have had a clear effect on the formalization of informal firms, and its impact on employment is smaller. Moreover, the long-run impact is not clear.

To understand the main barriers to starting a business and the impact of reform, a study in Peru analyzes the impact of licensing procedures on entrepreneurs [9]. The licensing process, a part of business registration, is divided into two parts in Peru: incorporation of the company and issuance of a tax identification number, and issuance of a municipal business license, which is required for operation as a formal firm. The study investigates the impact of a reform that reduced the cost of the licensing process. The reform in one district in Lima, Peru, included several revised measures to simplify and modernize the process: coordination with the municipality, a closer link to any public safety risk posed by a new business, streamlining of inspection, and an overhaul of outdated business classifications and zoning laws.

The study finds that the reformed licensing procedures reduced the time spent and the cost of obtaining a license. The time to get a license fell by 60% and the cost fell by 42% compared with the time and cost before the reform.

The impact on formalization was large: the number of firms that obtained a license was four times greater after the reform than before, rising from 1,758 firms in the year before the reform to 8,517 firms after the reform. That rise expanded the stock of firms with a municipal license by 43%. In terms of firm characteristics, the study finds that the types of firms and owner characteristics differed little between newly licensed firms before and after the reform. Before the reform, most newly licensed business owners were men, about 41 years old, who had completed high school. Their firms employed an average of two workers, mostly in the retail sector, had about US$230 in weekly revenue, and had been operating about a year before applying for a license. These characteristics changed very little after the reform. Many of the firms that got their license after the reform were informal before the reform, which the study considers an indication that formal and informal firms have similar characteristics [9].

An important reason why firms decide to get a license, before and after reform of the licensing process, seems to be the ability to avoid paying bribes and fines [9].

Which policies encourage formalization?

Several empirical studies have been conducted in emerging market economies trying to understand what kind of reforms and policies are likely to induce firms to register and formalize their business and their employees. These studies assess the impact of various policies on formalization more systematically than the studies on reforms in Brazil and Mexico [10], [11].

Randomized controlled experiments were set up to test the response of firms to various policies to address formalization. Firms were randomly assigned to treatment groups, which received the intervention, or control groups, which did not. The control group served as a baseline against which to assess any changes brought about by the policy change, to allow clear measurement of the impact of the reform.

These experiments tested three reforms that might influence firms to formalize:

Information: Distributing information on the benefits of formalization and dispelling misinformation on the costs of registering; publishing clear guidelines on how to become a registered firm.

Information and free registration costs or payments: In addition to distributing information on registering, waiving registration fees for firms, and in some cases subsidizing some of the other costs of formalization.

Enforcement: Sending an inspector to visit the firm or a neighboring firm.

The first two policies are positive inducements to formalize; the third takes the penalizing approach of harassment and tighter enforcement of regulations, including sanctions ranging from potential notification and a return inspector visit to, in extreme forms, fines and firm closure. Experimental evidence can help understand what policies, and in what combinations, have an impact on the formalization of firms and jobs.

A field experiment in the city of Belo Horizonte, Brazil, tests these three policies and finds no effect of information, fee waivers, or subsidies for other costs of formalization. A visit from an inspector, however, has a significant effect, leading to a 21–27 percentage point increase in formalization. But the effect of enforcement is very narrow: visits to neighboring firms have no spillover effects on nearby firms. The study concludes that informal firms do not formalize unless they are forced to do so by the threat of an inspection visit [11]. The finding on the effect of increasing information dissemination differs from that of an earlier non-experimental study in Bolivia, which finds that informal firms that have no information on how to formalize gain more from information policies than do other firms. The study concludes that better information provision by governments may induce firms at the margin to formalize [3].

The informal firms did not seem to benefit from registration, but there might be a larger benefit to society through additional tax revenue collected by the government as a result of increased formalization if the extra tax revenue exceeded the cost of inspections.

In another field experiment in Sri Lanka, firms received various levels of intervention: information and free registration or various amounts of additional subsidies (10,000, 20,000, or 40,000 rupees, Rs) [10]. The study finds no effect on formalization from the provision of information and free registration. However, when firms were offered additional subsidies to register, more firms became formal. When offered Rs 10,000 or Rs 20,000, 17–22% of firms registered. The share rose considerably, to 48%, when firms were offered Rs 40,000. When given even more time to register or offered further payment, the remaining firms also registered.

Higher profits for firms were one of the impacts of formalization, but only a few fast-growing firms benefited. The study also finds that land ownership problems, an issue external to registration reforms, is the most common reason for not registering.

Limitations and gaps

Empirical results on registration reforms to encourage formalization are still rare for most emerging market economies. The evidence discussed here draws on the few studies available, mainly for Latin American countries and South Asia, Sri Lanka in particular. Further studies are needed for other countries and regions to understand the effects of registration reforms on formalization in different contexts, as current evidence is limited in its validity to specific country contexts.

The different approaches to encourage formalization—providing more and better information, lowering registration fees and time, and increasing enforcement—need to be carefully weighed and evaluated for their effects on the costs and benefits of formalization for firms and employees in many different contexts. In addition, existing regulations were implemented for particular reasons, and easing or removing them could have implications that extend beyond the formalization of firms.

The reasons that firms and individuals do not register also need careful examination. They might not want to register for their own reasons, but the non-registration may also be involuntary, due to an employer’s unwillingness to register or other constraints. Failure to register could also reflect a lack of trust in the state. Empirical evidence on the reasons for informality would need to be studied before reforms are designed.

Questions still open for future research concern the trade-offs between registration reforms and enforcement in each country at the various levels of administration and for the groups of firms and individuals for which the reforms are most applicable.

Increased tax revenues due to formalization may not outweigh the increased payments necessary to convince firms to formalize or to cover the costs of increased enforcement efforts [10]. Enforcement, implemented through frequent visits or threats of visits by labor inspectors and the effects on informality and formality are an important, understudied dimension of encouraging formalization. For example, a study in Brazil finds that increases in labor inspections were followed by increases in formal employment and decreases in informal employment [12].

There may be different combinations along the informal–formal distribution, and these need to be understood. For instance, a formally registered firm may employ formal and informal workers, and the response to changes in the registration process may affect them differentially. Firms may decide to reallocate labor between formal and informal workers.

More empirical evidence is needed on changes in the registration process related to social security payments and their impact on employees. Most reforms are at the firm level, and studies do not look at employee social security registration in detail.

Finally, much more information is needed on the effect of registration reforms and job creation on the overall size of the informal sector.

Summary and policy advice

Why the informal sector exists and how to formalize it has been at the forefront of policy debates since de Soto highlighted the cost and benefits of formalization in Peru [13]. Cumbersome registration and licensing procedures were seen as the main reason for the existence of informal firms and workers.

However, recent empirical evidence suggests that the benefits of formalization can be quite limited for some informal firms and individuals, while the benefits for the government and the economy may be larger. A policy for formalization needs to consider the reasons for informality in the first place and then target the policy with potential trade-offs of formalization for individuals, firms, and the government in mind.

Reform of the registration process and stepped-up enforcement need to be carefully evaluated and weighed as potential options to create incentives for firms and individuals to formalize.

Offering more information on how to register may be the simplest reform to implement, but alone it might not lead more firms and individuals to register. Disseminating information on registration needs to be accompanied by simplifying the process of registering and possibly by paying firms to encourage registration. Sometimes better or more enforcement is also needed. Enforcement policies could complement reforms to the registration process. Increases in labor inspections and changes to the fine structure are some measures that could complement registration reforms.

Barriers to formalization in areas other than registration and enforcement might also need attention, to create stronger incentives for firms to formalize. Reforms in land titling and ownership may be needed to deal with an area that has been identified in some locations as an obstacle to formalization. Having legal title to land, and thus being able to operate from a fixed business location, might encourage more firms to register.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Melanie Khamis

Informality and formalization

An example of the registration process in Bolivia

Source: McKenzie, D., and Y. S. Sakho. “Does it pay firms to register for taxes? The impact of formality on firm profitability.” Journal of Development of Economics 91 (2010): 15–24.