Elevator pitch

A large share of the population in emerging market economies has no pension coverage, exposing them to the economic risks arising from socio-economic and individual shocks. This problem, which arises from having large informal (unregulated) sectors, affects not only poor workers, but as many as half the newly or nearly middle class in some emerging market economies. With very little social protection coverage today, these workers will also be vulnerable in the future unless tax, labor, and social policies change to encourage formalization. While formalization would require substantial resources in the short-term, it seems financially sustainable.

Key findings

Pros

Formality can be fostered with stronger monetary and non-monetary incentives, backed with new technologies.

Substantial resources would be needed in the short-term, but formalization seems financially sustainable and could avoid future financial pressures arising if reforms are ignored.

Increasing formality through pension contribution subsidies and new savings channels would increase saving, notably among the middle class, and boost growth and equity.

Involving the emerging middle class in pension reform might ease the challenging political-economy obstacles.

Cons

If subsidies fail to move a substantial share of low- and middle-income workers into the formal economy, they would be regressive.

With multiple competing uses for scarce public resources and the high visibility of other pro-poor programs, there might not be adequate support for formalization policies.

Some pension reforms risk creating parallel schemes that can discourage formalization.

Too little is known about the effectiveness of monetary and non-monetary instruments in emerging market economies, so reforms should embed evaluation mechanisms.

Author's main message

Pension systems in emerging market economies are inadequate, with large gaps in coverage of low- and middle-income workers. Stop-gap measures, such as targeted benefits from non-contributory or parallel pension schemes, are the wrong approach for encouraging formalization. Instead, a combination of traditional and innovative social, tax, and labor tools should be used to improve the incentives for businesses and workers to become formal. Progressive pension contribution subsidies for formal jobs, along with a social pension, diversified savings channels, and better enforcement, are promising ways to spur formality.

Motivation

An important achievement of the recent economic expansion in Latin America has been the substantial reduction in poverty and the surge in the ranks of the emerging middle class. Many new middle-class workers remain vulnerable to loss of employment and income. A considerable part of their vulnerability stems from working in the large informal sector, which substantially limits their pension coverage. In Latin America, only five in ten middle-income workers contribute to social insurance [1]. Findings are similar for other measures of middle class and informality (such as contributions to health insurance plans, workers without a written contract, occupation, and sector) [2], [3], [4]. Improving the labor status and savings of this emerging middle class is a key social challenge. This paper argues that a promising approach is to combine pension contribution subsidies to formal jobs (universal subsidies for workers and firms) and innovative savings channels, paired with stronger enforcement. These policies should be part of an overall social insurance and protection system, taking into account the functioning of the labor market and the economy as a whole. Latin America is used to analyze these challenges because of its heterogeneity, its innovations in social policies, and the remarkable increase in the middle class in the region.

Discussion of pros and cons

The precarious position of the emerging middle class

Some 29% of the population in Latin America lives on less than $4 a day (in purchasing power parity terms, which adjusts for cost of living), a level considered to be moderate poverty, and another 68% lives on $4–$50 a day [5]. Many in this second group are the new emerging middle class, whose situation is still very fragile in many cases. The middle class includes vulnerable workers, who make up 39% of the population and live on $4–$10 a day, and a slightly more secure group of workers, who make up 30% of the population and live on $10–$50 a day. It is this large 30% share of the population—the emerging middle class—who, while not poor, are at risk of losing their job, developing health problems, and suffering a large income decline after retirement, and thereby slipping into poverty.

One of the greatest vulnerabilities of this emerging middle class arises from widespread informality in the labor market. Often thought of as a problem only of low-income workers, informality is also a problem of the emerging middle class, whose members frequently transition into and out of informal-sector work. This insecurity of work sets them apart from other members of the middle class whose economic position is more stable [6].

Strengthening the labor status and savings of this emerging middle class is a key social challenge. In Latin America, countries such as Brazil, Colombia, Chile, Peru, and Mexico have recently established policies to expand the reach of social protection programs by increasing formality and fostering savings. Too often, however, these programs are narrowly targeted in a way that excludes the emerging middle class or are not integrated into the general social protection system. By contrast, a notable activism is observed in more than a dozen countries that recently relaxed eligibility conditions for minimum pensions or implemented social pensions [7].

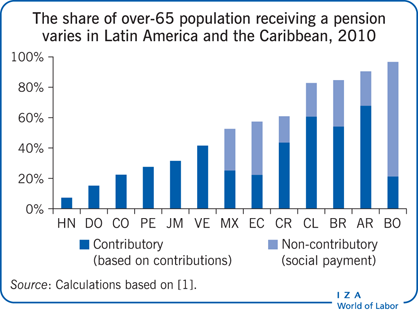

If unchanged, low pension coverage will have social, economic, and political costs in coming decades

The deficient scope of pension coverage in emerging market economies is striking. In Latin America, less than half of the 38 million workers aged 65 and older are receiving a pension that is based on their contributions during their working lives (contributory pension). Recently, some countries have expanded pension coverage through social payments that are not based on workers’ contributions (non-contributory pensions). However, a majority of contributory and non-contributory pensions pay less than $10 a day. Therefore, most pension systems are not fulfilling their goals of eliminating poverty in old age and maintaining an adequate standard of living for workers after they stop working.

Without further reforms, this low coverage will have substantial social, economic, political, and fiscal costs. And the situation is expected to worsen due to the rapid aging of the population and widespread informality. Some projections suggest that by 2050 as many as half of the 140 million elderly in the region will not be eligible for an adequate pension [1]. People aged 65 and older will make up 20–30% of the electorate in the region, setting the stage for potential political unrest. In fiscal terms, the lack of coverage is a latent, mounting unaccounted-for liability that governments in the region will eventually have to meet.

The emerging middle class shows savings capacity but remains largely informal

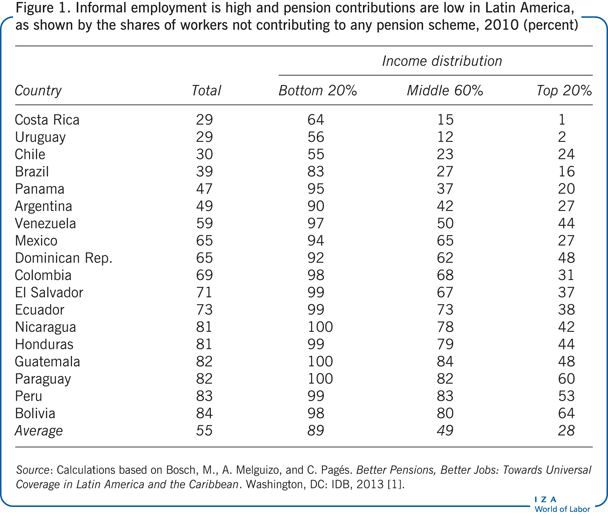

Gaps in pension coverage in Latin America reflect a pattern of low and irregular worker contributions. Less than half contributed to any pension scheme in 2010 [1]. Informality among workers averaged 55% for the region as a whole, ranging from around 30% in Chile, Costa Rica and Uruguay to more than 80% in Bolivia, Peru, and Central America (Figure 1).

Informality is widespread among middle-income workers, defined here as workers in the middle six deciles of the income distribution (middle 60%). On average for the region, 49% of workers in this emerging middle-income working class do not have a job in the formal sector: 60–70% in Colombia, Ecuador, El Salvador and Mexico and near or above 80% in Bolivia, Paraguay, Peru and most countries in Central America.

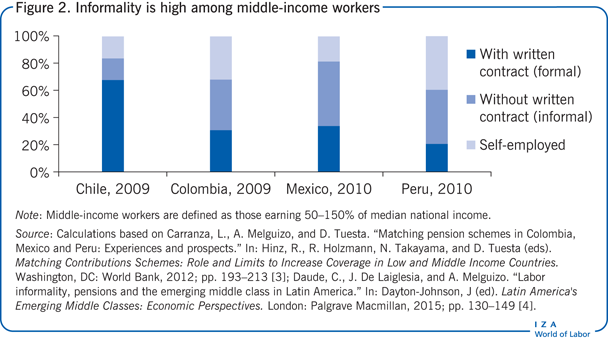

These high levels of informality among the emerging middle-income working class reflect their occupations. In Chile, Colombia, Mexico, and Peru combined, for example, 21 million middle-class urban workers (incomes of 50–150% of the median) are self-employed or lack a written contract—almost twice as many as have a written contract (Figure 2). Only in Chile do workers with formal salaried work constitute the largest group, and even there, approximately a third of middle-income workers do not have a signed contract. That share rises to two-thirds in Colombia, Mexico, and Peru. As a consequence, less than 10% of middle-class workers in Peru, 28% in Mexico, and 39% in Colombia contribute to a pension plan [3], [4].

The income of these middle-class workers in the informal sector is well above national poverty lines (two times higher in Peru, three times higher in Colombia and Mexico, and five times higher in Chile), which suggests that they have some savings capacity. However, their earnings are close to the legal minimum wage in Colombia and Peru, suggesting that this labor institution might be creating an additional hurdle.

Expanding contributory pension coverage is a work in progress

Latin American countries have followed different paths in expanding the number of workers who contribute to a pension system. Reducing required contributions to social pension systems seems to be effective in generating formal employment, especially for young people, non-wage earners, and workers in small businesses, as selective implementation in Brazil, Chile, and Costa Rica has shown. In a similar vein, Colombia and Peru are implementing matching contribution programs, which increase workers’ returns to savings or subsidize contributions. These programs are too recent for rigorous evaluation, but preliminary evidence is positive. One concern is that targeting the self-employed or small business employees could discourage firms from growing or encourage self-employment in low-quality jobs. In this regard, Colombia’s recent tax reform, which greatly reduced hiring costs in labor-intensive sectors, seems a promising complement to pension system expansion.

Many countries have been experimenting with non-contributory pension systems [7]. Non-contributory pensions are effective in increasing the number of people with access to income in old age, as shown by experience in Bolivia and Chile, two countries with different income levels and distributions and extent of informality. However, such non-contributory pensions could discourage participation in the formal labor market and adversely affect fiscal sustainability [2]. Hence instruments need to be designed carefully and should be viewed as complementary to more general pension reform.

Making broader reform happen: Starting with the fundamentals

The analysis thus far suggests that decisions taken by government, workers, and firms created an imbalance in pension system contributions and eligibility, in which only a small share of middle-income workers regularly contribute to the pension system, despite having the savings capacity to do so. Recent reform measures only partly address this problem. While no single pension system reform is appropriate for all countries, a set of key principles does apply: universality (understand the interaction of the pension system with the labor market and the tax system); integrality (connect all contributory and non-contributory provisions of the social protection system, including retirement, disability, survivors’ pensions, and health and unemployment insurance); efficiency (create good incentives for pension saving and formal employment); transparency (simplify the rules so they are easily understood by workers and firms); and innovation (experiment with pension contribution subsidy mechanisms and with savings channels).

Getting the monetary incentives right in the formal economy

In many emerging economies, the balance of costs and benefits between formality and informality seems in favor of informality. To achieve universal pension coverage, it is crucial to increase the benefits or reduce the costs of complying with formality for workers and employers. For policymakers, this rebalancing requires evaluating not only contributions to the pension system but also the costs and procedures associated with labor legislation (health insurance, termination costs, minimum wage, and registration costs).

Monetary subsidies are among the most popular options. By reducing required contributions for wage and non-wage earners alike, subsidies can nudge low- and middle-income workers toward formality. Such financial incentives could be complemented by non-contributory pensions to reduce old-age poverty. Non-contributory pensions need solid financing and strict eligibility criteria related to age (adjusted to life expectancy) and residence. So as not to discourage formality, non-contributory pensions should be available to everyone who meets the criteria, whether formal- or informal-sector workers, and should be set at a level sufficient to reduce poverty in old age [8].

Beyond money: Design, enforcement, and innovation

Beyond monetary incentives, efforts should be made to improve the design and implementation of pension policies, notably by phasing non-wage earners into social security. One approach that shows promise is to establish an obligation to contribute for all workers, whether formal or informal, offering flexible savings channels and means of fulfilment.

The empirical literature also suggests that moving from informality to formality (especially for small firms) requires not only greater supervision, but also an increase in the perceived benefits of formality for firms and workers, including short-term benefits (such as subsidies for professional insurance fees). Stricter monitoring will expand the number of formal jobs, but it can also destroy jobs that cannot survive regularization, whether because of low productivity or because the firms and workers do not value pension plans. Governments can improve the chances for positive outcomes by looking for inexpensive, innovative ways to expand pension coverage. Relying more on modern information technologies could improve supervision, information, and financial education while also offering greater flexibility in how workers and firms can contribute to pension plans.

An illustration of a pro-formality reform in Latin America: Benefits and costs

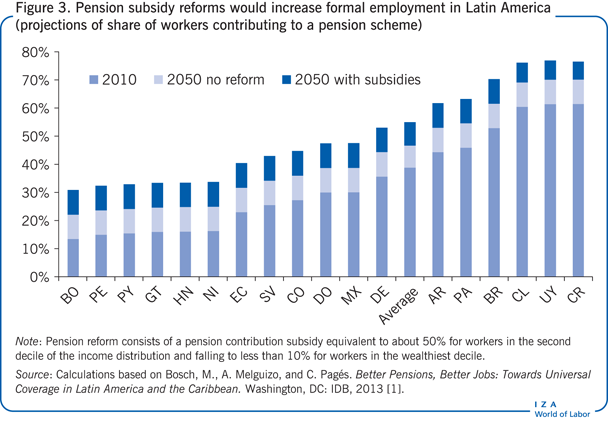

A simple way to implement a progressive subsidy for pension contributions that encourages formality is to grant a fixed subsidy to all workers who contribute. Since no one making less than the minimum wage could afford to contribute to a pension plan and thus would not be eligible for the subsidy, this incentive would benefit mainly the middle class. A stylized simulation of the impact of such a reform in Latin America, which assumes that the minimum wage is equal to the income of those in the second decile of the income distribution, finds that the subsidy is equivalent to 50% of the income of workers in the second decile and falls to less than 10% for workers in the wealthiest decile [1].

In a no-reform scenario, the proportion of all contributors in the working population is assumed to grow 10 percentage points when GDP per capita doubles. In the reform scenario, this proportion rises to 40 percentage points for low-income workers, thanks to the introduction of a 50% subsidy, which is in line with the empirical literature [9]. According to the simulation, these monetary incentives would raise formality rates by around 10 percentage points in 2050, mostly among low-middle and middle-income workers (Figure 3).

Funding pension reforms along these lines would cost 0.5–1% of GDP a year, at least in the short term, a substantial increase in budget allocations to pension systems That would make reforms a considerable technical and political challenge. To improve the chances of success, efforts should be made to avoid placing additional burdens on the formal sector. In some emerging market economies, such as Colombia, Mexico, and Peru, tax collections are low despite the high non-wage costs imposed on formal firms and workers. The funding challenge is compounded by the political challenges. According to the 2010 Latin American Public Opinion Project, pensions are not among the top 20 concerns of people in Latin America. However, respondents express some aspirations intrinsically related to pension reforms, such as lower poverty and unemployment.

One way to finance the pension subsidies and also compensate workers in the poorest deciles through direct cash transfers includes reforming consumption taxes, by eliminating the numerous tax deductions [10]. Another financing option is tax and non-tax revenues from commodities (like royalties on oil and metals), which could be less distortive and increase intergenerational equity.

The labor market is at the core of the solution: A dynamic view of progressivity

Most informal-sector workers sometimes work at formal-sector jobs, but usually only temporarily. This means that the formal and informal sectors are not segmented but rather that the boundaries are porous, with workers, both poor and middle class, moving back and forth. If pension contribution subsidies (and other policies) increase the rate at which workers become and remain formal, resources will increasingly be allocated more progressively in relative terms—that is, giving everyone the same amount of subsidies would decrease inequality by raising the income of low-earning workers proportionally more than the income of higher earners. Going a step further and giving larger subsidies to workers earning the minimum wage and raising income taxes for top earners would reduce inequality even more.

Limitations and gaps

Most of the studies considered in this paper are constrained by data limitations. The analyses and simulations are based on cross-section data from household and labor force surveys. The results would be sounder if they were based on longitudinal or panel data linked to administrative records. In addition, little is known about the actual impact of monetary and non-monetary incentives on informality. More rigorous impact evaluations are needed. More insights on the political economy of pension reforms are also needed to learn how to bring together the agents—retirees, formal and informal workers, firms and government—needed to support the reforms.

These limitations are on top of the usual caveat that policy recommendations need to account for different conditions and circumstances in each country, including institutional capabilities and fiscal capacity. Countries need to weigh all these factors and choose their own path.

Summary and policy advice

Informality, which is widespread in Latin America and other developing country regions, even among middle-income groups, is an outcome of the original design of social welfare systems, labor market incentives, and the low value workers and firms assign to formality. All these factors, which discourage formality, can be improved. In coming decades, key priorities in most developing countries are eradicating poverty, increasing savings, and expanding labor formality. Promising policies focusing on the middle-income segments of the population in Latin America include a combination of pension contribution subsidies to encourage formalization of jobs (by reducing the cost of pension contributions) and innovations in savings channels. All such policies should be integrated in the general pension scheme and coordinated with social pensions. The new middle class in Latin America is still largely informal and vulnerable to economic and personal shocks. Therefore, it would be advisable to focus on a series of ambitious pension changes that could contribute to growth and equity while reinforcing the weak social contract in most countries. Creating more formal jobs is the only sustainable strategy for ensuring adequate pensions in the long term.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles. The analysis and conclusions expressed in this article are those of the author and not necessarily those of the OECD Development Centre.

© Angel Melguizo

Who is the middle class?

Source: Easterly, W. “The middle class consensus and economic development.” Journal of Economic Growth 6:4 (2001): 317–335; Birdsall, N. The (Indispensable) Middle Class in Developing Countries; Or the Rich and the Rest Not the Poor and the Rest. Center for Global Development Working Paper No. 207, 2010; Banerjee, A. V., and E. Duflo. “What is middle class about the middle classes around the world?” Journal of Economic Perspectives 22:2 (2008): 3–28; Kharas, H. The Emerging Middle Class in Developing Countries. OECD Development Centre Working Paper No. 285, 2010; Ferreira, F. H. G., et al. Economic Mobility and the Rise of the Latin American Middle Class. Washington, DC: World Bank, 2013.

What do we talk about when we talk about informality?

Source: Perry, G., W. Maloney, O. Arias, P. Fajnzylber, A. Mason, and J. Saavedra-Chanduvi. Informality: Exit and Exclusion. Washington, DC: World Bank, 2007; International Labour Organization. Final Report of the XVII International Conference of Labour Statisticians. Geneva: International Labour Office, 2003.