Elevator pitch

Informal employment accounts for more than half of total employment in Latin America and the Caribbean, and an even higher percentage in Africa and South Asia. It is associated with lack of social insurance, low tax collection, and low productivity jobs. Lowering payroll taxes is a potential lever to increase formal employment and extend social insurance coverage among the labor force. However, the effects of tax cuts vary across countries, often resulting in large wage shifts but relatively small employment effects. Cutting payroll taxes requires levying other taxes to compensate for lost revenue, which may be difficult in developing economies.

Key findings

Pros

Reducing payroll taxes can increase the share of formal jobs and reduce informal employment and/or unemployment, leading to positive impacts on social security coverage.

Part of the reduction in payroll taxes is shifted to higher wages.

Lower non-wage costs can increase employment of youth and low-wage/low-productivity workers.

A reduction in payroll taxes may have larger effects in developing countries with high minimum wages relative to income per capita.

Cons

In some countries, reducing payroll taxes has had no effects on formal employment.

Reducing payroll taxes can lead to lower tax collection if the positive effect of widening the tax base does not outweigh the loss of revenue.

When payroll taxes are lowered only for certain groups, regions, or industries, employment in the targeted groups may increase at the expense of non-targeted ones.

A reduction in payroll taxes will have less of an effect if skill gaps or geographical mismatches constrain the supply of workers to formal employment.

Author's main message

Payroll tax cuts can help increase formal employment in economies with high informality and/or unemployment. They have higher payoffs, in terms of formal employment creation, when minimum wages are binding and when labor demand and supply to the formal sector can be easily expanded. Finding alternative sources of revenue to pay for social insurance is often difficult in developing economies because they tend to be characterized by a small tax base. However, in economies with high informality, paying for social insurance, at least partly, with a consumption tax can be more efficient than funding it with payroll taxes.

Motivation

The share of informal employment—that is, the share of workers not contributing to social security—exceeds 50% in Latin America and the Caribbean, and is over 65% in at least one-third of the world’s countries. Informal employment is associated with low tax collection, low productivity, and lack of access to social insurance. It is therefore not surprising that increasing formalization is an important target for many developing economies.

While informality may have many causes, a commonly stated one is the presence of high payroll taxes. Payroll taxes, often referred to as social contributions, are levied on workers’ wages and/or on employers’ payrolls to pay for health insurance, old age pensions, disability insurance, and other social insurance programs such as unemployment insurance and maternity and sick leave. In some countries, they also pay for childcare facilities or workers’ training. Social contributions may increase the cost of hiring formal workers vis-à-vis hiring them informally, that is, without all the protections afforded by labor laws. The question thus arises: by how much can formal employment be raised if payroll taxes are cut?

Discussion of pros and cons

Theories relating payroll taxes to formal employment

Standard economic theory predicts an ambiguous effect of payroll taxes on employment and wages as it depends on factors such as the elasticity of labor demand—i.e. by how much labor demand changes as a result of changes in labor costs; the elasticity of labor supply—i.e. by how much labor supply changes due to changes in wages or earnings; workers’ valuation of social security taxes—i.e. how much workers are willing to pay for having access to services and amenities funded with payroll taxes; the level of minimum wages; and workers’ bargaining power, among others [2]. A payroll tax cut tends to stimulate demand for formal employment, triggering increases in employment and wages. However, it may also prompt a reduction in the number of workers willing to work in the formal sector.

A key parameter for determining the labor supply reaction is the valuation of the benefits paid with social contributions. If benefits are valued by workers, and workers interpret the reduction in taxes as a reduction in formal benefits (because benefits are typically funded by the tax), then fewer workers will be willing to work in the formal sector. In this case, a payroll tax cut generates a reduction of labor supply and an increase in labor demand in the formal sector. Formal wages will necessarily rise to attract additional workers into the formal sector, but, the decline in labor supply may outweigh, or even cancel out the positive effect of a payroll tax cut on formal employment. Conversely, if benefits are of little or no value to workers (e.g. due to low service quality or lack of information), then a reduction in payroll taxes does not alter the supply of labor to the formal sector and would lead to positive gains in employment as well as some gains in wages (to attract more people to the formal sector), though wage gains will be smaller than if labor supply declines.

Given this ambiguity in the labor supply response, a payroll tax cut is expected to increase formal sector wages, but not necessarily expand employment. Economic theory also predicts that the increase in formal sector vacancies generated by a payroll tax cut will be more easily filled in labor markets where the minimum wage is binding, i.e. when legal wage floors increase wages in the formal sector above the value of workers’ alternative use of time (e.g. working in the informal sector or searching for a job). When this is the case, more workers will want to work in the formal sector than there are jobs available; therefore, any expansion in vacancies can easily be met with workers who were previously unemployed or in the informal sector, without needing to raise wages. This is an important point, as there is an ongoing discussion between economists who believe that typically, in developing economies, many workers want a formal sector job, but are “excluded” due to an insufficient number of available formal sector jobs. If this is always the case, then payroll tax cuts will likely boost formal employment.

Given these considerations, a number of studies have adapted the standard neoclassic model of labor supply and demand to the characteristics of developing economies, where a large number of workers work in informal arrangements—defined in this case as workers who do not contribute to social security. In these models, informality emerges because tax agencies are not able to fully enforce payroll taxes in a context characterized by a predominance of small-scale firms, which are costly to tax and regulate. In such an environment, a payroll tax cut increases the demand for formal employment. The amount of labor that reallocates from the informal to the formal economy depends, on the one hand, on the capacity of formal firms to expand labor demand as a response to a labor cost reduction (also referred to as the elasticity of labor demand) and, on the other hand, on whether informal workers are willing to reallocate to the formal sector. If informal workers cannot or are unwilling to move to the formal sector, then the expansion of formal employment as a consequence of the tax cut will draw solely from the unemployment pool. Conversely, if rising formal wages motivate informal workers to move to the formal sector, then payroll tax cuts will trigger increases in formal sector employment as well as in formal and informal wages, the latter because there will be fewer workers competing for the same pool of informal jobs.

The above models have been used to predict the effects of tax cuts on formal sector employment. For example, in Colombia, a recent tax reform lowered payroll taxes by 13.5 percentage points (or 22.4%) for workers earning up to 10 times the minimum wage and created a new tax on firms to compensate for revenue losses. A general equilibrium model predicts that this reform will increase formal employment by 3.4–3.7% and lead to a formal wage increase of approximately 4.9% [3].

Empirical estimates of employment and wage effects vary widely

While theoretical models are useful to assess the possible magnitudes and channels by which tax cuts affect jobs, the effect of payroll taxes on formal employment or wages is ultimately an empirical question. However, measuring the impact of changes in payroll taxes presents a series of methodological challenges that cannot be overlooked. These arise because payroll taxes do not change often, and when they do, they tend to change across the board, with little variation between individuals or firms; this lack of variation makes identifying the effects of tax cuts on employment and wages quite difficult, as the effect of tax cuts may be easily confounded with the effects of other contemporary changes in policy or the environment.

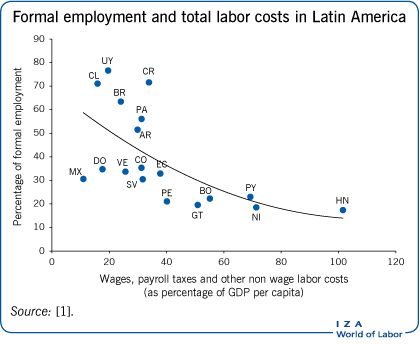

The illustration on page 1 shows a strong correlation between non-wage labor costs (i.e. the sum of wages, payroll taxes, and other labor costs introduced by labor legislation, such as dismissal costs)—adjusted by income per capita—and the level of informality across Latin American economies. It suggests that as the cost of hiring formal labor rises—in relation to its productivity—formal employment will decrease. As payroll taxes are an important part of the cost of labor, the figure suggests a negative relationship between payroll taxes and formal employment. An interesting question is then: What do detailed econometric studies that assess this relationship find?

To assess the effects of payroll taxes on employment and wages, some studies have relied on differences across countries and through time with respect to payroll taxes. One such study for Latin America and the Caribbean estimates that a 10% tax cut leads to an increase in total employment (formal and informal) of 4.47% [4]. Another study covering the regions of Central and Eastern Europe and Latin America estimates the effect of payroll taxes on a broad measure of informality [5]. This broad measure is defined as all market-based production of goods and services that are not declared to public authorities so as to avoid paying taxes and/or social security contributions, labor laws, or administrative procedures, as a percentage of the country’s official GDP. The study finds that a reduction in payroll taxes is associated with a decline in this measure of informality.

However, as already mentioned, this type of study can easily confound the effects of changes in labor taxes with the effects of other contemporaneous policy changes. Moreover, the possibility cannot be discarded that causality goes from changes in employment or unemployment to changes in payroll taxes, which would also lead to biased estimates of the effect of payroll tax cuts on employment.

Given these problems, studies that make use of within-country, cross-industry, geographical, or individual variation in payroll taxes are considered a more reliable way to identify the effect of a payroll tax cut on formal employment. One of the pioneering studies examined the effects of a large reduction in payroll taxes (of 25%) in Chile using information from a panel of manufacturing plants and on the actual tax rate paid by each company before and after the reform [6]. It found that the reduction in taxes was fully shifted to wages (i.e. wages increased by an amount equal to the tax reduction), with no discernible impacts on employment.

Another study analyzed the impact of payroll taxes in Colombia during a period when payroll taxes increased considerably (from 35.48 % in 1980 to 51.48% in 1996) and when contemporary studies indicated a strong effect of minimum wage laws in creating wage floors that raised formal sector wages above the wage of the informal sector [7]. As in the Chilean study, the Colombian study used a panel survey of manufacturing plants to assess the effect of payroll tax changes. Consistent with theoretical predictions regarding the impacts of payroll tax cuts in the context of binding minimum wages, the authors found that only about 20% of the increase in taxes was shifted to wages (i.e. wages could not adjust downward to compensate for the decline in formal sector jobs, because of the minimum wage floor). They also estimated that a 10% increase in payroll taxes reduced formal employment by between 4% and 5%. In addition, they found smaller employment effects and higher wage shifts for non-production than for production workers, consistent with the fact that minimum wages were more binding for the latter.

Similarly, a study for Argentina provides another valuable estimate of the effect of payroll taxes on employment and wages [8]. The interesting feature of this study is that it examines the effect of statutory payroll taxes that varied across time and geographical areas, providing cross-sectional and time series variation. In December 1993, a uniform national payroll tax rate of 33% was reduced by varying amounts across 85 regions in Argentina to between 6.6% and 23.1%. These reductions followed pre-established and well-explained rules, based on the distance to Buenos Aires and the percentage of each region’s population facing basic needs deficits. During the study period, which began in 1995, payroll taxes were further lowered twice in different percentages across provinces until 2001, when a uniform payroll tax of 21% was mandated in all provinces. The authors employ a data set of payroll payments and employment rates aggregated by geographical area. The study finds that changes in payroll tax rates caused a change in wages equal to half of the percentage reduction in taxes. However, evidence of wage shifts was only found when taxes were reduced, which may be indicative of downward wage rigidities (i.e. wages could not decrease when taxes were increased, possibly due to minimum wage restrictions). The study does not find any significant effects of payroll tax changes on formal employment. Another important lesson documented in this study is that while employment did not increase, tax collection as a percentage of total wage income fell by almost half between the mid-1990s and the early 2000s, showcasing the trade-offs between potential employment gains—not realized in this case—and tax collection.

Finally, another study, in this case for Turkey, also exploits geographical variation over time and across regions to assess the impact of (changes in) payroll taxes on formal employment in a developing economy [9]. To estimate the impact of those changes, the authors made use of the fact that tax rates were lowered only in some provinces, and that the number of provinces covered by the payroll tax cut increased over time. It is worth pointing out that payroll taxes in Turkey at the time of this study were among the highest in the OECD, particularly for low-income workers. Another important feature in this case is that, rather than offering an across-the-board reduction in payroll taxes for all workers in the treated provinces, tax cuts were offered only to newly registered workers and were equivalent to 37% of the minimum wage. Incentives also included credits on workers’ income taxes, subsidies to electricity consumption, and land subsidies. The authors compare the evolution of employment in the provinces where the subsidy was offered with the evolution of employment in a group of comparable provinces that did not qualify for the subsidy. Their results suggest a positive and large effect of the subsidies on formal employment (around 5–13%) which seems to be caused by the formalization of informal employment rather than new employment creation.

The authors of the Turkish study estimate that the cost incurred by the state for each additional formal job averaged between 52% and 124% of the average monthly minimum wage. While most studies do not calculate the costs of payroll tax cuts in terms of each additional formal job created by the policy, the lesson here is that they are likely to be large. This highlights the need for states to substitute for the foregone tax collection, likely by instituting some other form of taxes, for example by raising the value added tax (VAT). The cost per formal job created is likely to be larger in schemes that reduce payroll taxes for both new and active workers (compared to programs that only reduce taxes on certain groups, e.g. new workers), as the benefits of employment creation have to be weighed against a larger reduction in the amount of taxes collected.

In sum the available studies for developing economies indicate that the effects of payroll tax cuts on formal employment, particularly those estimated through more reliable techniques, vary considerably across countries. It is unclear exactly what explains such differences, although, in the case of Colombia, the presence of binding minimum wages could account for why the employment effects have been significantly larger in this country than in others. Likewise, in the Turkish case, the fact that payroll taxes were accompanied by income tax credits as well as subsidies on land and electricity consumption could explain the relatively large employment effect observed there.

Studies from developed countries reveal additional useful information

Given the dearth of studies employing reliable identification methodologies to estimate the effect of payroll taxes on formal employment in developing economies, it may be useful to examine what insights can be gained from studies in developed economies. While the size of the informal sector in developed economies tends to be small, it is still useful to assess the measured response of total employment (almost entirely made up of formal employment in these countries) to payroll tax cuts. This is particularly relevant because there are several studies in developed economies that use geographical and time variation to estimate such impacts. A large share of these have taken place in Nordic countries (Finland, Norway, and Sweden). These studies find that between one-quarter and half of the payroll tax reductions are shifted to wages, while the effects on employment are found to be smaller, at most in the order of one-quarter of the tax cut reduction.

Additional insights can be gained from a study that analyzes the effects of payroll tax cuts targeted at youth in Sweden [10]. In 2007, Sweden lowered payroll taxes by 11 percentage points for youth who were between 18 and 24 years old. This group comprised about 10% of the overall labor force. The study finds an effect on employment of around 1%, or less than 0.1 of the tax cut amount, although the effects are found to be larger for workers earning near the minimum wage. This study also suggests that the low employment response had more to do with restrictions on the demand for labor, than on the supply side. The authors postulate that this was because many firms had no demand for young workers, given their relatively higher cost and lower productivity, and that tax cuts were insufficient to promote positive hiring. This hypothesis is backed by two findings: there was no additional hiring among the unemployed (arguably the least productive of the group) and the response was much higher among workers with at least two years of vocational training (considered to be in short supply).

Two further issues are important when assessing tax cuts targeted at youth like the ones implemented in Sweden. First, payroll tax cuts for youth could reduce the employment prospects of workers outside this targeted age group. If that is the case, then the measured results on youth will overestimate the total employment effects because they will not account for employment reductions among older workers. Second, the authors find the estimated cost per job created to be very large, in the order of more than four times the cost of directly hiring these workers at the average wage. Therefore, evidence from the Nordic countries suggests that the employment response to tax cuts is quite low (0.25 of the tax cut, or less) and that payroll tax cuts may be an expensive way to create additional jobs.

The Nordic findings contrast with results from France [11]. A recent study examined the effect on employment of a payroll tax reform that changed payroll taxes depending on whether firms had switched to a 35 hour workweek, and the date at which they did so. The authors then compared changes in employment and wages to the changes in labor costs faced by each firm as a result of the reform. Restricting the analysis to firms that were in business during the whole period of study, the authors find a relatively large employment response, around 0.4% for each 1% change in average labor costs, implying that changes in payroll taxes had a substantial impact on employment.

In summary, the available empirical evidence provides heterogeneous results within both developed and developing economies. Despite this wide variety, many studies do find small effects on employment as well as substantive, but not full, wage shifts. The method of analysis also seems to influence the results, with studies using geographical variation finding, in general, smaller employment effects.

Shifting social insurance funding: From payroll taxes to other income sources

Given the relatively minor sensitivity of formal employment to payroll taxes documented in the above studies, achieving large reductions in informality would require considerable tax cuts, which raises the issue of how to finance social insurance. Some authors have argued in favor of the state providing a non-contributory universal social insurance scheme financed with VAT [12]. This scheme would have the advantage of putting an end to a truncated welfare state that excludes a large percentage of the population and, potentially, creates distortions in the labor market. Financing social insurance with general revenues would allow all workers to be covered, regardless of their type of employment or the productivity of their firms.

Raising VAT can provide a valuable alternative to payroll taxes, but it can also increase VAT evasion. Therefore, the relative merits of payroll taxes vis-à-vis consumption taxes need to be carefully assessed. Recent studies, however, suggest it may be a very interesting way to finance social insurance for all workers, both formal and informal, in developing economies. Economic theory indicates that in economies where both firms and workers can choose whether to operate formally or informally, and where there is imperfect compliance of consumption and payroll taxes, VAT can be a better way to pay for social insurance than payroll taxation. Thus, it can be shown that, in principle, it is possible to eliminate payroll taxation and increase VAT by an amount that yields the same employment, wages, and production of goods and services, but produces higher revenues for the state. A study for Mexico shows that reducing VAT exemptions, mandating a universal VAT of 16%, and discontinuing non-contributory programs available only to informal workers would be enough to pay for a universal social insurance package that provides similar health and pension benefits to those offered by the current social security system to workers who earn twice the minimum wage [12]. This study showcases the potential of compressive tax reform for improving both the coverage of social insurance and the allocation of employment in developing economies.

Limitations and gaps

There is still a very limited number of studies in developing economies that provide a reliable response to the question of how much formal employment can increase if payroll taxes are cut or eliminated. While studies on developed countries provide additional evidence, it is unclear whether this evidence provides a good proxy for such effects in developing economies.

In addition, while studies that exploit variation across time within a country, such as the ones reviewed here, are considered to be the best in terms of identifying the effects of payroll taxes on formal employment and wages, they still encounter a number of shortcomings. First, identification of treatment groups based on differences across geographical areas is problematic in that the treated regions tend to differ from the control regions in many respects (e.g. location, level of economic activity, types of activities). All the studies reviewed in this article attempt to control for such differences, selecting control regions that are as similar as possible to the treated areas; however, it is practically impossible to find perfect control matches given the vast array of characteristics to consider. Another important issue is that the measured effects are only representative of the treated areas and the generalizability of results is not clear. Finally, the estimated effects may overstate employment effects if firms and workers in control areas move to treated regions as a result of the policy change.

Summary and policy advice

Payroll taxes have been shown to have effects on formal employment, informality, and wages, but their measured effects vary substantially across countries and studies. As many developing countries attempt to reduce the size of their informal sectors and expand their social security systems’ coverage, they are pondering whether to enact payroll tax cuts. With that in mind, the reviewed evidence suggests that such a strategy can have a higher payoff under the following circumstances: (i) Minimum wages present a binding constraint for employment creation in the country; (ii) due to low quality or lack of information, programs financed with payroll taxes are perceived to be of low value; (iii) there are few constraints to the expansion of labor demand because firms can easily access markets in which to sell or export additional goods; (iv) there are workers that are willing, and, quite importantly, have the skills to work in the industries that are expected to expand as a result of a payroll tax cut.

Conversely, if informal workers do not have the required skills, or are not willing to take formal employment, then the expected effects on formal employment will be low. As such, it is important to analyze the incentives for workers to remain in the informal sector as a consequence of well-intentioned, but poorly designed social policies [13].

Given the scarcity of high-quality evidence from developing economies, countries considering implementing such schemes could benefit from piloting reforms; moreover, they should design the pilots so that they can be rigorously evaluated.

It is also worth mentioning that any additional jobs created by way of payroll tax cuts may incur a high price in terms of public resources, particularly when tax cuts are given across the board, or when the employment effects are very low. Therefore, given developing economies’ low fiscal base, it is necessary to carefully evaluate the benefits and costs of such initiatives and to consider alternative ways of securing financing for such benefits. In economies with high informality, VAT may be a more efficient way to finance social insurance than payroll taxes.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. The author also thanks Juan Miguel Villa for helpful support.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Carmen Pagés