Elevator pitch

Decreased transportation costs have led to the transmission of ideas and values across national borders that has helped reduce the barriers to international labor mobility. In this context, high-skilled individuals are more likely to vote with their feet in response to high income taxes. It is thus important to examine the magnitude of tax-driven migration responses in developed countries as well as the possible consequences of income tax competition between nation states. More specifically, how does the potential threat of migration affect a country’s optimal income tax policies?

Key findings

Pros

Some types of taxpayers do move in response to taxation levels, most notably highly paid (and highly skilled) workers.

Increasing tax competition for high-income earners may damage the “social contract” that resulted from the historical development of the welfare state in developed countries.

The response of migration to post-tax earnings must be precisely understood in order to derive the optimal income tax schedule.

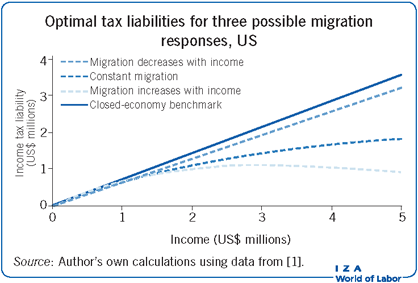

If very rich people are very sensitive to tax changes, and in particular are more sensitive than others, then tax progressivity may not be optimal.

Cons

The best current estimates of taxpayers’ migration responses are essentially useless, because they do not estimate the correct parameter.

Because those who move in response to taxation are a small share of the overall population, estimating the relevant statistic requires rather exhaustive data sets.

The link between tax competition and increased inequalities has not been clearly established.