Elevator pitch

With aging populations and increased demands on government revenue, countries need to boost employment and earnings. Tax policy should focus on labor market entry and retirement. Those are the points where labor supply is most responsive to tax incentives, which can enhance the flow into work of people leaving school and women with young children and can prolong employment among older workers. Human capital policy has a complementary role in improving the payoff to work and ensuring that earnings hold up longer over a lifetime.

Key findings

Pros

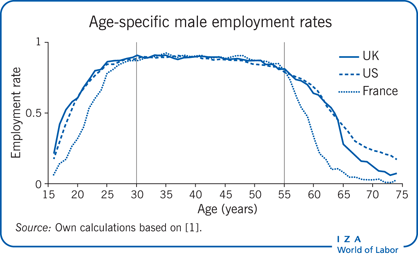

Employment and hours worked are responsive to tax incentives at key points in the life cycle, particularly the early and late stages.

Employment and hours worked are also responsive to tax incentives for mothers with young children.

Human capital investments extend incentives for lifetime labor supply by boosting wages and keeping them higher longer into old age.

Cons

Longer-term payoff to employment is small for people with only basic school qualifications.

Part-time work experience seems to have little long-term payoff.

Tax and welfare policy is limited without a focus on human capital investments.