Elevator pitch

With aging populations and increased demands on government revenue, countries need to boost employment and earnings. Tax policy should focus on labor market entry and retirement. Those are the points where labor supply is most responsive to tax incentives, which can enhance the flow into work of people leaving school and women with young children and can prolong employment among older workers. Human capital policy has a complementary role in improving the payoff to work and ensuring that earnings hold up longer over a lifetime.

Key findings

Pros

Employment and hours worked are responsive to tax incentives at key points in the life cycle, particularly the early and late stages.

Employment and hours worked are also responsive to tax incentives for mothers with young children.

Human capital investments extend incentives for lifetime labor supply by boosting wages and keeping them higher longer into old age.

Cons

Longer-term payoff to employment is small for people with only basic school qualifications.

Part-time work experience seems to have little long-term payoff.

Tax and welfare policy is limited without a focus on human capital investments.

Author's main message

Even before the financial crisis of 2008–2009 many developed economies were struggling to maintain employment and earnings. These problems become even more severe as populations age. The key to extending employment and earnings is to focus policy on improving the flows into work for people leaving school and for mothers with young children, and on expanding work among people in their 50s and 60s. These are the margins where labor supply is most sensitive to tax incentives, and a policy redesign can enhance earnings throughout the working life.

Motivation

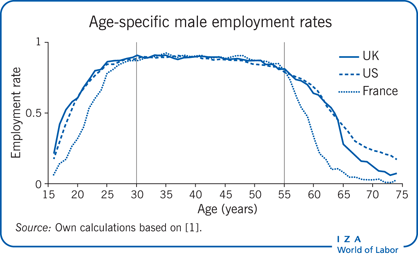

Three key trends explain the recent history of variation in employment and hours worked [1]: declining employment among men, especially older men; rising employment and hours worked among women; and declining employment among people in their late teens and early 20s, partly reflecting an increase in educational attainment. These are also the three key margins most likely to respond positively to tax reform.

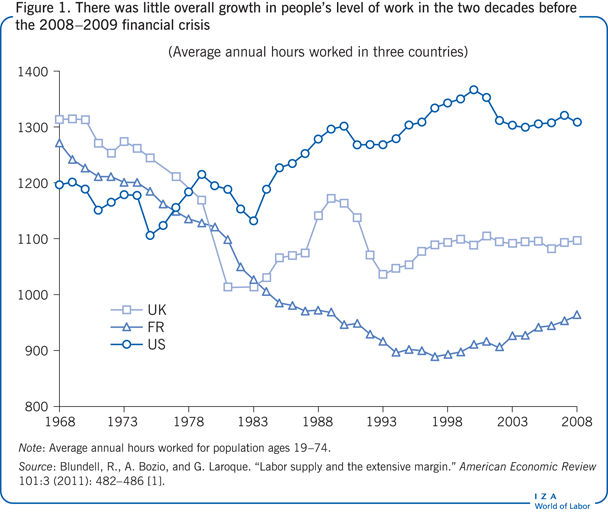

Despite large overall differences in the level of work in France, the UK, and the US, for example, average annual hours worked by people aged 19–74 in the 20 years preceding the 2008–2009 financial crisis grew very little (see Figure 1). Performance was mediocre despite the strong increase in female employment and hours worked.

While there are only minor differences in employment rates across countries for some age groups, differences are stark for others (see Figure 1). Thus, in normal economic times employment rates vary little across countries for people aged 30–55. This was the case for both men and women in 2007, the last buoyant year before the great recession. In contrast, differences in employment across countries are considerable at younger and older ages. At young ages the decision whether to leave school, to start work, or to combine work and college comes into play. These decisions vary widely across countries [1]. At later ages, most of the wider differences in employment rates across countries cannot be explained simply by differences in the health of workers or the technology of employers [2].

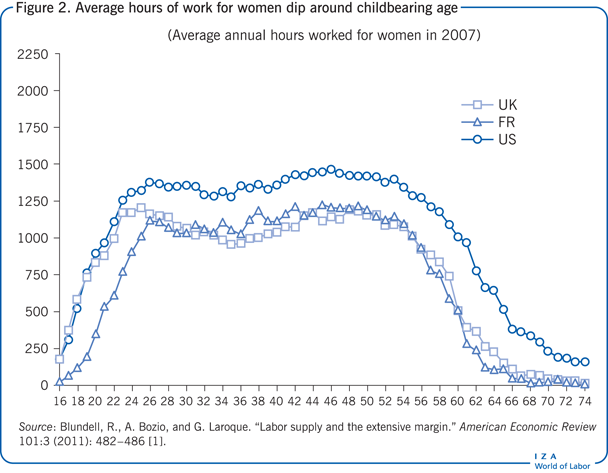

The much lower labor supply of women of childbearing age is also noteworthy, as reflected by wide differences in average annual hours worked (see Figure 2).

It is not just employment and hours worked that matter, though. Overall earnings are the key to income levels and to sustaining an aging population. And when it comes to wage differentials, differences in human capital investments really matter.

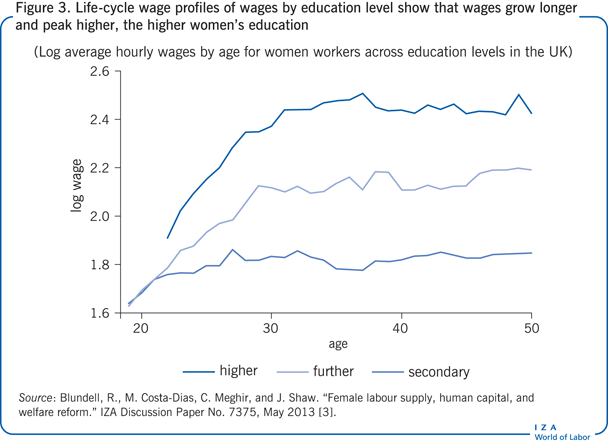

Hourly wages grow faster and for a longer time among people with more education. Looking at the average hourly wages (in log units) for women in the UK over their working life by education level reveals a clear story: The higher the education level, the longer wages continue to grow and the higher they peak (see Figure 3).

Discussion of pros and cons

The story behind these trends is revealing. It suggests that the key to improving employment levels in the long run is to enhance human capital investments and focus on the entry and retirement margins of labor supply. Policies should be guided by what is known about the size of the responses of labor supply and human capital investment to tax reform.

Empirical studies yield lessons about taking a life-cycle approach and considering policy interactions

The responsiveness of employment and earnings to tax policy incentives has received enormous empirical attention at both micro and macro levels [4] [5]. Increased access to administrative data on individual tax returns has added precision to empirical analysis, reducing measurement error and enabling studies of responses by specific groups and at specific points on the tax schedule. Tax return information has also provided direct evidence on taxable income elasticities.

Five clear messages emerge from these empirical studies:

It is important to view employment and earnings over a lifetime, because there are points in the life cycle when responses to tax incentives are most effective.

Work incentives are also influenced by decisions on human capital investment. Investments in formal schooling boost wages over the working life, and on-the-job training adds a dynamic incentive to any tax reform.

Because tax, tax credit, and welfare systems interact, incentives in the tax credit and welfare systems can influence work decisions as much as incentives in the personal income tax system do. Intended incentives in reforms of a particular tax, tax credit, or welfare benefit can be muted or neutralized by these interactions.

Fixed costs and information costs of work also affect work incentives. The fixed costs of work mean that decisions at the extensive margin (whether to work) and at the intensive margin (how much and when to work) will respond differently to incentives. Additionally, information costs mean that the incentives facing individuals and families may not be precisely as written in the tax and welfare law. Consequently, large reforms that are well understood are more likely to have the desired impact on work incentives and net incomes.

Opportunities for tax avoidance and tax shifting can induce responses of taxable income to tax reform in addition to the induced changes in gross earnings.

A life-cycle perspective

Many recent studies emphasize a life-cycle perspective, noting that although responses may appear small at certain points in the life cycle, they are large at other points. Viewed over the whole life cycle, labor supply can be quite responsive to taxes even for those who appear not to respond to changes in incentives early in their working career. In a life-cycle analysis, tax reforms can substantively alter the input of hours and effort over a lifetime.

A micro-data-based model of retirement choices, which allows for disincentives in social security and medical insurance at the individual level, has been developed to explore these lifetime responses. Weakening these disincentives is found to have much larger impacts for older workers than for younger ones. At older ages there are more workers who are close to their labor market participation margin and who are more likely to respond to incentives. These workers provide more convincing micro-evidence on the potential of supply-side responses through the extension of the working life.

Interactions between human capital investments and labor supply

Added to this life-cycle view is a greater focus on the interaction between human capital investments and labor supply. A lifetime framework accounts for responses in investments in education and on-the-job training alongside labor supply. Human capital investments increase the payoff to work and augment earnings over the working life. Micro-based studies increasingly acknowledge features of both labor supply and human capital behavior in tax policy analysis. A recent study noted that the payoff to human capital investments may be greater among workers with higher initial education investments [3]. In turn, education investments depend on perceived returns that can be clearly influenced by redistributive taxation. A long line of research relating experience capital and future wages convincingly supports the argument that allowing for human capital increases the responsiveness of labor supply to tax changes and that these effects differ over the life cycle.

Interactions of tax and welfare systems

While hardly new, this life cycle–human capital setting for analyzing labor supply responses deserves more attention and better integration in the general analysis of supply-side reforms of tax, welfare, and social insurance systems. Assessing the effective incentive, or disincentive, to work induced by the tax and welfare systems requires careful analysis of how tax rates, tax credits, and welfare benefits overlap. Benefits change incentives to work, first by providing income to those who are out of work and then by withdrawing those benefits as income is earned in work. When considered together with tax credits, employer taxes, and income tax rates, effective tax rates can be extremely high, especially for low-wage workers.

Fixed costs and information costs

The distinction between whether to work and how much to work seems a natural one to make in a study of work incentives. Yet it is not as simple as it seems. Should the unit of analysis of the decision on whether to work be a day, a week, a month, a year, a job, or a lifetime? The answer depends partly on where the “fixed costs” of work are important. Potentially important aspects of fixed costs include child care, travel to work, and work clothing. Even then, the strength of the responses at the extensive and intensive margins can have a large effect on where work incentives are placed and where they are likely to be most effective. At the extensive margin, responses are strongest for younger workers, parents of young children, and older workers.

Information is also vital for understanding responses and properly measuring effective incentives in the tax system, as shown in a series of studies that consider bunching at the “kinks” in hours of work and in earnings and the role of information on the earned income tax credit [6]. If the information requirements are too complex, some people will be unwilling, unable, or too uninformed to access all the benefits and tax credits for which they are eligible. It is difficult to argue against a policy reform that makes an individual’s eligibility for certain benefits and tax credits more transparent and clarifies the effective tax rates in the system.

Tax avoidance and shifting

The focus here on hours, employment, and human capital is not meant to ignore other key ways that earnings respond to taxes, such as taxation of top income earners and the self-employed. In that context concerns about the tax base come back into play. For example, a convincing case can be made for looking directly at taxable income. The more opportunities for tax exemptions and deductions and for tax shifting to lower tax jurisdictions, the more difficult it is to raise revenue from the top income earners. Analysis requires a general elasticity measure that captures these other avenues of response. The taxable income elasticity does just that.

A higher tax rate on a smaller base will raise less revenue and will probably be harder to sustain. The responsiveness of taxable income to the tax rate is a key parameter for setting top tax rates (see Higher tax rates on a smaller base). This elasticity captures additional avoidance and tax-shifting responses and can be expected to fall as the tax base broadens. For a given tax base a simple formula can give an idea of the revenue maximizing rate for the top tax bracket—the Laffer rate [7].

Estimated responses vary at different points in the life cycle

From a life-cyle perspective, the various estimated response elasticities reported in the literature form a much more coherent pattern. The points at which many key lifetime decisions are being made are also the points at which incentives, including those in the tax and welfare systems, have the greatest effect. These are: the entry into work after school; work decisions for those with young children; and work decisions for older workers who are making retirement decisions.

Younger, low-education workers and workers with young families

The evidence suggests that younger workers with little formal education are likely to experience a low payoff from investments in on-the-job training, whether through passive learning by doing or active investment, because of the complementarities between human capital investments [8]. Consequently, at least in buoyant economic times, low-education workers have little dynamic incentive to stay in work over and above the current-period incentives modeled in standard labor supply analyses. Typically, they face important complexities in the tax and welfare benefit systems through the interaction and overlap of the tax, tax credit, and welfare systems, especially if they have children. To understand their responses, it is important to model these nonlinear budget constraints and to account for awareness and take-up of welfare and tax credit entitlements.

The distribution of younger, low-education workers is likely to be closer to the participation margin than the distribution of their more educated counterparts, making the low-education workers particularly sensitive to incentives at the extensive margin. For these workers it becomes important to allow for fixed costs of work, including child-care costs. There is evidence that once these details are accounted for, standard static models of labor supply behavior that account for demographic differences and differences at the extensive and intensive margins, as well as program take-up, can provide a reasonably good guide to the behavioral responses to tax and welfare reform [3].

The literature on labor supply responses for low-education workers suggests moderately high extensive margin elasticities, especially for women with young children, and somewhat lower intensive margin elasticities (often also pointing to important income effects for such groups) [4]. This combination of elasticities can be used to argue for the introduction or expansion of earned income tax credit-style subsidy programs for certain groups of low-wage workers [7].

Perhaps the most responsive segment of labor supply is low-education mothers returning to work after having a child. Well documented in the empirical literature, this phenomenon deserves to be a key part of the design of work incentives for low-wage workers. A suggested means of reaching these women is “tagging” implicit tax rates in tax credits and in the taper rate of means-tested benefits according to the age of the youngest child.

Children play a key role. Even if fertility decisions are exogenous to the tax system (which may be an assumption worth relaxing), the reforms that follow from these Mirrlees-style arguments often make a case for targeted wage subsidies that encourage work among young low-education women. There are of course other arguments to justify these policies. But if early childhood investments by parents (through time spent interacting with and reading to their children, for example) are key to child development, subsidizing work for low-education mothers with younger children might seem counterproductive. However, if human capital begets human capital from one generation to the next, then this concern may be less compelling. Instead, the argument for early child human capital investment might suggest targeted subsidies or targeted loans for high-quality child care to complement earnings incentives for low-wage parents.

Human capital investments

Human capital investment decisions have often been left aside in arguments about labor supply incentives. But progressive taxes will change the incentives to acquire education and to invest in human capital over the working life by reducing the expected return to education and by insuring against very low-wage outcomes that might otherwise occur for low-education workers. Both considerations have been shown to be potentially important in incentives for high school and college enrollment. On the flip side, targeted financial incentives to remain in school have met with some success. However, the degree to which progressive taxes reduce education investments is still far from fully researched.

Human capital investments take two forms: formal education and on-the-job training. The higher the education level, the longer into the working life that wages grow and the higher they peak (see Figure 3). Research has also found that on-the-job investments tend to complement formal education investments. Education complements experience capital, increasing earnings, extending the life-cycle profile, and making early retirement less advantageous. There is some evidence that this complementarity also extends to workplace qualification training.

For younger workers who have acquired higher levels of formal education before entering the labor market, an enhanced dynamic incentive adds to the static current-period incentives for work. That human capital investments enhance incentives to work and to work for longer is perhaps no surprise [9]. For educated workers, employment generates valuable experience, which is likely to depreciate with time out of the labor market. Consequently, very few educated young workers will be near the participation margin, and so they are unlikely to respond strongly to employment incentives or disincentives in the tax system while they are young. But from a lifetime labor supply perspective, the overall impact of taxation on the career length and earnings profile of higher-educated workers can be substantial. Incentives for early retirement implicit in some social security, earnings tests, and medical insurance schemes may then act to reduce the incentive to acquire human capital.

Added to this, part-time work produces little in the way of experience payoff, at least for women [3]. So there is a dynamic incentive to stay in full-time work. The part-time experience penalty adds to the other fixed-cost and work organization arguments about why part-time work is often less financially rewarding.

For people leaving school with lower educational qualifications, the key is to design a transition into work that avoids long spells of unemployment. This transition also appears responsive to work subsidy incentives and monitoring. But the policy design issue here is to prevent young people from leaving school too early and experiencing spells when they are neither in work nor in school. Financial incentives to stay in school can help. In general, work decisions by people with less education do appear to be sensitive to incentives in the tax benefit system.

Older workers

Even workers with high human capital investments are likely to become more responsive to incentives at the extensive margin as they approach retirement. This pattern of responsiveness over a lifetime is confirmed by high labor-supply responses at the extensive margin among older workers. The greater density of older workers around this margin has important implications for tax policy. That work decisions later in life are responsive to incentives is well documented [2].

The evidence shows strong variation in labor market activity for men and women in their late 50s and 60s. In most developed countries labor market activity declines at older ages, though with some recent reversals. In the UK, for example, people at the lower and upper ends of the wealth distribution are more likely to leave employment early than those in the middle. Broadly speaking, the poor are more likely to move onto disability benefits, while those with higher pension income and greater financial wealth are more likely to retire early and live on private pension income. Those in the middle are more likely to remain in paid work.

Limitations and gaps

Much work remains to be done linking human capital, health, and work decisions in the analysis of tax and welfare reform. Similarly, researchers have only begun to gain insights into decisions within families and the role of taxation in family formation.

Summary and policy advice

With aging populations and increasing demands on government revenues following the great recession, many countries face growing pressure to increase employment and earnings—and this at a time of sluggish productivity growth. The key to improving long-term trends in employment and earnings is to focus policy on labor market entry and retirement. Education also has a key role by improving the payoff to work, enhancing incentives to stay in work, and ensuring that earnings hold up longer over the life cycle.

The evidence points to a blueprint for a coherent and effective policy that takes a life-cycle view of work and human capital accumulation. At a broad level, key proposals would follow those in the Mirrlees Review [10]: to simplify and integrate the benefits and welfare systems, target work incentives where they are most effective, and align tax rates across similar sources of income to reduce avoidance opportunities and broaden the tax base.

More specifically, tax policy should be designed to acknowledge that incentives have been found to operate most effectively in enhancing lifetime earnings at certain key points in the life cycle, thus suggesting three key policy elements:

improving labor market entry for those leaving school and for women with young children;

keeping older workers in the labor force;

increasing human capital investments.

These three elements can go hand in hand. The path to improving long-term trends in employment and earnings would be to reduce disincentives in the tax and welfare systems around labor market entry and retirement, the margins of labor supply found to be most responsive to tax incentives. Reforms should recognize that early human capital investments enhance the incentive to work and to accumulate human capital while in work, ensuring that gross earnings hold up longer through the life cycle. In turn, the prospect of higher net income earned later in working life provides an important incentive for human capital investments.

These arguments point to a targeted rearrangement of the tax rate schedule that directs incentives toward points in the lifetime when labor supply responses, especially at the extensive margin, are strongest—largely for parents with young children and for older workers. For people leaving school with lower educational qualifications, the aim is to avoid excessive spells of unemployment. Their transition into work appears responsive to work-subsidy incentives, unemployment insurance, and monitoring. The key policy design issue is to prevent young people from leaving school too early and experiencing periods when they are neither in work nor in school.

For older workers, work decisions are particularly responsive to taxes. Incentives to stay in work longer and to strengthen incentives to invest in human capital can be improved by reducing the disincentives to work for people in their late 50s and 60s that are implicit in social security retirement ages, earnings tests, disability insurance, and medical insurance provisions. The more that welfare benefits can be linked to social insurance contributions, the less distortionary they become.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. The author would also like to thank colleagues at the Institute for Fiscal Studies (IFS) for helpful comments and the Economic and Social Research Council (ESRC) Centre for the Microeconomic Analysis of Public Policy at the IFS for financial support.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Richard Blundell

Higher tax rates on a smaller base

Slemrod, J., and W. Kopczuk. “The optimal elasticity of taxable income.” Journal of Public Economics 84:1 (2002): 91–112 (page 92).