Elevator pitch

Decreased transportation costs have led to the transmission of ideas and values across national borders that has helped reduce the barriers to international labor mobility. In this context, high-skilled individuals are more likely to vote with their feet in response to high income taxes. It is thus important to examine the magnitude of tax-driven migration responses in developed countries as well as the possible consequences of income tax competition between nation states. More specifically, how does the potential threat of migration affect a country’s optimal income tax policies?

Key findings

Pros

Some types of taxpayers do move in response to taxation levels, most notably highly paid (and highly skilled) workers.

Increasing tax competition for high-income earners may damage the “social contract” that resulted from the historical development of the welfare state in developed countries.

The response of migration to post-tax earnings must be precisely understood in order to derive the optimal income tax schedule.

If very rich people are very sensitive to tax changes, and in particular are more sensitive than others, then tax progressivity may not be optimal.

Cons

The best current estimates of taxpayers’ migration responses are essentially useless, because they do not estimate the correct parameter.

Because those who move in response to taxation are a small share of the overall population, estimating the relevant statistic requires rather exhaustive data sets.

The link between tax competition and increased inequalities has not been clearly established.

Author's main message

Migration responses of highly skilled workers to tax changes are usually studied through looking at migration elasticities with respect to post-tax earnings (i.e. what percentage of workers migrate due to a change in their post-tax earnings). However, the generally accepted theory relies upon the wrong measure of elasticity. This calls for a new direction in empirical work regarding the estimation of migration responses to tax changes. Policymakers should avoid “tax tagging,” intended to draw highly skilled foreign workers into their labor market, and instead work to strengthen international cooperation on both corporate and income tax levels.

Motivation

Traditionally, capital has been much more mobile than labor, and this largely remains the case today. However, since the beginning of the 1980s, an “era of human capital” has replaced the previous economic regime in which physical capital played the critical role. Globalization has made the mobility of labor, in particular skilled labor, much easier than it used to be. Nowadays, highly skilled workers represent about 35% of the OECD migration stock, but only 11.3% of the world’s labor force. In other words, a highly skilled worker is six times more likely to emigrate than a low-skilled one. This increased mobility presents a new constraint for the design of redistributive tax policies at the national level. Hence, it is important to investigate to what extent this increased mobility may be harmful to the progressivity of tax systems.

Discussion of pros and cons

Recent trends and challenges

A study from 2011 brings to light two clear tendencies in migration patterns within OECD countries [2]. First, more-educated people are more likely to emigrate; second, more-educated migrants settle in destination countries with high monetary rewards to skill. This article focuses on the mobility of highly skilled individuals, and more precisely on the issue of tax-driven migrations of “productive talents” between developed countries. These individuals are concentrated in the top of the income distribution.

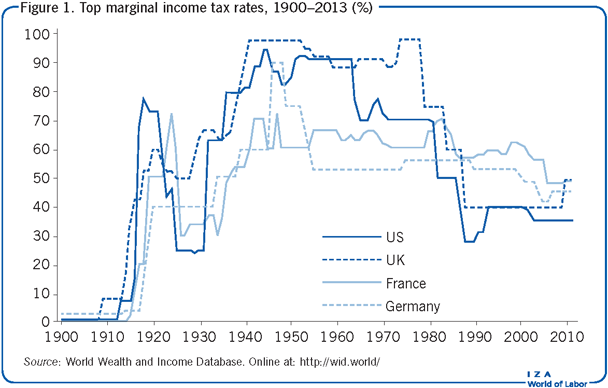

In this context, two trends emerge regarding top income tax rates in developed countries. First, there has been a declining tendency in these tax rates since the end of the 1970s, at least until the financial crisis of 2007–2008 (as illustrated in Figure 1). Moreover, a rather remarkable convergence process has taken place between the US and many EU countries. This convergence deserves explanation given the supposed differences in social preferences between the two sides of the Atlantic.

Second, the last few years have seen the introduction and development of specific tax cuts for highly skilled or rich foreign workers. These tax breaks exist in all Scandinavian countries, Germany, the Netherlands, Belgium, France, the UK, Switzerland, and Italy, among others. In addition, they have recently been extended in several countries, including France and the UK, and there are ongoing discussions about their extension in the Netherlands and Denmark.

The first phenomenon may mirror increased tax competition between nation states, with each trying to keep and attract highly skilled workers. The second trend illustrates the fact that increasing tax competition for high-income earners may damage the “social contract” that resulted from the historical development of the welfare state in developed countries. Mobile highly skilled individuals would be offered the possibility of a free ride by settling abroad, while the cost of the welfare state would be borne by the less-mobile and less-skilled “home-attached” residents.

The first question to address is whether high-skilled individuals react to differences in taxation when they choose where to locate. If this is the case, it is important to know what the relevant sufficient statistics are for the design of optimal income tax policies in an open economy. These relevant statistics then allow for an investigation into what the top optimal income tax rates look like.

Tax-driven migrations

Even though the potential impact of income taxation on migration choices has been extensively discussed in the theoretical literature, there are still few empirical studies estimating the actual migration responses to taxation. Tax-driven migrations are decisions along the extensive margin. This means that they result from comparisons of average tax rates (or tax liabilities) and not from comparisons of marginal tax rates (the tax rate on one additional unit of income). What matters is therefore to examine the extent to which a variation in the average tax rate in a given country induces migration flows (i.e. variations in the number of movers) and, thus, variations in the stock of taxpayers. Most of the studies report migration elasticities, which are defined as variations in the stock of taxpayers (or a specific category of taxpayers) resulting from variations in the net-of-tax income (or, equivalently, to the average tax rate).

A first set of studies considers the determinants of migration, in particular across US states (for a recent study see [3]). These studies find that per capita income has a positive effect on net migration rates into a state. This conclusion is entirely compatible with an explanation based on tax differences between US states, but may also be due to other differences, such as variations in productivities, housing rents, amenities, or public goods. A clean identification framework is therefore required to disentangle the pure tax component.

A second set of studies focuses exclusively on migration responses to taxation, typically narrowing the scope down to migration within a given country. Several studies, for example, exploit tax variation across Swiss jurisdictions. A study from 2007 uses tax differences across Swiss cantons and computes migration elasticities for different subpopulations, in particular for different groups in terms of education. The results suggest that young Swiss college graduates are the most sensitive to a rise in taxes. However, the estimated effects are not large enough to offset the revenue-increasing effect of the tax increase. The migratory responses of foreigner workers and other age-education groups are smaller, and reverse causation appears negligible.

A more recent study exploits the fact that Swiss municipalities, in addition to cantons and other jurisdictional levels, can affect personal income tax rates [4]. More precisely, the study investigates the response of income taxpayers within the 38 municipalities in the Bern metropolitan area from 2002 to 2011. The estimated elasticity of tax-induced migration, with respect to the net average tax rate, amounts to 1.17 for unmarried taxpayers with high incomes. Consequently, a 1% increase in the average tax rate induces 1.17% of this population to move to another jurisdiction, everything else being constant. Most of the other groups, in contrast, do not systematically respond to income tax changes, and some subcategories even react negatively.

Another study focusing on a single country uses a millionaire tax specific to the US state of New Jersey [5]. Because the salience of this millionaire tax is limited, the study’s estimates of the causal effect of taxation on migration are not statistically significant, except for extremely specific subpopulations. Still, the results suggest that the elasticity of migration is increasing in the upper part of the income distribution, implying that wealthier taxpayers do seem to migrate more in response to increases in taxation.

Another study exploits a recent tax reform in Spain granting regions the authority to set income tax rates [6]. This reform resulted in substantial tax differences, and is therefore well-suited to estimate the magnitude of potential tax-induced migration responses. It should be noted however that this study does not specifically focus on mobility by those at the top of the income distribution. Even so, the authors find that, conditional on moving, taxes have a significant effect on the location choice. More precisely, a 1% increase in the net-of-tax wage rate (i.e. what remains in a taxpayer’s pocket after paying taxes) for a region relative to others increases the probability of moving to this region by 1.5 percentage points. The authors estimate that the migration elasticity is at most 0.25 on average. This implies that, everything else being equal, a 10% increase in the average tax rate in a given region reduces the corresponding stock of migrants by 2.5%.

Important categories of people actually move in response to taxation

Some research has been devoted to the estimation of migration elasticities between countries, based on behavior of football (soccer) players ([7] and the studies it cites). The migration elasticity of domestic players with respect to domestic tax rates is rather small, around 0.15. By contrast, the corresponding elasticity for foreign players is much larger, around 1. This implies that a 10% increase in a given country’s average tax rate would induce the departure of 1.5% of the domestic players, and 10% of the foreign players.

The large estimate for foreign football players applies to the broader market of highly skilled foreign workers. More precisely, another study finds an elasticity above 1 in Denmark for the top 1% of the income distribution [8]. In any given country, the number of foreigner workers at the top of the income distribution is relatively small. Again, they are found more elastic to tax changes than nationals. An increase of 10% in the average tax rate faced by foreign and national taxpayers in the top 1% would result in the departure of about 10% of the foreign taxpayers, but of only 2.5% of the nationals [9]. This number is comparable to the one obtained in the study on Spain [6], although, as mentioned, the Spanish study does not specifically focus on taxpayers with incomes in the top 1% of the distribution.

In the context of increasing tax competition to attract talent, it might be tempting to suggest that the observed drop (recall Figure 1) in the top marginal tax rates (and hence in the average tax rates for the rich) is the upshot of this phenomenon. However, a 2014 study notes that there is little evidence that the downward trend in top marginal rates is a direct outcome of international competition for skilled labor or savings [10]. More generally, it would be interesting to establish a causal link between a lower contribution of the rich to the tax burden, a decrease in social spending, and an increase of inequality. However, a recent study notes that “the rise in income inequality since the 1970s owes nothing to any retreat from progressive social spending” [11]. It could thus be concluded that, at this stage, such a causal link between the increase in tax competition and the rise of inequalities has not been established. However, one should remain cautious on such a topic.

A tax game between two countries

The empirical evidence discussed above suggests that migration responses to taxation cannot be fully neglected when thinking about top marginal income tax rates. This empirical evidence is measured in terms of elasticities, as is usually done for other economic phenomena. A 2010 study presents a simple framework whereby the migration elasticity to the tax rate is considered a sufficient statistic to determine the optimal tax rate on the top income bracket [12]. However, this framework rests on implicit assumptions, which, in a general tax competition framework, have been shown to be insufficient for deducing the optimal income tax in a given country using only knowledge of the migration elasticity [1]. In other words, and in contrast to the commonly held belief, this measure of elasticity is not a sufficient statistic for determining a country’s optimal income tax rate.

A 2014 study investigates how the threat of migration for tax reasons affects which nonlinear income tax schedules competing governments will find optimal to implement in a Nash equilibrium (i.e. in which each competing government is “playing” a best response to the other’s strategy) [1]. Therefore, in such a Nash equilibrium, no government has an incentive to modify its tax policy unilaterally.

In the archetypal case of two (not necessarily identical) countries between which individuals are free to move, each worker’s income depends on his or her effort and productivity, as in the canonical Mirrlees model of the optimal income tax. Policymakers would ideally want to levy taxes based on productivity. This, however, is not feasible because of the basic separation between public and private information: each worker’s productivity is private knowledge, and only the overall distribution of productivity within the population is common knowledge. As a result, policymakers are constrained to levy taxes on incomes, which are observable. A crucial assumption is that taxes are levied according to the residence principle (only households who live in a country pay the income tax). This corresponds to what is implemented in almost all countries, though not in the US. This point will be addressed later on in the discussion of the results.

A key element of a new model developed in [1] is the manner in which it accounts for migration responses to taxation. There is a distribution of migration costs at each skill level. Hence, every individual is characterized by three characteristics: their birthplace, their skill level, and the cost they would incur in case of migration, with the last two being private information. As emphasized by a 1999 study, “the migration costs probably vary among persons [but] the sign of the correlation between costs and (skills) is ambiguous” [13]. This is why the 2014 study makes no assumptions about the correlation between skills and migration costs [1]. Individuals make decisions along two margins: the choice of taxable income operates on the intensive margin (choice of hours of work), whereas the location choice operates on the extensive margin (whether one is in a country or abroad). As such, an individual decides to move abroad if their utility abroad minus their migration costs is higher than their utility in their home country.

A new concept of elasticity to evaluate the impact of taxation on migration

In a closed economy (no international mobility of labor and capital), the government faces an equity-efficiency trade-off. For simplicity, assume that each government favors the well-being of the worst-off individual (i.e. someone who cannot work and who always prefers to live in his or her home country). Equity in this case means that the goal of the government is to achieve the highest possible consumption for this individual. This implies that the size of the redistribution budget should be as high as possible. The taxes that can be implemented are distortive, meaning that the marginal tax rates are non-zero. As a result, taxation has an efficiency cost: it reduces the number of hours of work that an individual is willing to offer. The optimal marginal tax rate is obtained when the marginal social benefit of increasing the tax rate by one additional unit of income, associated with an equity gain (higher consumption by the worst-off), is exactly compensated for by an increase in the marginal social cost (decrease in collected taxes). However, this has to be amended because this is an open world. The efficiency cost of increasing the marginal tax rate in an open economy is larger than in a closed economy: collected taxes may decrease further, because some of the taxpayers hit by an increase in the marginal tax rate may decide to move abroad.

This last consideration about taxpayers moving away due to increases in their taxes must be taken into account when attempting to determine a country’s optimal marginal tax structure. This necessitates introducing a new concept of elasticity, the semi-elasticity of migration to post-tax earnings. This new concept is defined as the percentage increase in the number of taxpayers of a given skill level when their after-tax income is increased at the margin. Roughly speaking, the semi-elasticity reveals the percentage of taxpayers who decide to move abroad when their net income decreases slightly in their residence country.

The main finding here is that the shape of the optimal income tax function depends on the slope of the semi-elasticity (which cannot be deduced from the slope of the elasticity of migration) and, in particular, whether the slope is constant, decreasing, or increasing. For example, when there is increasing semi-elasticity as income increases, this implies that a slight decrease in the after-tax income induces a larger share of richer taxpayers to move abroad. On the other hand, when the slope is decreasing as income rises, a slight decrease in the net-of-tax income induces a smaller share of richer taxpayers to move abroad. The analysis therefore calls for a change of focus in the empirical analysis when considering an open economy. If one wants to say something about the shape of the tax function, one must estimate the profile of the semi-elasticity of migration with respect to post-tax earnings.

The slope of the semi-elasticity cannot be deduced from the level of the elasticity

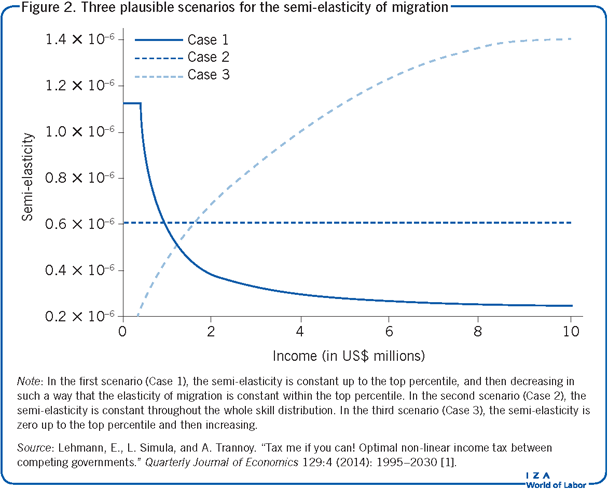

The slope of the semi-elasticity of migration cannot be recovered from the mere information of the value of the migration elasticity with respect to the tax rate. To illustrate this point, three possible scenarios for the migration elasticity in a tax competition can be investigated [1]. Imagine the US economy competing with an economy with the same characteristics, such as a unified Europe. In each of these scenarios, the average elasticity for the population in the top 1% of the income distribution is equal to 0.25, as suggested in [9]. Figure 2 shows the corresponding semi-elasticity profiles in response to earnings capacities. In the first scenario, the semi-elasticity is constant up to the top percentile (i.e. everyone but the wealthiest 1%), and then decreasing in such a way that the elasticity of migration is constant within the top percentile (the wealthiest 1%). In the second scenario, the semi-elasticity is constant throughout the whole skill distribution. In the third scenario, the semi-elasticity is zero up to the top percentile and then increasing.

Implication for the shape of the optimal tax schedule

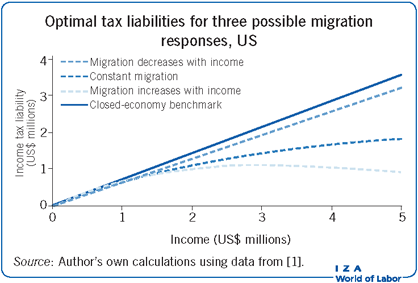

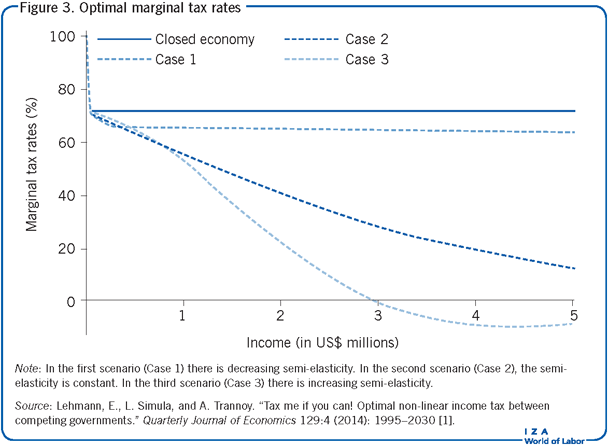

Using the calibration shown in Figure 2 for migration responses, and reasonable estimates of the elasticity of taxable income, the optimal tax liabilities and optimal marginal tax rates are computed for a case in which the US is in competition for high-skilled migrants with a similar country. The results are illustrated in Figure 3 for the optimal marginal tax rates and in the Illustration for tax liabilities. In the first scenario (decreasing semi-elasticity), the tax function is close to being linear for high-income earners and remains close to the closed-economy benchmark. In the second case (constant semi-elasticity), the tax function is more concave for large incomes, but remains increasing. In the third case (increasing semi-elasticity), the tax function decreases around a pre-tax income of $2.9 million. In particular, the richest people are not those paying the largest taxes. It is clear that the shape of the optimal tax schedule, especially at the top, depends crucially on the shape of the semi-elasticity. Moreover, the entire shape of the optimal income tax schedule is impacted by the threat of migration of high-skilled people. It might have been reasonable to believe that only the top bracket would be affected by tax competition and the mobility of the highly skilled, which is the assumption made in [9]. However, this belief is correct only in the first scenario, where the semi-elasticity is decreasing.

Limitations and gaps

The empirical studies mentioned in this article suggest that migration responses to tax variations differ across the population. Furthermore, a clear distinction must be made between the elasticity of the flow and the elasticity of the stock of migrants. In addition, it may be worth distinguishing several stock elasticities. In a given country, there are three groups of highly skilled workers: (i) high-skilled natives who have never emigrated abroad, (ii) mobile highly skilled natives who previously emigrated and have returned to their home country, and (iii) highly skilled foreign workers. With the first category in mind, it may be possible to define an elasticity of immigration: what is the impact of a tax variation (at home or abroad) on the stock of stayers. For the second category, an elasticity of repatriation could be defined, capturing variations in the stock of movers who came back to their home country due to tax variations at home. Finally, variations in the stock of highly skilled foreign workers may be captured in an elasticity of expatriation.

A key point to consider in this discussion is that averaging elasticities may be misleading. Even ignoring any form of tax differentiation, when there exist several groups of people responding to taxes in rather different ways, computing an average elasticity is equivalent to ignoring complex composition effects and may result in large biases of the marginal tax rates. The various migration elasticities thus have to be computed for rather small groups of people. It is therefore necessary to have access to exhaustive data sets to be able to correctly estimate these statistics, which play a key role in a global economy.

Research has focused on tax competition between nation states, considering that, in a given country, all tax residents face the same income tax schedule. This implies that tax differentiation based on citizenship is ruled out by assumption. However, if productivity cannot be directly observed by a policymaker, an alternative is that it is easy to know if an individual is non-native and when he or she arrived in a given country. Such information is used by an increasing number of governments, which have introduced specific tax breaks for highly skilled foreign workers. These tax reductions can typically be enjoyed for a limited number of years. Moreover, it should be noted that an EU country is even allowed to offer such temporary tax breaks to foreigners from within the EU. In practice, many countries therefore implement (at least) two income tax schedules: one designed for their native residents and potentially “usual” foreign workers (i.e. not high-skilled), and one targeted to the highly skilled foreign workers.

Summary and policy advice

Tax-driven migration appears to be a new constraint on the design of redistributive policies at the national level. Faced with this phenomenon, a defensive policy response may be to reduce workers’ ability to move across national borders (for example by reducing the public supply of higher education or by taxing remittances to family remaining in the country of origin, thus making emigration less attractive). Whilst there are many benefits to taking part in a global society, the introduction and reinforcement of tax breaks for highly skilled foreign workers in many developed countries, especially within the EU, could signal the beginning of a cycle of collectively harmful dynamics. For example, consider a scenario where a given country enacts such non-cooperative tax policies aimed at increasing collected taxes by attracting highly skilled workers from abroad, without modifying the tax schedule for the rest of the resident population. Other countries may respond to these actions by offering similar tax cuts. This could ignite a race to the bottom, in which the most highly skilled (and thereby highly paid) workers end up paying suboptimally low income taxes. When looking at the EU in particular, member countries should not follow this dangerous path any further. Instead, they should strengthen tax cooperation, not only with respect to corporate taxes but also when it comes to income taxes.

Another possibility would be for countries to tax their citizens on a worldwide basis. If this principle was widely applied, each country’s set of taxpayers would largely be independent of the other countries’ tax policies. However, collecting information on incomes earned abroad would require huge cooperation between tax administrations and some countries might lose tax revenues in the transition.

Acknowledgments

The authors thank an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Previous work of the author contains a larger number of background references for the material presented here and has been used intensively in all major parts of this article [1].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Laurent Simula and Alain Trannoy

Understanding semi-elasticity

The semi-elasticity of migration refers to the percentage change in migration/the number of taxpayers due to a unit change (in percentage points) in consumption. The elasticity of migration refers to the percentage change in migration/number of taxpayers due to a percentage change in consumption. The elasticity is linked to the semi-elasticity as follows: it is the product of the semi-elasticity and net income.