Elevator pitch

Do migration policies affect whether immigrants contribute more to public finances than they receive as transfer payments? Yes. But simply accumulating the annual fiscal transfers to and fiscal contributions by migrants is not sufficient to identify the policy impact and the potential need for reform. What is also required is measuring the present value of taxes contributed and transfers received by individuals over their lifespans. Results underscore the need for, and the economic benefits of, active migration and integration strategies.

Key findings

Pros

Knowledge about the net fiscal effects of migration is important for policymakers to cope with the economic needs for selective labor migration.

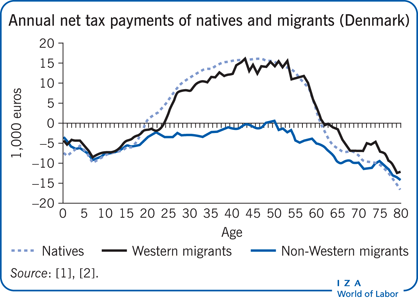

The balance of the net payments and receipts of migrants reveals whether migration and integration policies produce net fiscal benefits or costs.

Intensified research on the generational balances of migration may help support reforms in migration policy.

To increase the net fiscal effects of migration and integration, policy decisions should focus on a clear-sighted labor migration strategy that allows for an active selection process and facilitates migrants’ economic success and social integration.

Cons

The results of computing the net fiscal effects and generational accounts for migrants should not be overestimated, especially in country comparisons. Methods are complex, and comparable data are limited.

Revealing net negative effects may be misinterpreted and increase pressure to reform migration policies, since the different outcomes of alternative strategies take time.