Elevator pitch

Do migration policies affect whether immigrants contribute more to public finances than they receive as transfer payments? Yes. But simply accumulating the annual fiscal transfers to and fiscal contributions by migrants is not sufficient to identify the policy impact and the potential need for reform. What is also required is measuring the present value of taxes contributed and transfers received by individuals over their lifespans. Results underscore the need for, and the economic benefits of, active migration and integration strategies.

Key findings

Pros

Knowledge about the net fiscal effects of migration is important for policymakers to cope with the economic needs for selective labor migration.

The balance of the net payments and receipts of migrants reveals whether migration and integration policies produce net fiscal benefits or costs.

Intensified research on the generational balances of migration may help support reforms in migration policy.

To increase the net fiscal effects of migration and integration, policy decisions should focus on a clear-sighted labor migration strategy that allows for an active selection process and facilitates migrants’ economic success and social integration.

Cons

The results of computing the net fiscal effects and generational accounts for migrants should not be overestimated, especially in country comparisons. Methods are complex, and comparable data are limited.

Revealing net negative effects may be misinterpreted and increase pressure to reform migration policies, since the different outcomes of alternative strategies take time.

Author's main message

Immigrant selection through migration policies generates either a surplus or a deficit in social security systems and public budgets. Economic selection criteria and early labor market integration increase the likelihood of substantially positive net fiscal effects. Less active migration policies and barriers to immigrant labor market participation enlarge the risk of weak or even negative fiscal effects. Policy reforms should consider the results of generational accounting for natives and immigrants.

Motivation

The socio-economic and fiscal consequences of immigration and the immediate effects of different migration policies are underappreciated by many policymakers, especially in many European countries that lack a clear and transparent economic approach to immigration. It seems obvious that facilitating labor market access for migrants will reduce dependency on social transfers and more generally improve the use of human capital. But knowledge about the net fiscal effects of immigration and their interdependence with welfare incentives appears to be limited; yet any assessment of the efficiency or reform needs of migration policies would be incomplete without this knowledge.

For instance, if low-skilled migrants, attracted by a certain migration policy, are given a rational choice to opt out of the labor market owing to high wage-replacement benefits for low-income workers, it should not be surprising if this migrant segment of the workforce declines, or remains small. Proscribing work (for, say, refugees) distorts the statistics and is inefficient from an economic perspective. Unstable occupations of migrants (the first to be hit in cyclical downturns) reduce their eligibility for unemployment benefits and the pension system. Highly qualified immigrants, if not employed according to their qualification but declassed as a result of lacking formal recognition, may fall permanently below their potential tax payments and social security contributions. And since migrants at the date of entry show on average a significantly lower age structure than the average native population, higher benefits claims for, say, family allowances and education in the first years of their stay have to be balanced with the substantial fiscal advantages of their favorable age patterns over their lifespans.

By calculating the annual net tax payments (as the balance of taxes and welfare receipts) and the generational accounts of migrants and natives over their lifespans, the fiscal redistribution between the two population groups becomes obvious—and may facilitate policy decisions on migration and labor market integration.

This paper uses earlier research on the socio-economic balance of migration in Germany and Denmark to shed light on the interactions of migration, labor, and social policies, and immigrant fiscal contributions. A cross-country comparative approach illustrates the pros and cons of different migration policies [1], [2]. Even in two welfare states with a similar cultural and economic background, migration policy decisions can result in substantially different fiscal outcomes.

Discussion of pros and cons

Passive migration policy and weak integration efforts

The different immigration experiences of Germany and Denmark in the late 1990s and early 2000s reveal the scope for designing migration policies. Germany had for decades been the European country with the highest number of immigrants, heavy inflows and outflows, and a comparatively large share of non-natives in the population. But in Denmark the absolute number of immigrants had been rather small, resulting in a high share, given the small total population. Neither country actively managed immigration with comprehensive selection criteria for labor migrants, responding instead to public reactions to migration inflows. Both had similar legal standards for immigrant access to the labor market and social transfers (except labor permits for refugees), while their social security legislation worked differently.

Denmark in the late 1990s had a substantially lower education level of immigrants than Germany, mainly as a consequence of its higher share of non-Western immigrants [1], [3], [4]. The Danish education system was obviously more successful in promoting immigrants’ further education than the system in Germany, while even second-generation immigrants in Germany were confronted by more discrimination in the education system than those in Denmark.

Labor market integration in both countries was burdened with severe disadvantages. In Denmark, a continually declining participation rate due to the lack of selection criteria prior to entry and the wrong labor incentives in the welfare system crowded down non-Western immigrants to the lower end of the labor market hierarchy. But Denmark succeeded (modestly) more than Germany in securing early labor market payoffs for qualified migrants.

After the mid-1990s, Denmark—unlike Germany—practiced a rather successful employment policy that established the country among Europe’s top labor market performers. That makes the deficits in the economic integration of immigrants even more striking. Besides the negative effects of lacking language skills, the labor market and social exclusion of too many (non-Western) migrants without high qualifications indicated the strong need to rethink migration strategies in both countries.

Net fiscal accounting: Do expenses outweigh revenues?

Against this background, a clear negative fiscal balance of immigrants’ social and economic integration could be expected—a finding that might easily underscore widespread prejudices against immigration at large—and provoke criticism of undesirable migration into the social security system. But calculating the fiscal effects reveals that, even without an economically driven economic policy, the results could be positive.

Migrant shares of welfare and unemployment benefit recipients were above average for both Germany and Denmark at that time—with significant differences between earlier and later immigrant cohorts and between ethnic groups, underscoring the substantial effect of the structural composition of migrants [1], [2]. Legal eligibility standards and different compositions of qualifications, income, household size, and age structure define the intensity of social transfer benefits. A fair assessment would need to add a long-term perspective and compare migrants and native households with the same characteristics. Under identical preconditions, migrants receive welfare benefits to the same extent or even less often than natives—another reason for practicing a selective migration policy [5].

Are the expenses for unemployment benefits, welfare, pensions, and other social security services too dominant over the lifespan? Are they more or less balanced? Or are they even outnumbered by revenues in the form of social security contributions, lower pension claims, and direct and indirect taxes? What can be learned from a country comparison of generational accounting results?

The net fiscal balance depends heavily on the demographic and qualification structure of migrants, with the redistribution measures in a state’s fiscal policy also playing a major part. Taxes and transfers are redistributed between members of the same as well as different generations. Intragenerational redistribution aims at reducing the gap between wealthy and poor parts of the population; intergenerational, between those who are of working age and those who are not. If the migrant population has a more “unfavorable” structure than the native population in education, employment, income health, or family status, the volume of this redistribution can increase. If “favorable,” however, it can have a reverse, positive, effect.

A further aspect of intergenerational distribution that is especially relevant in the light of demographic aging concerns the shifting of consumption opportunities over time due to a public deficit, which restricts future latitude in public budgets. Since the resulting interest burden cannot be covered by taking on new lending in the long term, primary budget surpluses are needed at a future date to ensure government solvency. If they can be achieved only through higher taxes or lower transfers, (labor) migration can ease the burden for natives, given the sharing of the existing burden of adjustments among more people [1], [2], [6].

Tax and transfer levels shift over time when the population of migrants ages, while migrants have children who, as tax contributors and transfer recipients, also influence public budgets. This effect even increases when the present level of public revenues and expenditures is not sustainable in the long term, because the growing deficit per capita in an aging society requires some correction of fiscal policy. Assessing the net fiscal effects of immigration therefore needs to incorporate a demographic perspective in the intertemporal analysis.

Generational accounts

Generational accounting measures the present value of contributed taxes and received transfers of representative individuals over their whole lifespan. Generational accounts consider the marginal costs of providing public goods and real expenditures to show how much specific generations relieve or burden the public budget (see [6], [7]). Calculating the specific generational accounts of migrants and natives shows the fiscal redistribution between the two groups [7], [8]. Such generational balances of migration, available for several countries, show considerable variation depending on the immigration policy and the resulting migrant structure.

Generational balances of migration are available for many countries (but not for direct country comparisons). The outcomes show considerable variation, depending on the immigration and integration policy applied and the resulting migrant structure. Even for experienced immigration countries such as Canada, positive results from immigrant generational accounting are not self-evident. Recent research reveals clear deficits and a potential need to reform selection criteria and integration efforts for Canada, but the opposite for Australia [9].

Surplus or deficit: Balancing tells

For Denmark and Germany, in a first step, generational accounting calculated the average age-specific net tax payments of native and immigrant individuals by striking the balance of taxes paid annually (including social contributions) and transfer payments received. This procedure requires extensive examination of numerous data sources, not only to develop fiscal age profiles and avoid contortions by cyclical shocks but also to secure comparable results across the countries evaluated.

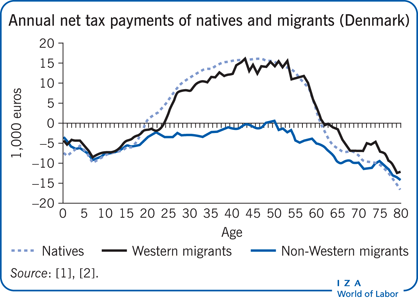

Age-specific tax payment profiles reflect the development of average incomes throughout people’s careers and the given tax laws (see Figure 1).

Migrants generally make lower tax contributions than Germans or Danes in the same age group. The gap results from backlogs in migrant incomes. The profile is dominated by the employment rates and wages during the phase of occupational activity. Tax payments decline less sharply in Denmark than in Germany. The main reason lies in the different taxation of pensions, which are taxed more in Denmark. The 20–40 age group lags behind in Denmark more than in Germany.

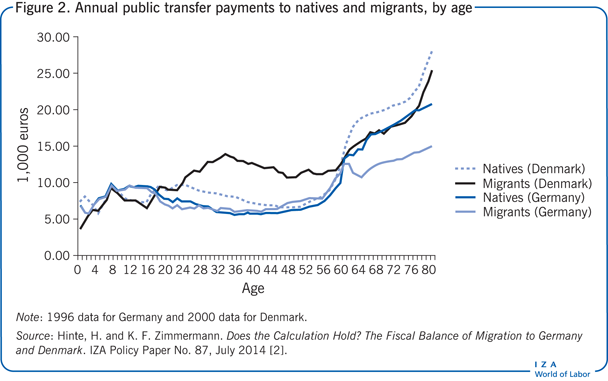

Now note the striking differences between Denmark and Germany in the public transfer payments received (see Figure 2). German adolescents generate higher public expenditures because migrants tend to start their working lives earlier, and Germans often remain in publicly financed educational establishments longer. In Denmark, migrants received more transfer payments than natives during the 25–55 age span. One possible cause for the difference is the materially generous protection of the unemployed in Denmark during that period. Low-skilled individuals benefitted from higher income replacement rates (up to 90%) and shorter eligibility requirements (shorter minimum insurance). Even more important is the low average labor market participation of migrants, which leads to high per capita welfare benefits [1], [2].

As a direct result of aging and a continuously growing share of public spending for retirement, health, and care, transfer payments are concentrated among the older native and migrant population in both countries (with early retirement provisions in place at that time). But due to shorter employment histories, lower incomes, and thus lower pension claims, transfer payments to natives were significantly above those to migrants.

So, were migrants net recipients or net contributors to public finances in Germany and Denmark at that time? Even under the “non-optimal” framework of a passive migration policy practiced by Germany, the migrants’ net contributions were still predominantly positive (see Figure 3). Migrants not actively involved in the employment phase—as well as their German counterparts—benefitted from the public redistribution between older and younger generations. Connecting the identified net contribution profiles with the age structure of the population yields the average contributions of the migrant population under age 80 at €2,100 per capita in 1996, almost catching the €2,700 of German natives. Working-age migrants (20–60) contributed a net tax payment of €6,900 (natives: €10,500) in the same year [1], [2].

The fiscal position of migrants was far less favorable in Denmark, where migrants under age 30 were net recipients of public transfer payments in 2000. This was due to relatively low taxes, social security payments for people just beginning to work, and high transfer payments for all migrants of working age. As a consequence, the positive net tax payments of this migrant age group ranked far below the German level, resulting in a negative net balance across all age groups of €–1,400 in 2000 (native: €4,000) [1], [2].

Denmark suffered a substantial structural shift in its migrant population—younger cohorts mainly represented non-Western ethnicities. Separating the net tax payments between Western and non-Western migrants makes this apparent (see Figure 3). The net tax payments of Western migrants did not differ much from those of natives of the same age group, whereas the balance of non-Western migrants reflects their poor integration into the Danish labor market, remaining (almost) consistently negative.

This snapshot analysis for one fiscal year of course neglects aging effects over time that will partially level the differences in the age structure of natives and migrants. The proportion of migrant net transfer recipients in retirement will adjust to that of the native population, causing the average per capita net contributions of the migrant population to decline. These shifts are measurable through the generational accounts, which capture the present value of all net tax and transfer payments from a given time until death for a representative member of a specific age group. The generational accounts relate the age-specific net tax payments per capita with the age-specific survival rates of a birth cohort, assuming a constant fiscal policy and economic growth rate.

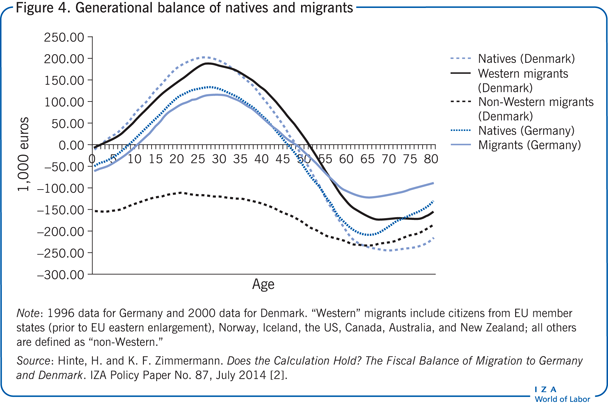

Germany

A characteristic age pattern for migrants and natives alike becomes obvious for Germany in 1996 (see Figure 4). There, the generational balance is negative for newborns (age zero), hinting at a lack of fiscal policy sustainability: The average contributed tax payments of a typical lifespan are not sufficient to cover transfer payments and real expenditures of the state under the fiscal policy conditions of the first year. Young adults are already net contributors to public funds, with the highest fiscal production generated by 20–30-year-olds. All Germans and migrants older than 45 years are, on average, net transfer payment recipients.

Although the patterns are similar, the resulting numbers are not. The maximum backlog where migrants show generational net payments (for 22-year-olds) is €22,500. Looking at the population group at the legal retirement age of 65, the present value of net transfer payments that are received until the end of the lifespan is roughly 40% lower for migrants (€122,900) than for Germans (€207,900).

Weighing the generational accounts against the age structure of the initial stock of the population shows that the long-term fiscal relief through immigration is much higher than the previous cross-sectional analysis assumed. The average net financial contribution of all migrant age groups under age 80 sums to €35,500 per capita for 1996, while Germans receive net transfer payments of €14,000 per capita on average.

This good result is a consequence of the favorable demographic structure of the migrant community. The average 10-year age advantage of migrants causes the median value of the generational balances for the active population between 20 and 60 years to be almost twice that of the (West) German comparison group.

In other words, the calculation indeed held true for Germany, even in the lasting absence of an active migration policy that doubtless would have strengthened this positive effect. The overall value of the positive contributions of the local migrant population in Germany under the given fiscal policy conditions was a remarkable €260 million for 1996 [1], [2].

Denmark

The Danish experience, however, shows that generational balances may also trend in the opposite direction, if a lack of migrant selection and having the wrong incentives within the welfare system form an “unholy alliance” (see Figure 4). The generational accounts for Denmark show the same wavelike pattern as in Germany for natives and Western immigrants. Calculated for 2000, the net payments of the Western immigrants amount to €39,700 until the end of their lifespan, clearly outplaying native Danes with €16,600. This reflects the stronger position of Western immigrants in the working-age groups and their smaller share of pensioners.

But non-Western immigrants, not overcoming severe barriers to economic integration, end up as net transfer recipients throughout their lifespans according to the generational accounts. The negative self-selection of immigrants, the passive migration policy, and the negative employment incentives deliver this unfavorable outcome. Amounting to a negative balance of €–142,900 for non-Western immigrants, the average generational account for all migrants in Denmark at that time was thereby downgraded to €–93,300.

A change in integration policy would have been worth putting into practice at this stage, given the high above-average share of non-Western migrants in the 10–30 age group. The less active integration policies are in terms of a foresighted strategy toward successful labor market inclusion, the more it becomes important to configure an economically driven migration policy with clear selection criteria, avoiding, at least to a certain extent, the inflow of less-qualified migrants with poor labor market perspectives.

These figures by way of example could easily be complemented with findings for other countries (see, for example, studies for France [10] and Spain [11]). The results for Denmark and Germany should be interpreted as a case study for the fiscal effects of interaction between migration, labor, and social policies, and the need for a methodical policy aiming at reliable positive outcomes of immigration and integration over time.

Limitations and gaps

Measuring the net fiscal effects of migration is an ambitious field of research, and far from being fully explored. A dynamic lifespan approach should be systematically expanded and used in cross-country comparisons to gain more information about the long-term fiscal effects of migration policies and their potential contribution to fiscal sustainability. Generational accounting can do more to serve policymakers. And migration policies should give more attention to the net fiscal effects of migration and social and labor market integration rather than focusing solely on popular, short-term objectives.

Balancing the costs and benefits of immigration within the receiving countries focuses on the legitimate objective to learn more about the options for stimulating positive socio-economic results. An evaluation of the fiscal effects of worldwide migration needs to take into account the positive and negative effects of emigration for the sending countries as well.

Summary and policy advice

Calculating the net fiscal effects of immigration not just for a fiscal year but over individuals’ lifespans accentuates the assets and deficits in migration and integration policies and their long-term potential. The less that national policies concentrate on a labor migrant selection process according to economic criteria, the higher the risk of generating economic losses or only a reduced surplus.

A country comparison of net tax payments and generational accounts for migrants and natives reveals even more clearly that the right mix of migrants will give the best chance to maximize positive and sustainable net fiscal effects to the benefit of society. Similar socio-economic frameworks—as in the Western welfare states of Denmark and Germany showcased here—may still result in substantially different economic outcomes of migration. Traditional immigration countries with a long experience in selecting migrants are nonetheless confronted with the need to evaluate and adapt their policies. They may also learn from the results of net fiscal balancing.

Acknowledgments

This article is substantially based on Chapter 6 in [1]. [2] is an English version of that chapter, which offers an extended comparative analysis of the socio-economic integration of immigrants in Germany and Denmark. The author thanks Holger Bonin, who provided the original calculations, an anonymous referee, and the IZA World of Labor editors for helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Holger Hinte