Elevator pitch

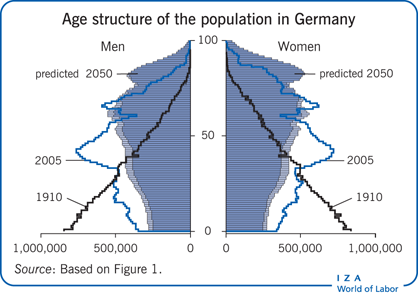

For decades, pension systems were based on the rising revenue generated by an expanding population (demographic dividend). As changes in fertility and longevity created new population structures, however, the dividend disappeared, but pension systems failed to adapt. They are kept solvent by increasing redistributions from the shrinking working-age population to retirees. A simple and transparent structure and individualization of pension system participation are the key preconditions for an intergenerationally just old-age security system.

Key findings

Pros

Pension reform can improve social equity by balancing the interests of workers and retirees.

By lowering labor costs, pension reform can reduce entry barriers to the labor market.

Pension reform can reduce tax distortions that discourage job creation.

By reducing subsidies to the pension system, reform can improve public finance.

More transparent institutions can lead to more rational decisions on savings, work, and family.

Cons

Pension reform faces political obstacles from the opposition of those due to retire or recently retired.

The strong tendency to make the same choices like in the past ignores condition changes.

Pension system complexity makes it hard to see the need for reform, and to assess its merits.

If reforms involve financial markets, negative as well as positive externalities may arise.

Accounting applied to contributions flowing through pension systems requires modernization.