Elevator pitch

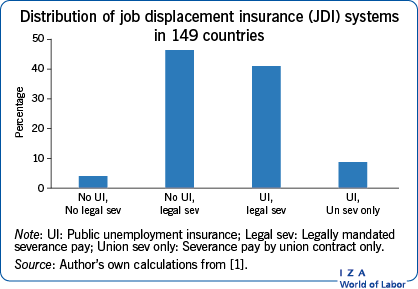

Job displacement is a serious earnings risk to long-tenured workers, both through spells of unemployment and through reduced wages on subsequent jobs. Less developed countries often rely exclusively on government mandated employer-provided severance pay to protect displaced workers. Higher income countries usually rely on public unemployment insurance and mandated severance pay. Beyond these options, more administratively demanding plans have been proposed, including UI savings accounts and “actual loss” wage insurance, though real-world experience on either model is lacking.

Key findings

Pros

Job displacement of long tenured workers is a major risk to lifetime earnings, both from unemployment spells and reduced earnings upon reemployment.

An integrated system of unemployment insurance and severance pay could offset much of job displacement-related earnings losses.

The larger part of job displacement losses are reemployment wage losses, which are persistent and strongly linked to job tenure at the displaced job, making scheduled benefits feasible.

The incidence of job displacement of long tenured workers is relatively small, and expected costs to the firm at the time of hire modest.

Cons

Unemployment spells are less well defined in more informal labor markets.

The wage loss data required for designing an ideal system are not available for many countries.

Job displacement losses near retirement are especially difficult to estimate robustly because of the availability of alternative disability and retirement support and voluntary withdrawal from work.

The ideal wage rate protection, wage insurance, is administratively expensive, forcing protection programs to rely on “scheduled benefits,” which is essentially severance pay.