Elevator pitch

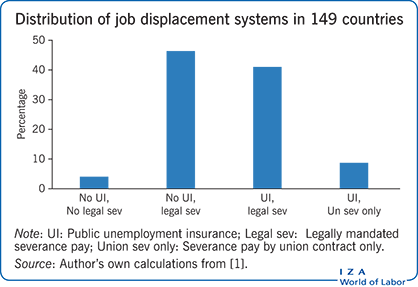

Job displacement poses a serious earnings threat to long-tenured workers through unemployment spells and lower re-employment wages. The prevailing method of insuring job displacement losses involves an uncoordinated combination of unemployment insurance and severance pay. Less developed countries often rely exclusively on public mandating of employer severance pay due to the administrative complexity of unemployment insurance systems. If both options are operational, systematic integration of the two is important, although perhaps not possible if severance pay is voluntarily provided.

Key findings

Pros

Ideally, an integrated system of unemployment insurance and wage insurance can fully offset job displacement earnings losses.

Job displacement losses are strongly correlated with job tenure, which makes scheduled wage insurance or severance pay a practical alternative to difficult-to-provide wage insurance.

Individual displaced worker wage losses are often large, but the incidence of job displacement of long-tenured workers is relatively small, as are total expected severance expenditures.

Cons

Wage loss data required for designing an ideal system are only available for a handful of countries.

The practical value of severance pay as scheduled wage insurance depends on the quality of the connection between earnings losses and job tenure, and the fit is far from perfect.

Long-tenured workers are often older workers, but job displacement losses near retirement are especially difficult to es-timate because of alternative disability and retirement support systems.