Elevator pitch

Job displacement poses a serious earnings threat to long-tenured workers through unemployment spells and lower re-employment wages. The prevailing method of insuring job displacement losses involves an uncoordinated combination of unemployment insurance and severance pay. Less developed countries often rely exclusively on public mandating of employer severance pay due to the administrative complexity of unemployment insurance systems. If both options are operational, systematic integration of the two is important, although perhaps not possible if severance pay is voluntarily provided.

Key findings

Pros

Ideally, an integrated system of unemployment insurance and wage insurance can fully offset job displacement earnings losses.

Job displacement losses are strongly correlated with job tenure, which makes scheduled wage insurance or severance pay a practical alternative to difficult-to-provide wage insurance.

Individual displaced worker wage losses are often large, but the incidence of job displacement of long-tenured workers is relatively small, as are total expected severance expenditures.

Cons

Wage loss data required for designing an ideal system are only available for a handful of countries.

The practical value of severance pay as scheduled wage insurance depends on the quality of the connection between earnings losses and job tenure, and the fit is far from perfect.

Long-tenured workers are often older workers, but job displacement losses near retirement are especially difficult to es-timate because of alternative disability and retirement support systems.

Author's main message

The two sources of earnings risk faced by long-tenured workers as a result of job displacement—unemployment spells and lower re-employment wages—call for careful coordination of unemployment insurance and severance pay (scheduled wage insurance). The two programs are usually treated as distinct, but logically they should be integrated. Integration might require direct government provision of both benefits, but the additional costs need not be large. While the ability to implement it varies greatly across countries, the ideal job displacement package would allow severance pay to increase with tenure, while unemployment benefits would decrease.

Motivation

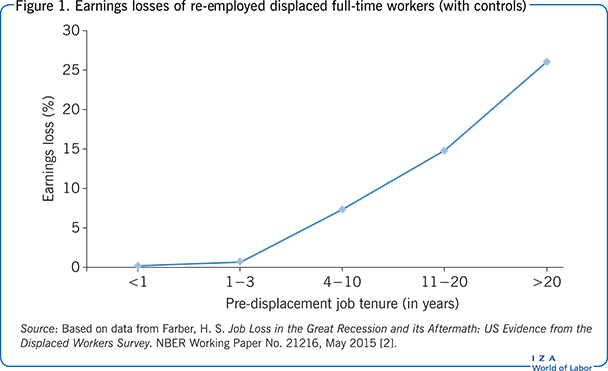

Many studies have documented the magnitude of earnings losses resulting from job displacement in the US, Canada, and the UK. That the displaced face potentially long unemployment spells is obvious, but the magnitude of re-employment wage losses among long-tenured workers is more surprising. The losses grow more or less in proportion to tenure (or service) and are quite large for long-tenured workers. Using data drawn from two decades of displaced worker surveys, one study reports average re-employment wage losses of 25% among workers displaced after 20 years of service (Figure 1) [2]. A number of researchers have confirmed a related finding that these wage losses are quite persistent, making the capital value of the earnings loss especially troubling [3]. To offset losses related to both unemployment spells and lower wages upon re-employment, an ideal insurance package would thus include: (i) unemployment insurance (UI) and (ii) wage insurance [4], [5].

Discussion of pros and cons

Searching for balance between job displacement insurance instruments

The balance between the two dimensions of job loss—unemployment spells and lower re-employment wages—will, like the ideal insurance package, vary across countries. Wages in highly regulated economies may vary little across firms, and the displaced workers’ primary challenge is thus to secure a next job, not the wage at which they will get that job. This may be casually referred to as the “European model,” to distinguish it from the US model with its much greater wage risk (and lower unemployment risk).

At a minimum, UI and wage insurance are at some level substitutes. If a plan offered unemployment benefits of limitless duration with a 100% replacement rate, the unemployed would not find it financially attractive to accept a wage offer less than their original wage. Re-employment wage loss would be rare even as unemployment would be abundant. In this environment, there would be no need for severance pay. In Denmark for example, which as recently as the early 1990s offered 90% replacement rates for low-wage workers for an almost limitless duration, collective bargaining contracts included severance pay benefits only for higher paid white-collar workers. The maximum duration of benefits is now much shorter in Denmark and subject to nonmonetary burdens (active labor market policies), which might call for restructuring the joint programs.

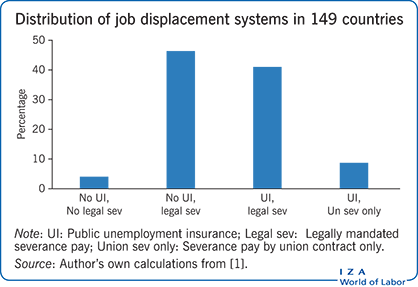

All but a handful of countries (six) mandate employer-provided severance pay or defer to collective bargaining systems (see the illustration on page 1). However, many countries do not offer public UI at all, presumably because of the program’s administrative demands. In these countries, severance pay plans must cover both risks. Of those countries that offer unemployment benefits, almost all mandate that employers provide severance pay, though a few defer to collective bargaining agreements or voluntary, often implicit, contracts. The US is in the latter category, though its modest union density leaves the bulk of severance provision to the decisions of individual employers. Both mandated and voluntary severance plans typically limit payouts to involuntary separations and offer payment schemes that correspond to job displacement losses, with benefits strongly increasing in service or years of tenure [6]. If both programs are offered, the need for coordination is obvious. The challenge is to design the joint system appropriately.

The rationale for better coordination of unemployment and severance benefits

The value of coordinating UI and severance benefits can be found in the earliest theoretical analyses of optimal unemployment benefits. One such analysis, for example, argues that search moral hazard would optimally depress unemployment benefits, but at the same time increase severance benefits so that the unemployed worker would be otherwise supported [7].

The primary function of severance pay, however, is to compensate for re-employment wage losses. Offering displaced workers a number of weeks of pay per year of service, as is common, parallels earnings losses by tenure or service. The same observed decline in re-employment wage has important implications for UI benefits [2]. UI benefits should decrease with tenure if, as commonly conjectured, they are limited by search moral hazard concerns [5]. Otherwise, long-tenured workers will be discouraged from accepting jobs. Treated as separate programs, reducing unemployment benefits for higher tenured workers is likely to be unpopular, no matter the moral hazard concerns, but this may not be so if considering the package as a whole. As workers accumulated tenure, severance pay would rise and UI benefits would fall.

The value of identifying job displacement insurance as an entity, with integrated unemployment and wage insurance programs, seems obvious. The total losses from job displacement are large for long-tenured workers, with the proportions resulting from re-employment wage loss and long unemployment spells varying with the labor market.

Less obvious is the relatively low cost of severance pay (wage insurance). The average annual cost per worker of severance plans (scheduled wage insurance) is modest, because job displacement of long-tenured workers cannot by definition be an everyday affair. For example, consider a worker who is displaced after 20 years of experience. To achieve 20 years of service and then lose it in a standard last-in, first-out (LIFO) layoff system requires decades of relative job stability punctuated by a sharp drop in demand. While this may occur under extreme conditions, it is rather rare. Many workers will never qualify for large severance benefits, either because of insufficient job tenure at separation or because they leave voluntarily (quit) to seek better opportunities elsewhere. Similarly, older workers who leave for retirement reasons do not generally qualify for severance. One study reports that mandated severance pay comprises only 2% of all “labor law” costs in OECD countries, with firm contributions to social security pension plans accounting for the vast bulk.

Firing cost problems, perhaps more usefully labeled layoff moral hazard, may arise, however, because payouts at the time of displacement may be substantial [8]. Firm-financed separation benefits raise the possibility that the firm may choose to conceal low demand and retain workers when it would actually be more efficient to release them. The employer may choose not to release a worker in bad times, especially if the worker is long-tenured with a large expected severance payout and is close to normal retirement age. Despite careful study of this phenomenon, the magnitude of the effect on layoffs remains uncertain, though more substantial (negative) consequences for employment and unemployment are not likely.

When would coordination of UI and severance fail?

The arguments against a coordinated job displacement insurance system arise from various administrative limitations and information imperfections. Public UI, for example, is administratively infeasible in many low-income countries. In these countries, severance pay must cover both unemployment and re-employment wage losses and is likely to do poorly in the first application as well as the second. The rationale for a government mandate of private firm activities is obvious—the firms are more capable than the government of executing the severance plan. The same logic would suggest that enforcement of the mandate may be incomplete. Indeed, extremely high severance mandates arise in countries which are unlikely to enforce the mandates, at least systematically. The imperfections here are in the government’s fundamental capabilities and not in policy design. Employer-mandated severance pay is likely to be less worthwhile in these countries than in countries where reasonable enforcement is feasible.

Government-provided UI signals a reasonable degree of administrative competence. In countries where this is offered, the additional administrative demands of providing public severance pay would appear to be modest. Nonetheless, most governments do not directly administer severance pay plans, but rely on government mandates of private employer provision. Clearly, this reduces government administrative costs, but the mixture of approaches has the unfortunate consequence that the potentially valuable interrelationships between UI and severance benefits may be neglected.

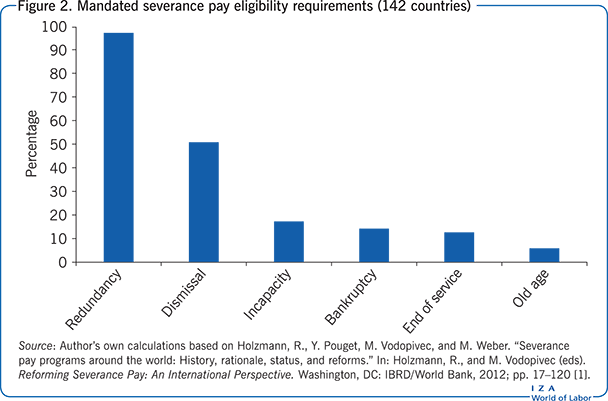

The role of severance pay as scheduled wage insurance is apparent in both (i) the eligibility requirements for severance payouts and (ii) the link between the payout schedule and job tenure. Using data from 142 countries, one study shows that the focus of severance payouts is clearly on job displacement with redundancy or dismissal a requirement (Figure 2) [1]. Although there is evidence of occasional use of severance pay for disability or other problems, employer-initiated separations clearly dominate. The same pattern emerges in an OECD subsample.

Similarly, severance benefit schedules closely parallel the job displacement earnings losses illustrated in Figure 1. The modal benefit schedule includes a specified number of weeks of pay (often one or two) per year of service. This tendency toward a benefit scheme that increases proportionally with service is transparent in the graph of payouts at five and 20 years of service, as shown in Figure 3 [1]. Again, the same pattern emerges in an OECD subsample. Although a variety of schemes are offered, the proportional pattern is clear.

Unfortunately, private employer provision of severance pay is difficult and voluntary coverage is incomplete. Severance pay is not offered by third-party insurers, as the firm is the only entity that has inside knowledge of whether layoffs are looming in the near future. But the firm has its own difficulties providing this type of insurance directly. With a LIFO layoff policy, severance payouts will be quite small in low layoff periods—only short-tenured, low-severance workers would be released. Payouts grow sharply as the severity of layoffs grows, meaning payouts are especially large when the firm is under the most serious economic stress. The employer’s willingness to pay severance aside, firms may go bankrupt and no longer have the legal right to distribute funds unless permitted by a bankruptcy court.

Severance savings plans as an alternative to severance insurance

If UI benefits distort workers’ search incentives sufficiently, it may make sense to replace insurance altogether and rely instead on an alternative consumption smoothing device, e.g. severance saving plans. Given complete information, insurance is preferable to savings as a strategy for offsetting small probabilities of large losses. In less favorable conditions, savings may serve as a second best option for consumption smoothing. By transferring ownership of the funds to the worker, both search moral hazard and layoff moral hazard can be avoided. In fact, severance savings plans are common. Examples can be found in [9]. These plans are typically embedded in pension plans, and are especially useful when pension funds are large relative to potential job displacement losses, so that early life withdrawals do not threaten retirement security.

Limitations and gaps

In the context of UI, the principal limitations are informational. Researchers have only superficial knowledge of the administrative costs that limit developing countries from offering UI systems. Likewise, the threshold level of development that signals when a country can reasonably adopt a UI system has not been established in the literature.

An integrated unemployment/wage insurance program also requires a good understanding of job displacement losses. UI benefits typically depend on observed losses, but severance pay benefits must reflect expected losses. To implement scheduled benefits (based on job tenure), it is essential to know (i) how annual wage losses grow with tenure and (ii) how the losses persist over time, so that the losses can be properly capitalized. There is a substantial pool of information on this issue for the US and similarly structured economies, but the nature of job displacement losses appears to vary greatly internationally [10]. To illustrate the problem, many of the successor nations to the Soviet Union mandate that firms provide flat-rate severance pay, generous by usual standards at low levels of tenure and ungenerous at high. Is this a failure of design or a difference in the way job displacement losses vary with tenure?

Even in relatively well-investigated economies like the US, displacement loss estimates are not always reliable. For example, re-employment earnings loss estimation is difficult among older workers, who are also often long-tenured workers. Many withdraw from the labor market after displacement, which indicates either large wage losses or the availability of alternative income support systems, notably disability and retirement benefits.

Summary and policy advice

At the individual level, job displacement losses can be large, especially for long-tenured workers. The earnings losses from unemployment spells may be substantial. Of greater consequence in flexible wage economies, re-employment wages may be low and persist for years. Consumption evidence indicates that these heavy losses are poorly insured in the US by public unemployment benefits and voluntary, employer-provided severance pay. The issue then becomes one of designing a better insurance package.

The first key point is to understand that the information required to design a job displacement program does not exist for most countries, and there is thus ample reason to believe that one size does not fit all. An ideal information initiative would include:

a broad screening of consumption data to determine the importance of the job displacement risk in a country’s overall earnings risk—job displacement insurance may not always be the priority it would appear to be in the US;

assessment of a country’s administrative competence to offer a UI system if one is not already functioning; and

estimation of the magnitude and duration of earnings losses, in total and as a function of job tenure or other key factors.

Second, workers’ vulnerability to job displacement provides a case for extending UI and severance plans, where practical. In less developed economies, that involves the development, if feasible, of UI programs to supplement mandated severance plans, upon which many now rely exclusively. Unfortunately, little work has been done on the question of the political and economic conditions that make public UI appropriate. For economies that have mature unemployment programs, this argues for incorporating the severance plan into the publicly operated UI system. At present, most industrialized countries simply mandate that private employers provide a defined severance plan.

For the US and Canada, this would involve a more abrupt change in policy, because severance benefits, if offered, are voluntary and coverage is partial. That said, a severance pay plan would not seem difficult to integrate into a formal UI system. The US system, for example, is already “experience rating,” with both contributions (taxes) and benefits linked to both employers and individual workers. Eligibility for UI benefits, moreover, is conditioned on past (individual) worker wages and the reason for job separation, voluntary or involuntary. If the worker is permanently and involuntarily separated from the firm, benefits could be paid out of the employer’s account. If the worker separates voluntarily (quits) or reaches normal retirement age and becomes ineligible for payouts, the contributions credited to the worker would revert to the firm.

The extensions of UI and/or severance may include savings plans rather than insurance plans. Especially if (i) moral hazard problems are severe and (ii) pension plans robust, then savings plans may dominate the more obvious insurance plans.

Third, where both unemployment insurance and severance pay are offered, policy designers should consider the value of integrating the two benefit systems. The differing delivery structures foster the idea that the two plans are unrelated, which limits the degree of useful integration of what should be a single, two-dimensional system. For example, the same economic reality that severance pay should rise with tenure would argue for reduced UI benefits with tenure. UI benefits should fall with lower expected wages if benefits are limited by search moral hazard problems, while severance benefits should increase.

Finally, sensitivity to (joint) program financing is important. Whether mandated or voluntary, nearly all severance payouts are currently financed directly by the firm. The average annual costs per worker of financing severance benefits are low across all firms, but can be large to individual firms at the time of payout. Some care must be taken to ensure that firing cost issues (layoff moral hazard) do not arise if individual employers are individually responsible for financing unemployment insurance as well (as they are with experience rating programs). In any case, modest adjustments in tax incidence can limit layoff moral hazard to acceptable levels.

Properly designed and executed, a job displacement insurance system promises considerable benefits to a country’s workers.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Previous work of the author contains a larger number of background references for the material presented here and has been used intensively in all major parts of this article [4], [5], [6].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Donald O. Parsons