Elevator pitch

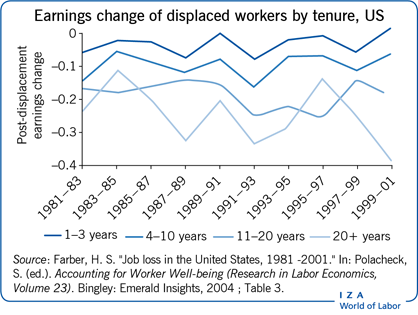

Job displacement represents a serious earnings risk to long-tenured workers through lower re-employment wages, and these losses may persist for many years. Moreover, this risk is often poorly insured, although not for a lack of policy interest. To reduce this risk, most countries mandate scheduled wage insurance (severance pay), although it is provided only voluntarily in others, including the US. Actual-loss wage insurance is uncommon, although perceived difficulties may be overplayed. Both approaches offer the hope of greater consumption smoothing, with actual-loss plans carrying greater promise, but more uncertainty, of success.

Key findings

Pros

Actual-loss insurance is the theoretical ideal, promising complete smoothing of consumption following job displacement, but is costly to provide.

Tenure-linked severance pay serves as scheduled wage insurance, helping offset re-employment wage losses at modest cost.

Savings accounts may provide an alternative to severance pay of actual-loss wage insurance if moral hazard problems are severe, but are only found as severance savings accounts in current government programs.

Cons

Theoretical concerns about actual-loss insurance are manifold, including measurement and moral hazard concerns.

Tenure-linked severance benefit schedules only crudely track actual wage losses.

Improvement in severance benefit schedules, say by introducing additional loss factors (e.g. general economic conditions), might be difficult.

Savings accounts are inferior to insurance if, like job displacement of long-tenured workers, the event involves a small probability of a large loss.