Elevator pitch

Job displacement represents a serious earnings risk to long-tenured workers through lower re-employment wages, and these losses may persist for many years. Moreover, this risk is often poorly insured, although not for a lack of policy interest. To reduce this risk, most countries mandate scheduled wage insurance (severance pay), although it is provided only voluntarily in others, including the US. Actual-loss wage insurance is uncommon, although perceived difficulties may be overplayed. Both approaches offer the hope of greater consumption smoothing, with actual-loss plans carrying greater promise, but more uncertainty, of success.

Key findings

Pros

Actual-loss insurance is the theoretical ideal, promising complete smoothing of consumption following job displacement, but is costly to provide.

Tenure-linked severance pay serves as scheduled wage insurance, helping offset re-employment wage losses at modest cost.

Savings accounts may provide an alternative to severance pay of actual-loss wage insurance if moral hazard problems are severe, but are only found as severance savings accounts in current government programs.

Cons

Theoretical concerns about actual-loss insurance are manifold, including measurement and moral hazard concerns.

Tenure-linked severance benefit schedules only crudely track actual wage losses.

Improvement in severance benefit schedules, say by introducing additional loss factors (e.g. general economic conditions), might be difficult.

Savings accounts are inferior to insurance if, like job displacement of long-tenured workers, the event involves a small probability of a large loss.

Author's main message

Re-employment wage losses following job displacement are often a substantial concern in flexible wage economies; many countries address this issue by mandating scheduled benefit plans (severance pay). Potential problems with actual-loss wage insurance are easy to enumerate, but limited evidence suggests that these problems may be overstated. Ways of improving scheduled wage insurance are easy to identify, for example by linking benefits to business cycle conditions, but may be hard to implement. The promise of performance efficiency in actual-loss plans argues for additional demonstration projects and testing.

Motivation

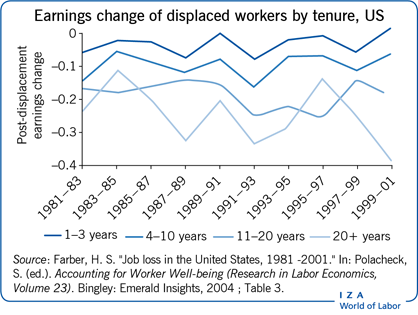

Job displacement generates substantial long-term earnings losses for workers, the result of both spells of unemployment and reduced re-employment wages. For long-tenured displaced workers in economies with flexible wage schemes, these losses are in most instances the result of sharply lower re-employment wages, which can persist for many years. This is not simply an issue of reduced worker hours, but holds true even for full-time displaced workers who secure other full-time jobs. It is thus natural to explore wage insurance as a way of offsetting these earnings losses.

Scheduled insurance-severance pay-is by far the most common form of wage loss insurance. It provides displaced workers with a sum fixed at the time of displacement and linked to expected losses, and is publicly mandated, included in union contracts, or supplied voluntarily by displacing employers. The calculation of benefits typically takes into account the worker's wage and tenure with the firm, perhaps offering the displaced worker one or two weeks of pay per year of service [1], [2]. The resulting benefits, which may be paid out in instalments, ideally compensate for (the discounted sum of) lifetime re-employment earnings losses. Many plans include upper limits for benefit calculations that may adjust crudely for the reduced remaining work life of long-tenured workers, although few plans actually reduce benefits as retirement approaches.

In contrast to the ubiquitous severance pay plan, actual-loss wage insurance has not been widely adopted. As the label implies, actual-loss insurance offers benefits linked to individual losses (early in the re-employment period)-for example, some proportion of measured wage losses for a specified time period. This approach permits a complete offset of wage losses, and its absence hints at the seriousness of perceived moral hazard problems, including the choice of less demanding, lower wage jobs.

If employers finance separation plans, savings plans might be superior to either scheduled or actual-loss insurance plans. The main concern in severance plans is layoff moral hazard, a reluctance to downsize a labor force when productivity drops because of severance benefit costs. About 10% of all government job displacement plans include severance savings accounts [3]. Various moral hazard issues arise with wage insurance, but employer financing of wage insurance is more difficult to conceptualize because re-employment wage losses emerge only in time, and savings plans have not been proposed.

Discussion of pros and cons

The primary approaches to insuring against wage losses due to job displacement are: (i) scheduled insurance that links benefits to expected wage losses, and (ii) actual-loss insurance that links benefits to individual wage losses. The first approach has been widely adopted in practice, but the second is closer to the ideal if various moral hazard issues can be overcome. All individual losses would be offset in a complete, costlessly provided, actual-wage loss plan. In practice, all wage insurance plans are quite incomplete. Each approach has distinct strengths and weaknesses, and possibilities of improvement.

Severance pay is the most common approach

Severance benefits are mandated in most countries and supplied voluntarily by many firms in countries that do not mandate them. Severance pay offers scheduled benefits based on expected losses and its efficiency depends crucially on the quality of the earnings loss forecast. Both mandated and voluntary severance benefits are often linked to job tenure, reflecting a common finding in the literature that job displacement earnings losses increase with job tenure, indeed almost linearly. The welfare value of a common severance benefit schedule of "x weeks of pay for each year of service" is transparent [4].

Unfortunately, a benefit algorithm that calculates benefits based solely on pre-displacement wages and years of service generally results in a modest fit to earnings losses at the individual level. Benefits that match losses only on average will undercompensate some displaced workers (those with unusually large wage losses) while overcompensating others. However, a benefit algorithm so good that it perfectly matches individual earnings losses would be equivalent to actual-loss insurance with no moral hazard distortions.

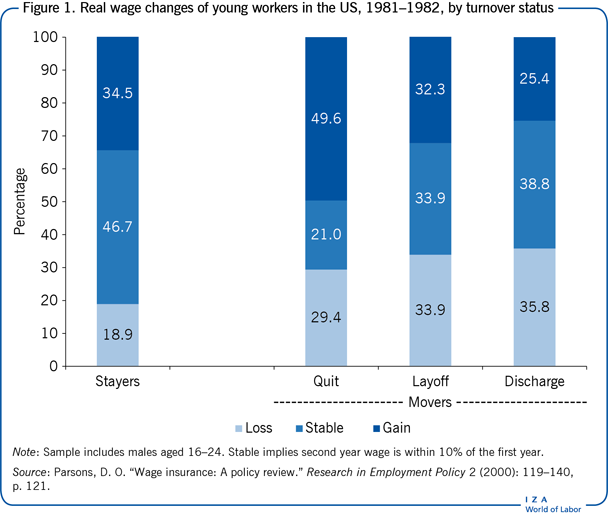

The limits of fixed benefits are apparent in the wage data; wages are noisy. That is apparent in the distribution of wage changes across types of separation (or no separation at all), as shown in Figure 1. Many workers who quit voluntarily accept wage losses, presumably because of the offsetting attributes of their new job. The distribution of wage changes over the course of one year for young workers in the US is quite large for displaced workers and voluntary leavers alike, and even among job stayers. From 1981 to 1982, almost 20% of stayers suffered a year-to-year real wage loss of 10% or more, which is certainly lower than the 34% of layoffs who suffered a similar wage loss, but less dramatically different than might have been imagined. The percentage of young quitters who suffer real wage declines of at least 10% is only slightly lower than that of young re-employed laid off workers, 29% versus 34%, despite the fact that these job separations are voluntary.

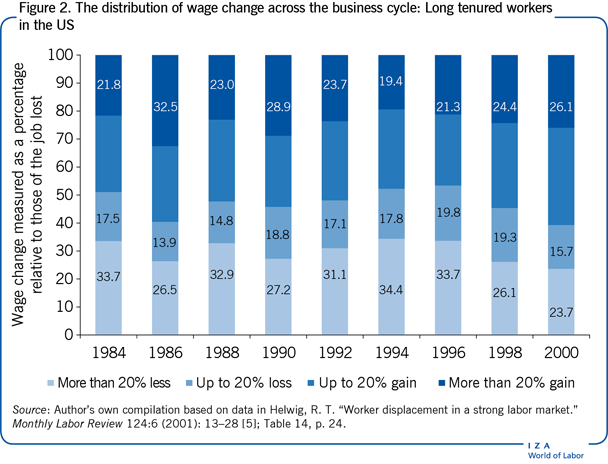

Improvement in loss forecasting and benefit schedules is conceptually possible, if difficult to implement. A review of the wage loss literature identifies covariates other than job tenure that might improve the efficiency of scheduled payments. It is well known, for example, that wage losses are on average higher in a deep recession [5], [6]. Indeed, in good times, average losses may actually be negative (a wage gain)-average re-employment wages of displaced workers may exceed pre-displacement wages, as shown in Figure 2. However, even in those years, large numbers of displaced workers experience large earnings losses.

Almost all workers are covered in mandated severance programs, but coverage is a problem in voluntary severance plans [3]. In the US, for example, only about one-quarter of the workforce is covered by severance plans. Incorporating severance into the unemployment insurance (UI) system would seem an inexpensive way to expand coverage if policymakers accepted the importance of this insurance instrument.

The financing of severance benefits may explain the reluctance to vary benefits with business conditions. Both mandated and voluntary programs are employer funded, usually on a pay-as-you-go basis. The last-in, first-out (LIFO) principle of many layoff protocols causes the value of payouts to increase at a growing rate with the severity of the cutback. Clearly, additional payouts in bad times may strain firm finances.

Although severance costs may be substantial to a firm when it must make a major reduction in its workforce, the expected cost of severance plans at the time of hire is relatively modest. Many workers never qualify for severance benefits. For example, workers who leave voluntarily (quit) to seek better opportunities elsewhere are normally not eligible for benefits. Similarly, older workers who retire do not generally qualify for severance benefits. Moreover, many workers who do receive benefits receive only small payments or none at all if there is a minimum service requirement. Under the usual LIFO rule, long-tenured workers do not often experience permanent job loss. Large severance payouts require decades of relatively stable employment punctuated by a precipitous drop.

There are a host of potential moral hazards to consider in any wage-loss insurance scheme. In the case of severance pay schemes, firing cost problems, perhaps more usefully labeled layoff moral hazard, may arise, because payouts at the time of displacement are substantial. The firm is the only fully reliable source of information on its own economic distress, and, if separation benefits are firm-financed it may choose to conceal low demand, retaining workers when it would actually be more efficient to release them. The practical importance of this concern remains under investigation, but the empirical record appears to reject claims of broader distortions of employment and unemployment [7].

One study argues that attention must be paid to the form of the severance benefit payout [3]. Displaced workers appear to consume benefits quickly, which argues for extended periodic payouts, not a single lump sum, if government interest in consumption smoothing is to be met.

Actual-wage insurance proposals

Actual-wage insurance is primarily known through proposals for programs. The primary proposal, which has been labeled the Brookings proposals [8], involves benefits linked to 50% of wage losses for fully employed workers for a relatively short period of time: two years [9]. This encourages a rapid return to work.

The absence of actual-loss wage insurance, despite its policy appeal, suggests that moral hazard and other concerns are large for this insurance instrument. Such concerns are not hard to imagine. Search moral hazard is an obvious problem. Finding a well-paid job likely involves more demanding search activities than finding a low-paying one, so the insured displaced worker is likely to engage in less vigorous search. Indeed, if fully insured, the worker would simply accept the first job offer, whatever its quality (wage).

Less familiar moral hazard problems emerge in actual-loss plans, including distortions in job choices by workers and in the provisions of jobs of various types by firms. For example, wages are only one dimension of a job; other dimensions include required effort, occupational safety, training opportunities, and fringe benefits. An extreme example might be labeled the "volunteer problem." Individuals often work long hours for almost no pay for causes that they care about. If the wage insurance plan compensated displaced workers for half their wage losses, token wage payments would qualify volunteers for half pay from the wage insurance systems. Less extreme examples are more common.

Insurance may also affect the attributes of jobs that firms offer. In particular, firms have an incentive to shift their compensation packages toward non-wage aspects of the job from direct wage payments if the displaced are a significant proportion of their new hire pools. Non-wage elements of the compensation package might include better health insurance, improved job training, and reduced work intensity. Any compensating differential wage adjustments would be partly subsidized by the wage insurance program.

To curb such moral hazard distortions, proposed actual-loss plans usually have narrow ambitions, sharply limiting program generosity, which of course reduces the insurance value of the plans. Common restrictions in proposed wage insurance plans [8], [9] include: permitting wage gainers to keep all their gain (full insurance among the displaced would call for pooling wage gains among winners and losers); and limiting the subsidy to 50% of wage losses.

A practical difficulty with actual-loss wage insurance is that the impact of a given displacement on wages grows more uncertain as wage shocks of all types hit the worker. It is not possible to imagine that the difference between the worker's actual wage and predicted wage ten years in the future reasonably measures the impact of that single event. As a consequence, most actual-wage loss proposals impose severe limits on the duration of wage losses, for example: limiting the period of loss recovery to two years.

Additional features often found in proposed plans include re-employment bonuses; greater program benefits if the displaced worker finds their next job more quickly. For example, the two-year limit on loss recovery raises the question, when does the two years begin? If the two years begins at the date of displacement, aggregate plan benefits fall with longer unemployment spells. A displaced worker who is immediately re-employed would receive benefits for the full two years, while a displaced worker who is re-employed after six months would recover only 18 months of lost wages. The re-employment literature gives little reason to believe that this refinement is of serious value [10].

Plan costs may also be limited by excluding high-wage displaced workers, where, of course, "high-wage" would be defined by the plan. For example, the program could be limited to low-earning individuals, say those making US$50,000 or less after displacement. However, there is no evidence that low-wage workers suffer higher proportional wage losses than higher-wage workers following job displacement, which makes the rationale for this feature unpersuasive. However, the possibility of fraud no doubt grows with the size of the individual payout.

A serious concern with implementing an actual-wage insurance plan is the lack of real-world experience with such plans [8]. Two small pieces of evidence have emerged from the Trade Adjustment Assistance (TAA) literature. TAA is essentially actual-wage insurance with the additional condition that job displacement must arise from import penetration [11]. The latter is hard to establish with any precision [12], but the practical operation following that determination is the same as for any displacement.

One large Canadian demonstration project assesses the distortions generated by the (limited generosity) actual-wage plan described previously [13], and the results are reassuring, if somewhat surprising. The investigators undertook a project that offered displaced workers wage insurance that was more generous than the basic actual-loss plan, covering 75% of wage losses for full-time workers. Although the study focuses on the assessment of the re-employment bonus feature of actual-wage plans (there were no effects), the results bear directly and importantly on a variety of potential distortions in actual-loss plans. The authors find few behavioral distortions of any sort, implying that moral hazard distortions may not be substantial. However, take-up rates were low, about 20% of the trade displaced. Those who qualified for small payments chose not to enroll and, more importantly, many displaced workers who otherwise qualified for benefits did not secure another full-time job in the required time (two years).

Actual-wage insurance was introduced into US TAA legislation in 2002, though the focus remained on job training and extended unemployment benefits during the training period. In 2009, greater emphasis was put on wage insurance, which was offered as an alternative to the training/extended UI option [14]. As with the Canadian study, the wage insurance take-up rate was low. Among those who did take up wage insurance, post displacement employment and earnings behavior of recipients varied only modestly from the behavior of those in the traditional track, and not at all in the long term. A demonstration project would presumably be required to determine the impact of a broader displacement program, which did not already have the TAA base support.

Alternative models of wage loss insurance

In addition to insurance plans, severance savings plans are relatively common (see [15] for specific examples). These are typically extensions of pension plans, which, if generous enough, can cover wage losses without threatening retirement well-being. The advantage of such saving plans is that workers have little incentive to game the system, because resources are the workers' own. Search moral hazard in particular might not be a problem under these schemes, although all savings schemes transfer losses only across time for the same individual, and not across individuals in various loss statuses.

The most common actual-wage insurance proposal [8], [9] has been discussed for 25 years without being adopted, which at least hints that there is a problem with the basic design of the proposed plan. For example, the greatest threat to workers' economic security comes from the persistence of wage losses among the displaced. Initial wage losses of voluntary job quitters or even job stayers may be almost as substantial, but presumably more ephemeral (Figure 1). Perhaps "catastrophic" wage loss insurance would be more valuable to the worker. Loss coverage under current proposals is front-loaded, often only covering the first two years of losses. If the primary objective is to compensate workers for large losses an alternative plan would be to cover wage losses only later, in say post-displacement years three through six. Under this type of back-loaded insurance, targeting would be improved as resources would be directed to those most harmed by the displacement.

There may be other gains to back-loaded benefits, such that moral hazard problems are likely to be eased. The adverse impact of the wage subsidy on a person's search for a better paying job may be reduced if displaced workers know they will face wage losses for one or more years before receiving wage loss compensation. The program could be integrated with the UI plan to limit especially large income losses between the end of the UI program and the start of the wage insurance program.

Limitations and gaps

Wage insurance is distinct from UI because of its focus on wage rates or, in an important application, earnings at full-time work hours, not on work hours. Earnings records are relatively reliable because of the state's income tax interests. Indeed, many state UI systems in the US use substantial earnings as a proxy for "full-time work," and make no attempt to measure work hours. Assessment of the cause of job separation is also a potential difficulty. Presumably, wage insurance, like the most common form of UI, requires that the wage loss be precipitated by an involuntary job loss without prejudice to the worker. This condition is not without cost to administer.

Even if individual wage rates were (i) well measured and (ii) the only element of the compensation package to vary across firms, then problems arise. For low-income workers, means-tested welfare programs may cover some portion, and perhaps all, of earnings losses. These benefits vary, sometimes discontinuously, with earnings/income, and come in a variety of forms, of which monetary earnings are only a small part. Presumably, wage payments must adjust for these program benefits, or conversely the other programs must adjust. For higher-income workers for whom income taxes are significant, insurance benefits must be taxable. These are practical considerations and can be surmounted with sufficient effort, although political problems might arise in implementation.

Summary and policy advice

The earnings losses of long-tenured displaced workers threaten workers' economic security in much of the world. In flexible wage economies, these losses are largely the result of sharply lower re-employment wages, which often persist for years. Certainly in the US, these losses are poorly insured, providing a challenge to social insurance system designers.

There are two basic approaches to relieving the strain of re-employment wage losses: (i) scheduled insurance benefits (severance pay), and (ii) actual-loss wage insurance, either as insurance or as a savings plan. Each has efficiency limits, including shared concerns over the measurement of wage rates, but each struggles operationally in its own ways.

The most common form of wage loss insurance, by far, is severance pay, providing displaced workers with a sum of money that is fixed at the time of displacement. It is linked to expected losses, and is publically mandated, included in union contracts, or supplied voluntarily by displacing employers. Unfortunately, a benefit algorithm that calculates benefits based solely on pre-displacement wages and years of service generally results in a modest fit to earnings losses at the individual level. Wage losses often persist for years, even though the estimation difficulty grows with time since the original displacement event.

The ideal wage insurance package is an actual-loss plan, with benefits linked to the full wage losses of the individual worker. However, the most popular proposals for actual-wage insurance differ sharply from this ideal. The modest extent of proposed wage loss offsets, often 50% of losses and only for a limited time, reveals serious concerns about moral hazard and may explain the limited public interest in implementing actual-loss plans. Search moral hazard is a common concern, for example if "good" jobs are harder to find than "bad" jobs, insurance may reduce the worker's zeal to find the former. Other moral hazard problems also arise, including the possibility that employers may redesign jobs, perhaps easing effort requirements or increasing fringe benefits while lowering wages which can be subsidized by the system.

Both scheduled/severance and actual-loss insurance plans offer the potential for significant design improvement. The efficiency of severance insurance plans is directly related to the ability of the scheduled benefit algorithm to reflect wage losses. Linking benefits to wage and tenure certainly captures important elements of expected wage loss. Other well-established correlates of wage loss, including the general business cycle, might further improve the expected wage loss linkage. Improving awareness and recognition of the role of severance pay and its importance in the earnings security of displaced high-tenure workers is a valuable goal in countries with voluntary severance pay provision; coverage rates for voluntary severance pay are seriously incomplete.

Additional thinking on actual-loss designs might be fruitful. Standard proposals invariably offer to cover a fraction of early losses, but the main social concern is large, persistent losses extending over many years, possibly a lifetime. Perhaps catastrophic loss insurance models, paying benefits only after a lengthy period of low wages, would better insure this risk. For the moment, however, the threat of large wage losses upon displacement remains very real.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Previous work of the author contains a larger number of background references for the material presented here and has been used intensively in all major parts of this article [7], Parsons, D. O. "Wage insurance: A policy review." Research in Employment Policy 2 (2000): 119-140. Version 2 of the article adds research on layoff moral hazard, actual-loss wage insurance, and new "Key references" [3], [11], [12], [14], [15].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Donald O. Parsons