Elevator pitch

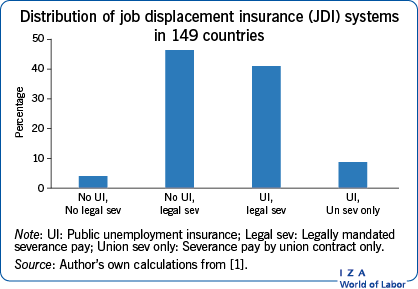

Job displacement is a serious earnings risk to long-tenured workers, both through spells of unemployment and through reduced wages on subsequent jobs. Less developed countries often rely exclusively on government mandated employer-provided severance pay to protect displaced workers. Higher income countries usually rely on public unemployment insurance and mandated severance pay. Beyond these options, more administratively demanding plans have been proposed, including UI savings accounts and “actual loss” wage insurance, though real-world experience on either model is lacking.

Key findings

Pros

Job displacement of long tenured workers is a major risk to lifetime earnings, both from unemployment spells and reduced earnings upon reemployment.

An integrated system of unemployment insurance and severance pay could offset much of job displacement-related earnings losses.

The larger part of job displacement losses are reemployment wage losses, which are persistent and strongly linked to job tenure at the displaced job, making scheduled benefits feasible.

The incidence of job displacement of long tenured workers is relatively small, and expected costs to the firm at the time of hire modest.

Cons

Unemployment spells are less well defined in more informal labor markets.

The wage loss data required for designing an ideal system are not available for many countries.

Job displacement losses near retirement are especially difficult to estimate robustly because of the availability of alternative disability and retirement support and voluntary withdrawal from work.

The ideal wage rate protection, wage insurance, is administratively expensive, forcing protection programs to rely on “scheduled benefits,” which is essentially severance pay.

Author's main message

It is important to recognize job displacement as a serious risk and to design programs to insure against it. The risk is two-fold: earnings losses from unemployment spells and wage losses upon reemployment. Informal labor markets limit displacement benefits to fixed sum amounts at displacement, i.e., severance pay. Formal markets additionally enable actual loss unemployment insurance. Severance pay, whether mandated or voluntarily provided, only crudely targets reemployment wage losses. Programs have been proposed to improve the situation, including unemployment insurance savings accounts and (actual loss) wage insurance, although neither has been fully tested at the operational level.

Motivation

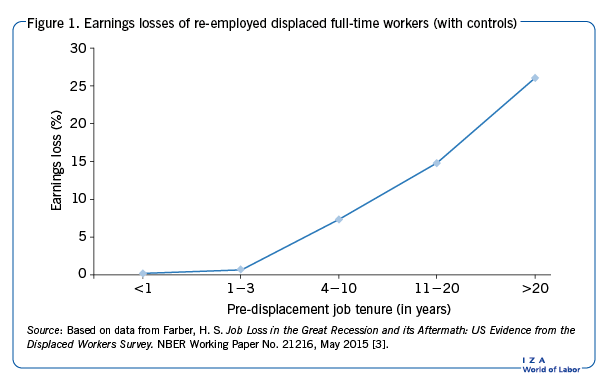

An array of studies have documented the magnitude of earnings losses that result from job displacement in the US, Canada, and the UK [2]. That the displaced face long unemployment spells is obvious, but the magnitude of reemployment wage losses among long tenured workers is dramatic. The losses grow more or less in proportion to tenure (or service) and are quite large for long tenured workers. A 2015 study from the US, using data drawn from two decades of Displaced Worker Surveys, reports average reemployment wage losses of 25% among workers displaced after twenty years of service, (see Figure 1) [3]. A number of researchers have confirmed the early results from a seminal study [4] that these wage losses are persistent, making the capital value of the earnings loss especially troubling.

Apparently these earnings losses are poorly insured, at least in the US. Another early study, this one from 1991 [5], identified too major sources of consumption risk in the US—(i) the job displacement of long tenured workers and (ii) the onset of a serious impairment. The focus in this article is on insuring against job displacement losses. An ideal insurance package would include both: unemployment insurance (UI) and wage insurance.

UI is sufficiently difficult to administer that it is not offered in a wide range of less developed countries, and wage insurance yet more so and offered in none [1]. Common instead is severance pay (see the illustration on page 1), which is typically linked to worker earnings and increases with job tenure. Mandating that private firms provide severance pay is administratively economical, although loss targeting is crude. Mandated severance pay in the UK is modest and is largely absent in the US and Canada, leaving provision as a voluntary choice by employers.

Severance pay can be viewed as scheduled wage insurance (proportional to the discounted sum of lifetime reemployment earnings losses). Both mandated severance pay worldwide and voluntary plans in the US usually limit payouts to involuntary separations and offer payment schemes that correspond to job displacement losses, with benefits strongly increasing in service or years of tenure [6]. The modal employer offers benefits as the product of a specified number of weeks of pay per year of service, often one or two, and years of service. This algorithm correlates with the capitalized value of average job displacement losses. Many plans have service maximums for benefit computations. This may crudely adjust for the reduced work life for long tenured workers, although few plans actually reduce benefits as retirement approaches. Severance also serves as (scheduled) UI when actual loss UI is not available [7], but the capitalized value of reemployment earnings losses greatly exceeds unemployment losses for displaced workers with substantial tenure. A second-best job displacement insurance (JDI) system would then contain: unemployment insurance and severance pay.

All but a handful of countries (six) mandate employer-provided severance pay or defer to collective bargaining systems (see the illustration on p. 1). However, many countries do not offer public UI, presumably because of the program’s administrative demands. In these countries, severance pay plans must cover both risks. Of those countries that offer unemployment benefits, almost all mandate that employers provide severance pay, though a few defer to collective bargaining agreements. A 2012 study places the US in the latter category, though its modest union density leaves the bulk of severance provision to the decisions of individual employers [1].

If both programs are offered, careful consideration must be given to coordination. At a minimum, the two instruments are at some level substitutes. If one offered unemployment benefits of limitless duration with a 100% replacement rate, the unemployed would not find it financially attractive to accept a wage offer that is less than the original wage. Reemployment wage loss would be rare even as unemployment would be abundant. In this environment there would be no need for severance pay. In Denmark for example, which as recently as the early 1990s offered 90% replacement rates for low wage workers for an almost limitless duration, collective bargaining contracts included severance pay benefits only for higher paid white-collar workers. The maximum duration of benefits is now much shorter in Denmark and subject to nonmonetary burdens (active labor market policies) and the joint programs perhaps should be recalibrated.

The efficiency of the joint unemployment and wage insurance plan depends, not only on the integration of the two, but the structure of each individually. A study from 2006 considers such a joint system with innovations in both elements beyond what is currently observed [8]. The author proposes that (i) unemployment insurance be replaced with a UI savings account (UISA), which would ideally eliminate any limitations due to search moral hazard, and (ii) severance pay be replaced with actual loss wage insurance. The value of these changes is considered below.

Discussion of pros and cons

The logic of identifying job displacement insurance as an entity, with integrated unemployment and wage insurance programs, requires little justification. The arguments against arise from the various administrative limitations and the information imperfections that emerge in second-best mechanisms. The search moral hazard problems that limit UI generosity represent only one of these.

Public unemployment insurance, for example, would appear to be administratively infeasible in many circumstances, most obviously ones with highly informal labor markets. In countries characterized by such markets, severance pay must cover both unemployment and reemployment wage losses and is likely to be a crude fit at best. The rationale for government mandating of private firm activities is obvious—firms are more capable than the government of executing the severance plan. However, there remain serious questions about how regularly such mandates are enforced [9]. Extremely high severance mandates arise in countries which are unlikely to enforce the mandates, at least systematically. For example, is it likely that Zimbabwe employers routinely pay 130 weeks of severance to a worker displaced after 10 years, much less 433 for those displaced after twenty years [1]? The imperfections here are in the government’s fundamental capabilities and not in policy design. Obviously a high nonperformance rate for employer-mandated severance pay means that the insurance is itself risky.

Government-provided unemployment insurance signals a reasonable degree of administrative competence. In countries with such systems, the additional administrative demands of providing public severance pay would appear to be modest. Nonetheless, most governments do not directly administer severance pay plans, but instead rely on government mandates of private employer provision. Clearly, this reduces government administrative costs if enforcement difficulties are not too substantial.

Reemployment wage losses are not directly insured (based on actual losses) anywhere in the world. Instead, severance pay is offered, which can be viewed as scheduled wage insurance. It may also serve as scheduled unemployment insurance in countries not capable of supporting unemployment insurance systems, or in countries which offer only partial unemployment insurance because of search moral hazard concerns.

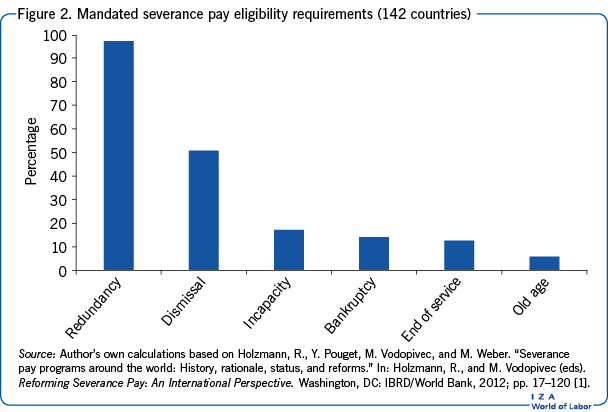

The role of severance pay as scheduled wage (rate) insurance is visible in the US and internationally in both (i) the eligibility requirements for severance payouts, and (ii) in the shape of the payout schedule in job tenure. In data from 142 countries, the focus of severance payouts is clearly on job displacement with, in most cases, redundancy or dismissal a requirement, (see Figure 2) [1]. Although there is evidence of occasional use of the program for disability or other problems, employer-initiated separations clearly dominate.

The benefit payout schedules closely parallel the job displacement earnings losses illustrated in Figure 1. The model benefit schedule includes a specified number of weeks of pay per year of service algorithm, often one or two weeks of pay per year of service. It is not surprising that a benefit structure of this type is welfare enhancing in US style economies [10].

It would seem appropriate to integrate unemployment and severance benefits [11]. Under the severance-pay-as-wage-insurance argument, the weeks per year of service algorithm neatly matches earnings losses by tenure or service. But the same reemployment wage loss profile would argue that UI benefits should decrease with tenure if, as commonly conjectured, UI benefits are limited by search moral hazard concerns. If reemployment wage rates fall with tenure, UI benefits per week should also fall if the unemployed are not to be discouraged from accepting jobs. The full job displacement package would include a larger severance payment with tenure, and the JDI benefit package would simply vary its composition with tenure, with unemployment benefits per week down and the lump sum severance payment up. Treated as separate programs, reducing unemployment benefits for higher tenured workers is likely to be unpopular, no matter the moral hazard concerns. Not so if considering the package as a whole.

The US and Canada are relatively unusual among highly developed countries in their reliance on voluntary employer-provided severance pay. Unfortunately, the private employer provision of severance pay is not popular; neither is it offered by third party insurers, who might be wary of the insuring firm’s likelihood of large scale layoffs. With a last-in-first-out (LIFO) layoff policy, severance payouts will be quite small in low layoff periods--only low tenured, low severance workers would be released. Payouts grow sharply as the severity of layoffs grows. Obviously, that means that payouts are especially large when the firm is under the most serious economic stress and least able to provide the funds. The employer’s willingness to pay severance aside, firms may go bankrupt and no longer have the legal right to distribute funds unless permitted by a bankruptcy court. It is perhaps not surprising that voluntary severance payments are common only in large firms in the US.

A severance pay plan would not be difficult to integrate into a formal UI system, reducing nonperformance and bankruptcy risk. The US system for example is already “experience rated,” with both contributions (taxes) paid and benefits distributed linked to both employers and individual workers. Eligibility for UI benefits, moreover, is often conditioned on past (individual) worker earnings and the reason for job separation, voluntary or involuntary. If the worker is permanently and involuntarily separated from the firm, benefits could be paid out of the employer’s account. If the worker separates voluntarily (quits) or reaches normal retirement age and becomes ineligible for payouts, the contributions credited to the worker would revert to the firm.

The expected cost per worker of severance plans to the employer at the time of hire is relatively modest; job displacement of high tenured workers by its nature cannot be an everyday affair. Many workers will never qualify for severance benefits; e.g., workers who leave voluntarily (quit) to seek better opportunities elsewhere are normally not eligible for benefits. Similarly, older workers who leave for retirement reasons do not generally qualify for severance benefits. If the program is financed by fixed payments per employed worker, the accumulated reserves of a specific worker would presumably revert to the employer’s account upon uninsured departure of the worker. Permanent job loss of a worker with twenty years of experience illustrates the unlikelihood of its occurrence. To achieve twenty years of service and then lose it in a standard LIFO layoff system requires decades of relative job stability and presumably firm demand stability, punctuated by a sharp drop in demand.

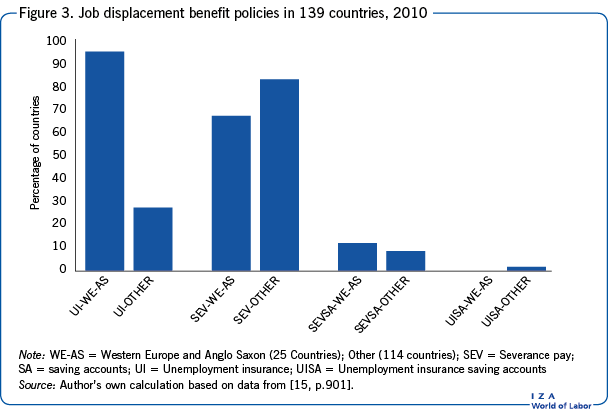

Firing cost problems, perhaps more usefully labeled layoff moral hazard, may arise, however, because payouts at the time of displacement may be substantial [12]. The employer may choose not to release a worker in bad times, especially if the worker is long tenured with a large expected severance payout and the worker is close to normal retirement. Firm-financed separation benefits raise the possibility that the firm, the only fully reliable source of information on the firm’s economic distress, may choose to conceal low demand and retain workers when it would be efficient to release them. Despite careful study of this phenomenon, the magnitude of the effect on layoffs remains uncertain (recall that the firm must operate with good time wages and hours if the demand report is to be credible). Layoff moral hazard may not be trivial; severance savings accounts, which avoid this moral hazard problem, represented about ten percent of all displacement insurance systems internationally in 2010 (see Figure 3). More substantial (negative) consequences for employment and unemployment have been robustly rejected [13].

Limitations and gaps

The principal limitations and gaps are informational and administrative. Researchers have only superficial knowledge of the administrative costs that keep developing countries from offering UI systems, forcing them to rely on mandated (employer) severance pay. The threshold level of development that signals when a country can reasonably adopt a UI system has not been established in the literature, although labor market informality is surely key.

An integrated unemployment/wage insurance program also requires a good understanding of job displacement losses. That is less a problem for actual loss unemployment insurance, which reveals itself in the event. However, for severance pay, which is scheduled wage insurance, benefits must reflect expected losses, not individual losses. To implement scheduled benefits (based on job tenure), it is essential to know how (i) annual wage losses grow with tenure and (ii) how the losses persist over time, so that the losses can be properly capitalized. There is a substantial pool of information on this issue for the US and similarly structured economies, but the nature of job displacement losses appear to vary greatly internationally [14]. To illustrate the problem, many of the successor nations to the Soviet Union mandate that firms provide flat rate severance pay, generous by usual standards at low levels of tenure and ungenerous at high [1]. Is this a failure of design or a difference in the way job displacement losses vary with tenure?

Even in relatively well investigated economies like the US, displacement loss estimates are not always reliable. Reemployment earnings loss estimation is difficult among older workers, who are also often long tenured workers. Many withdraw from the labor market after displacement, which indicates either large wage losses or the availability of alternative income support systems, notably disability and retirement benefits designed to cover the second major source of earnings loss--permanent impairment.

A major concern with the individual innovations-UI savings accounts, actual loss wage insurance-proposed by a 2006 study [8] is the lack of practical operating experience. Neither has been broadly adopted individually and there is little reason to believe that imposing the two jointly will seriously ease performance concerns. UISAs suffer from the weakness that worker myopia, a common concern in social insurance programs, reintroduces search moral hazard concerns into compulsory unemployment insurance plans. Actual loss wage insurance requires excellent post-separation wage data, ideally over the remainder of the individuals work life, a major data requirement. Shortening the loss period to two years, as is common, eases the data problem, but at a substantial reduction in coverage of total losses.

Summary and policy advice

Job displacement losses are large, especially for long-tenured workers. The earnings losses from unemployment spells are substantial, but of greater consequence in the US, the UK, and Canada (and perhaps similar economies) is the sharp fall in reemployment wages, an average decline that persists for years. Consumption evidence indicates that these heavy losses are poorly insured in the US by public unemployment benefits and voluntary, employer-provided severance pay. The question becomes how to design a better insurance package.

In less developed economies, that involves the development, if feasible, of unemployment insurance programs, to supplement mandated severance plans upon which many now rely exclusively. Unfortunately, little work has been done on the question of the political and economic conditions that make public UI appropriate.

For economies which have mature unemployment programs this argues for incorporating the severance plan into the publicly operated unemployment insurance system. At present, most industrialized countries simply mandate that private employers must provide a severance plan of required form.

For the US and Canada, that would involve a more abrupt change in policy, because severance benefits, if offered, are voluntary. Nonetheless, incorporating a severance plan into an unemployment insurance program such as that of the US would not be technically difficult because records are currently kept by firm and individual worker. Where both unemployment insurance and severance pay are offered, policy designers should explore the value of integrating the two systems.

The differing delivery structures (public UI and mandated, employer-provided severance pay) foster the idea that the two plans are unrelated, which limits the degree of useful integration of what should be a single two-dimension system. For example, the same economic reality that severance pay should rise with tenure would argue for reduced UI benefits with tenure. If UI benefits are ideally limited by search moral hazard problems, large predictable variations in reemployment wages should induce corresponding variations in benefit generosity. Although UI reductions directly induce a negative shift in benefits, when paired with increasing upfront severance payments, the net change in value is ambiguous. One size does not fit all, so that careful estimation of the consequences of job displacement for each country or each country type is required.

An ideal information initiative would include:

a broad screening of consumption data to determine the importance of the job displacement risk in a country’s overall earnings risk—job displacement insurance may not always be the priority it would appear to be in the US.

careful consideration of a country’s administrative competence to offer a UI system if one is not already functioning.

if having the capacity to undertake the reasonably demanding administration of a UI, estimation of the magnitude and duration of earnings losses, in total and as a function of job tenure or other key factors. For example, countries with strong, widespread labor union coverage may have little wage loss on the next job, but long spells of unemployment.

Properly designed and executed, a job displacement insurance system promises considerable benefits to a country’s workers. The efficiency of an integrated unemployment insurance/ wage insurance system depends in part on the efficiency of the individual insurance elements and experiments and demonstration projects to establish the value of UISAs and actual loss wage insurance should be undertaken.

The absence of broad adoption of UISAs and actual loss wage insurance provides its own warning that these programs may have serious flaws, but the nature of the problems that emerge with careful study may themselves be amenable to remedy.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Previous work of the author contains a larger number of background references for the material presented here and has been used intensively in all major parts of this article [11]. Version 2 of the article updates several arguments and findings, and adds new Key references [2], [5], [8], [9], [10], [13], and [15].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Donald O. Parsons