Elevator pitch

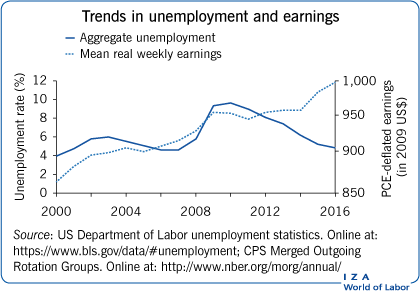

As the largest economy in the world, the US labor market is crucial to the economic well-being of citizens worldwide as well as, of course, that of its own citizens. Since 2000 the US labor market has undergone substantial changes, both reflecting the Great Recession, but also resulting from some striking trends. Most interesting have been a remarkable drop in the labor force participation rate, reversing a nearly 50-year trend; the nearly full recovery of unemployment from the depths of the Great Recession; and the little-known continuing growth in post-inflation average earnings.

Key findings

Pros

Unemployment has returned to near its pre-Great Recession level.

The job vacancy rate is at its highest since data have been collected.

The labor force participation of men and women ages 20–54 has fallen, so that in 2016 the labor force has six million fewer people than were expected in 2000.

Real earnings of the average and median full-time worker have risen.

Women’s wages have risen relative to those of men but remain somewhat lower.

Cons

Even near full employment in 2016, long-term unemployment is much greater than at similar points of the business cycle.

Youth unemployment remains far above the adult average.

The labor force participation of men and women aged 20–54 has fallen, so that in 2016 the labor force has six million fewer people than were expected in 2000.

Wage inequality has continued to increase with this rise concentrated in the upper half of the earnings distribution.

Wages of African Americans have fallen compared to that of whites and remain far lower.

Author's main message

In the aggregate the US labor market is doing quite well. Unemployment is currently below 5%, and real weekly earnings of full-time workers increased from the 2000 cyclical peak to the current period of near full employment. The difficulties lie behind the aggregates. Earnings inequality continues to rise, with the growth in earnings most prevalent among workers in the upper half of the earnings distribution. Even though labor force participation rates of people aged 55 and over have continued to rise, those of adult men aged 20–54 have dropped, continuing a trend. Surprisingly so too have those of women aged 20–54, sharply reversing the previous trend. The earnings of African-American and Hispanic workers relative to whites have not changed greatly and remain far below those of white workers.

Motivation

Knowing the facts about a labor market is crucial for understanding labor-market policy—and for knowing the general background of the discussions in IZA World of Labor articles. Equally important is knowing which areas a country’s labor market is doing well in and which ones poorly. This study provides these facts and discussions for a major country, the US.

Discussion of pros and cons

Aggregate issues

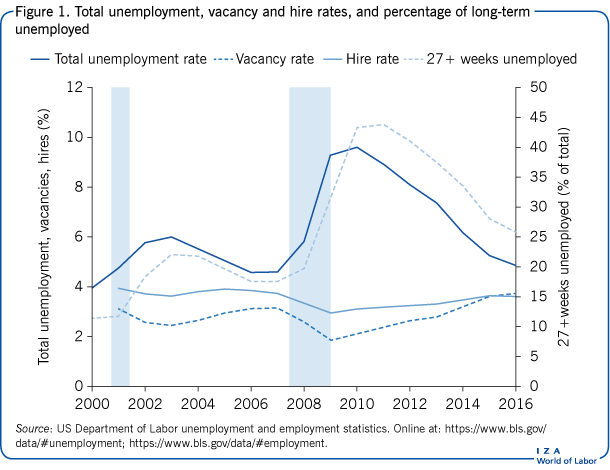

After a nearly ten-year economic expansion through the 1990s, the US fell into recession in March 2001. Figure 1 shows the aggregate unemployment rate from 2000 through 2016, the two recessions that occurred during this period are shaded. The 2001 recession was shorter than most in the post-Second World War period, lasting for only eight months; and it was also milder, with the seasonally adjusted aggregate unemployment rate rising only from 3.9% to 6.3% of the labor force, a smaller increase than had occurred on average in the previous 55 years of US business cycle history.

The US economy made a slow recovery from this mild recession, so that the monthly aggregate unemployment rate had not fallen below 4.4% even five years after its end. Standard cyclical forces brought the economy back into recession at the end of 2007; and these were compounded by the tides created by the financial crisis of 2008, so that shortly after the trough of the Great Recession the aggregate unemployment rate peaked in October 2009 at exactly 10%, just slightly below the postwar peak at the end of the recession in the early 1980s.

The Great Recession by some calculations was the longest and deepest in the post-war period, although one might argue that the double recession of the early 1980s was longer. Regardless, compared to anything in the previous 25 years it was the most serious—deepest and most prolonged—cyclical decline that the US had seen in a generation. The unemployment rate did, however, fall steadily from 2010 onward. With unemployment hovering between 4.5% and 5% in 2016, it is fair to say that the economy appears at or near full employment; and unemployment is now as low as it was shortly before the Great Recession.

Since 2000, the US has collected and published statistics measuring job openings (for short, vacancies), so that information on the counter-cyclical indicator, the aggregate vacancy rate, is now available. Figure 1 shows the entire annual time series of this indicator. One doubts that all vacancies are included, or, more importantly, that all hires fill officially declared job vacancies; nonetheless, the official vacancy rate is a good measure of employers’ unfilled demand for labor. The vacancy rate fell by nearly 50% during the Great Recession. Today, however, it is at its highest since the data began to be collected; and it is nearly as high as the unemployment rate (showing the percentage of people whose desire for work is not being filled). Together with the relatively low aggregate unemployment rate, the current vacancy rate underscores the conclusion that the economy is around full employment.

Despite the high vacancy rate, the rate of hires, also shown in Figure 1, has not reached its pre-Great Recession level. Indeed, while the rate of hiring frequently reached 4% per month in the two years before the business-cycle peak late in 2007, even after many years of recovery it has not gone above 3.8% per month. Coupled with the low aggregate unemployment rate and the relatively high vacancy rate, the pattern of hires suggests that employers simply cannot find the workers they need to meet the demand for their products at the wages they are willing to offer.

This currently rosy picture is marred if one considers the percentage of the unemployed who have been out of work and seeking work for 27 or more weeks (defined in the US as the long-term unemployed). Of course, this percentage rose sharply in the Great Recession (Figure 1); and, as in past recessions, mainly for mechanical reasons it only began to fall well after the business-cycle trough. What is disturbing, however, is that even in 2016 over one-quarter of all unemployed workers had been out of a job for more than six months. This is a far higher percentage than had ever been observed when aggregate unemployment was below 5%.

What does this unusual development mean? The aggregate unemployment rate is the product of the number of people experiencing unemployment in a given year multiplied by the average duration of unemployment of those who do become unemployed. With one-quarter of job-seekers being long-term unemployed, this means that a disproportionately large fraction of the labor force is bearing the burden of unemployment. And it is quite clear that social welfare is reduced when few people bear most of the burden of being out of work compared to when that burden is shared more widely [1].

Labor-force participation—Aggregate, by gender and by age

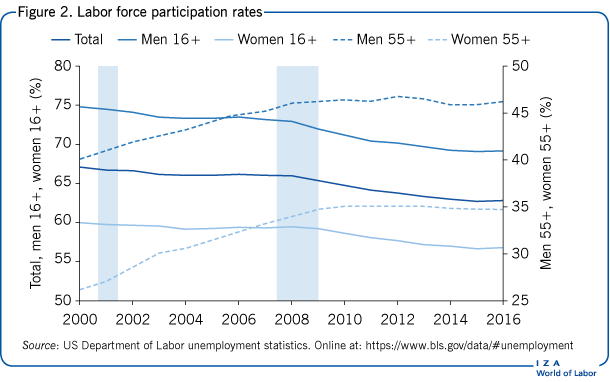

Since the labor force by definition consists of the employed and unemployed (i.e. it includes all those who are working or actively seeking work), focusing on the labor force participation rate (the fraction of the population employed or unemployed) allows a discussion of employment. Figure 2 presents the aggregate US labor force participation rate since 2000. Since then the participation rate has fallen by over four percentage points. Intriguingly, the fall has not stopped during the cyclical expansion that began in mid-2009. Indeed, if anything 2009–2016 is the period when most of the decline occurred.

After over 40 years during which the aggregate participation rate rose, this decline has surprised economists and other observers of the US labor market. Given the definition of the labor force, and given that the unemployment rate today is about where it stood in 2000, this decline means that employment is about six million people lower than it would have been had the participation rate not fallen. How should one view this truly momentous change?

During the 2016 presidential campaign, Donald Trump repeatedly argued that the focus should be on employment, and implied that anyone who was not working should be viewed as unemployed. Of course, this suggests valuing work “über alles”—that society should be maximizing employment, presumably in order to maximize production and GDP, and should not be valuing the additional leisure that results when employment decreases because of workers’ choices about how much to work. Within some range this is a reasonable view; and no doubt Americans would be richer if the participation rate had not fallen and an extra six million people were working.

Alternatively, one might argue that people have the right to choose not to work. They may be satisfied with lower incomes, working only occasionally and perhaps relying on family members. By that view, especially since the US is now the leader among wealthy nations in hours worked per adult [2], seeing a decline in participation may suggest that Americans are developing a more reasonable work–life balance. The subtitle of a 2008 volume—Are Europeans Lazy? Or Americans Crazy? [3]—suggests that Americans might be viewed as more similar to Europeans now than they had been in the past.

Figure 2 shows that the aggregate decline in labor force participation since 2000 stems from declines among both men and women. The decline among men parallels the long-term decline of participation by men aged 20 and over that began in the 1950s. Among women, however, the decline in participation, although not so large as that of men, is quite remarkable. It reverses a steady increase in female labor force participation from 30–60% among adult women that occurred from 1948 to 2000.

While adult participation rates in total have declined since 2000, labor force participation among Americans aged 55 and over has risen. Both men and women are postponing exit from the labor force longer than they had, perhaps because they are aware of the increased length of life that they are likely to enjoy, perhaps because they do not expect to have sufficient retirement income because they failed to save sufficiently, or perhaps because work has become less arduous and more enjoyable. While the participation rates of older people of both sexes have risen, the rise during this period has been especially pronounced among older women (just as the overall decline in participation has been less pronounced among women).

The demographics of unemployment—Age and gender

Many economies are plagued by huge rates of unemployment among youths. The US is not. Figure 3 shows that the unemployment rate of youths aged 16–19 rose sharply during the Great Recession, reaching nearly one-quarter of the teenage workforce. But while the rise appears sharper than that among adults, the ratio of teen to adult unemployment fell after the Great Recession. By 2016 the historic ratio of teen to adult unemployment rates of three to one was restored, with teen unemployment at 15% of the teen labor force.

This relatively low teen unemployment rate looks good in comparison with many other Western and especially Mediterranean economies. It is still, however, far higher than desirable, especially coupled with the higher long-term unemployment among teenagers that had been observed near previous business cycle peaks. (Today, teenagers unemployed for 27 or more weeks account for one-quarter of all teen unemployed, identical to the unemployed generally; in 2007, they accounted for less than one-tenth of all teen unemployed, a far lower fraction than among the unemployed generally.) This increase is especially disturbing, as it suggests that there is an increasingly large group who are beginning their work lives with long-term disappointment and with dim career prospects.

Figure 3 also presents, along with the aggregate unemployment rate, the unemployment rates of adult men and women. Until the mid-1980s the unemployment rate of adult women had exceeded that of adult men [4]; since then they have been roughly equal. The male unemployment rate even rose above that of women during and after the Great Recession because of the concentration of the downturn in more male-intensive industries, such as manufacturing. Today, however, the two unemployment rates are essentially equal, restoring the equality that had prevailed during the first half of the first decade of the century.

Wage developments

The calculations in this and subsequent subsections are all based on individual data collected by the monthly Current Population Survey (CPS) and released as part of the National Bureau of Economic Research’s Merged Outgoing Rotation Groups (MORG). They are based on the usual weekly earnings of full-time workers (those usually working at least 35 hours per week). Including all workers, even those with very short workweeks, changes no conclusions, but using only full-time workers has the advantage of abstracting from changes that arise because of the changing prevalence of part-time work, both secular and cyclical developments. The calculations thus focus on people who might be viewed as closely attached to the labor force and who have been the focus of much of the literature on changing wage inequality, going back to [5] and [6].

This focus is on the economic well-being of full-time workers over the past 17 years. An alternative, more focused on the price of an hour of labor to employers than on the returns to workers, would calculate the wage (better still, the total payroll cost) of the average hour of labor used each year. The choice here is arguably more appropriate in an examination of inequality in the labor market.

Aggregate developments

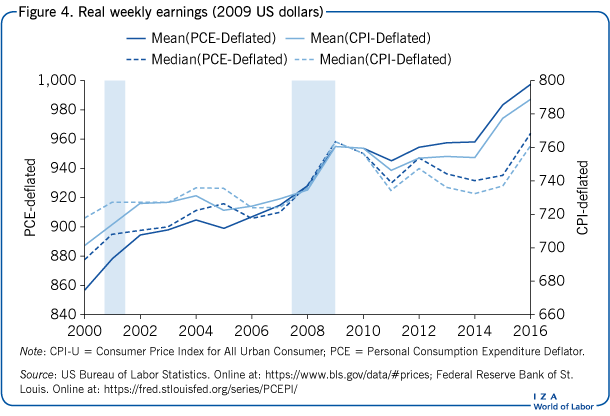

Policymakers and even the average citizen correctly focus on changes over time in the economic well-being of typical workers after accounting for inflation. Regrettably, no single measure would be universally agreed upon as reflecting these changes. There are two central issues:

Should the focus be on the earnings of the average worker, or on those of the median worker (the worker at the 50th percentile of earnings)? Using the average worker has the advantage of reflecting outcomes for workers as a whole, but it will miss changes caused by differential changes in earnings at different points of the earnings distribution. Using the median worker’s earnings avoids the latter difficulty but vitiates the former advantage.

The aim is to measure economic well-being, but for that one needs to account for inflation. This requires deflating nominal earnings to obtain real earnings. The Consumer Price Index for All Urban Consumers (CPI-U) is the standard deflator, used, for example, in indexing various pension and retirement benefits, including federal social security payments. It has long been known, however, that it overstates the rate of increase of prices facing consumers [7]. A better alternative is the Personal Consumption Expenditure (PCE) deflator from the US national accounts.

Being agnostic about these two pairs of issues, in Figure 4 the real weekly earnings of full-time workers are presented, both at the mean and the median, and using both price deflators. Comparing changes from 2000 to 2016 is sensible, as these two years were, more or less, at the same stage of business cycles. Regardless of the wage measure or price deflator used, there is no doubt that workers’ real earnings rose over this period. But the differences in one’s inferences across these four real measures are substantial: Using the average worker’s earnings deflated by the PCE deflator suggests an annual growth rate of nearly 1%; while using the median worker’s earnings deflated by the CPI-U suggests a meager, but still positive growth rate just below 0.4% per annum.

Growth in all four measures slowed for several years following the trough of the short recession at the start of the 21st century. It accelerated in the several years preceding the Great Recession, then slowed or even became negative after the trough of the Great Recession. It is only since 2014 that real earnings growth has become definitively positive.

Changing earnings inequality

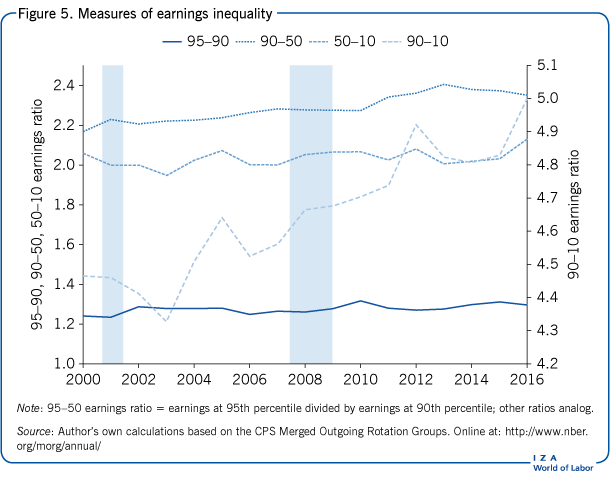

Economists have concocted numerous different ways of measuring inequality in distributions of earnings and income. Each can present different pictures of how the distribution has been changing over time. Here the ratios of earnings of pairs of individuals at different points of the distribution of weekly earnings of full-time workers are chosen. In particular, the 95–90 ratio (earnings at the 95th divided by earnings at the 90th percentile), the 90–50, 90–10, and 50–10 ratios are presented. This gives a fairly complete picture of the distribution of earnings. While one would like to go above the 95th percentile of earnings, given the evidence that a substantial part of the change in income inequality in the US has been at the very upper end of the income distribution [8], this is not possible with the CPS-MORG, as earnings above a certain weekly amount are top-coded.

Consider first the 95–90 ratio, whose time path from 2000 through 2016 is presented in Figure 5. While it has risen slightly over this period, by about 5%, this change is fairly small and suggests that changing earnings inequality in this part of the distribution of earnings has not been great. Similarly, the 50–10 ratio has risen, but also only slightly—by about 3%. Inequality of earnings has not risen greatly near, but not too near, the top; nor has it risen in the bottom part of the distribution.

The big changes in inequality are shown by the paths of the 90–50 and 90–10 ratios. The former has risen by 7%, the latter by over 10%. By inference, wage inequality in the US has continued to increase over this period. The overwhelming majority of the increase since 2000 has taken place in the upper part of the earnings distribution, but apparently not between the 95th and 90th percentiles. Most important, earnings inequality has increased in general over this period, continuing a rise that began in the 1970s.

Female–male earnings differences

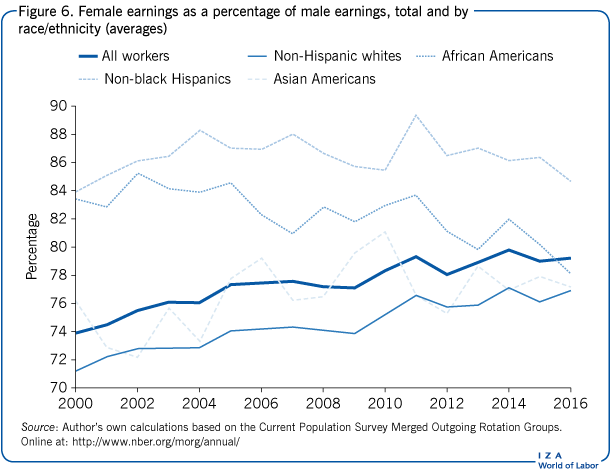

Differences in earnings by gender are often depicted for the entire working population, or for full-time workers; but this can be misleading since it can confound variations arising from changing racial/ethnic earnings differences with the gender differences that are of interest. To circumvent this potential problem, in addition to showing the overall female–male earnings ratio, Figure 6 also shows the paths of the ratios of female–male weekly earnings for full-time workers separately by racial/ethnic group: non-Hispanic whites; African Americans; non-black Hispanics, and Asian Americans. Included in the group of “all workers” are 2% of the full-time workforce who classify themselves as being of other or mixed races and are not included in the four groups. If Figure 6 were re-drawn based on medians rather than averages, the figure would look very similar.

The most important conclusion from the figure is the rise in female compared to male earnings that has taken place over these years, an increase of roughly five percentage points in women’s relative earnings. While these are still far from equaling those of their male counterparts, they are much closer than they were as recently as the late 1990s.

The intra-racial/ethnic changes in female–male earnings differences are quite diverse and demonstrate the value of disaggregating the national averages. Not surprisingly, given that they are the majority in the workforce, changes in female–male earnings among non-Hispanic whites parallel those in the aggregate: White women’s earnings have been rising relative to those of white men, at a slightly faster rate than in the entire workforce. Among the smaller racial/ethnic groups the picture is more mixed: African-American women’s earnings have fallen slightly relative to men’s in the same racial/ethnic group; among non-black Hispanics and Asian Americans there has been essentially no change in women’s relative earnings. The bottom line is that the substantial increase in women’s earnings relative to men’s in the entire workforce over this period has been generated exclusively by changes within the majority population.

Racial/ethnic earnings differences

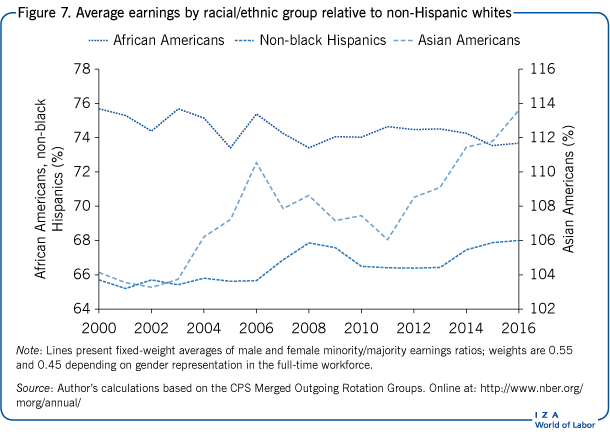

Among full-time workers in 2016, 11% were African American, 13% non-black Hispanic, and 6% Asian American (and 2% in other groups). With over 30% of the full-time workforce belonging to a minority racial/ethnic group, and with the role of race/ethnicity in US history being crucial, it is worth examining how wage differences between these groups and non-Hispanic whites have changed over time. It is well-known that members of the first two groups earn less than majority workers. But how have these differences changed during the 21st century?

These comparisons are shown in Figure 7, with each line showing the ratio of the earnings of full-time workers in the particular minority group to those of majority workers. Rather than presenting separate graphs for men and women, each line presents a fixed-weight average of the male and female minority/majority earnings ratios (with weights of 0.55 and 0.45 to reflect more or less gender representation in the full-time workforce), thus abstracting from any changes in the gender mix of the full-time workforce by racial/ethnic group. Note first that, as has been true historically, both African-Americans and non-black Hispanics earn less in full-time work than do non-Hispanic whites. On the other hand, throughout this period the earnings of Asian-American full-time workers exceeded those of majority workers. The time paths of racial/ethnic earnings differences over the past 17 years have been strikingly different from each other. African Americans’ already low earnings relative to those of majority whites have fallen, albeit slightly, even further, by about two percentage points. Non-black Hispanics, on the other hand, while still earning less than African Americans, have seen their earnings rise by about 2% relative to those of majority workers. The biggest changes have come among Asian Americans: Full-time workers are now earning over 10% more than majority workers, an increase of nine percentage points since 2000.

Limitations and gaps

Perhaps the biggest gap in the description of recent developments in the US labor market is in the area of earnings inequality. The top-coding of usual weekly earnings in the CPS has been fixed at $2,884 since the late 1990s. As nominal earnings have risen, this has meant that the reported weekly earnings of an increasing percentage of full-time earners have had their usual earnings top-coded. In 2016 this was 4%, whereas in 2000 it was “only” 0.9%. This limitation has meant that one cannot obtain nearly contemporaneous data on earnings near the very top of the distribution, even though retrospective evidence from other sources (e.g. [8]) indicates that, at least through the early 2000s, much of the increase in inequality has been at this very high end.

Summary and policy advice

The continuing rise in earnings inequality is the biggest difficulty in today’s US labor market; and the rise has been generated by the more rapid growth of earnings in the upper part of the earnings distribution. The solution to this problem is simple and would put the US economy more in line with those of other wealthy nations: Raise tax rates on households in the upper third of the distribution of household incomes (since the American income tax system is household- rather than individual-based). This could even be done without changing the federal deficit or raising marginal tax rates by sharply lowering the already very high taxable incomes at which the highest income tax rates become effective, while at the same time lowering rates on households in the bottom two-thirds of the income distribution. Since the labor market continues to generate increasing earnings inequality, its effects could be offset by tax policy affecting income inequality. The solution is clear and the difficulty is likely to persist. Thus at some future date these policies might actually be effected.

Acknowledgments

The author thanks the IZA World of Labor editors, and Martin Guenther and Michael Simmons for their assistance.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Daniel S. Hamermesh