Elevator pitch

Women are more likely than men to work in the informal sector and to drop out of the labor force for a time, such as after childbirth, and to be impeded by social norms from working in the formal sector. This work pattern undermines productivity, increases women’s vulnerability to income shocks, and impairs their ability to save for old age. Many developing countries have introduced social protection programs to protect poor people from social and economic risks, but despite women’s often greater need, the programs are generally less accessible to them than to men.

Key findings

Pros

Social protection programs designed with women in mind have reached even very vulnerable and marginalized women.

Efforts at the community level by nongovernmental organizations have often been most effective at reaching these women.

Micro-pension schemes that allow small, flexible contributions provide a way for poor women to save for old age.

Microfinance institutions have made it easier for women to use financial services, making saving/borrowing an ex post form of social protection.

Conditional cash transfers have been successful in channeling funds to women.

Cons

Women’s reproductive role and social norms exclude many from formal social protection programs.

Scaling up informal, community-level social protection programs can be difficult as these often rely on a network of highly motivated individuals.

Most women in the labor force are concentrated in the informal sector with limited access to pension schemes.

Although micro-pensions and defined contribution schemes are better value for women, these schemes place all the risk on individuals.

Many women lack access to financial markets and so find it hard to cope with income shocks.

Author's main message

Women face different risks in their daily lives than men do. Many women have difficulty accessing social protection programs, which are not devised with women in mind. Programs can be designed to reach women, however. Features that help women gain access include accommodating lower levels of literacy; allowing more flexibility in requirements for official documents, like birth and marriage certificates; providing services close to women’s homes; accommodating women’s family care responsibilities; and allowing small contributions and payments at flexible intervals.

Motivation

Although increasingly common in developing countries, social protection schemes often fail to adequately protect women. Among other reasons, this occurs because women are more likely to work in the informal sector, to drop out of the labor force to take care of children, and to have difficulty accessing financial services. Examining how and why women’s needs for social protection differ from those of men and what schemes have successfully reached women is important for understanding how to design appropriate social protection for women. Schemes designed with women in mind can mitigate the risks that undermine women’s productivity and harm many aspects of their lives and households.

Discussion of pros and cons

High-income countries spend 20−25% of their gross domestic product (GDP) on social protection. Developing countries spend less—about 1−5% [2]. Although many countries have introduced social protection schemes that are intended to support poor people, the schemes often fail to reach very poor and marginalized groups, including many women.

Social protection for women can be divided into three categories:

Risk-reduction or prevention strategies that seek to establish an environment that lowers the likelihood of a risk occurring (pre-risk). Examples include training programs that reduce the chance of unemployment or income loss, and childcare services that enable women to enter the formal labor market and gain access to greater earning opportunities.

Risk mitigation strategies that provide some insurance against existing risks before an adverse event occurs, such as the establishment of a workplace savings and loan co-operative that can be drawn on in hard times.

Coping strategies that assist women in coping with the consequences of exposure to risk (after an adverse effect has occurred), such as transfers or loans.

The case for designing social protection for women in developing countries

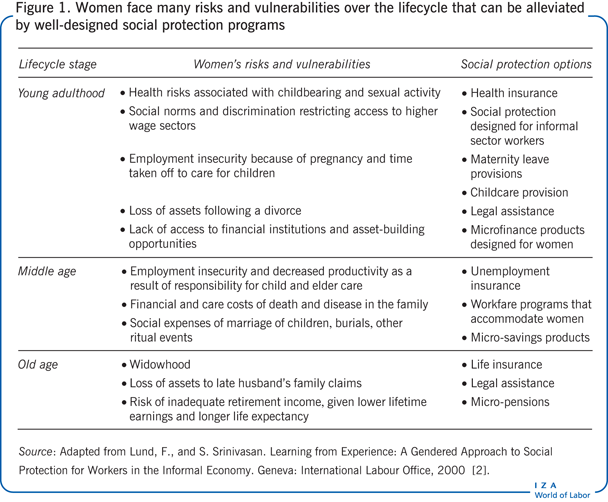

Social protection seeks to prevent, manage, and overcome risk. The risks women face in their daily lives in developing countries are shaped by differences from men in biological attributes and social norms [3] and by differences over the lifecycle (see Figure 1). These differences mean that the characteristics of schemes designed for men are often unsuitable for women. Equality of access to social protection thus requires programs that reflect the different nature of women’s work and the different risks they face.

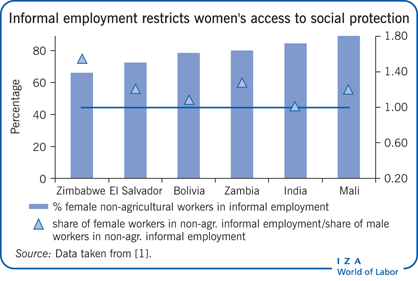

Many women are under-represented in the formal labor market because child-rearing and other household responsibilities interrupt their labor force participation, while societal norms result in labor market discrimination. In 30 of the 41 low- and middle-income countries for which data disaggregated by sex are available and in almost all of the low-income countries, the share of women in informal, nonagricultural employment outnumbers that of men [1].

Pregnancy and motherhood also lead to greater job insecurity, as employers are often reluctant to hire women of child-bearing age because of the maternity-related costs they might incur and the possibility of work disruption for childbirth and child-rearing. Flexible arrangements that allow women to manage family responsibilities and work (for example, work-based childcare, flexible working hours) are rare.

Many women work in informal, home-based jobs that provide the flexibility to work while managing a household and caring for children, but such home-based work arrangements also expose women to exploitation. Women’s greater representation in the informal sector, including home-based work, results in lower pay and limited access to most social protection programs, which are typically designed with formal sector workers in mind.

Women’s low pay and employment insecurity extend into middle age. Many women do not acquire the training and experience necessary to open up higher earnings opportunities by middle age, and women in this age bracket have often have assumed other additional household roles, such as caring for elderly parents. Women’s longer life expectancy exposes them to further risks in old age—widowhood and an inadequate retirement income, given their lower earnings stream. Women’s longer life expectancy alone means that, all else being equal, women require more resources than men at retirement to attain the same standard of living.

Women’s lack of access to social protection would be of less concern if women were better able to draw on savings or borrowing in bad times and if resources were equitably shared within households. Traditional savings and loan products are not accommodating of women’s need for smaller deposits and payments given their lower incomes. Getting to bank branches can be challenging in the face of women’s multiple household responsibilities. And women are often at a disadvantage in the distribution of household resources, their tenuous claim on household assets often overshadowed by counterclaims from the husband’s family after his death. Unmarried, divorced, and widowed women’s ability to benefit from social protection designed for men is even more limited.

Designing social protection programs with women in mind

Overcoming women’s disadvantages in access to social protection requires accommodating the different situation of women. Governments can design programs adapted to women. Nongovernment organizations (NGOs) have been found to be particularly effective in reaching women. NGOs can implement their own social protection programs. They can also fill gaps in government-provided social protection by covering under-represented groups and by providing alternatives for poor quality or inefficiently delivered government programs. And they can facilitate access to government programs through information campaigns, referral services, and assistance to women in acquiring the documentation often needed to participate in formal social protection programs.

NGO activities at the community level have been particularly effective in reaching marginalized and socially excluded women, but scaling up the programs, which are often resource-intensive and depend on a network of highly dedicated individuals, can be difficult. The challenge is to design interventions that can be scaled up to reach and positively influence a large number of women. An extensive state-implemented social protection program remains the ultimate goal.

What works? The empirical evidence

What kinds of social protection programs have successfully reached women, especially poor women and women in informal work, who stand to benefit the most from social protection? The examples here demonstrate common forms of social protection: employment guarantee schemes, pension schemes, comprehensive social protection for informal sector workers, microfinance, and conditional cash transfers.

Employment guarantee schemes

Employment guarantee programs, common in developing countries, typically provide opportunities for unskilled laborers to work on constructing and maintaining infrastructure, such as roads and irrigation schemes. Well-designed projects set the wage slightly lower than the market wage for unskilled labor, to attract the poor people for whom the programs are intended. Because of the manual labor component, these projects often fail to reach women.

However, employment guarantee programs can be designed to attract more women. The most elementary way is to include work that is socially acceptable for women, for example, by reducing the manual labor component. In some parts of Africa programs with wages based on output have attracted more women because of the greater flexibility in the allocation of time. Such arrangements recognize that working a straight day can be difficult for women, who also have to attend to children and other household responsibilities. Payment in kind (food) can also be attractive to women, who are often responsible for household food security and whose children, research shows, benefit more from women’s greater access to resources than from men’s. Programs in Lesotho and Zambia that paid half of wages in food attracted more women than men [4]. Programs that make provisions for childcare also make it easier for women to participate. India’s Maharastra Employment Guarantee Scheme, designed with women in mind, offers employment within five kilometers of home. Childcare facilities are also provided. Almost half of participants are women.

Pension and micro-pension schemes

Standard pension schemes are typically available only in the formal sector and are still sparse in most developing countries. For the pension schemes that do exist, there has been a shift (encouraged by international institutions such as the World Bank) from pay-as-you-go schemes to either defined-benefit schemes, with pension payments based on earnings and job tenure, or defined contribution schemes, with payments determined by the level of individual contributions and the returns on these contributions.

Although women’s lower earning capacity generally results in lower contributions, women tend to be better off under defined contribution than defined benefit schemes. Defined contribution schemes are portable and depend only on the amount and timing of contributions. Defined benefit payments are based on final salary and tenure, thus implicitly redistributing benefits from short-tenured, low-earning workers to long-tenured, higher earning workers. Because women’s more variable labor force participation reduces their tenure in any one job, their capacity for salary growth and thus their final salary is lower than men’s. Women will still do worse than men under defined contribution pension systems, but the gender gap is likely to be smaller than under defined benefit systems.

Some pension programs have features that are friendly to women. Benefits in Chile’s national pension scheme are based on contributions, and there is no minimum requirement in terms of years of contributions to receive benefits. It also has a minimum pension guarantee, which raises the benefits for women with low schooling. Studies found that it provides equal access to benefits for men and women [5], [6]. A 2002 study of pensions programs suggests other measures that can make them more accessible to women [7]. These include social security credits for family caregivers for time out of the labor market spent caring for young or elderly family members (as in France and Germany) and funded schemes based on family savings or investments rather than individual savings and investment. Women would also benefit from allowing claims on the pension of the main income earner for years of unpaid work by the dependent spouse in cases of divorce.

Most pension programs are available only to formal sector workers. A relatively new approach to old age support that reaches informal sector workers in developing countries is micro-pensions. UTI, a publicly owned mutual fund in India, has established a micro-pension scheme that accepts very small, voluntary deposits at flexible intervals, with no entry charges. Contributions must be paid until age 55, and pension payments begin after age 58. A 1% charge is applied to balances withdrawn before the stipulated retirement age.

UTI’s micro-pension program involves an administratively and financially competent third party—a cooperative, a microfinance institution, or an NGO—whose job it is to attract large numbers of members with shared characteristics, to channel communications between members and UTI, and to conduct administrative functions [8]. UTI manages the fund. This partnership lowers the cost of account servicing and customer acquisition, which helps make the scheme viable despite the low value of individual accounts. Member savings are pooled and transferred to UTI, but records are maintained on an individual basis, and each member has a personal account number.

The Rajasthan state government’s Motivational Contributory Pension Scheme takes another approach that includes government matching contributions of up to 1,000 rupees (Rs) a year per worker. At age 60 members receive a pension based on total member contributions, government contributions, and accumulated interest payments.

A downside of micro-pension schemes such as these and of formal defined contribution schemes is that there is no risk sharing: individuals bear all the risk. One way to introduce risk sharing would be to base payments on the contributions of a group of workers rather than individual workers.

Comprehensive social protection for informal sector workers

Some countries have comprehensive social protection programs for informal workers that are provided by the government or by worker organizations. The Bidi Welfare Fund is one of several funds set up in India intended to provide social protection for workers in the informal economy. The funds, set up by either the central government or state governments, target workers in particular industries. Bidis are small, hand-rolled cigarettes and are produced mainly by women working from home. The Bidi Welfare Fund is funded through a bidi export tax. Similar funds have been established in other countries, including Thailand. The funds provide medical care, education for children, housing, water supply, and recreational facilities.

The state of Kerala has the most comprehensive set of worker welfare schemes. The schemes are funded by contributions from workers, employers, and government. Benefits vary but commonly include pension and retirement benefits, disability allowances, funeral expenses, education benefits, medical care, marriage and maternity benefits, unemployment benefits, and housing loans.

Another possible funding model calls for taxing the factories that subcontract the home-based work or the wholesalers that market the products.

An example of nongovernment provision is the insurance provided through India’s Self-Employed Women’s Association (SEWA), a trade union of self-employed women with more than 200,000 members. Established in Gujarat state in 1972, SEWA lobbies for the rights of self-employed women. It has its own bank, cooperatives, and health initiatives, and in 1992 it set up a simple life insurance scheme that has since expanded into an integrated insurance scheme that offers health, life, asset, and loan insurance, as well as a maternity benefit, to more than 30,000 members.

The administrative cost of collecting premiums from a large number of poor women is high, which reduces their attractiveness to the market. SEWA got around this problem by acting as an intermediary between national financial institutions and SEWA’s large membership of self-employed women. Dealing with SEWA rather than directly with hundreds of thousands of individuals made it feasible for the institutions to offer their services to SEWA’s members.

SEWA also worked with the Indian government. In 1991, under a government program aimed at reducing the premiums to social organizations wishing to insure poor workers in the informal sector, SEWA reached an agreement with a state insurance company and the Indian government to provide life insurance to its members. Over the years SEWA gradually built up its own funds, with the help of a $350,000 grant from the German government’s GTZ (German Society for International Cooperation), and technical skills. This enabled SEWA to shift from an intermediary to a direct provider of loans and insurance for economic activities to its members.

The original insurance product was a simple life insurance benefit of Rs 3,000 paid to the husband of a SEWA member on her death or permanent disability. Since then, SEWA has added a health insurance component covering hospitalization costs and an asset insurance component. The principal features of the integrated insurance scheme since 2000 have been:

A choice of two ways to pay the annual premium: an annual payment of about Rs 60 or payment through the accumulation of interest on a Rs 500 fixed deposit with SEWA Bank; members can accumulate the deposit through fixed monthly instalments of Rs 20.

Death benefits, hospitalization insurance, asset insurance, and a fixed-sum maternity benefit for each pregnancy.

SEWA health workers collect claims in the villages and forward them to SEWA Bank. The health worker discusses the claims with the doctor, collects the disbursements from SEWA Bank, and delivers them to the women in the villages. Health workers also publicize the insurance program and sign up new members.

Microfinance

Because savings and credit can help people get through bad times, access to financial services is a form of social protection. Women are often excluded from financial services for a variety of reasons, including low levels of literacy, lack of necessary documents and collateral, and difficulty reaching bank branches. In Bangladesh the Income Generation for Vulnerable Group Development program has demonstrated that it is possible to provide access to microfinance services for very poor women. The program is run by the Bangladesh Rural Advancement Committee (BRAC), a large NGO, in collaboration with the government of Bangladesh and the United Nations World Food Programme [9]. Some two million women have accessed microfinance services through the program.

The program targets destitute women who have little or no income-earning opportunities. Areas are identified on the basis of food insecurity and vulnerability maps [9]. Community committees with female representatives assist in selecting beneficiaries. Each participant is expected to save at least 25 taka (30 cents) a month. Participants meet weekly with 25–30 members of BRAC’s microfinance program. The groups provide a forum for discussion and mentoring on legal and social issues and small-scale enterprise challenges, and training on income-generating activities that require low initial capital outlays, such as poultry rearing [9]. After six months of training, participants receive the first of two loans to start a small business. They are expected to supplement these loans with their accumulated savings. Participants also receive 30 kilograms of rice or wheat for an 18-month period. Loans are repaid over 45 installments, so that by the end of the cycle of free food grain transfers, most participants will have paid off their first loan and have received their second. By the end of the full program, participants should be in a position to access and use mainstream microfinance services [9].

The program was embedded in a strong framework of evaluation and learning. This evaluation and learning framework, which is considered a key to the program’s success, allowed project implementers to learn and adapt as the program proceeded. Impact assessments found modest increases in income, a decline in begging, some savings, increased asset ownership, and improvements in social status. Two-thirds of program graduates had joined microfinance programs [9].

Conditional cash transfers

Conditional cash transfers are a fairly new form of social protection and have been growing in popularity in developing countries. The schemes provide cash payments to participants, mainly women, who meet a number of explicit criteria. The conditions typically concern children’s school enrollment and attendance at preventive and reproductive health clinics. Payments in these programs are generally made to mothers because of evidence that women tend to invest more in children than men do. This form of social protection differs from most of the others discussed here in that it does not provide protection from income shocks but instead provides payments to women in recognition of their role as mothers and caregivers.

Limitations and gaps

Although there have been many high-quality impact evaluation studies of social protection programs, including conditional cash transfer programs, few studies have compared programs designed specifically for women with programs without gender-sensitive designs, and few have evaluated holistic approaches to social protection for women, such as SEWA’s integrated insurance scheme. Thus the empirical evidence presented here relies mainly on case studies and qualitative, descriptive evaluations rather than experimental design studies that can assess causal impacts.

Summary and policy advice

Social protection schemes often fail to adequately protect women. Examining how women’s needs for social protection differ from those of men and what schemes have successfully reached women is important for understanding how to design social protection for women. Women are more likely than men to work in the informal sector and to drop out of the labor force for a time, such as after childbirth or because of social norms, so their needs can often be greater than those of men. This combination of factors undermines productivity, increases women’s vulnerability to income shocks, and makes it harder for them to save for old age.

To reach women and mitigate these risks, social protection programs need to reflect the features of women’s daily lives. Women need to be offered flexible work times, services within easy reach of home, and assistance with child and elder care. Low levels of literacy need to be accommodated, and documentation requirements eased. NGOs are often well placed to harness local knowledge and so are able to draw the most vulnerable women and design projects to reflect local needs. To learn more about how to reach women and the kinds of programs that are effective for them, studies need to compare the reach and impact of programs designed specifically for women with other programs and to evaluate how well integrated insurance schemes provide social protection to women.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Lisa A. Cameron

Social protection schemes

- Unemployment insurance;

- Maternity leave and employment protection during pregnancy and post-delivery;

- Childcare and other social support services;

- Health coverage and insurance;

- Life and disability insurance;

- Pension schemes; and

- Interventions to enhance access to financial services.

International Labour Organization. Social Protection: A Life Cycle Continuum Investment for Social Justice, Poverty Reduction, and Sustainable Development. Geneva: ILO, 2003