Elevator pitch

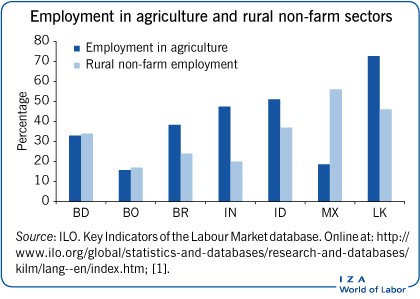

The rural non-farm sector plays an important role in diversifying income for rural households in developing countries and has the potential to emerge as a major source of employment. In some cases it has outgrown the agricultural sector, in part due to the expansion of credit through microfinance institutions that are supported by governments, donor agencies, and businesses. However, future expansion of the rural non-farm sector requires increased flexibility in credit contracts, as well as decreasing the cost of credit and the delivery of complementary inputs, e.g. skills training.

Key findings

Pros

Rural non-farm enterprises can help absorb growing labor forces in many developing countries.

Rural non-farm enterprises can be very profitable; injections of new capital often result in high returns.

Evidence suggests a strong association between rising rural non-farm employment and a decline in poverty.

Expansion of microfinance alternatives that do not require collateral for loans and target poorer households may help the poor to engage in rural non-farm employment.

Cons

In the absence of credit and other complementary services, rural non-farm employment is often of low productivity.

Owners of rural non-farm enterprises, especially female owners, frequently use unpaid family labor, which may lead to overstated profits.

The non-farm sector is heterogeneous in terms of productivity and quality of employment; its expansion may increase inequality.

Microfinance can be inflexible, requiring frequent (e.g. weekly) and almost immediate loan repayment.

Microfinance institutions typically charge high interest rates and may not offer credit to men.