Elevator pitch

Poor people in developing countries can benefit from saving to take advantage of profitable investment opportunities, to smooth consumption when income is uneven and unpredictable, and to insure against emergencies. Despite the benefits of saving, only 41% of adults in developing countries have formal bank accounts, and many who do rarely use their accounts. Improving the design and marketing of financial products has the potential to increase savings among this population.

Key findings

Pros

Demand for savings seems to be high.

Access to low-cost savings accounts increases savings and improves measures of individual well-being.

Marketing campaigns and account features that try to overcome psychological obstacles to saving show promise in increasing take-up and use of savings accounts.

Technological innovations, including mobile banking and direct deposit options, have the potential to expand access to and use of savings accounts.

Cons

Simply increasing the interest rates on savings accounts does not seem to raise savings.

Most financial-literacy interventions have had little or no effect on savings but may be an important complement to other interventions.

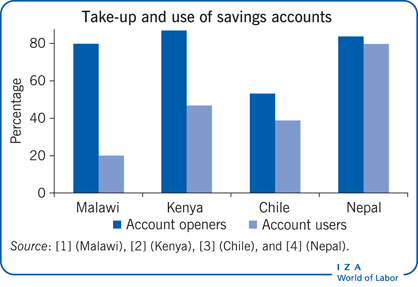

Interventions that encourage people to open savings accounts do not guarantee that they will make deposits into those accounts.

Poor service and lack of trust in banks can reduce the effect of savings accounts.

Many poor people hold expensive debt, and reducing that debt might be a higher priority than accumulating savings.