Elevator pitch

The potential benefits of higher minimum wages come from the higher wages for affected workers, some of whom are in poor or low-income families. The potential downside is that a higher minimum wage may discourage employers from using the low-wage, low-skill workers that minimum wages are intended to help. If minimum wages reduce employment of low-skill workers, then minimum wages are not a “free lunch” with which to help poor and low-income families, but instead pose a tradeoff of benefits for some versus costs for others. Research findings are not unanimous, but evidence from many countries suggests that minimum wages reduce the jobs available to low-skill workers.

Key findings

Pros

Many low-wage, low-skill workers retain their jobs and earn higher wages when minimum wages are increased.

Some studies do not find that minimum wages lead to fewer jobs.

Living wage policies, adopted by some municipalities in the US, may help reduce poverty.

Targeted tax credits do a better job of reaching the poor than minimum wages do.

Cons

Compelling evidence from many countries indicates that higher minimum wage levels lead to fewer jobs.

Studies that focus on the least-skilled workers find the strongest evidence that minimum wages reduce jobs.

Low-paying jobs requiring low skills are the jobs most likely to decline with increased minimum wages.

In the US, higher minimum wages do not help poor or low-income families.

Author's main message

Although a minimum wage policy is intended to ensure a minimal standard of living, unintended consequences undermine its effectiveness. Widespread evidence indicates that minimum wage increases are offset by job destruction. Furthermore, the evidence on distributional effects, though limited, does not point to favorable outcomes, although some groups may benefit.

Motivation

The main case for a minimum wage is that it helps poor and low-income families earn enough income. However, the potential downside is that it may discourage employers from using low-wage, low-skill workers. If minimum wages destroy jobs for low-skill workers, that creates winners and losers. Whether a minimum wage reduces poverty or helps low-income families then depends on where along the distribution of family incomes these winners and losers are located. Clearly, the effect on jobs is critical: If a higher minimum wage does not destroy jobs, then from the government’s perspective it is a free lunch that helps reduce poverty, even if higher-income families also benefit. Labor economists have long studied whether minimum wages destroy jobs. This paper looks at the accumulated evidence, and also at the reliability of the underlying research methods for estimating the effects of the minimum wage on jobs.

Discussion of pros and cons

Theory

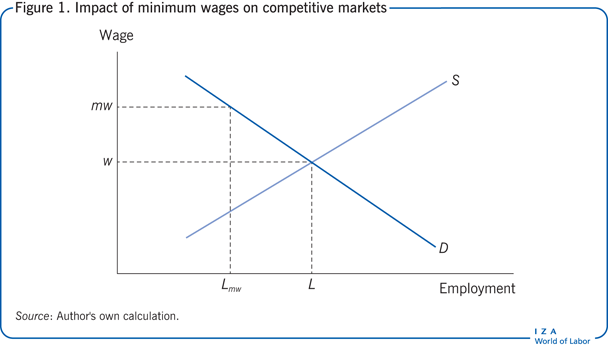

Textbook analyses of minimum wages portray a competitive labor market for a single type of labor, with an upward-sloping labor supply curve (S) and a downward-sloping labor demand curve (D). With no minimum wage, there is an equilibrium wage, w, and an equilibrium quantity of labor employed, L (see Figure 1).

With a “binding” minimum wage mw that is higher than w, fewer workers are employed, for two reasons. First, employers substitute away from the now more expensive labor and toward other inputs (such as capital). Second, because costs are higher with this new input mix, product prices rise, which further reduces labor demand. These two effects lead to lower employment—Lmw in Figure 1.

Of course this model oversimplifies. One issue is that workers have varying skill levels, and minimum wages are unlikely to matter for higher-skill workers. Employers will substitute away from less-skilled workers toward more-skilled workers after a minimum wage increase. This “labor−labor” substitution has implications for empirical evidence on the employment effects of minimum wages. The employment declines might not appear to be large, even if the disemployment effect among the least-skilled workers is strong. This is relevant from a policy perspective. The minimum wage is intended to help the least-skilled workers. If their employment declines substantially, the policy is self-defeating.

A more fundamental challenge to the competitive model is that it is simply the wrong model. Some argue that there can be “monopsony” in labor markets, because of frictions that tie workers to specific firms. These frictions imply that when an employer hires another worker, the cost of existing workers also increases. As a consequence, market-determined employment can fall below the economically efficient competitive level. Moreover, in this model, a minimum wage can sometimes lead to higher employment.

Evidence

Economists describe the effect of minimum wages using the employment elasticity, which is the ratio of the percentage change in employment to the percentage change in the legislated minimum wage. For example, a 10% increase in the minimum wage reduces employment of the affected group by 1% when the elasticity is −0.1 and by 3% when it is −0.3.

Through the 1970s, many early studies of the employment effects of minimum wages focused on the US. These studies estimated the effects of changes in the national minimum wage on the aggregate employment of young people, typically 16−19-year-olds or 16−24-year-olds, many of whom have low skills. The consensus of these first-generation studies was that the elasticities for teen employment clustered between −0.1 and −0.3 [1].

Limited evidence from the 1990s challenged this early consensus, suggesting that employment elasticities for teenagers and young adults were closer to zero. But even newer research, using more up-to-date methods for analyzing aggregate data, found stronger evidence of disemployment effects that was consistent with the earlier consensus. Using data through 1999, the best of these studies found teen employment elasticities of −0.12 in the short run and −0.27 in the longer run, thus apparently confirming the earlier consensus: Minimum wages destroy the jobs of young (and hence unskilled) people, and the elasticity ranges between −0.1 and −0.3.

In the early 1990s, a second, more convincing wave of research began to exploit emerging variation in minimum wages across states within the US. Such variation provides more reliable evidence because states that increased their minimum wages can be compared with states that did not, which can help account for changes in youth employment occurring for reasons other than an increase in the minimum wage. A related literature focuses on specific cases of state minimum wages increases. This case study approach offers the advantage of limiting the analysis to a state where the minimum wage increases and another very similar state that is a reasonable comparator. Unfortunately, these results do not necessarily apply in other states and other times.

An extensive review of this newer wave of evidence looked at more than 100 studies of the employment effects of minimum wages, assessing the quality of each study and focusing on those that are most reliable [2], [3]. Studies focusing on the least skilled were highlighted, as the predicted job destruction effects of minimum wages were expected to be more evident in those studies. Reflecting the greater variety of methods and sources of variation in minimum wage effects used since 1982, this review documents a wider range of estimates of the employment effects of the minimum wage than does the review of the first wave of studies [1].

Nearly two-thirds of the studies reviewed estimated that the minimum wage had negative (although not always statistically significant) effects on employment. Only eight found positive employment effects. Of the 33 studies judged the most credible, 28, or 85%, pointed to negative employment effects. These included research on Canada, Colombia, Costa Rica, Mexico, Portugal, the UK, and the US. In particular, the studies focusing on the least-skilled workers find stronger evidence of disemployment effects, with effects near or larger than the consensus range in the US data. In contrast, few—if any—studies provide convincing evidence of positive employment effects of minimum wages.

One potential exception is an investigation of New Jersey’s 1992 minimum wage increase that surveyed fast-food restaurants in February 1992, roughly two months before an April 1992 increase, and then again in November, about seven months after the increase [4]. As a control group, restaurants were surveyed in eastern Pennsylvania, where the minimum wage did not change. This allowed comparing employment changes between stores in New Jersey and Pennsylvania. The results consistently implied that New Jersey’s minimum wage increase raised employment (as measured by full-time equivalents, or FTEs) in that state. The study constructed a wage gap measure equal to the difference between the initial starting wage and the new minimum wage for fast-food restaurants in New Jersey and equal to zero for those in Pennsylvania. The increase had a positive and statistically significant effect on employment growth in New Jersey (as measured by FTEs), with an estimated elasticity of 0.73. Note that the study did not, as is often claimed, find “no effect” of a higher minimum, but rather a very large positive effect.

A reassessment of this evidence looked at the unusually high degree of volatility in the employment changes found in the data [5]. The new study collected administrative payroll records from fast-food establishments in the same areas from which the initial study had drawn its sample. In the initial survey, managers or assistant managers were simply asked, “How many full-time and part-time workers are employed in your restaurant, excluding managers and assistant managers?” [4]. This question is highly ambiguous, as it possibly refers to the current shift, the day, or the payroll period. In contrast, the administrative payroll data clearly referred to the payroll period. Reflecting this problem, the initial survey data indicated far greater variability than the payroll records did, with some implausible changes.

When the minimum wage effect was re-estimated with the payroll data, the minimum wage increase in New Jersey led to a decline in employment in New Jersey relative to employment in Pennsylvania [5]. The estimated elasticities ranged from −0.1 to −0.25, with many of the estimates statistically significant. In response to these results, the authors of the original study used data from the US Bureau of Labor Statistics on fast-food restaurant employment, this time finding small and statistically insignificant effects of the increase in New Jersey’s minimum wage on employment.

By far the largest number of studies use US data because state-level variation provides the best “laboratory” for estimating minimum wage effects. Many studies focus on the UK, which enacted a national minimum wage in 1999. A national minimum wage poses greater challenges to social scientists, because it is difficult to define what would have happened in the absence of a minimum wage increase. This challenge is reflected in the UK studies. Absent variation in minimum wages across regions in the UK, one recent study examines groups differentially affected by the national minimum wage, finding employment declines for part-time female workers, the most strongly affected. A second study looks at changes in labor market outcomes at ages when the UK minimum wage changes—at 18 and 22—and finds a negative effect at age 18 and at age 21 (a year before the minimum wage increases, which the authors suggest could reflect employers anticipating the higher minimum wage at age 22). However, there are numerous UK studies that do not find disemployment effects.

The current summary differs from many other brief synopses of minimum wage studies, which often point out that some studies find negative effects and others do not. The studies reporting positive or no effects are often given too much weight. Studies suggesting that “we just don’t know” often summarize the literature by citing one or two studies finding positive effects, such as [4], along with a couple of studies reporting negative effects, suggesting that one should not confidently hold the view that minimum wages reduce employment. However, the piles of evidence do not stack up evenly: The pile of studies finding disemployment effects is much taller.

The large review of minimum wage studies also highlights some important considerations when assessing the evidence on minimum wages [2]. First, case-study analyses may cover too little time to capture the longer-run effects of minimum wage changes. Second, case studies focusing on a narrow industry are hard to interpret, since the standard competitive model does not predict that employment will fall in every narrow industry or subindustry when an economy-wide minimum wage goes up.

This view of the overall lessons to be drawn from the large body of research on minimum wages has been contested in a review from 2013 [6], drawing in part on previous meta-analysis. The review uses the estimates displayed in Figure 1 in that meta-analysis to suggest that the best estimates are clustered near zero. However, the figure includes a pronounced vertical line at a zero minimum wage-employment elasticity, creating the illusion that the estimates are centered on zero. This illusion is perhaps further enhanced by including studies with elasticities ranging from nearly −20 (that is, 100 times larger than a −0.2 elasticity) to 5, making it hard to discern whether the graph’s central tendency is closer to 0, −0.1, or −0.2, which is the relevant debate. In fact, the previous meta-analysis reports that the mean across the studies summarized in the graph is −0.19.

Moreover, applying meta-analysis to minimum wage research is problematic. Meta-analysis treats all studies as equally valid, aggregating them to estimate an overall effect. This approach is intuitively appealing for combining estimates from similar experiments that differ mainly in the samples studied, because it turns many small samples into one large one. However, combining minimum wage studies without taking into account the variations in the reliability of their methods and in the groups of workers studied compromises the findings of such meta-analysis.

Two recent revisionist studies find no detectable employment losses from US minimum wage increases [7], [8]. These studies argue that higher minimum wages were adopted in states where the employment of teenagers and other low-skill workers was declining because of deteriorating economic conditions generally, so the negative relationship does not necessarily imply a negative causal effect.

More convincingly, another study suggests that when economic conditions are considered, minimum wage policies have an even stronger effect in reducing employment [9]. That study looks at variations in state minimum wages that arise not from the decisions of state legislators, who could be responding to immediate economic conditions, but from national decisions, which are less likely to respond to state-level economic conditions. The study finds evidence that teenage employment is negatively affected by minimum wage increases, with elasticities as large as −1, although smaller in some cases. This evidence suggests stronger disemployment effects of minimum wages than most other studies find.

Moreover, a review of the two studies finding no detectable employment losses finds that their conclusions are not supported by the data. The review suggests that the data show elasticities nearer to –0.15 for teenagers and some signs of negative employment effects for restaurant workers, although other factors make this hard to estimate [10]. The review concludes that elasticities of employment for groups strongly affected by minimum wage policies are in the range found by many earlier researchers, from –0.1 to –0.2.

Estimates in this range suggest that for groups of workers strongly affected by the minimum wage, disemployment effects are relatively modest. That has led some people to conclude that there are, at most, “small” disemployment effects. However, these elasticities understate the effects on the most affected workers, because even among these groups many workers earn more than the minimum wage. Suppose, for example, that half of teenagers earn the minimum wage and that a rise in the minimum wage sweeps them from the old minimum to the new one. And suppose that the other half of teenagers earn above the new minimum wage and are not affected by the increase. Then, a 10% increase in the minimum wage with a −0.15 elasticity for teens implies that teen employment will decline 1.5%. However, this decline occurs solely among the teenagers earning below the new minimum wage. Since in this example they make up just half of teenagers, their employment must fall 3% to generate a 1.5% decline among all teenagers.

Distributional effects—In brief

The main argument proffered in favor of a minimum wage is that it helps poor and low-income families. But because there are some disemployment effects, minimum wages create winners and losers. The winners get a higher wage with no reduction in employment (or hours), while the losers bear the burden of the disemployment effects—losing their job, having their hours reduced, or finding it more difficult to get a job. If the gains to the winners are large, if these winners are disproportionately from the low-income families that policymakers would like to help, and if the losses are concentrated among higher-income workers or other groups from whom policymakers are willing to redistribute income, then the losses experienced by the losers from a minimum wage increase may be deemed acceptable. However, research for the US fails to find evidence that minimum wages help the poor; they may actually increase the number of poor and low-income families.

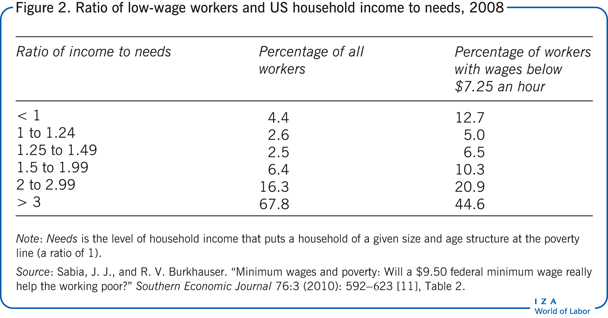

The fundamental problem with using minimum wages to increase the incomes of poor and low-income families is that the policy targets low-wage workers, not low-income families, which are not necessarily the same. Consider the US federal minimum wage of $7.25 an hour in 2008. Although 13.2% of people lived in poor households in 2008, only 4.4% of all workers lived in poor households (see Figure 2). Moreover, many minimum wage workers lived in non-poor and even relatively high-income households. Only 12.7% of workers earning a wage of less than $7.25 an hour were in poor households, while 44.6%—or nearly half, most of whom were probably teenagers or other secondary workers—were in households with incomes three times the poverty line (or approximately $63,000 in 2008 for a family of four) or higher. Thus, if the benefits of the minimum wage were spread equally across all affected low-wage workers, only 12.7% of the benefits would go to poor households, and nearly half would go to households in the top half of the household income distribution.

Another reason minimum wages may fail to help low-income families is that many low-income families have no workers. Of families whose head was below age 65 in 2010, 52% of families below the poverty line had no labor income, while only 6% of families above the poverty line had none.

If the winners from a minimum wage increase are low-wage workers in poor families, and the losers are low-wage workers in high-income families, minimum wages would redistribute income to poor families. But the opposite is also plausible. A comprehensive study covering state and federal minimum wage increases between 1986 and 1995 (welfare reforms in 1996 could confound analyses using data after 1995) finds that minimum wage increases do not reduce the number of poor families and may even increase it slightly [12]. The results are similar for families below 1.5 times the poverty line, sometimes referred to as a marker of near-poverty. Other studies reach similar conclusions. In short, there is no compelling evidence of beneficial distributional effects of minimum wages in the US.

The distributional effects of minimum wages could well vary with other factors, however, such as institutions and policies or features of the wage and income distribution that influence the targeting of minimum wages. Research shows that living wages—wage floors adopted by some US cities that target city contractors or businesses that receive financial assistance from cities—also generate job losses but do a better job of targeting benefits to poor families. The broader, financial-assistance versions of these laws generate modest reductions in urban poverty. Most of the research is based on experiences in the US, although there is evidence that minimum wages in Brazil did not generate beneficial distributional effects. US results may not apply elsewhere.

The inability to help poor and low-income families through a higher minimum wage is understandably frustrating for policymakers. In the US, however, a far more effective policy tool is the Earned Income Tax Credit (EITC) enacted in the 1970s. Some European countries have implemented similar policies. These programs pay subsidies to low-income workers, based on family income; the subsidies are phased out as income rises.

While the incentive effects of these subsidies are often complicated, the subsidies, handled correctly, unambiguously create an incentive to enter the labor market for eligible individuals who were not working. Moreover, the subsidies depend on family income, thus creating incentives precisely for the families most in need of help. Poverty rates are very high for female-headed families with children, for example, and there is overwhelming evidence of the EITC’s positive employment effects for single mothers. Moreover, the EITC helps families escape poverty not simply through the EITC subsidy, but also through the added labor market earnings generated because of the labor supply incentive effects of the EITC [13].

Combining the EITC with a higher minimum wage can lead to better distributional effects than the minimum wage alone, although it increases the adverse effects of the minimum wage on other groups [13]. That is because a higher minimum wage coupled with an EITC can induce more people who are eligible for the EITC to enter the labor market, while exposing people who are not eligible for the EITC to greater competition in the labor market, which can amplify the disemployment effects for them. An exploration of the interactions between higher state minimum wages in the US and the more generous state EITC programs finds that a combination of the two policies leads to more adverse employment effects on specific groups—like teenagers and less-skilled minority men—that are not eligible for the EITC (or are eligible for a trivial credit), while finding positive employment and distributional effects for single women with children who are eligible. This research does not change the conclusion that minimum wages destroy jobs; rather, it shows that the effects can vary across subpopulations—in this case because of interactions with another policy.

Limitations and gaps

There are two key gaps in our understanding of the effects of a minimum wage. One concerns the interactions between minimum wages and other labor market institutions and policies and the ultimate disemployment effects. This question has been explored for countries within the Organisation for Economic Co-operation and Development (OECD), but the analysis needs to be extended to developing countries as well, where the policy variation is greater.

The other concerns how minimum wages affect different groups and regions. For example, it would be helpful to be able to isolate the employment effects of minimum wages on poor, low-income, and other families to find out whether the negative effects are concentrated on low-wage workers in low-income families. If so, this would add to the weight of the evidence against higher minimum wages. If not, the fairly modest disemployment effects would need to be reconciled with no apparent beneficial distributional effects.

Summary and policy advice

While low wages contribute to the dire economic straits of many poor and low-income families, the argument that a higher minimum wage is an effective way to improve their economic circumstances is not supported by the evidence.

First, a higher minimum wage discourages employers from using the very low-wage, low-skill workers that minimum wages are intended to help. A large body of evidence confirms that minimum wages reduce employment among low-wage, low-skill workers.

Second, minimum wages do a bad job of targeting poor and low-income families. Minimum wage laws mandate high wages for low-wage workers rather than higher earnings for low-income families. Low-income families need help to overcome poverty. Research for the US generally fails to find evidence that minimum wages help the poor, although some subgroups may be helped when minimum wages are combined with a subsidy program, like a targeted tax credit.

The minimum wage is ineffective at achieving the goal of helping poor and low-income families. More effective are policies that increase the incentives for members of poor and low-income families to work.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© David Neumark