Elevator pitch

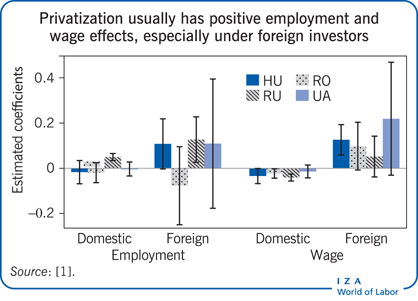

Conventional wisdom and prevailing economic theory hold that the new owners of a privatized firm will cut jobs and wages. But this ignores the possibility that new owners will expand the firm’s scale, with potentially positive effects on employment, wages, and productivity. Evidence generally shows these forces to be offsetting, usually resulting in small employment and earnings effects and sometimes in large, positive effects on productivity and scale. Foreign ownership usually has positive effects, and the effects of domestic privatization tend to be larger in countries with a more competitive business environment.

Key findings

Pros

Budget constraints are not infinitely soft, so state-owned firms have some incentives to economize.

New private owners have access to technologies, skills, and markets that imply expansion of output and employment.

Productivity increases may lead to wage increases.

Positive effects are more likely the larger the scale and productivity effects, which may be greater under experienced, skilled investors in better business climates.

The business environment and intensity of competition matter regardless of ownership.

Cons

Soft budget constraints and lack of competition under state ownership may lead to rents for incumbent employees.

State ownership and central planning are generally thought to be associated with excess employment.

New private owners are likely to pursue different goals than state owners: profit maximization rather than political objectives.

Negative consequences for employment and earnings are larger where state-owned firms are most protected, regulated, and subject to planning.