Elevator pitch

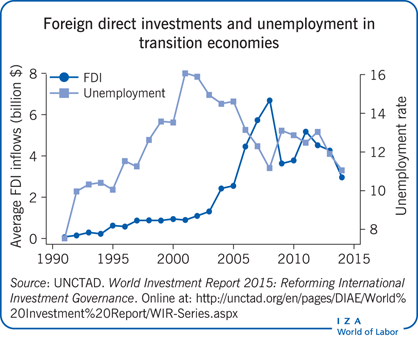

Foreign direct investment (FDI) has been argued to improve company performance and stimulate growth and employment. Transition economies of Central and Eastern Europe (CEE) faced a desperate need to join the global economy, to improve their competitiveness and to create jobs through FDI. So, did the FDI come, and did it deliver what was expected? FDI levels were high for CEE, and for some resource-rich transition countries (e.g. Russia and some of Central Asia), but primarily delivered significant benefits (e.g. employment) for the former. FDI arrived much later to other transition countries (e.g. the former Soviet republics and the Balkans) and had much less impact.

Key findings

Pros

FDI was a significant investment source in transition economies, though with marked variation across regions and time periods.

FDI arrived earlier in countries that joined the EU.

Transition economies experienced positive effects on growth and the labor market due to FDI inflows.

FDI inflows were associated with higher levels of GDP and lower unemployment for some periods.

EU member states exhibit distinct effects of FDI on firm restructuring, productivity, and employment.

Cons

FDI arrived later in Russia, the Central Asian region, the former Soviet Union, and the Balkans than in EU member countries.

FDI was driven largely by resource-seeking in Russia and some of the Central Asian republics, where the effects on employment were less pronounced.

Positive spillover effects from FDI were much less apparent in Russia, the former Soviet Union, and the Balkans, likely due to institutional challenges and insufficient human capital.