Elevator pitch

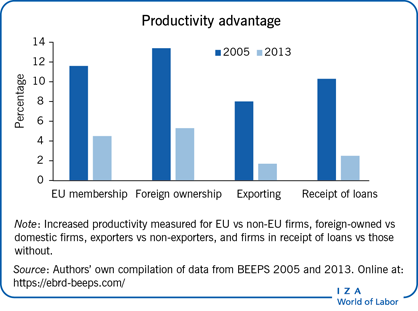

Firms in the new EU member states of Eastern Europe are more productive than those in other transition economies, but with a diminishing advantage. The least productive firms benefit the most from membership, although the situation is reversed in the case of foreign-owned firms. Foreign direct investment fails to promote knowledge and technology spillovers beyond the receiving firms. The dominance of multinational enterprises in the new EU member states enhances the threat of corporate state capture and asymmetric infrastructure development, whilst access to finance remains a constricting issue for all firms.

Key findings

Pros

EU membership promotes labor productivity as a result of improving institutions and in response to increased competition from foreign imports.

Acceptance into the EU is conditional on the implementation of institutional reform, which is one of the key drivers of productivity.

Increased foreign direct investment after EU accession led to productivity improvements resulting from improved management techniques and technology.

Access to finance, which is a key productivity driver, improved for firms in receipt of loans in new EU member states.

Cons

Competition from foreign imports disadvantages domestic firms in new member states, but the survivors successfully improve productivity.

Institutional change increases the risk of state capture by corporate or political factions, potentially disadvantaging domestic firms.

The increased presence of foreign firms in new member states does not always lead to knowledge and productivity spillovers.

Foreign inputs into manufactures reduces the value added in domestic production and therefore national GDP, reducing the opportunity for profit.

Sophisticated credit scoring by foreign banks can reduce access to finance.