Elevator pitch

Firms in the new EU member states of Eastern Europe are more productive than those in other transition economies, but with a diminishing advantage. The least productive firms benefit the most from membership, although the situation is reversed in the case of foreign-owned firms. Foreign direct investment fails to promote knowledge and technology spillovers beyond the receiving firms. The dominance of multinational enterprises in the new EU member states enhances the threat of corporate state capture and asymmetric infrastructure development, whilst access to finance remains a constricting issue for all firms.

Key findings

Pros

EU membership promotes labor productivity as a result of improving institutions and in response to increased competition from foreign imports.

Acceptance into the EU is conditional on the implementation of institutional reform, which is one of the key drivers of productivity.

Increased foreign direct investment after EU accession led to productivity improvements resulting from improved management techniques and technology.

Access to finance, which is a key productivity driver, improved for firms in receipt of loans in new EU member states.

Cons

Competition from foreign imports disadvantages domestic firms in new member states, but the survivors successfully improve productivity.

Institutional change increases the risk of state capture by corporate or political factions, potentially disadvantaging domestic firms.

The increased presence of foreign firms in new member states does not always lead to knowledge and productivity spillovers.

Foreign inputs into manufactures reduces the value added in domestic production and therefore national GDP, reducing the opportunity for profit.

Sophisticated credit scoring by foreign banks can reduce access to finance.

Author's main message

Accession to the EU has led to improved institutional development, the promotion of firm-level productivity, encouragement of foreign direct investment, and increased exports. However, the significance of increasing foreign funds and dominance of foreign ownership have resulted in states adjusting subsidization, tax regimes, and infrastructure spending to benefit these entities at the expense of domestic firms. This race to the bottom could be avoided by a more balanced infrastructure expenditure and the promotion of local industry, combined with a more equitable approach by the EU toward new member firms.

Motivation

The attraction of the EU to those countries situated on its eastern periphery lies in its stability, prosperity, and democratic freedom. Add to that the benefits of free trade and flow of funds, in the context of a single market and customs union, and the motivation for membership is overwhelming. However, does the promise of membership live up to expectation, and how should success or failure be measured?

In examining the effectiveness of the EU's approach to the accession process, an evaluation of firm performance, post-accession, provides a useful platform. “Productivity isn't everything, but in the long run it is almost everything. A country's ability to improve its standard of living over time depends almost entirely on its ability to raise its output per worker” [1], p. 11. The combined effects of accession should increase productivity and improve national welfare. Essentially, the privatization process, foreign imports, and the establishment of a free market would be expected to increase competition amongst firms, although to become competitive and maintain competitiveness it is necessary to produce a quality product at the right price. Failure to do either will lead to market exit. The availability of foreign direct investment (FDI) introduces improved technology, management, and access to markets, encouraging domestic firms, particularly those supplying foreign-owned entities, to improve productivity. An enlarged free market and customs union provide the opportunity to export to previously inaccessible destinations where increased competition demands productivity improvement. The expansion of foreign banks into the new member states (NMS) should increase credit availability, providing further impetus for increased efficiencies. Moreover, there is evidence that the successful establishment of a free market and vibrant business environment forces the development of supporting institutions to uphold the new economic paradigm.

Discussion of pros and cons

Institutions

Following the collapse of the Soviet Union in 1991, and the associated assumption that capitalism had triumphed over socialism, the 28 former Soviet states as well as the satellite states of Central and Eastern Europe began their transition from a command to a market economy. The premise was that they would accept the “one-size-fits-all” prescription enshrined in Western neoliberal ideology, regardless of any cultural, societal, or institutional factors that may demand an alternative approach [2]. Countries were encouraged to adopt the basic tenets of the program, namely, privatization of state-owned enterprises, relaxation of price controls, market liberalization, and a freeing up of capital controls. This transition was undertaken in an environment in which government institutions were geared to a command economy and led by a dictatorial state, with societies accustomed to price controls and full employment in state monopolies. The results were mixed: some states became democracies, others remained dictatorships, and the Balkans descended into bloody conflict.

In 2005, the Central European countries demonstrated that, in relation to economic governance and institutional development, they were ahead of both the South-Eastern European nations and the Commonwealth of Independent States (CIS), which were primarily the countries which formed the old Soviet Union. However, shortly after the first wave of NMS accession in 2004, economic reform began to stagnate. The CIS failed to develop strong political institutions to support economic reform, which retarded progress. The failure of capital flows after the financial crises, namely FDI in Central Europe and bank credit in the Baltics and Balkans, led to a deterioration in current account positions and some serious debt overhangs. The dangers of capital misallocation and the implications of massive capital inflows into individual states were not appreciated, neither was the impact on foreign currency or the appropriateness of an exchange rate policy. The antecedent and ideology of the leadership was also significant to the success or failure of transition; a finding that resonates today in the state capture by political factions in Poland, Hungary, the Slovak Republic, the Czech Republic, Romania, Bulgaria, and Latvia, representing 54% of the NMS [3]. State capture in this sense is defined as the manipulation of state institutions by corporate, political, ethnic, or military factions to serve their own interests, and may have had its gestation in the process of accession and the perceived economic welfare advantages thereafter.

EU membership was dependent on conformity to the Acquis Communitaire, the body of common rights and obligations that is binding on all the EU member states, and acquiescence to a trading regime designed to benefit EU15 competitiveness and reduce the dangers of an enlarged market to the original bloc. The neoliberal regimes established throughout the NMS exerted pressure on social democrats attempting market-orientated reforms whilst sustaining redistributive programs to improve national welfare. Due to limited economic growth and ensuing fiscal constraints, the unsustainability of these programs provided fertile ground for nationalist parties to appeal to the electorate, and for state capture by illiberal elites motivated by the twin ambitions of power and wealth [3].

In relation to FDI, there is evidence of state capture occurring, where firms with a domestic shareholding are essentially “capture firms,” with multinationals relying on kickbacks (a form of bribing). Before the financial crisis, the significant flow of FDI into the NMS enhanced the possibility of state capture. Corrupt practices benefit firms in terms of productivity, profit, and growth, particularly in high-capture economies, causing negative externalities to smaller domestic firms. In the accession countries, state capture firms, namely those that pay bribes, represent 9.9% of firms surveyed in 1999 by the World Bank and European Bank for Reconstruction and Development (9.1% amongst other firms outside the EU) and 10% of firms of influence, namely those with alternative means of exploitation (11.4% amongst other firms outside the EU). This indicates that roughly one-fifth participate in corrupt practices with little improvement after two years of membership [4]. Amongst the EU pre-accession countries, those with low corporate state capture display a high level of political capture, indicating a trade-off between corporate and political power [3]. This is an important aspect of the potential for domestic firms to grow and become competitive through productivity improvements. If, through corporate state capture, foreign-owned firms gain competitive advantages due to infrastructure expenditure or favorable regulatory and political environments, this has the potential to crowd out domestic firms, thus reducing the opportunity for indigenous firm growth. Furthermore, if infrastructure development comes at the expense of spending on education and training, it also reduces the prospect of improvement in absorptive capacity, which is essential to take advantage of any productivity improvement opportunities.

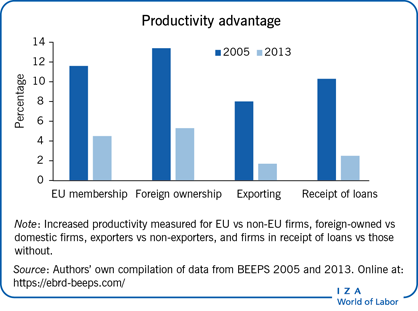

EU membership

As shown in the Illustration, in 2005, there was a significant deviation between the productivity of firms in EU member states and in non-member states. This was probably the result of the accession process, improved institutional development, financial intermediation, and the creation of a service base capable of supporting a market economy. By 2013, substantial convergence had occurred between firms in member and non-member states, as illustrated by a reduction in the productivity gap to 5%; when the key determinants of receipt of loans, foreign ownership, exporting, and innovation are added to EU membership the productivity gap marginally increases. Outside the EU, the advantages presented by FDI, the propensity to export, access to finance, innovation, and the availability of human capital were broadly maintained. The convergence process between 2005 and 2013 is almost certainly due to non-member states recognizing that in order to compete in a global market it was essential to adopt the same practices as those used within the EU, together with the effect of the Eurozone crisis on firms in the EU member states.

There is a potential causality issue in that the NMS had a higher GDP than other transition economies and therefore self-selected into the accession process. However, economic theory favors the argument that membership improves productivity. First, the significance of FDI flows into the NMS has led to a large foreign ownership presence, with those firms enjoying the comparative advantage of cheap labor and bringing with them management expertise and technology that enhances productivity. Second, the opening of domestic markets to foreign imports has forced domestic firms to improve productivity or exit the market. Third, firms (albeit mainly foreign ones) have the advantage of joining the largest single market and customs union in the world, which has brought access to international production networks (IPNs) and significant increases in exports. Therefore, it is not unreasonable to suggest that, since it is a stylized fact that competition and the propensity to export goes hand in hand with productivity, membership has resulted in improvement.

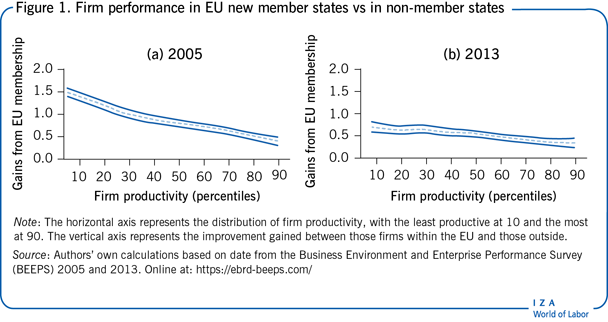

Figure 1 shows the productivity improvement obtained by firms in the NMS. It measures the productivity of firms and ranks them along a distribution curve; the most productive at 90% and the least at 10%. It then measures the effect of EU membership on these firms against a control group with the same characteristics but not in member states. The figure indicates that in both 2005 and 2013, the least productive firms gained the greatest productivity improvements. The intensity of competition in a previously protected economic environment forced firms lagging in productive performance either to improve or exit the market. It is equally salient to observe that the most productive firms also show the benefits of membership, which may depend on FDI, improved management, and technological transfer, at least to the receiving firm [5].

The results for 2013 have to be viewed in light of the global financial and Eurozone crises of 2008 and 2009, respectively. The onset of the crises saw the NMS in an economic environment capable of withstanding their effects. However, falling exports, reduction in FDI, and the repatriation of capital by foreign banks led to recession and increasing current account deficits.

The diversity of the institutional environments, along with a degree of state capture, created developmental models in which economic shocks threatened to destabilize economies and long-term development. The Czech and Slovak Republics and Hungary all experienced significant reductions in exports. Hungary and Latvia sought emergency support from the IMF and Poland suffered a 30% currency devaluation, all resulting in increased unemployment and reduced aggregate demand.

Privatization and competition

A key factor in the transitional process is the role of the privatization of state-owned companies. Economists assumed that this process would result in improvements in firm-level performance. The result has been more nuanced, however, with firms taken over by foreign investors exhibiting substantially greater productivity than those in domestic ownership [5]. Literature shows that a more competitive market results in improved productivity, and EU membership intensifies the competitive environment [6]. Within the NMS, there is evidence that “a well-designed and well implemented competition policy has a significant impact on TFP [total factor productivity] growth” [7], p. 1334. The influence of competition also resonates with international trade, suggesting that larger, more productive firms grow in size and become more efficient. Thus, the breakup of state monopolies was an important event in the creation of increased competitiveness.

The majority of transitional economies quickly liberalized their trading policies which, along with the breakup of monopolies and the creation of a competitive market, led to improvements in productivity and a reduction in the influence of soft budget constraints (the ability of state-owned firms to extract subsidies regardless of the economic imperative), thereby forcing firms to increase efficiency or exit the market. This process included the dismantling of large monopolies into separate entities and allowed the entry of completely new firms [8]. The economic impact of privatization is significant on firms outside the CIS, with Central and Eastern Europe showing the greatest benefit. The former Soviet Union was particularly adversely affected by the disintegration of its internal market; the introduction of imported competition into the NMS increased pressure on former-Soviet domestic firms [9].

Foreign direct investment

Motivation for FDI is divided into three categories: (i) horizontal, when investment is internalized; (ii) platform, when the objective is exporting; and (iii) vertical, when the purpose is to utilize a country's comparative advantage within an international value chain. In the accession economies of Central and Eastern Europe, emphasis was on vertical and platform types.

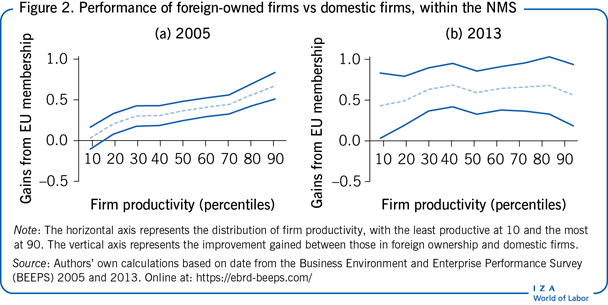

Literature indicates diversity between industries and firms within sectors, with some finding little spillover to domestic firms from the presence of foreign firms or capital. Productivity appears driven by the foreign firms with their superior technology and management, along with the exit of less productive domestic firms. However, in the productivity gains achieved at firm level, there seem to be significant differences within industries [10].

There are important caveats attached to the attraction of FDI, its influence on exports, and the availability of finance in the NMS. A significant proportion of FDI was devoted initially to the privatization process and the opportunities presented by the comparative advantage of cheap labor. Multinational enterprises expanded their supply chain by incorporating the NMS into IPNs, thus boosting exports. However, within the manufacturing sector, a significant percentage of exports are from foreign-owned multinational enterprises (MNEs) which use the NMS as part of their IPN, bringing an element of extra national inputs and leaving only labor to provide the value added. This implies that these inputs do not add significant value to the process and, if it is only cheap labor providing the productivity boost, it is likely to be lost in the price−cost ratio and the opportunity for an export multiplier. Essentially, the significant quantity of imported inputs reduces the value added to a level which diminishes the amount of profit available and reduces the impact of exported goods in the economy. The domination of imported material in the assembly process not only impacts the export multiplier, but also reduces the opportunity for forward and backward linkages with upstream and downstream firms, as a result of MNEs restricting activity to specific processes. Additionally, margins may be influenced by currency and internal transfer pricing protocols [11].

Figure 2 shows foreign-owned firms within the NMS, ranging from the least to the most productive, and compares them to domestic firms within the NMS with similar characteristics to measure the effect of FDI on productivity. It indicates that in 2005, unlike EU membership distribution, the most productive foreign-owned firms are gaining the most from membership. However, in 2013, the figure indicates that optimal efficiency has been reached and progress is no longer being made in relation to productivity.

Export

The characteristics of exporting firms suggest they are more productive, capital intensive, larger in size, and employ more people at higher wage levels than non-exporters. The question is whether there is a causal effect of exporting or whether firms self-select as exporters as a result of performance and asset-based characteristics. The focus on exporting in relation to productivity is important as it highlights the superior performance of exporters. Associated with firm growth and survival, this is particularly important in the context of institutional support for smaller, new exporting firms [12].

There is evidence that the most productive firms do self-select into exporting. However, only a small group of companies export while the majority concentrate on domestic markets. Evidence from Central and Eastern Europe demonstrates that labor force productivity, together with research and development, firm size, foreign ownership, and the stock of human capital, are all significant determinants of the propensity to export, with the emphasis on firm size indicating the importance of economies of scale. The exposure of exporters to international markets, technological advancement, and experienced professional management reinforces their productive superiority. This exposure further implies that some benefit accrues to the exporting firm and that there is a learning process. Evidence suggests that learning by doing (exporting) is most apparent in new firms and those furthest away from the production frontier. More established and experienced firms, with prolonged exposure to the potential spillover benefits, demonstrate a less observable effect.

A dichotomy exists between the results for manufacturing and services. Exporting has little influence on manufacturing, whereas the “least-most productive firms” show the greatest positive effects. The result may support the proposition that firms have self-selected as exporters and that the most productive are so close to the production frontier that no further movement is possible. However, in 2016, the NMS exported around 82% of goods within the EU, with evidence that there was no exporter premium for intra-European exporters, possibly resulting from the failure to achieve an export multiplier. The reformation of the service sector has been successful and the NMS are now amongst the largest exporters to the EU15 and are competitive compared to other international suppliers. Part of the comparative advantage that exporting NMS firms enjoy rests with the gravity theory (that distance to market determines the volume of exports), although the quality of the institutional environment is also an important dimension.

Loans

Access to finance is essential to fund investment, to ensure that businesses reach their full growth potential, and to facilitate new business start-ups. A study by the World Bank reveals that in emerging markets more than 50% of small- and medium-sized enterprises (SMEs—those with fewer than 100 employees) are credit constrained, 70% do not use external financing from formal financial institutions and, of the 30% receiving credit, 15% are underfinanced from formal sources. Information asymmetries suggest the existence of credit gaps and insufficient available credit for all but “bankable” propositions. Adverse selection and finance rationing can also occur when banks require collateral. Additionally, information asymmetry, in the form of adverse selection and moral hazard, is the source of market inefficiency in transitional countries, leading to low-risk borrowers such as SMEs being side-lined or even excluded from the stream of potential lenders.

In theory, finance contributes to economic growth in five key ways: the availability of savings, investment information, risk management, due diligence processes, and facilitating trade in economic commodities and services. These concepts provide ample motivation to suggest that finance has an important role to play in transition [13].

In 2005, the statistics were broadly similar across regions and sectors in transition economies, with over 90% of firms, regardless of size, claiming credit constraints; 43.7% of SMEs and 35.1% of large firms surveyed by the World Bank and European Bank for Reconstruction and Development stated that the obstacles were major or severe. Within the NMS, the figures were comparable, with 45.1% of SMEs and 31.6% of large firms stating that credit constraints were major or severe. A total of 81.4% of the sample were SMEs and 95% reported some obstacle to accessing finance. It is therefore evident that a financial intermediation problem exists in the transitional economies as a whole but also in the NMS. This may be due to credit constraints imposed by state-owned and foreign banks that employ enhanced credit-scoring criteria, which penalize SMEs, start-ups, and other firms lacking collateral. Given the importance of loans across all sectors, a strong financial sector is essential for economic growth and evidence of market failure is problematical.

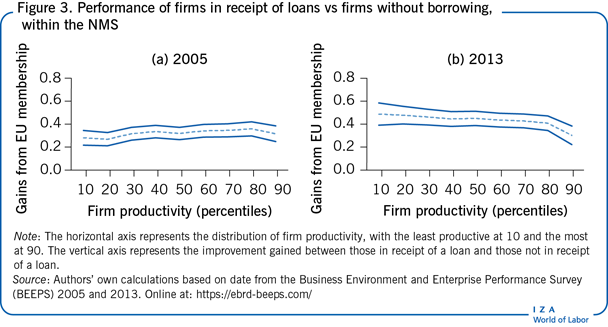

Of note is the small number of firms in receipt of loans. Within the NMS, 43.9% of the total sample are in receipt of loans; 40.1% of SMEs and 62.8% of large firms. The figures for non-EU member states are marginally lower, but not significantly so, suggesting this is a universal problem throughout the region. There is evidence on the importance of loans to firm-level performance, and the number of firms struggling to access finance is thus worrying. These non-borrowing firms are also more likely to be new firms, which display more resilience and learning capacity than their older more experienced competitors and often represent sectors whose development should be supported.

In relation to firms within the NMS in receipt of loans, the position in 2013 was unchanged for large firms and showed a 2% improvement for SMEs. Given these results, it is surprising that the percentage of firms claiming difficulty accessing finance has reduced. Those claiming constraints within the NMS dropped to 49.5%, and to 54.8% for non-NMS firms; those indicating that the problem was major or severe had fallen to less than 20%.

Figure 3 shows the effect of loan receipt on firms, from the most to the least productive, measured versus those without loans. It indicates that in 2005, firms in receipt of loans demonstrate improved productivity and the effect appears uniform throughout, suggesting a universal benefit, regardless of a firm's position in relation to its productive efficiency. There is some indication that the most productive gain the most, although this effect dissipates amongst the top 10%. By 2013, the influence of loans was most beneficial to the least productive, albeit with a marginal effect. However, the results also suggest that loans had a stronger effect on firm performance in 2013 than in 2005. This may indicate that improved financial intermediation created a more efficient lending process and made access to finance easier for those making an application. Equally, it may mean that capital as opposed to loans played a more important role in the case of the most productive firms.

There is evidence that the presence of foreign banks has created an environment where SMEs are discouraged from applying for loans because, given the credit scoring criteria and the demand for collateral, they expect rejection. However, the degree of rejection measured throughout Eastern Europe is less than 3%, and only half of this group actually admitted to having applied for a loan. A selection effect is clearly present: the expectation of rejection results in non-application. Those applying tend to be larger firms, exporters, and innovators, and since results show that they are amongst the most productive, it is not unreasonable to suggest that they apply in the expectation of being accepted.

Limitations and gaps

There are some key limitations to consider in relation to this research. First, the results are based on matching models; causality issues may thus arise from unobservables that are not identified. These issues may also result from the cross-sectional nature of the data. Second, due to the limited number of observations on service sector capital and skilled workers, it was not possible to measure the influence of capital, financial or human, on the full sample.

It is also possible that the selection of the NMS for accession was based on the strength of their GDP per capita, which is higher than the transitional economies of the CIS or the pre-accession states of the Western Balkans. Therefore, any productivity differentials were already extant. However, the evidence suggests that the least productive firms gain the most from EU membership. This would suggest that the opening up of markets to competition forces firms to either improve or exit and the improvers make significant productivity gains. There is scope for more detailed research involving domestic firms to gain more insight into their productivity performance.

Summary and policy advice

Firms within the NMS are more productive than those in non-EU member states. This indicates that the protocols introduced in the accession process have improved productivity and provided a platform for survival and further development within the enlarged free market. However, there is evidence that the firms that gain the most are amongst the least productive, implying that the introduction of a competitive environment has forced them to either improve their performance or exit the market. As the least productive exit, the perceived performance of the survivors shows improvement, implying that the actual measured improvement may be exaggerated. An exception is the performance of firms either owned by or with a substantive foreign investor, where the more productive the firm, the greater the performance enhancement.

FDI has undoubtedly brought benefits to the transition economies. However, the substantive nature of the flow of funds and the introduction of the NMS to IPNs has not yielded the anticipated economic benefit, with high foreign inputs reducing value added components, thereby diminishing the opportunity of an export multiplier. This in turn has diminished the potential role of local domestic suppliers, reducing the potential for managerial and technology spillovers. The attraction of FDI led states into a competitive environment to attract foreign investors, which in turn led to corporate state capture, gearing taxation and infrastructure to the demands of foreign investors. The resulting revenue loss, along with the asymmetric development of infrastructure and institutions, has had a detrimental effect on national welfare.

Firms in receipt of loans are more productive than those that are not. This may be a selection issue, as higher performing firms are more likely to receive loans. Although less than half of SMEs receive loans, about 50% do not apply, either because they are not required or in anticipation of refusal.

Overall, EU membership benefits firms; however, certain aspects of the way the Aquis Communitaire was implemented, particularly the lack of control of FDI flows, the underdevelopment of financial intermediation, and the exploitation of host country comparative advantage, negatively impact NMS’ national welfare and the productivity of domestic firms.

Acknowledgments

The authors thank two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Previous work of the authors has been used in the preparation of this article.

Competing interests

The IZA World of Labor project is committed to the IZA Code of Conduct. The author declares to have observed the principles outlined in the code.

© Jens Hölscher and Peter Howard-Jones