Elevator pitch

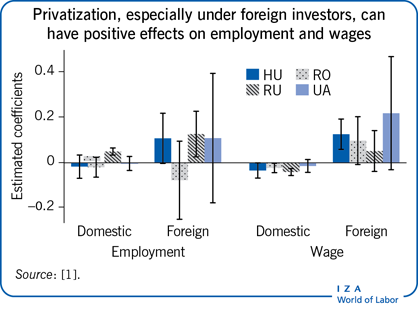

Conventional wisdom and prevailing economic theory hold that the new owners of a privatized firm will cut jobs and wages. But this ignores the possibility that new owners will expand the firm’s scale, with potentially positive effects on employment, wages, and productivity. Evidence generally shows these forces to be offsetting, usually resulting in small employment and earnings effects and sometimes in large, positive effects on productivity and scale. Foreign ownership usually has positive effects, and the effects of domestic privatization tend to be larger in countries with a more competitive business environment.

Key findings

Pros

State ownership and central planning are generally thought to be associated with excess employment.

Soft budget constraints and lack of competition under state ownership may lead to rents for incumbent employees.

Private owners are likely to aim for profit maximization rather than political objectives; they may have access to skills, markets, and technologies that increase output, employment, and productivity.

Productivity increases may lead to wage increases.

Positive effects are more likely the larger the scale and productivity effects, which may be greater under experienced, skilled investors in better business climates.

Cons

Budget constraints are not infinitely soft, so state-owned firms have some incentives to economize.

Negative consequences for employment and earnings are larger where state-owned firms are most protected, regulated, and subject to planning.

The business environment and intensity of competition matter regardless of ownership.

Limited evidence suggests that wage and employment losses are greatest for low-skilled workers.