Elevator pitch

Taxpayer effects are a central part of the total economic costs and benefits of immigration, but they have not received much study. These effects are the additional or lower taxes paid by native-born households due to the difference between tax revenues paid and benefits received by immigrant households. The effects vary considerably by immigrant attributes and level of government involvement, with costs usually diminishing greatly over the long term as immigrants integrate fully into society.

Key findings

Pros

Lower negative taxpayer effects are linked to higher-skilled migrants.

Taxpayer effects are more positive in the long term than at the outset.

Financing the education of immigrant children, rather than welfare, unemployment, or health care, is the major fiscal cost.

Cons

Immigrants are a small share of the population, so the positive taxpayer effects of their contributions to the benefits of the aging native population are too small to resolve long-term fiscal deficits.

The principal data sets in the US and in Europe do not contain essential information for the study of the fiscal impact of immigration.

The best current estimates of taxpayer effects are becoming seriously outdated.

Author's main message

The taxpayer effects of immigration need to consider the future paths of taxes and expenditures across generations. In the long run, the effects are positive in the US and in several European countries, and strongly positive for better-educated immigrants, but negative in other areas and for poorly educated and illegal immigrants and refugees. The same calculations are needed for countries losing people by outmigration. High-skilled young immigrants who work provide the highest taxpayer benefits; allowing immigrants and their progeny to reside permanently provides a net benefit to society.

Motivation

Labor economists have conducted considerable global research on the labor market effects of immigration—specifically, the effects on wages and employment. There has been much less research on the effects of immigration on taxpayers—a key area when evaluating the full economic effects of immigration.

The taxpayer effects of immigration are the additional or lower taxes paid by native-born households as a consequence of the difference between tax revenues paid and government benefits received by immigrant households over both the short and the long term. Without reliable estimates of taxpayer effects, any economic analysis of the costs and benefits of immigration is seriously incomplete. Taxpayer effects also need to be computed separately by “type” of immigrant to inform immigration policy decisions.

Discussion of pros and cons

The analysis needs to consider immigrant attributes and the role of the state

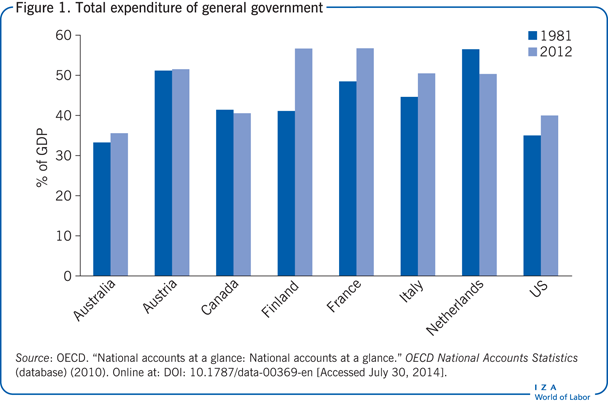

As government involvement in economic activity has increased, the impact of immigration on taxpayers has become much more important. In the US, for example, spending at all levels of government at the start of the 20th century was less than 7% of the gross domestic product (GDP). It has climbed steadily since—with spikes caused by wars and military action—with government spending accounting for around 40% of GDP. Although current government spending levels are higher in Western Europe, the trends are similar, especially in countries with a large welfare state. In the UK, for example, spending was 14% of GDP in 1900 and 45% in 2011. In Sweden—an EU country with a large welfare state—government spending was at 52% of GDP in 2011. Figure 1 shows the total expenditure of general government in several large economies, relative to GDP, in 1981 and 2012.

The standard computation of a taxpayer effect is based on a comprehensive comparison of all government expenditures and all taxes paid in a given year computed separately for the native-born and the foreign-born residents of a country. To simplify, any difference between the flow of expenditures and taxes for immigrants implies either a benefit to tax-paying native-born households (immigrant taxes paid exceed benefits received) or a cost (immigrant benefits received exceed taxes paid). Since many components of expenditures and taxes differ appreciably between immigrants and native-born residents, it is important to consider all forms of expenditures at all levels of government and all types of taxes, not simply taxes on income. For many taxes (say, property taxes), who pays the tax must be discussed and made transparent (do immigrants, who may be renters, pay any part of the property tax?). Since annual budgets have to balance at the state and local level, the analysis can be normalized to a balanced budget situation, so that it is not subject to the vagaries of a current budget surplus or deficit position in a particular year.

The most important factor in determining the magnitude of the immigrant taxpayer effect is, of course, the relative size of the immigrant population. No matter how different foreign-born residents are from native-born residents, they cannot collectively impose much of a net tax burden or bestow much of a benefit if they represent only a small fraction of the total population.

Attributes of immigrants that differ from those of native-born residents will also clearly drive taxpayer effects. Immigrants tend to be young and to be workers, so ordinarily they will help, at least temporarily, to finance age-related income support and health-care programs. Those attributes also help with tax revenues, but this is easily offset in places where immigrant incomes are lower than those of native-born residents. The relative youth of immigrants means that their school-age children’s education will also be financed mostly by the state—potentially another economic burden.

Because the mix of immigrant attributes and the role of the state differ in each immigrant-receiving country, whether immigrant taxpayer effects are harmful or beneficial to native-born households will also differ for each country. Even within countries, there will always be some types of immigrants (often the highly skilled) who are a fiscal plus, and others (often the low skilled) who are a fiscal drain.

There is an entirely symmetric computation that—to my knowledge—is rarely performed: the taxpayer effects of emigrants on their country of origin. Countries that lose emigrants are simultaneously losing taxpayers and recipients of government benefits. Depending on the attributes of emigrants compared with those of the native-born residents who remain, this exit could result in a taxpayer benefit or loss to the sending country. In countries with large numbers of relatively skilled emigrants, the taxpayer cost of emigration could be considerable.

A tale of two states: In the US the taxpayer effect varies by state—and becomes much smaller when federal taxes and benefits are included

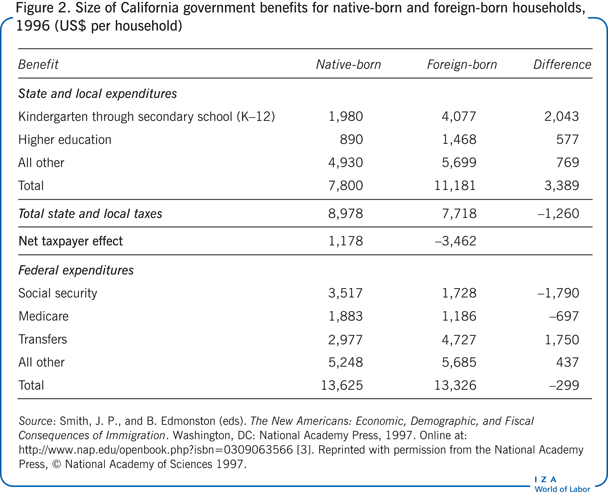

It is easiest to see how annual taxpayer effects of immigrants are estimated by using a specific, well-documented case. Consider this analysis of detailed selected expenditures for California by type of program in 1996 [3]. At all state and local levels of government, immigrant households received US$3,389 more in government benefits than did native-born households [1]. Since immigrants are, on average, younger than native-born residents, it is not surprising to find that they are a taxpayer plus on an annual budget for such age-related programs as social security and Medicare (see US welfare programs: Selected list). In the US these are federal government programs, and, as a result, immigrants are much more of a plus at the federal government level than at the state level.

K–12 (kindergarten through secondary school) education and income taxes drive most of the results in California (see Figure 2). Immigrant households in the state receive on average US$2,043 more in K–12 education benefits than do native-born households. In contrast, the annual taxpayer loss due to immigration in California has less to do with either welfare benefits or health care, although these spending categories are fiercely debated—as they are in most countries. On the revenue side, foreign-born households paid US$1,260 less in taxes than native-born households did.

In California in 1996, across all levels of state and local government, summing across all types of government benefits received and taxes paid, and assuming a balanced aggregate budget, foreign-born households received US$3,462 more in benefits than they paid in taxes. For state and local government budgets to balance annually, this deficit for immigrant-headed households implies that native-born households paid US$1,178 more in taxes than they received in benefits. If the estimates are adjusted only for inflation and the larger size of the immigrant population today in California, the taxpayer effect on native-born households in California would be about –US$2,200 in today’s dollars. There is no credible estimate of the labor market effect of immigrants in California that would offset that taxpayer loss. One could rightly claim that, on net, immigrants represent an economic loss in California.

But California is only one state in 50. If precisely the same computations are done for New Jersey—considering all levels of state and local government, summing across all types of government benefits received and taxes paid, and assuming an overall balanced budget—the situation is quite different. There are fewer immigrants in New Jersey than in California, and they are better educated, with incomes only 5% less than the incomes of native-born households (compared with 25% less in California).

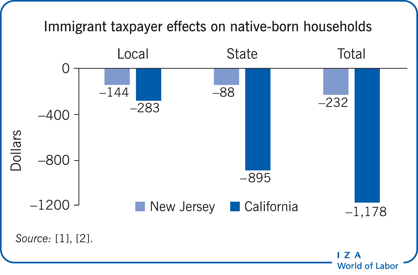

Most immigrants in New Jersey are of European heritage and have fewer children than immigrants in California. All these factors imply a lower taxpayer effect of immigration in New Jersey than in California. Using the same procedure, the estimated net fiscal burden at the state and local level on native-born households in New Jersey was US$232 in 1996 [2], much less than the estimated US$1,178 for native-born households in California (see Illustration).

Why are negative immigrant taxpayer effects so much larger in California than in New Jersey? Essentially, immigrant incomes are higher in New Jersey, so immigrants pay more taxes. Immigrants in California have more children than those in New Jersey, leading to higher government expenditure to educate immigrant children in California. This difference may offer some insight into the diverse political attitudes toward immigration in the US, since the strongest anti-immigrant attitudes appear to be highly correlated with the size of the taxpayer burden. This may also be relevant in some European countries where local governments have responsibility for some government functions and central government for others.

These different estimates for California and New Jersey are, however, incomplete, because they do not include the federal side of the taxpayer calculus. When that is included, the net taxpayer effect of immigrants living in these two states is small, since immigrants are a modest part of the total US population. When calculated across all native-born households throughout the US, immigrants in California represent a net loss of US$266 and immigrants in New Jersey a net loss of US$166.

The welfare dependency of migrants in Europe appears to be related mainly to their attributes and to whether they are EU or non-EU migrants

The scale of immigration into the European Union (EU) is now similar to that in the US, with more than half of the foreign-born population living in Germany and France [4]. The estimated taxpayer effects of immigrants in the EU are similarly diverse.

Europe is a particularly interesting case, since it is possible to distinguish between migrants from countries within the EU (where there are now no restrictions on within-EU labor market migration) and migrants from outside the EU, both legal and illegal. There remain large differences in GDP across EU member countries, and differences in GDP are even larger when non-EU countries are brought into the mix. Reasons for migration are also diverse, reflecting political upheavals in Europe and elsewhere, asylum seekers and refugees, family reunifications, and traditional economic migrants. There are also substantial numbers of illegal migrants.

A study of the fiscal impact of migrants from recent EU member countries in Central and Eastern Europe to the UK found that these immigrants were a net fiscal plus on an annual basis largely because they made less use of benefits and public services [5]. Part of this net benefit flows from the historical provision of some benefits—such as council housing at less than market rents—for which waiting lists are long, and new immigrants would be at the end of the line. Immigrants to the UK also tend to be younger, better educated, and with higher employment rates than the native-born population. Other studies have reached similar conclusions on a net fiscal benefit from all migrants to the UK [6].

In contrast, results for Denmark—which has a generous welfare state and immigrants of a less than average skill set—indicate a long-term negative fiscal impact [7]. And while migrants to Sweden are, not surprisingly, less likely than native-born residents to be receiving pension benefits, migrants to some countries, such as France and Germany, are more likely than native-born residents to receive unemployment benefits and welfare assistance [4].

The welfare dependency of migrants in Europe appears to be related mainly to their attributes, such as age, education, and number of children, and not to migrant status per se [4]. One could argue, however, that it is the unconditional data (not taking attributes into account) that are more relevant for analysis of the fiscal impact of immigrants. That is, even if migrant and non-migrant households are similar when conditioned on attributes, the fact that migrants are more likely to have attributes that lead to a more negative or positive overall taxpayer effect is relevant. The distinction between EU and non-EU migrants is also critical in their personal characteristics, including their legal status [4].

Discussion of results

Changes within generations

Since immigrants tend to be young, they might help—at least in the short term—to pay for age-related income and pension benefits and the health-care costs of the aging native-born residents. This effect will depend critically on how such benefits are financed, as individually financed government and private pensions raise no real issues.

Generally speaking, research in Europe and the US has found that, although immigrant contributions to the age-related benefits of the aging native-born residents are a component of the fiscal contribution of immigration, the effect is too small to be a major factor in resolving long-term fiscal deficits—immigrants will themselves eventually become beneficiaries of such programs, and the volume of immigration flows is simply not large enough to sustain the effect.

Once settled, immigrants change over time in important ways that affect the fiscal calculus. On the positive side, economic adjustment into the host country is often characterized by a considerable improvement in immigrants’ relative economic position, including their wages, which in turn leads to higher tax payments. On the negative side, as immigrants grow older, they too become recipients of large transfers in the form of government income support and the health-care benefits that typify most immigrant-receiving countries such as the US and those in the EU.

Changes across generations

Many immigrants start families and have children and grandchildren. The evidence from the US, where the data are better because of the inclusion of generational data in past decennial censuses, indicates strong progress down the generations in education and income. By the third generation, descendants of immigrants are indistinguishable in their economic performance from native-born residents. This is true equally for people of Asian, Hispanic, and European ancestry.

The methodology for forward-looking generational estimates of taxpayer effects of immigration, outlined by several authors, requires several critical assumptions [8]. First, a transparent discussion is needed about how future expenditures will react to the increased population induced by more immigrants. It is not plausible to argue that expenditures, even those that are public goods, are independent of population growth. There are as many good reasons to argue for diseconomies of scale as for economies of scale in expenditures with population growth, so the assumption that government expenditures grow at the same rate as population is most neutral as the baseline case.

Second, some assumption must be made about any future fiscal adjustment. If future expenditures continually exceed future taxes, debt-to-GDP ratios will explode and become unsustainable. Therefore, a transparent assumption about when debt-to-GDP ratios stabilize is necessary.

Conducting a sensitivity analysis of alternative assumptions for both these factors is a good idea. Forward-looking estimates take into account future streams of taxes and government benefits, while dynamic estimates add assumptions about the economy-wide adjustments implied by those streams of government taxes and benefits (for example, fiscal adjustments, interest rates, and economic growth rates). Although assumptions about the future stream of benefits and taxes are uncertain, simulations can be made with credible alternative assumptions about the main things that are likely to matter in the future.

Using methodology and estimates published in 2000, the net present value over the long term of admitting an immigrant to the US was US$80,000 in 1996, obviously quite a positive effect [9]. The descendants of immigrants, who are much better off than their immigrant forebears, contribute a great deal to this number being positive. But even over the long term, however, this number is positive at the federal government level (+US$105,000) but negative at the state and local level (–US$25,000).

These long-term fiscal calculations also vary by immigrant attributes such as age and education. To illustrate, using the most comprehensive estimates of the forward-looking and dynamic taxpayer effects to date in the US, there is a long-term taxpayer benefit of US$198,000 for immigrants with more than a high school education, whereas there is a long-term taxpayer loss of –US$13,000 for immigrants with less than a high school education [3].

Fiscal impact computations tend to identify as favorable the admission of younger, working-age adults and better-educated immigrants, and these computations are therefore far less neutral in terms of differences between expenditures and tax revenues than estimates of economic benefits from immigration based on labor market effects alone. Even when the forward-looking dynamic taxpayer effect framework is used, taxpayer effects are by no means immediately positive, although they do become more positive with time. This probably plays a large role in the political debate on immigration, as political horizons give too much weight to the short term.

A dramatic instance of diversity by immigrant type in Europe is provided in a 2004 study for Denmark that estimated an immigrant tax burden of €7,500 across all immigrant generations and types compared with an immigrant benefit of €7,500 if the immigrants are from other Western countries [10]. Low employment rates among immigrants from non-Western countries appear to be the primary cause.

One of the best forward-looking studies in Europe is from Sweden [8]. Sweden is an interesting contrast to the US because it is a large welfare state economy with high taxes. In Sweden, immigrants are characterized by low wages and high levels of unemployment. Using a forward-looking model that takes into account the effects of both current immigrants and the future generations to which they give rise, the study found a US$20,000 net cost per immigrant to Sweden [8]. This contrasts dramatically with the forward-looking generational result for the US mentioned above, which was a US$80,000 net benefit.

Limitations and gaps

The most important element of future calculations of taxpayer effects that is missing from the data is information on the future generations who are a consequence of the first generation’s immigration. In both Europe and the US, labor force and population surveys often do not contain the information necessary to conduct analyses of immigrant taxpayers, especially in a forward-looking context. At a minimum, information is needed on an immigrant’s country of birth and that of the parents, and, better still, also that of the grandparents. For each of these generations, information is also needed on individual attributes, including age, income, and education.

For example, in most data sources in the UK and elsewhere in Europe, generations beyond the first are often not separately identified, and first-generation immigrants are not asked about the category of legal entry [6]. In the US, data on generations other than the first and second are no longer available in the national census. In addition, European data often do not identify immigrant status but only current nationality. These data limitations go a long way toward explaining why so few estimates of taxpayer effects are available, especially in a forward-looking framework.

Summary and policy advice

There is no universally correct answer to whether, on average, the taxpayer effects of immigrants are positive or negative. That answer varies across countries and depends largely on types of immigrants and how large a part the government and the welfare state play in the economy. It also varies by whether the taxpayer effect is evaluated on an annual basis or over the long term, for example including future generations. If immigrants economically assimilate successfully, forward-looking taxpayer effects tend to be more positive.

While immigration policy should not be formulated by considering only the taxpayer effects of immigration, these effects should be part of the equation. Compared with the labor market effects of immigrants, there is a more systematic result for how taxpayer effects vary with the type of immigrant. High-skilled, working-age immigrants produce a much greater positive taxpayer effect than do low-skilled and older immigrants, for whom the net effect is generally negative.

In general, taxpayer computations point countries in the direction of favoring high-skilled, higher-income immigrants of working age. Such fiscal impact computations are far less neutral in terms of differences between expenditures and tax revenues than estimates of economic benefits from immigration based on labor market effects alone. In addition, political horizons give too much weight to the short term.

Taxpayer effects, while not immediately positive, do become more positive with time. For the taxpayer effects of immigration there is a compelling argument that immigrants not be limited in their job acquisition or confined to limited sectors of the economy. Taxpayer effects can be quite different at different levels of government (federal and state and local being a good example), since the benefits provided can be quite distinct. Equitable rules of transfers between levels of government should be more transparent in advance.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts. This research was supported by grants to NICHD.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© James P. Smith

US welfare programs: Selected list

Medicaid: Medicaid is a health insurance program for low-income people and those in need, jointly funded by the federal and state governments. It covers children, the elderly, blind people, disabled people, and other people who are eligible to receive federally assisted maintenance payments. (Source: US Social Security Administration)

Aid to Families with Dependent Children (AFDC): AFDC enables states to provide cash welfare payments for needy children who have been deprived of parental support or care because their father or mother is absent, incapacitated, deceased, or unemployed. (Source: US Department of Health and Human Services)

Supplemental Security Income (SSI) Benefits: SSI makes monthly payments to people who have low income and few resources, and are aged 65 or older, blind, or disabled. (Source: US Social Security Administration)

Pharmaceutical Assistance to the Aged and Disabled (PAAD): The PAAD program helps eligible New Jersey residents pay for prescription drugs. (Source: State of New Jersey Department of Human Services)