Elevator pitch

There is evidence that better performing firms tend to enter international markets. Internationally active firms are larger, more productive, and pay higher wages than other firms in the same industry. Positive performance effects of engaging in international activity are found especially in firms from less advanced economies that interact with partners from more advanced economies. Lowering barriers to the international division of labor should be part of any pro-growth policy.

Key findings

Pros

Better performing firms engage in foreign trade and offshoring activities.

Positive effects of exporting are often found in younger firms that export from less advanced economies to more advanced economies.

Exporters pay higher wages to comparable workers.

International trade and firm survival are positively linked.

The overall effect of offshoring on the labor market is modest.

Cons

Low-skilled workers feel pressure from international outsourcing.

The empirical picture is still incomplete due to a lack of strictly comparable international studies.

Author's main message

Trade liberalization tends to benefit better performing firms and, therefore, to contribute to economic growth. Positive effects tend to be especially pronounced in firms in less advanced economies that are actively engaged with international partners in more advanced countries. Reduction of barriers to the international division of labor should be an element of a pro-growth policy, especially in less advanced economies.

Motivation

A large number of empirical studies since the early 1990s have revealed that firms engaged in international markets are larger and more productive than comparable firms that are active only in their home market. Furthermore, internationalized firms pay higher wages to comparable employees.

Policymakers who aim to promote the creation of more highly competitive and well-paying jobs should be interested in the connection between better firm performance and international activities. They should consider, for example, whether better performing firms self-select into these activities and whether international activities help improve firm performance through learning from the internationalization experience.

This paper summarizes and discusses key empirical findings on these issues, with a focus on four types of international activity (exports, imports, offshoring, and inward foreign direct investment that leads to foreign-owned firms) and four labor-related dimensions of firm performance (employment, productivity, wages, and survival).

Discussion of pros and cons

The relationship between productivity and exports and imports

Effect on firms that export

In 1995 comprehensive firm-level data for the US was used to systematically document for the first time the differences between exporters and firms that sell their product only on the home market [2]. This started a literature in which the central topic is the relationship between exports and productivity, a dimension of firm performance that is crucial for competitiveness, survival, and growth.

Exporting firms turn out to be more productive than non-exporters of the same size and in the same narrowly defined industry. Empirical studies using firm-level data from countries around the world have investigated the direction of causality for this correlation, seeking to answer questions such as the following:

Do more productive firms self-select into export activity? If they do, is it because of the additional costs of selling goods in foreign countries? These extra costs—which include transportation, distribution, marketing, hiring of personnel with the skills to manage foreign networks, and the production costs of modifying current domestic products for foreign consumption—may set up an entry barrier that less successful firms cannot overcome [3].

Is the behavior of firms forward-looking in the sense that the desire to export tomorrow leads a firm to improve performance today so as to become competitive in the foreign market?

Does exporting help firms improve through the knowledge they gain from international buyers and competitors?

Does exporting enhance performance because firms participating in international markets face more intense competition and must improve faster than those that only sell their products domestically?

A 2007 study summarized the findings of 54 empirical papers published between 1995 and 2006 that used firm-level data from 34 countries to investigate the relationship between exporting and productivity [4]. Among the countries covered were highly industrialized countries, countries in Latin America and Asia, transition economies, and least developed countries. The evidence for this wide range of countries is remarkably consistent and clear-cut. The findings for pre-entry differences often show evidence in favor of the self-selection hypothesis: firms that eventually became exporters tended to be more productive than firms that never ventured outside the domestic market years before they entered the export market. They also often had higher rates of productivity growth before entering the export market. The message is clear: good firms go abroad.

Evidence on the learning-by-exporting hypothesis is more mixed. Results for post-entry differences in performance between export starters and non-exporters point to faster productivity growth for exporting firms in some studies only. Exporting does not necessarily improve firms [3].

There are several hundred studies on this topic, a summary of which would fill a book [3]. One 2010 survey concluded that studies supporting the self-selection hypothesis numerically overwhelm those supporting the learning-by-exporting hypothesis, and that this implicitly provides stronger support for the positive effects of productivity and growth on trade than for the positive effects of trade on productivity and growth [5].

However, another study surveying more than 170 empirical studies on the learning-by-exporting hypothesis concluded that positive effects of exports on productivity are often found in younger firms from less advanced economies, in firms that operate at some distance from the technological frontier, in firms that export intensively, and in firms that export to more advanced markets [6]. Exports may improve productivity in some firms.

Effect on firms that import

While the causes and consequences of exporting and its mutual relationships with productivity are prominent topics in the literature on internationally active firms, importing is seldom explored. One summary discusses the arguments for both a positive impact of productivity on importing—which is in accordance with the self-selection of more productive firms into import markets—and for a positive impact of importing on productivity (“learning by importing”) [3]. The study points out that the use of foreign intermediate goods increases a firm’s productivity but that, due to the fixed costs of importing, only inherently highly productive firms import intermediate goods. Importing is associated with fixed costs that are sunk because the import agreement is preceded by a search process for foreign suppliers, inspection of goods, negotiation, contract formulation, and similar expenses. Furthermore, the importer must learn and become familiar with customs procedures, another sunk cost of importing.

On the hypothesis of learning by importing, advocates of this view argue strongly in favor of a causal effect of importing on productivity, because importing enables firms to exploit global specialization and use inputs on the frontier of knowledge and technology [3]. Proponents point to studies on the international diffusion of technology, which identify imports as an important vehicle for knowledge and technology transfer.

Importing intermediate products also allows a firm to focus its resources on and specialize in activities in which it has particular strengths. Importers may improve productivity by using higher quality foreign inputs or by extracting technology embedded in imported intermediates and capital goods. Moreover, some studies posit a variety effect, in which the broader range of available intermediates contributes to production efficiency, along with a quality effect caused by the possibly better quality of imported intermediates than local ones [3].

If importing increases productivity, this might lead firms to self-select into export markets and improve their success in these markets, which might help explain why two-way traders (both exporters and importers) are the most productive firms. From a theoretical point of view, therefore, the direction of causality between productivity and importing can run in one direction or both simultaneously [3].

With new data sets that include information on importing at the firm level becoming available for more countries, a new literature is emerging that focuses on the links between productivity and imports. A number of empirical studies based on data from a wide range of countries document the shares of firms that are exporters, importers, and two-way traders, along with those that sell or buy on the national market only, and look at differences among these four types of firms. The studies focus on differences in productivity and their relationship with different degrees of involvement in international trade [3].

Details aside, the big picture that emerges from this literature can be outlined as follows [3]:

There is a positive link between importing and firm productivity, and the productivity differential between firms that import and firms that do not trade internationally is significant.

The same holds for firms that export.

Often, two-way traders are the most productive group of firms, followed by importers and then exporters, while firms operating only in their home market come last.

There is evidence for self-selection of more productive firms into exporting from most of the studies that look at this issue.

The evidence on learning by importing is still very limited and inconclusive.

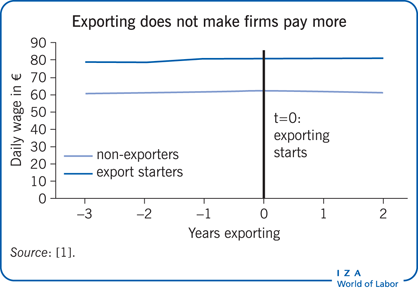

Exporters and wages

Turning to wages—another important performance dimension from a labor point of view—an exciting finding documented in the recent literature is that exporters tend to offer higher wages and benefits [2]. Studies find a statistically significant wage premium for exporters for all categories of wages and benefits after controlling for capital per worker, size of plant, multi-plant dummy variable, industry, year, plant age, and region. A 2007 study summarizes 21 studies published between 1995 and 2005 covering 22 countries, from highly developed economies, through emerging economies, to least developed sub-Saharan African economies [7]. Results on the wage premia offered by exporters are broadly consistent with the findings from the earlier study [2], [3].

A question that is not dealt with in this literature is whether the wage premia paid by exporters actually indicate that exporting firms pay higher wages than other types of firms, other things being equal (in the sense of comparable workers in comparable workplaces). Because all these empirical studies use average data at the plant or firm level, individual characteristics of the workers that might influence their productivity (and therefore their wages) cannot be taken into account, and certain characteristics of the workplace that might call for compensating wage differentials are not represented adequately [3]. A number of empirical studies have tested for the existence of these wage premia when individual observable and unobservable characteristics of the employees and the workplace are controlled for using a linked employer–employee panel data set [7].

The number of these “second generation” studies on trade and wages based on linked employer–employee data is still small (and the number of countries covered is even smaller), and some studies use only cross-sectional data that do not allow controlling for unobserved firm or worker heterogeneity. These studies have been reviewed elsewhere [3]. Therefore, a big picture that can be accepted with confidence has still not emerged.

One consensus has been reached, however: the wage premium paid by exporters is found to be much smaller when individual worker characteristics (whether observed or unobserved) are controlled for than in studies that use empirical evidence based on average information at the firm level. In fact, in some studies based on linked employer–employee data no wage premium for exporting per se is detectable. This indicates that linked employer–employee panel data are much more appropriate than uncontrolled data for investigating the existence and size of the exporter wage premium [3].

Exporters, importers, and firm survival

The third dimension of the performance of firms reviewed here is their survival. What are the reasons to expect that international trade activities and firm survival are linked, and in which direction are these links expected to work?

By spreading sales over different markets with different business cycle conditions or in different phases of the product cycle, exporting helps firms’ diversity risk [3]. For example, exports might provide a chance to substitute foreign sales for domestic sales when demand in the home market contracts and firms would otherwise be forced to close down.

Importers are also more likely to survive than non-importers, all else being equal. Imported intermediate inputs or capital goods might be cheaper or technically more advanced than inputs bought on the domestic market.

In addition, there is empirical evidence of a positive link between importing and productivity. Firms that both export and import can be expected to benefit from the positive survival effects of both forms of international trade [3].

A small number of empirical studies that look at the role of international trade activities in shaping the chances of firm survival find a higher estimated chance of survival for exporters even after controlling for firm characteristics that are positively associated with both exports and survival (like size, age, and productivity) [3]. With few empirical studies based on data from multiple countries, there is as yet no clear picture of how importing and two-way trading are related to firm survival.

Offshoring and employment in the home country

Offshoring—defined as the relocation of activities previously performed by a domestic firm to a firm in a foreign country—is one of today’s catchwords. Most of the time offshoring is used with a negative connotation, implying that jobs are lost in the home country when production is relocated to countries where labor is cheaper.

But offshoring does not necessarily have a negative impact on domestic employment. When some tasks performed by a certain type of labor can be more easily offshored, the firms that gain the most are those that use this type of labor intensively. The profitability of these firms will rise, creating an incentive to expand relative to firms that rely heavily on other types of labor. The increase in labor demand by these firms will in part fall on local workers who perform tasks that cannot easily be moved abroad.

At the level of the offshoring firm, therefore, there can be a positive impact if the competitiveness of its production increases and productivity rises. At the macro level, an increase in the international division of labor and specialization in products in which the home country has a comparative advantage should also foster growth.

Furthermore, it is questionable whether the adverse employment effects that are attributed to offshoring are always caused by offshoring itself. Often, production that is relocated is no longer profitable in the home country, and the employees would lose their jobs even if the firm did not engage in offshoring.

Most empirical studies on the consequences of offshoring focus largely on labor market issues—the level and skill composition of employment, and the level and structure of wages, which have been covered in several surveys [8], [9]. Although some studies have identified small negative effects on employment from offshoring, a consensus seems to be emerging that the effects are either broadly neutral or a small net gain in employment. Similarly, the results of empirical studies suggest that the overall effect of offshoring on the labor market is modest [9]. However, low-skilled workers, in particular, feel the pressure from international outsourcing.

Effects of foreign ownership

Multinational enterprises—enterprises that own firms in more than one country—play a key role in the world economy. The differences in performance, especially in the labor-related dimensions of firm performance, between foreign-owned firms and domestically controlled firms are an intensively discussed topic. (See Foreign direct investment (FDI) for a definition of this term and for details of how inward FDI can lead to foreign-owned firms.)

Evidence from earlier studies and results from the first microeconometric cross-country analysis of the effects of foreign ownership on wages, employment, and worker turnover have been summarized using firm-level and linked worker–firm data [10]. A standardized approach was used to investigate the effects of the takeover of a domestic firm by a foreign firm in three developed countries (Germany, Portugal, and the UK) and two emerging market economies (Brazil and Indonesia). The analysis finds positive wage effects, with larger effects in developing countries. For each country the largest effect on wages comes from workers who move from a domestic firm to a foreign-owned firm. According to the findings, employment growth after foreign takeover is concentrated in high-skill jobs. There is no evidence of greater job insecurity, and separation rates (the percentage of workers who lose or quit their jobs each month) fall slightly after takeover.

For all stakeholders, a key dimension of a company’s performance is its survival. From a theoretical point of view, the relationship that should be expected between foreign ownership and a firm closing its doors is not clear. On one hand, foreign-owned firms could have access to superior technologies that might increase their efficiency and lower the risk of failure. On the other hand, these firms are less rooted in the host country’s economy, and their activities can be shifted to another country if the local economy deteriorates. This should increase the probability of shutdown compared with nationally owned firms.

A number of microeconometric studies have used firm-level data for foreign-owned firms and domestically controlled firms to investigate the relationship between foreign ownership and firm survival, all else being equal. One study summarizes 26 mainly country-specific papers that use data from 17 developed and developing countries; two of the studies use data on affiliates worldwide [11].

The big picture that emerges from these studies can be summarized as follows. Results are highly country-dependent. Foreign affiliates have been found to be more likely to exit than their domestic counterparts in Belgium, Germany, Indonesia, Ireland, and Spain, but less likely to exit in Canada, Italy, Taiwan, and the US. No significant differences in closure rates due to foreign ownership have been found for Japan, Turkey, and the UK. Unsurprisingly, other factors that influence firm survival, such as size and productivity, are the main determinants.

Limitations and gaps

Although empirical evidence is now available on the links between the international activities of firms (exporting, importing, offshoring, and foreign direct investment) and the labor-related dimensions of their performance (employment, productivity, wages, and survival) in many countries all over the world, the picture is still incomplete. That is the case for two reasons.

First, sound empirical evidence for some of the links discussed (for example, exports and wages) is available only for a small number of countries, not least because suitable longitudinal microdata at the level of the firm and employees are lacking for many countries.

Second, any attempt to compare the findings from empirical studies for different countries beyond a qualitative assessment (“the link is positive and statistically significant in all these countries”) falters in the face of different sampling frames and definitions of variables between country studies and differences in the empirical models estimated.

Therefore, quantitative assessments of similarities and differences in the size of an effect, and investigations of the causes of cross-country differences, are only rarely possible. Future research should focus on filling this gap based on coordinated empirical research projects that use strictly comparable data and empirical models for many countries.

Summary and policy advice

Despite the gaps in the research, the evidence on the links between firms that operate internationally and the labor-related dimensions of firm performance can be summarized as follows:

Internationally active firms are found, on average, to be “better” firms—they employ a larger workforce and are more productive—than their counterparts from the same narrowly defined industry that serves the home market only.

Internationally active firms pay higher wages to employees with comparable observed and unobserved characteristics.

These differences in performance tend to be evident even before a firm becomes internationally active; there is overwhelming evidence for this characteristic (referred to as “self-selection”) in firms that subsequently enter international markets.

Empirical evidence for the positive causal effects of international activities on a firm’s performance is much less clear-cut. However, positive effects tend to be found in firms from less advanced economies that are actively engaged with international partners from more advanced countries.

Due to the limitations and gaps in the literature, it is too early to consider all these findings to be solidly established. However, the accumulated evidence seems to justify at least the following policy advice: trade liberalization tends to benefit the better performing firms and, therefore, to contribute to economic growth. Lowering barriers to the international division of labor should be part of any pro-growth policy, especially in less advanced economies, although all economies would benefit from such policies.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Joachim Wagner

Offshoring

Source: Blinder, A. S. Offshoring: Big Deal, or Business as Usual? CEP Working Paper No. 149, June 2007.

Foreign direct investment (FDI)

Source: OECD. OECD Benchmark Definition of Foreign Direct Investment. Paris: OECD, 2008.

OECD. OECD Factbook 2013: Economic, Environmental and Social Statistics. Paris: OECD, 2013.