Elevator pitch

Deregulation and managerial compensation are two important topics on the political and academic agenda. The former has been a significant policy recommendation in light of the negative effects associated with overly restrictive regulation on markets and the economy. The latter relates to the sharp increase in top executives’ pay and the nature of the link between pay and performance. To the extent that product-market competition can affect the incentive schemes offered by firms to their executives, the analysis of the effects of competition on the structure of compensation may be informative for policy purposes.

Key findings

Pros

Regulatory changes aimed at easing the process of starting up a business are likely to foster output growth and employment at no additional expense to the public.

To motivate and elicit effort from their managers, firms are likely to design explicit or implicit employment contracts that relate their pay to performance.

Executives’ compensation schemes are related to the levels of product-market competition.

Cons

Barriers to firm entry have negative effects on the economy (e.g. on competition, innovation, employment, wages, etc.).

While in most studies increased competition leads to stronger incentives provided by firms to their managerial workers, this is not necessarily always the case.

As firms can substitute fixed for variable pay (and vice versa), the overall effect of changes in competition on the executives’ pay remains uncertain.

Author's main message

Empirical evidence suggests that executive pay is related to the level of product-market competition. However, while most shocks or policy reforms that foster competition tend to strengthen the link between competition and performance-related pay, it can also be the case that increasing competition reduces incentives. Also, as firms may change their pay structures, the effect of changes in competition to CEOs’ pay is uncertain. Policies aimed at reducing wage inequality or at affecting the provision of incentives should consider market idiosyncrasies as well as taking these different effects into account.

Motivation

Virtually all governments, as part of their industry or competition policies, decide whether to allow the free entry of firms into the market or to regulate access. However, the extent and nature of such regulation differs from country to country. High barriers to entry are likely to have negative effects, including those on competition, innovation, employment, wages, and economic growth overall. Hence, a major policy recommendation has been to reduce the red tape associated with firm creation.

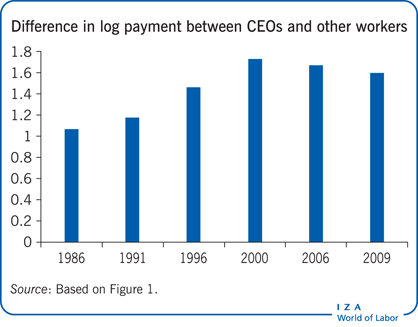

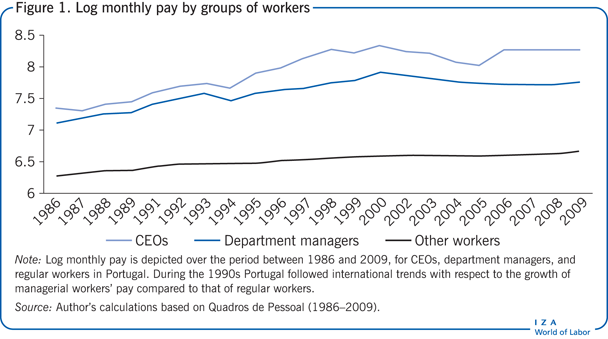

An additional and related topic on the political agenda is the pay of top executives, and especially the sharp increase, in particular during the 1990s, in CEOs’ pay relative to that of other workers.

The economic literature suggests that there is a causal relationship between competition and managerial compensation, or executive pay. It has been argued that the effect of increased competition on the performance-related pay of managers depends on the method by which competition is increased [1]. That is, if competition increases through a reduction in the cost of entry to the market, the link between pay and performance will be weakened. The opposite would occur if competition is measured; for example, by a larger market size or greater product substitutability.

However, the nature of the link between competition and the provision of incentives remains rather ambiguous and depends to an extent on the idiosyncrasies of the markets. While in most empirical studies increased competition led to an increase in the size of the incentive offered to executives, it has also been found that reducing red tape in relation to firm creation can also weaken the link between performance and pay [2]. Furthermore, increased competition can also affect the structure of compensation (e.g. fixed versus variable pay). Overall, the effects of competition on workers’ compensation are not clear-cut and require further empirical analysis.

Discussion of pros and cons

With most economies recently experiencing weak economic performance, high levels of unemployment, and perilous fiscal positions, governments have been seeking ways of stimulating growth without incurring additional public expenditure. Deregulating the entry of firms into the market, and thereby making it easier and/or less costly to start a new business, is one such policy that is likely to foster output growth and employment. It is also likely to lead, eventually, to overall economic growth at relatively low public cost. Therefore, the analysis of firm entry barriers is of considerable practical and public policy importance.

Apart from the concern about barriers to entry keeping competition low, there is also concern that in some sectors, in particular in the banking and financial sectors, increases in managerial compensation may have spiraled out of control.

The sharp increase, in particular during the 1990s, in CEOs’ pay relative to that of other workers raised questions about wage inequality and whether top executives are worth what they are paid (Figure 1).

Some argue that executives’ pay is not related to performance and is excessive. Others argue that an executives’ compensation system is necessary in order to attract managerial talent and needs only to be revised. However, in order to revise or reform the compensation arrangements that firms agree with their executives, it is important to understand the mechanisms underlying current compensation schemes and how they relate to the product market structure.

A branch of the literature (both theoretical and empirical) has established a causal link between product–market competition and the compensation packages, in particular the performance-related pay, of managerial workers. There is a significant amount of empirical evidence on the effect of increased competition on the behavior of firms (in that they are more productive and innovative) and workers (in that they exert more effort). However, there is little evidence—in particular based on longitudinal data—on whether, following a change in product-market competition, firms change their incentive compensation arrangements in order to elicit higher productivity levels from their workers.

The purpose of this paper is to survey the particular branch of the literature that relates competition and pay to performance of executives. It will be shown that both theoretical predictions and empirical results are diverse regarding the nature of the relation between competition and performance-related pay. Therefore, policies aimed at either strengthening the provision of incentives by firms to their workers (through increased performance-pay sensitivities) or reducing wage inequality between types of workers (through, for example, changes in the structure of compensation), need to take the potential different effects into account.

Underlying economic theory

Empirical evidence suggests that firms are heterogeneous and that they differ with a high degree of persistence in several respects with regard to human resource management, productivity, and pay policies, even within narrowly defined industries. However, despite the degree of heterogeneity in compensation policies of firms, most compensation plans of managerial workers consider four components: (i) base wage; (ii) bonuses; (iii) stock options; and (iv) long-term incentive plans.

If the structure of the product market affects the workers’ incentive to exert effort, it induces some sort of dependence between the product-market competition and the optimal incentive contract designed by firms. In other words, as changes in the product-market competition may change the implicit incentives of workers, firms may use performance-related pay as an instrument to increase the productivity of their workers. In so far as managerial compensation can be, both explicitly and implicitly, related to firm performance, it motivates analyses of the sensitivity of executive pay to firm performance as well as its effect on subsequent firm performance.

Some research has attempted to theoretically derive the causal link between the competitive pressure in the product market and the provision of incentives by firms to their managerial workers [1], [3], [4], [5], [6], [7]. A considerable majority of the theoretical models reach ambiguous results regarding the effect of increased competition on performance-related pay as an incentive scheme. The reason for such uncertainty is that increased competition generates two counteracting effects. On the one hand, there is greater sensitivity of a firm’s market share to higher levels of productivity. In which case firms become more likely to provide stronger incentives to elicit effort from their workers. On the other hand, increased competition is likely to reduce the firms’ residual demand. In which case the incentives for firms to undertake efforts toward cost reduction (such as providing incentives to increase the productivity of their workers) are reduced.

One exception in the theoretical literature also investigates how changes in the distribution of firms’ profits, induced by changes in the product market structure, affect the workers’ compensation arrangements [1]. The most significant element of this model lies in its prediction that the link between performance and managerial incentives depends critically on the way in which competition is increased. It suggests that if competition is measured by larger market size or greater product substitutability, then the link between pay and firm performance will be strengthened. It also suggests that if competition increases through a reduction in the cost of firm entry, new firms enter the market and each firm-level output decreases. As firms become smaller (in terms of output) the value of a cost reduction is reduced, and firms provide weaker managerial incentives (lower performance-pay elasticities) to their CEOs.

Given the prevalence of ambiguous theoretical predictions on the effects of competition on the incentive schemes firms provide to their workers, the identification of the effect is an empirical matter and depends on the characteristics of each market and how its structure is changed (e.g. through changes in the number of competitors, the degree of product substitutability, market size, or costs of entry).

Empirical evidence

Empirical research considered in this review provides evidence on the link between competition and managerial compensation; in particular, how performance-related pay is strengthened or weakened when the level of product-market competition is increased.

Based on UK and US data, some studies provide empirical evidence on the effects of increased competition on the structure of compensation, particularly in the performance-related sensitivity of executive pay. Some authors study the effects of international trade shocks [8], [9]. Other studies consider the effects of deregulation in the banking and financial sectors on the structure of compensation [10], [11], [12]. More recently, some research looks at the economy-wide effects of regulatory changes, which reduced firm entry costs, on performance-related pay [2].

Effects of international trade shocks

Some studies have analyzed how the implicit incentives provided by increased product-market competition interact with the compensation schemes that firms have with their workers [8]. The data used cover the period 1992–2000 and contain a sample of more than 22,000 manufacturing firms based in the UK. The authors exploit the 1996 appreciation of the British pound as a measure of an exogenous change in the product-market competition. The appreciation was not expected by firms and it changed the relative prices of imports and exports in the UK. In other words, the relative costs of production of UK and foreign firms were changed. Foreign firms became more competitive and the prices at which they could offer their products in the UK market were reduced. As a result, some foreign firms that were not competitive enough at the relative costs before the appreciation of the currency could now enter the UK market. Despite the temporary nature of the appreciation of the currency, its effects on the competitive structure of the market were likely to be long-lasting, as both home and foreign firms adjusted to the shock. This phenomenon is known as the “hysteresis effect” of shocks in exchange rates. This exogenous shock on the UK market structure had an effect on the profits of firms, as their growth rate began to slow down, particularly in the group of firms in those sectors that were more exposed to foreign competition.

Given this setting, the key findings in this study were that the higher level of competition in the market strengthened the sensitivity of the managerial workers’ (i.e. top executives and average directors) performance-related pay. This effect was stronger for managerial workers in those sectors that were more exposed to international competition.

Also in the context of changes in foreign competition, one study considers how changes in the degree of import penetration (as a result of exchange rates and tariffs) faced by US firms affected compensation and incentive schemes of executives [9]. Import penetration is a measure of the importance of imports in the domestic economy, either by sector or overall. Growing import penetration implies an increase in the competitive pressure within an industry because foreign firms have a bigger presence in the market. In addition, the residual demand that each firm faces becomes more elastic and shifts down. In the presence of fixed costs of entry, once foreign firms enter the domestic market they are unlikely to exit. Because of this, changes in foreign competition can permanently reshape the general competitive structure of an industry.

In this study, the authors used panel data, for the period 1992–1999, of 737 manufacturing firms in the S&P 1500 index and concluded that higher foreign competition (that is, higher product-market competition) resulted in a more pronounced pay−performance relationship, although it reduced the level of fixed pay. However, the overall effect of this change on the structure of compensation on total pay differed across the managerial workers’ hierarchy. While the highest-ranked executives experienced an increase in total pay, lower-rank executives saw their total pay fall. Therefore, pay inequality increased across managerial workers.

In summary, this research uses sources of variation in product-market competition based on international trade shocks and globalization measures and shows that higher levels of competition led to stronger provision of incentives by firms to their managerial workers in the UK and the US manufacturing sectors [8], [9]. However, international trade shocks and globalization are not the only potential sources of changes in the market structure. To the extent that they may reduce barriers to entry, deregulation is also likely to have important consequences in the levels of competition and in the compensation arrangements and, in particular, the pay for performance of workers.

Effects of regulatory changes on the banking and financial sectors

Some research has looked at the effect of regulatory changes on the competitive structure of the banking and financial sectors in the context of compensation arrangements of executives [10], [11], [12]. Using the deregulation of the commercial banking industry that took place in the US in the 1980s, some of these studies examine the effect of the structure of the market for corporate control, on both the level and structure of CEO pay [10], [11].

After the Great Depression of the 1930s, the corporate control market for banks in the US was defined by regulations legislated by each state and was influenced by whether banks from other states were allowed to compete in local banking markets. Every bank had to comply with state branching restrictions. Cross-state activities or mergers were not allowed in most states. However, during the 1980s, some states began deregulating the industry and alleviated some interstate banking restrictions as new legislation allowed local banks to be acquired by out-of-state banks. By reducing geographical restrictions, this change made the bank market for corporate control more competitive.

Using panel data on banks for the late 1970s and the 1980s, the authors of these studies concluded that the higher levels of competition resulting from the regulatory changes affected both the level and the structure of CEO pay. In addition, that the pay−performance relation was stronger in deregulated interstate banking markets.

In one study, the authors extended this research and analyzed the effects of: (i) the 1994 Riegle–Neal Interstate Banking and Branching Efficiency Act, which permitted interstate banking at a Federal level; and (ii) the 1999 Gramm–Leach–Bliley Act, which made banking, insurance, and securities part of the same industry. This meant that, for example, banks and investment firms were from then on in direct competition. The study found substantial changes in the compensation arrangements that firms offered to their managers following deregulation. On the one hand, evidence suggested stronger performance-pay sensitivities, while on the other hand, the fixed component of pay fell following deregulation. Effectively, increasing competition resulted in a substitution of variable for fixed pay. Given the increase in the performance-pay sensitivities and the decrease in the fixed component of pay, the effect of increased competition on overall pay was negligible.

The research surveyed so far relates to the effects of increased competition in a particular industry, or sector of economic activity, on performance-pay and on the structure of compensation overall. Events as different as regulatory changes, globalization, or international trade shocks all seem to induce stronger pay−performance relations. However, as they may also affect the fixed component of compensation, the overall effect of more competition on workers’ total pay is uncertain.

Economy-wide effects of deregulation

At an economy-wide level, one study has used an exogenous change in firm entry costs in order to identify the causal link between lower entry costs and higher competitive pressure on the structure of compensation of managerial and non-managerial workers [2]. The authors used Portuguese data for the period 2002–2009 that included the implementation of a business registration reform known as the “On the Spot Firm” (“Empresa na Hora”) program, which effectively reduced the cost of firm entry in Portugal.

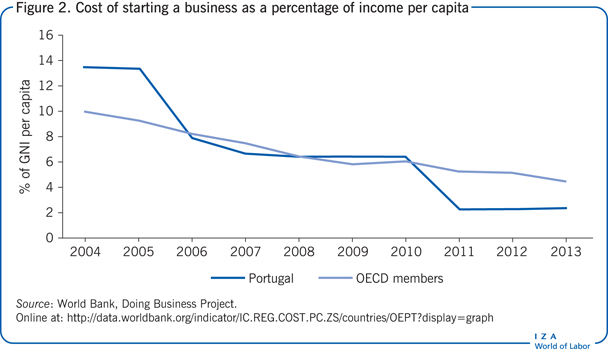

The “On the Spot Firm” program was introduced in Portugal in 2005 with the purpose of reducing both the cost of starting up a business and the complexity of the process associated with the registration of a new firm. Prior to 2005, the bureaucracy associated with setting up a firm was extensive and required an entrepreneur to complete 20 forms and undertake 11 procedures. The overall process of creating a new firm would take around 78 days, and the costs of business start-up procedures were estimated to be nearly 13.5% of the gross national income (GNI) per capita, way above the OECD members’ average (Figure 2).

In 2005, “On the Spot Firm” shops were opened in a few municipalities and, in the following years, the program was expanded to many other municipalities across the country. This business registration reform was unannounced and unanticipated and established one-stop shops where entrepreneurs could register a company in less than an hour. By 2008, over 70% of the newly created firms were established through the “On the Spot Firm” shops. Furthermore, in 2008, the estimated cost of the procedures of starting a new business was more than halved as a percentage of the GNI per capita (6.5%), which was in line with the OECD average.

This business registration reform became part of a larger package for administrative and legislative simplification called “Simplex”. The program is one of the most successful initiatives for red-tape reduction in the industrialized world, and Portugal rose from 113th to 26th in the World Bank’s “Doing Business” ranking between 2005 and 2010.

The “On the Spot Firm” program lowered firm entry costs and resulted in higher rates of firm creation, both across as well as within industries and municipalities. By using the “On the Spot Firm” business registration reform, the authors were able to identify the causal link between competition and performance-based pay of workers. From their analyses they concluded that the reform reduced the performance-pay sensitivity of managerial workers.

The result is consistent with the theoretical prediction that increasing competition through lower entry costs leads firms to flatten the incentive packages given to their managers. However, the authors also found that the business registration reform increased the relative fixed component of directors’ pay. Since firms seem to be substituting fixed for variable pay it is not clear whether the total effect would render a reduction in the overall pay of managers, hence wage inequality. No effects were found for other non-managerial workers.

In summary, the levels of competition in a market affect both the productive behavior of firms and workers and the type of contracts and incentives firms provide to their workers. To motivate their employees, some firms use incentive contracts, which can be either explicit or implicit. Such contracts relate workers’ pay, in particular managerial workers’ pay, to firm performance. However, given the sharp rise in CEOs’ pay during the 1980s and 1990s and its effects on wage inequality, some analysts question why pay increased so much and indeed whether executives’ pay is related to performance.

Several studies have considered the effects of international trade shocks, globalization, and deregulation in the manufacturing, banking, and financial sectors of the US and the UK. They found evidence that suggests an increase in the sensitivity of pay to performance in response to increases in the competitive pressure of the market [8], [9], [10], [11], [12].

One important study, using data for the overall Portuguese economy, provides empirical support for the theoretical prediction that increased competition through lower entry costs induces firms to provide weaker incentives to their managerial workers [2]. Furthermore, some evidence has also found that, as a result of increased competition firms may change the structure of compensation (that is, substitute between the fixed and variable components of pay).

Limitations and gaps

There is still a limited amount of empirical evidence on the influence of product-market competition on the use of incentive payment schemes that firms provide to their workers (both managerial and non-managerial). A part of the reason for this relates to the measurement and identification of variations in competition empirically, as commonly-used measures of competition are prone to some limitations (e.g. endogeneity, correlation with omitted variables, non-monotonicity of their effects on outcome variables, etc.).

In order to overcome these limitations, the research reviewed in this paper used either “quasi-natural” experiments or instrumented changes in the levels of competition in order to identify the causal link between competition and performance-based pay, while avoiding the caveats of the usual measures of competition. However, natural experiments are not a panacea for establishing causality and one has to believe in the experiment’s validity.

In addition, firms can relate pay to performance either through explicit, written contracts or through implicit contracts, or through a combination of both. Due to the lack of available data, empirical studies are not able to distinguish between these alternatives. However, their results are still relevant in the sense that they shed light on the relation between changes in product-market structure and the compensation arrangements of managerial workers.

Summary and policy advice

The empirical research that has been considered in this paper provides some evidence on the link between competition and managerial compensation. In particular, how performance-related pay is strengthened or weakened when the level of product-market competition is increased.

However, the causal link between competition in the product market and the performance-related pay of managerial workers is not clear-cut. This is due to the fact that increased competition is likely to generate two counteracting effects. First, as the firm’s market share is more sensitive to higher levels of productivity, it becomes profitable to provide stronger incentives to elicit effort. Second, however, as the firm’s residual demand is reduced, it renders the provision of incentives to increase workers’ productivity less profitable.

Therefore, the identification of the effect of competition on executive pay is entirely a matter of empirical analysis and depends on the characteristics and idiosyncrasies of each market and how its structure is changed (e.g. through changes in the number of competitors, the degree of product substitutability, market size, costs of entry, etc.).

In summary, this research uses sources of variation in product-market competition based on international trade shocks and globalization measures and shows that higher levels of competition led to stronger provision of incentives by firms to their managerial workers in the UK and the US manufacturing sectors [8], [9]. However, international trade shocks and globalization are not the only potential sources of changes in the market structure. To the extent that they may reduce barriers to entry, deregulation is also likely to have important consequences in the levels of competition and in the compensation arrangements and, in particular, the pay for performance of workers.

Firms are likely to design employment contracts that relate the workers’ pay, in particular the managerial workers’ pay, to performance. By doing so, firms attempt to motivate their workers and induce them to exert more effort. The competitive pressure of a market, on the other hand, is predicted to have an effect on the performance-related pay of workers. Though evidence suggests that this effect differs depending on how competition is increased. Most regulatory changes or economic shocks that affect the competitive pressure of a market are likely to strengthen the performance−pay link.

However, while increased competition has been shown to strengthen incentives provision by firms to their managerial workers, this is not always the case. Furthermore, since there is some evidence that firms strengthen the variable component of pay while reducing the fixed component of pay—and vice versa—the overall effect of increased competition on executive pay is somewhat uncertain. Therefore, although deregulation may have important effects in terms of economic growth through increased competition within sectors and/or across an economy overall, its effects on the actual compensation of managerial workers is not so obvious. Hence, policies aimed at reducing wage inequality or at affecting the provision of incentives should take these different effects into account.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts; and also the Portuguese Ministry of Labor and Social Solidarity and the Office for National Statistics (INE) for granting access to the data used in this paper. Financial support by Fundação para a Ciência e a Tecnologia through the Applied Microeconomics Research Unit, award no. PEst-OE/EGE/UI3181/2014, is gratefully acknowledged. The author also thanks Ana P. Fernandes and L. Alan Winters for their support and comments while writing this piece, which is based on their joint work.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Priscila Ferreira