Elevator pitch

Employee ownership has attracted growing attention for its potential to improve economic outcomes for companies, workers, and the economy in general, and help reduce inequality. Over 100 studies across many countries indicate that employee ownership is generally linked to better productivity, pay, job stability, and firm survival—though the effects are dispersed and causation is difficult to firmly establish. Free-riding often appears to be overcome by worker co-monitoring and reciprocity. Financial risk is an important concern but is generally minimized by higher pay and job stability among employee owners.

Key findings

Pros

Employee ownership is linked to better company performance on average.

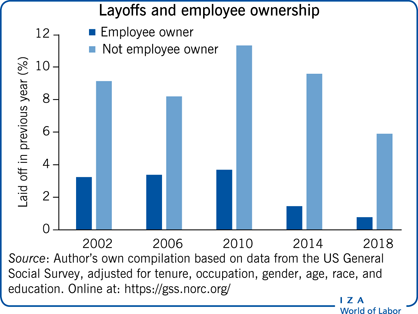

Employee ownership companies have more stability, higher survival rates, and fewer layoffs in recessions, potentially leading to lower unemployment in the overall economy.

Employer stock tends to come on top of, rather than substitute for, regular employee compensation, and thereby adds to pay and wealth in general.

The broader sharing of economic rewards may help reduce economic inequality.

Cons

Employee ownership is subject to the free-rider problem, since the rewards from individual effort are shared with other workers and the direct incentive to work hard may be weak, which can lead more able workers to leave.

The effectiveness of employee ownership may depend on a complicated combination of supportive policies, such as employee involvement, job security, and training.

Workers can be exposed to excessive financial risk, especially when employee ownership is a large share of a worker’s wealth, and when it substitutes for other pay and benefits.