Elevator pitch

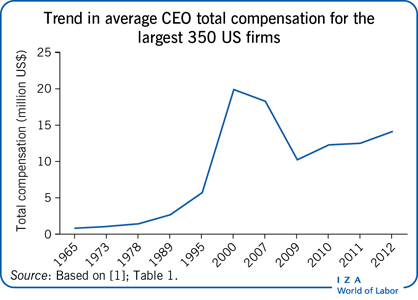

The escalation in chief executive officer (CEO) pay over recent decades, both in absolute terms and in relation to the earnings of production workers, has generated considerable attention. The pay of top executives has grown noticeably in relation to overall firm profitability. The pay gap between CEOs in the US and those in other developed countries narrowed substantially during the 2000s, making top executive pay an international concern. Researchers have taken positions on both sides of the debate over whether the level of CEO pay is economically justified or is the result of managerial power.

Key findings

Pros

CEO pay is market-determined and reflects the bidding by firms for scarce executive talent.

The increasing percentage of externally hired CEOs points to rising competition for top talent.

CEO pay is in accord with historical norms in relation to the size of the firm, and the growth in CEO pay corresponds to the growth in firm size.

When magnified by the scale of the firm, the value of small differences in top executive talent is large, justifying top achievers’ high pay.

The increase in CEO pay is due to the rise in incentive compensation that links pay to firm performance and aligns the incentives of managers with those of shareholders.

Cons

The pay-setting process is unduly influenced by the CEO.

CEO pay is excessive in firms with weaker boards of directors, no dominant outside shareholder, and a CEO who has a large ownership stake.

Incentive compensation is manipulated to benefit CEOs even when firm performance is poor.

High CEO compensation increases the odds of a firm being selected as a peer group comparator for pay-setting purposes at other firms.

The extent to which CEOs reduce the pay–firm performance sensitivity in their compensation through the use of managerial hedging instruments is unknown.