Elevator pitch

Many experimental studies and surveys have shown that women consistently display more risk-averse behavior than men when confronted with decisions involving risk. These differences in risk preferences, when combined with gender differences in other behavioral traits, such as fondness for competition, have been used to explain important phenomena in labor and financial markets. Recent evidence has challenged this consensus, however, finding gender differences in risk attitudes to be smaller than previously thought and showing greater variation of results depending on the method used to measure risk aversion.

Key findings

Pros

A higher degree of risk aversion may explain why women are under-represented in high-level occupations.

Risk attitudes are not entirely immutable, because nurture may matter.

Differences in risk attitudes exist but are not sufficiently large to explain gender pay gaps driven by different career paths.

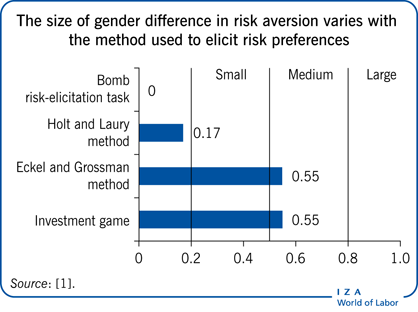

There is a systematic pattern linking the method used to elicit risk-related behavior, and the likelihood of finding that men and women react differently to risk.

Differences between men and women seem to emerge when a riskless option is available.

Cons

Risk preferences are difficult to measure, especially outside of gambling and financial domains.

The determinants of gender differences in risk attitudes are still largely unknown.

Although shown to react somewhat to the environment, gender risk differences are mainly an innate behavioral trait.

Overemphasizing risk attitudes undermines the scope of active policies for tackling unequal gender-based outcomes in the labor market.

Evidence on the existence of gender differences in risk taking is not as strong as the beliefs about them.