Elevator pitch

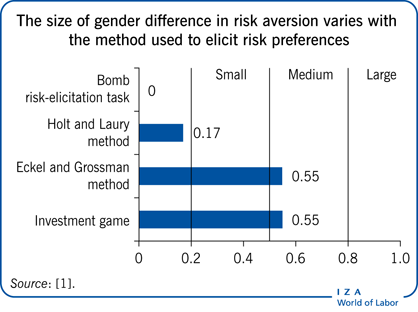

Many experimental studies and surveys have shown that women consistently display more risk-averse behavior than men when confronted with decisions involving risk. These differences in risk preferences, when combined with gender differences in other behavioral traits, such as fondness for competition, have been used to explain important phenomena in labor and financial markets. Recent evidence has challenged this consensus, however, finding gender differences in risk attitudes to be smaller than previously thought and showing greater variation of results depending on the method used to measure risk aversion.

Key findings

Pros

A higher degree of risk aversion may explain why women are under-represented in high-level occupations.

Risk attitudes are not entirely immutable, because nurture may matter.

Differences in risk attitudes exist but are not sufficiently large to explain gender pay gaps driven by different career paths.

There is a systematic pattern linking the method used to elicit risk-related behavior, and the likelihood of finding that men and women react differently to risk.

Differences between men and women seem to emerge when a riskless option is available.

Cons

Risk preferences are difficult to measure, especially outside of gambling and financial domains.

The determinants of gender differences in risk attitudes are still largely unknown.

Although shown to react somewhat to the environment, gender risk differences are mainly an innate behavioral trait.

Overemphasizing risk attitudes undermines the scope of active policies for tackling unequal gender-based outcomes in the labor market.

Evidence on the existence of gender differences in risk taking is not as strong as the beliefs about them.

Author's main message

The economics literature often treats gender differences in risk attitudes as conclusively demonstrated. Though most studies of risk preferences have been conducted in a gambling/finances context, labor economists cite gender difference in risk aversion as an explanation for why women are less represented in high-level jobs. However, the size of observed differences in risk attitudes is too small to support the outcomes they are used to explain. And recent evidence finds fewer gender differences in risk attitudes than previously claimed, leaving more room for policies to tackle discrimination and support women's participation in the labor market.

Motivation

Gender differences in labor market outcomes have received considerable attention in the literature. Understanding why women are less represented than men in higher-level positions and why, on average, women earn less than men is crucial for informing policy interventions aimed at ending these differences.

Several forms of discrimination have commonly been identified as the sources of such unequal labor market outcomes. Economists have also argued that individual traits, such as attitudes toward competition and risk may play a role. For instance, if women are more risk averse than men, they will be less likely to choose career paths involving high-paying jobs where a large share of the remuneration comes from bonuses based on company performance, and thus they will be less represented in such positions [2]. Similarly, if women are less competitive than men, they will be less likely to seek out promotions. However, recent contributions argue that there is no direct evidence demonstrating that greater female risk aversion can explain why women are under-represented in top-level jobs for two reasons. First, gender explains only a small fraction of the variance in risk attitudes. Second, the consensus on gender differences in risk attitudes has been challenged showing that such differences highly depend on the method used to elicit risk preferences. The purpose of this article is to shed some light on the robustness of the experimental evidence on gender differences in risk preferences.

Discussion of pros and cons

Behavioral traits, such as attitudes toward risk and competitiveness, are latent constraints that cannot be directly observed. The increased attention they are receiving parallels the boost in the use of experimental methods in economics. Analysis of the evidence from the experimental literature on differences in risk attitudes may therefore be highly informative for better understanding unequal outcomes in the labor market along gender lines.

Risk-elicitation methods

Risk preferences are usually elicited by administering a menu of incentivized lotteries in which subjects reveal their attitudes toward risk through their choices among a menu of options that offer different mixes of risk and reward. Choices made under conditions of risk allow subjects to be classified according to their preferences as risk neutral, risk averse, or risk seeking.

Risk-neutral subjects care about maximizing the expected return of their choice and are not affected by the risk involved in the choices available. For instance, risk-neutral subjects would be indifferent to being guaranteed €5 or playing a lottery with an equal probability of getting €10 or nothing, a risky alternative with the same expected value. Risk aversion captures the idea that a subject dislikes risk. A risk-averse subject tends to choose lotteries characterized by a lower but safer return. In the example above, a risk-averse individual would opt for the certainty of the €5. The opposite behavior is called risk seeking, because the subject enjoys risk and therefore is willing to accept a great deal of uncertainty in outcomes.

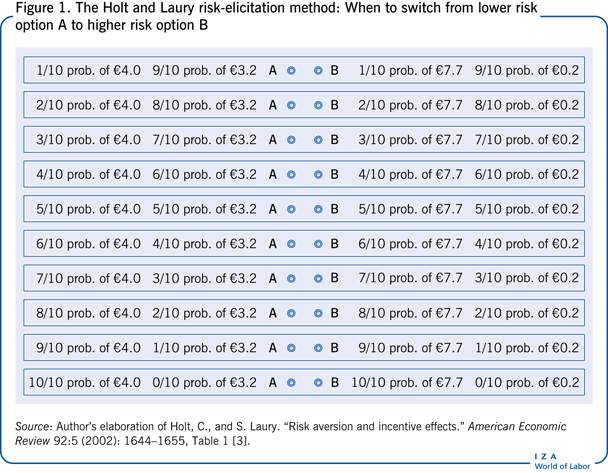

The most popular risk-elicitation method is the Holt and Laury method [3]. In this risk-elicitation task, subjects face a series of ten choices between pairs of lotteries. Option A is characterized by pairs of outcomes that are not too different from each other, while option B promises outcomes that are very different from each other (Figure 1). Subjects have to choose between option A and option B in each row, moving from top to bottom. At the end of the experiment, one row is randomly chosen and the lottery is played to determine the pay-off.

The row at which subjects switch from option A to option B captures their attitude toward risk. Risk-neutral subjects who care only about the expected return should switch from option A to option B from the fifth row down. Risk-averse subjects, who are willing to give up potential earnings in order to reduce risk, will make more safe choices (option A) than a risk-neutral subject. The higher the number of choices of option A over option B, the greater a subject's degree of risk aversion. Risk-seeking subjects, who prefer riskier choices with higher potential rewards, switch to option B before the fifth row.

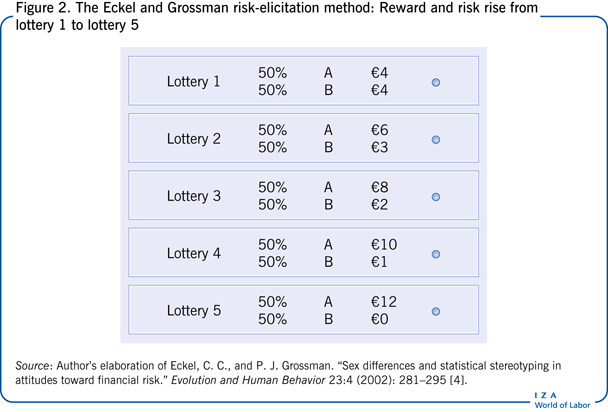

A simpler risk-elicitation experiment is the Eckel and Grossman method [4]. Subjects make a single decision, choosing their preferred lottery from the proposed menu of five lotteries (Figure 2). At the end of the experiment, the chosen lottery is played and the subject is paid accordingly. The expected reward for winning rises from lottery 1 (€4) to lottery 5 (€6), but so does the risk. Subjects must therefore accept a higher level of risk in exchange for a higher expected return. Which lottery subjects choose depends on their risk aversion—how much they dislike risk. A problem with this risk-elicitation method is that it can only distinguish among different degrees of risk aversion, while it cannot distinguish risk neutrality from risk seeking. A risk-neutral subject should choose lottery 5, the riskiest available, because it yields the higher expected value. But that is also the lottery that all risk-seeking subjects should choose.

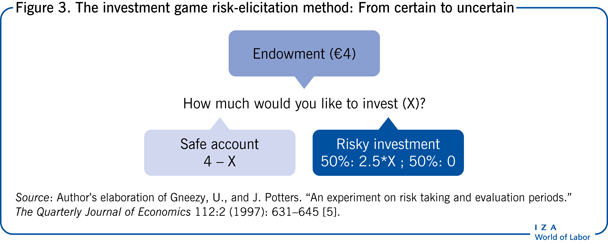

Another risk-elicitation method that shares some features of the Eckel and Grossman method is the “investment game” (Figure 3) [5]. In the investment game, subjects have to decide how to allocate a given endowment of €4 between a safe account and a risky investment that has an equal probability of yielding either 2.5 times the amount invested or zero. The higher the amount subjects invest, the lower their risk aversion. As in the Eckel and Grossman method, risk-neutral and risk-seeking subjects should make the same choice, which is to invest all their endowment in the high-risk/high potential reward investment.

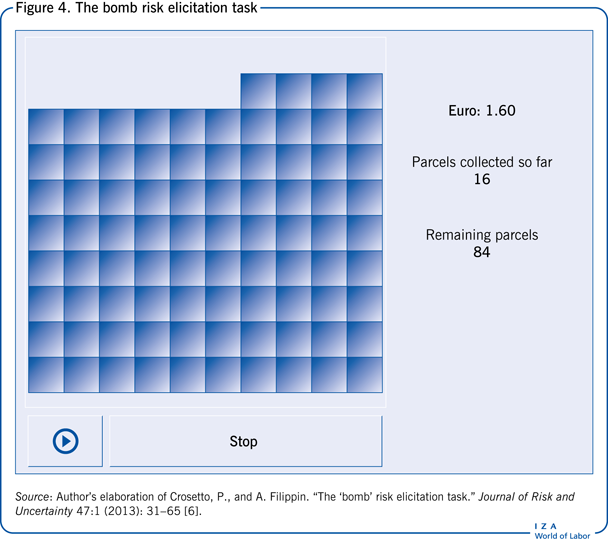

Another recently proposed risk-elicitation method is known as the “bomb risk-elicitation task” [6]. Subjects are presented with a square composed of 100 cells, each representing a parcel (Figure 4). Ninety-nine of the parcels are empty, while one contains a bomb. Subjects have to decide how many parcels they want to collect. Subjects receive ten cents for every parcel collected. The position of the bomb is determined by drawing a number from 1 to 100 after subjects have collected their parcels. If the bomb is among the parcels collected, the “explosion” wipes out the subject's earnings. In the example in Figure 4, the subject has collected 16 parcels. The subject would earn €1.60 if the position of the bomb is greater than or equal to 17. If the bomb is between parcels 1 and 16 (the number of parcels collected in this example), the subject earns nothing. In this task, the degree of risk aversion is negatively correlated with the number of parcels collected, and a risk-neutral subject should choose 50 parcels.

Implications from laboratory studies of risk-elicitation methods

Experimental evidence has shown that individuals’ attitudes toward risk vary greatly, with results that often differ across risk-elicitation methods. Despite these differences, some regularities have emerged in the literature. In particular, these studies often find that women are significantly more risk averse than men. Over the years, a consensus has emerged in the literature about such gender differences, and these differences have often been stressed in surveys of this branch of the literature [7]. Significant gender differences in risk aversion have also been found outside the laboratory, in studies involving representative samples of the population [8].

That women are more risk averse than men has become at a certain point a “stylized fact”—an empirical finding that is so consistent that it is accepted as a generalizable truth—in the experimental literature. Acceptance of gender differences in risk taking crossed over from experimental laboratories to studies in other fields, including labor economics [9]. What makes the labor market a particularly important environment for testing such differences in risk taking is the gender gap in achievement so commonly found in labor market studies. It has been argued that women's greater risk aversion is one reason why women are under-represented in high-level (and riskier) career paths [2].

Properly assessing the existence, significance, magnitude, and determinants of gender differences in risk attitudes has also great relevance to policy formation. The scope for active policy measures would shrink dramatically if the importance attributed to differences in risk preferences were high. Indeed, if unequal outcomes are seen to be driven by individual innate behavioral traits, interventions aimed at tackling unequal outcomes and differences in human capital accumulation would be largely ineffective. Some studies have shown that attitudes toward risk are not entirely immutable but can respond to different emotional states and external events. Nurture seems to matter, too, as women's risk preferences have been shown to react, for example, to the gender composition of the education environment [2]. However, risk attitudes are by and large considered to be an innate behavioral trait.

Despite the frequent mention of gender differences in risk preferences, a direct link has never been demonstrated between greater risk aversion and worse labor market outcomes. Nevertheless, any such potential mechanism should be investigated because the consequences, if true, are important. Some studies have found that higher risk aversion among women explains a large share of their lower likelihood of undertaking entrepreneurial activities. But the few studies analyzing the role of risk preferences in explaining differences in labor market outcomes between men and women find a negligible effect [10]. Moreover, the results in the experimental economics literature that have been used to support a claim of gender differences in risk preferences translate into approximately a 60% chance that a randomly chosen woman will have a higher risk aversion than a randomly chosen man [1]. That is not much higher than the 50% probability that would occur if the two groups were identical. A similar message is delivered by the observation that gender accounts for only 3–4% of the variance in risk aversion found in studies. In other words, the magnitude of the gender-based differences in risk attitudes in the literature points to an effect that is classified between small and medium by common statistical standards. Trying to explain a large phenomenon such as a difference on the order of 10% in the average wages of women and men using a3–4% variance in one of the possible determinants looks like a very long stretch.

Studies call into question the consensus about women being consistently more risk averse

Laboratory experiments are a useful methodology to investigate the existence and the significance of a qualitative relationship among variables. However, the validity of the results obtained cannot straightforwardly be extended outside the laboratory, and this constraint is even more binding when shifting to a quantitative perspective. While true in general, this caveat is particularly important when dealing with risk preferences, which are a multidimensional concept that encompasses domains far different from the gambling/financial sphere to which the risk-elicitation methods are usually applied. Moreover, the amounts at stake in a typical laboratory experiment are miniscule, on average in the order of $12, while the phenomena they would be called on to explain involve incentives that are incommensurably higher. Even in the original study of the Holt and Laury risk-elicitation method, significant gender differences in risk aversion appear only in the baseline condition but not in a control treatment in which the stakes are 20 times higher [3].

Besides the criticisms concerning the exportability of results obtained in the laboratory to the labor market, recent evidence has challenged the robustness of the experimental evidence about gender difference in risk attitudes. If the robustness of the evidence on which the consensus view is based is called into question, that would further weaken the asserted link between risk aversion and labor market outcomes.

One study questions the validity of the original results obtained through the investment game risk-elicitation method, arguing that the magnitude of the differences is smaller than originally reported [11]. Applying expanded statistical techniques to the same data, the study finds substantial similarity and overlap between the distributions of men and women in risk taking. It also finds a statistically detectable difference in means that is not substantively large.

Furthermore, another study shows that the earlier reported results supporting the view that men and women differ systematically in risk aversion may be based on a non-representative sample of the literature [1]. Thus, while gender differences are a consistent finding of studies based on both the investment game and the Eckel and Grossman risk-elicitation methods, the bomb risk-elicitation task does not yield the same findings. Moreover, the study claims that results based on the most widely used risk-elicitation task, the Holt and Laury method, have not been thoroughly analyzed. Surveying the contributions replicating the Holt and Laury risk-elicitation method, the study shows that gender differences are the exception rather than the rule [1]. Analysis of the original data for 54 published papers (covering about 7,000 test subjects), representing more than half of all the replications of the Holt and Laury task, finds that gender differences emerge in less than 10% of the published papers and that the magnitude of the differences varies greatly across methods. Thus, the average difference between men and women based on experiments using the Holt and Laury risk-elicitation method is about three times lower than the difference found using the investment game (based on the original data) or the Eckel and Grossman lottery choice task. By commonly used statistical standards, an effect of this magnitude does not even reach the threshold needed to be classified as a small effect, as shown in the Illustration.

The literature on risk aversion has regularly reported differences in risk preferences across tasks and fields of study. However, it is unlikely that such variation would be driven by idiosyncratic characteristics of the various studies [1]. Rather, the likelihood of observing gender differences in risk aversion seems to correlate with features of the task used to elicit risk preferences. In other words, it may be that not only do subjects react differently to different tasks, but that there are some regularities in the way even a group of subjects behave because of inherent differences in the tasks. For example, women tend to display more risk-averse behavior than men in the investment game and in the Eckel and Grossman task, show less difference from men in the Holt and Laury task, and no difference at all in the bomb risk-elicitation task.

New developments: What drives gender differences?

If measured risk preferences differ according to the risk-elicitation method used, it would be illuminating to find out why this is the case. Two recent studies aim at providing an answer. The first suggests that gender differences may be driven by the complexity of the task [12]. When the task is simple women display stronger risk aversion, while complexity tends to blur gender differences. This result is obtained by manipulating the degree of complexity of the Holt and Laury task (see Figure 1), but it is at odds with the observation that men and women behave indistinguishably in the fairly simple bomb risk-elicitation task (Figure 4).

The second posits that gender differences are more likely to be encountered when a safe option is available, meaning that subjects have the option of avoiding any risk [13]. For example, by choosing lottery 1 in the Eckel and Grossman task (Figure 2) or by allocating the entire endowment to the safe account in the investment game (Figure 3), subjects can secure some money without facing any risk. In contrast, neither the Holt and Laury task (Figure 1) nor the bomb risk-elicitation task (Figure 4) provides a riskless option: all the choices that may deliver a positive return entail some uncertainty.

Limitations and gaps

While the finding that risk preferences differ according to the risk-elicitation method used is interesting and novel, the evidence is preliminary and further research is necessary. Moreover, such an explanation is not likely to account fully for the observed pattern of gender differences in risk attitudes, whose determinants still remain in part unexplained.

Recent contributions to the literature on gender and risk aversion have shown that the widely made assertion that women are more risk averse than men is too one-dimensional. The availability of a safe option in the set of alternatives may explain at least part of the observed pattern of gender differences, but the evidence is not conclusive and what determines the variation in results should still be regarded as largely unknown.

Moreover, risk preferences are difficult to measure as they are a multidimensional construct, entailing domains that may differ in important ways from the gambling/financial area of the experimental studies commonly used to elicit risk preferences. And questionnaires designed to investigate additional domains of attitudes toward risk (such as health and recreation), which rely on respondent self-reporting, do not deliver more stable results.

Summary and policy advice

The economics literature has come to accept the generalization derived from experimental studies rooted in the gambling/financial domain that women are more risk averse than men. This finding has recently been used in labor economics studies to explain unequal gender-based outcomes in the labor market. As long as bonuses based on a company's performance account for a large share of remuneration in high-paying jobs, the argument goes, women, because they are more risk averse, are less likely to choose such a career path because of the uncertainty involved.

Recent contributions to the experimental economics literature have challenged this consensus about gender differences in risk attitudes, arguing that beliefs about higher risk aversion among women are stronger than the evidence supporting them. There is no direct evidence demonstrating that greater female risk aversion can explain why women are under-represented in top-level positions in the labor market. Moreover, some recent contributions to the literature have challenged the consensus by showing that gender differences in risk attitudes are neither large nor ubiquitous. Rather, gender explains only a very small fraction of the variance in risk attitudes, and finding such differences depends on the method used to elicit the risk preferences. Thus, further research is needed to understand under what conditions women behave in a more risk-averse manner than men. The determinants of such behavior are yet to be discovered, apart from the role that may be played by the availability of a riskless option, which seems to increase the likelihood of finding differences between men and women.

Overall, there is no evidence that gender differences in risk attitudes can explain unequal outcomes in the labor market. If confirmed, this absence of a proven link would be good news. Risk preferences, although shown to react to the environment (such as responding to different emotional states and to differences in upbringing), are still considered to be mainly an innate behavioral trait. Attributing gender differences in labor market outcomes to gender differences in attitudes toward risk would imply that policy interventions could play only a very restricted role in dealing with unequal outcomes. Finding that risk preferences play a limited role, if any, leaves plenty of room for policies aimed at eliminating discrimination and supporting women's participation in the labor market.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Version 2 of the article includes new evidence discussing under which conditions women display a more risk averse behavior, and adds new “Key references” [12], [13]

Competing interests

The IZA World of Labor project is committed to the IZA Code of Conduct. The author declares to have observed the principles outlined in the code.

© Antonio Filippin