Elevator pitch

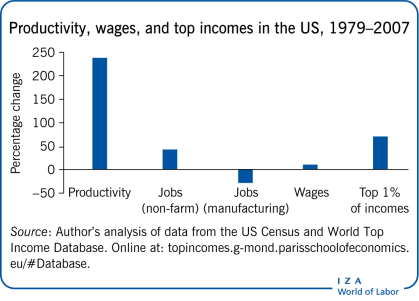

Automation and globalization have brought about a tremendous increase in productivity, but also accelerated job destruction, systemic risks, and greater income inequality. Current social policies may not be adequate for achieving the goals of redistributing the gains from automation and globalization, providing efficient buffers against economic shocks, and advancing the reallocation of jobs and skills. Under certain circumstances, an unconditional basic income might be a better alternative for achieving those goals. It is simple, transparent, and has low administrative costs, though it may require higher taxes.

Key findings

Pros

Unconditional basic income can redistribute the benefits from automation and globalization.

Since it is not conditional on income, unconditional basic income does not create “poverty traps.”

Unconditional basic income is simple and transparent, with low administrative costs.

Unconditional basic income is an efficient buffer against shocks and systemic risks from automation and globalization.

Some evidence from experimental studies suggests that unconditional basic income might have positive effects on labor supply and education and occupation choices.

Cons

Unconditional basic income is very costly to implement and requires higher taxes to finance it.

Microsimulation studies suggest that unconditional basic income might reduce labor supply because of the income effect of the transfer and the substitution effect of the higher taxes needed to finance the transfer.

Unconditional basic income might lead to a reduction in effort, motivation, and autonomy.

Unconditional basic income also benefits the “undeserving.”