Elevator pitch

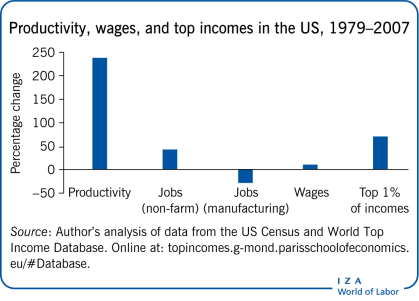

Automation and globalization have brought about a tremendous increase in productivity, but also accelerated job destruction, systemic risks, and greater income inequality. Current social policies may not be adequate for achieving the goals of redistributing the gains from automation and globalization, providing efficient buffers against economic shocks, and advancing the reallocation of jobs and skills. Under certain circumstances, an unconditional basic income might be a better alternative for achieving those goals. It is simple, transparent, and has low administrative costs, though it may require higher taxes.

Key findings

Pros

Unconditional basic income can redistribute the benefits from automation and globalization.

Since it is not conditional on income, unconditional basic income does not create “poverty traps.”

Unconditional basic income is simple and transparent, with low administrative costs.

Unconditional basic income is an efficient buffer against shocks and systemic risks from automation and globalization.

Some evidence from experimental studies suggests that unconditional basic income might have positive effects on labor supply and education and occupation choices.

Cons

Unconditional basic income is very costly to implement and requires higher taxes to finance it.

Microsimulation studies suggest that unconditional basic income might reduce labor supply because of the income effect of the transfer and the substitution effect of the higher taxes needed to finance the transfer.

Unconditional basic income might lead to a reduction in effort, motivation, and autonomy.

Unconditional basic income also benefits the “undeserving.”

Author's main message

Economic reasoning and empirical evidence suggest that, under certain conditions, unconditional basic income might be an important policy innovation for redistributing the gains from automation and globalization, building a buffer against shocks and systemic risks, and generating positive labor supply incentives among poor people. While an unconditional basic income policy is simple and transparent, with low administration costs, financing it might require higher taxes. Although the evidence on implied efficiency losses is mixed, carefully designed taxes can avoid the risk of canceling the potential benefits of unconditional basic income through efficiency losses.

Motivation

High unemployment and job insecurity are in part a consequence of the Great Recession following the economic and financial crisis of 2008–2009. More fundamentally, however, they are a byproduct of automation and globalization. Along with large potential gains, these processes bring massive dislocations, including job losses, shocks, and systemic risks (see Automation, globalization, and basic income). There is evidence that the gains from automation and globalization end up in just a few hands and are likely smaller than they might otherwise be because of the lack of efficient redistribution channels. Thus, failing to design an efficient means of redistributing the benefits may prevent some of the potential benefits from materializing. Designing income support policies that work well as both buffers against the volatility inherent in the global economy and as redistribution mechanisms for the gains from automation and globalization requires first considering how well current social assistance policies meet those goals.

Discussion of pros and cons

From welfare to workfare

There are several types of income maintenance policies, and the terminology used for them can be confusing. Guaranteed minimum income or minimum income guarantee policies envisage transfers that guarantee a minimum level of income. The transfers may be subject to some selection criterion (for example, only single mothers under age 25) or condition (such as means testing or work requirements). If there are no selection criteria, the policy is described as universal, and if there are no conditions, it is described as unconditional. The negative income tax guarantees a minimum level of income, but the size of the transfer depends on the person’s own income (means testing). In some implementations, negative income tax-like mechanisms might include a work requirement (such as requiring a minimum number of hours of work). There are also non-means-tested transfers that are subject to behavioral conditions, such as sending children to school; these are referred to as conditional cash transfers. The unconditional basic income measure discussed here envisages an unconditional transfer. When unconditional basic income is also universal (given to every citizen), it is sometimes referred to as citizen income. Sometimes the qualifiers “universal” and “unconditional” are used equivalently.

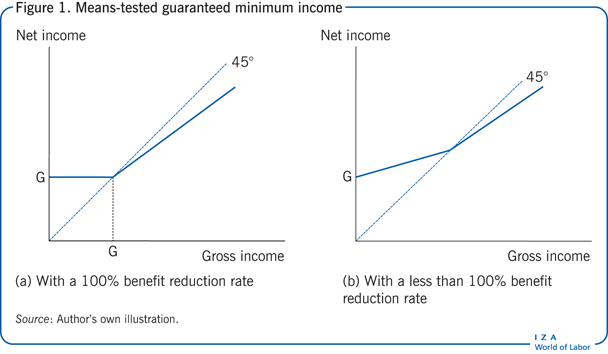

Until the late 1990s and early 2000s, the social assistance policies of most industrialized countries were close to a (more or less generous) means-tested guaranteed minimum income, with a high implicit benefit reduction rate (the rate at which benefits are withdrawn as the recipient’s own earnings increase). In Figure 1(a), the heavy line represents the relationship between gross income and net available income under a conditional guaranteed minimum income policy. To keep things simple, the policy is depicted under the extreme hypothesis of a 100% benefit reduction rate (a €1 reduction in benefits for each additional euro of earnings until earnings reach G). Figure 1(a), again for simplicity, also assumes that a flat tax is applied to gross income exceeding G. Such mechanisms are known to weaken the incentives to work (a “poverty trap” effect, which prevents people from escaping poverty). In Figure 1(a), putting aside non-pecuniary motivations, there is no point in working for earnings below G, and there might be no point in working at all without the opportunity and the willingness to earn sufficiently more than G.

Automation, globalization, and the recession inflated the number of people in need of assistance and, in turn, the volume of social expenditure. Many industrialized countries responded by moving toward less protection, greater selectivity, and more sophisticated means testing and eligibility conditions: reducing guarantees, increasing work incentives (through tax credits, wage subsidies, and behavioral requirements as a condition for receiving benefits), and narrowing the segment of the population qualifying for income support. Figure 1(b) depicts a conditional guaranteed minimum income with a less than 100% benefit reduction rate—an incentive-augmented conditional guaranteed minimum income. Although such policies are useful for managing short-term income support programs and moderating poverty trap effects, they do not meet the goal of an efficient mechanism of global redistribution.

The policies actually implemented are much more complicated than the stylized versions in Figure 1(a) and (b). The typical means-tested and selective regimes are a chaotic overlapping of interventions that do not favor transparency or rational decision-making. These multiple measures may also increase monitoring and litigating costs and may open up opportunities for fraud and error.

Critical analyses of these policies point out that program designs with more sophisticated incentives and eligibility conditions do not completely overcome the deficiencies of means-tested and conditional policies while introducing new problems [1], [2]. Incentive-augmented conditional minimum income policies do not eliminate the poverty trap. And they do not eliminate other problems, including take-up costs, stigma, and paternalism, that lead to low take-up rates and marginalization [3]. Programs focusing on wage subsidies or tax credits for low-income earners introduce additional distortions by favoring sectors that employ low-wage workers [4].

An alternative: Unconditional basic income

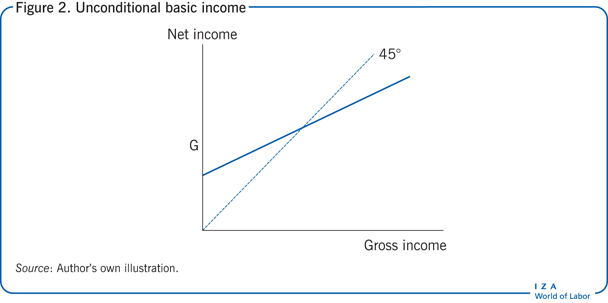

An alternative policy might provide an unconditional basic income for everyone, as shown in Figure 2, where G now represents the unconditional benefit. For simplicity, as in Figure 1(a) and (b), income is taxed at a flat rate.

Benefits of an unconditional basic income policy

An unconditional basic income policy promises an efficient, flexible, and automatic mechanism for protecting against shocks and redistributing the benefits of automation and globalization. The idea of paying everyone an unconditional amount of money goes back to Thomas Payne’s pamphlet Agrarian Justice, which called for compensating the original “owners” of the commons (by definition, everyone), which had been expropriated when land holding became private. More generally, the returns from an efficiently exploited common resource should be (to some extent) distributed among the resource’s original owners. The gains from automation and globalization are similar to the returns from an efficiently exploited natural resource in that they introduce more efficient ways of producing and exchanging goods at the cost of “expropriating” the jobs and skills of the original stakeholders.

An unconditional basic income policy would respond automatically to the volatility and shocks inherent in the globalized economy [4]. Moreover, it would provide an efficient mechanism for reallocating jobs and resources in the globalized economy, where employers need flexibility to compete on a global scale and employees need support to redesign their careers and occupational choices. Studies find that a considerable number of recipients of unconditional cash transfers use the money to cover training in new skills and related costs of changing jobs. Economic theory suggests, and recent empirical analyses confirm, that unconditional basic income policies can eliminate poverty traps [5], [6].

According to US estimates, the administrative cost of a non-means-tested transfer such as an unconditional basic income is around 1–2%. Means testing boosts the cost to four or five times that amount. Means testing introduces obvious incentives for income underreporting and erroneous reporting, such as incorrect inclusions and exclusions. For example, the rate of overpayment due to fraud and error in the UK in 2010 is estimated at around 1% for non-means-tested benefits and 4% for means-tested ones. Moreover, the costs (monetary and other) to recipients of means-tested transfers are substantial, as can be inferred from take-up rates well below 100% [3].

Challenges to implementing an unconditional basic income policy

Several arguments are presented against unconditional basic income. Chief among them is the claim that such policies also benefit the “undeserving.” That complaint is based on a false perception. While it is true that everyone is entitled to the same basic income benefit, taxation becomes progressive (even with a flat tax rate), so there is a level of gross income beyond which the benefit is exhausted: in Figure 2, it corresponds to the intersection of the heavy line with the dotted line, where gross and net income are equal.

Two other critical issues when considering unconditional basic income as an alternative to current policies are the cost and the effect on effort (labor supply, motivation), including the effect of the taxes required to pay for the benefit.

The gross cost of unconditional basic income is obviously large, although the precise cost depends on the size of the benefit. The net cost depends on whether unconditional basic income replaces other policies and to what extent, as well as on the size of the replaced expenditures. Where the social protection system is large (as in the Scandinavian countries), it might be possible to finance unconditional basic income simply by replacing current social assistance policies. In Mediterranean European countries, where expenditures on income support are much smaller, replacing them would probably not be sufficient to cover the cost of an unconditional basic income transfer at a realistic level of benefits [5], [6].

Economic theory suggests that unconditional basic income might have a negative income effect on labor supply, as a higher disposable income for a given number of hours worked would induce people to supply less labor and to consume more leisure time. An unconditional basic income policy might also induce negative substitution effects—for example, if it is financed through higher marginal tax rates on income or wealth. The economic logic is that higher marginal tax rates mean lower net wage rates since the unit gain from one more hour of work declines, inducing people to work less than they otherwise would, again substituting leisure for work.

The evidence on the effects on effort is not conclusive, especially as implementation of unconditional basic income policies is limited (see Studies on unconditional basic income). Alaska is the only known case of widespread implementation of a redistribution policy that is analogous to an unconditional basic income measure, although the amount of the transfer is very small.

Empirical evidence on unconditional basic income policies

During the 1970s and 1980s, the findings of experiments on US social welfare programs are believed to have undermined the favorable attitudes toward universal social policies that characterized the political and academic debate in the 1960s and early 1970s. More recently, however, new analyses suggest that the negative conclusions originally drawn from the data are based on improper interpretation of the findings or bad design of the experiments [7].

Recent experiments and pilot studies in India, Namibia, and Uganda reveal that universal and unconditional transfers, far from encouraging idleness, create positive incentives by strengthening recipients’ sense of autonomy and responsibility and by avoiding paternalism or stigma effects. Positive results include an increase in labor supply and productive activity and improvements in human capital (education, occupational choice, health). It remains to be seen whether similar results would emerge in industrial countries. The positive incentives created by these programs offer promise as well for easing the dramatic adjustments required by automation and globalization, which include a reallocation of labor and other resources. Mechanisms such as unconditional basic income can help people—financially and possibly motivationally—investing in new skills and search for jobs in new sectors.

Quasi-experimental studies have also been conducted. Lottery winners are ideal subjects for studying the effect of exogenous variation in unearned income on subsequent choices, particularly on labor supply decisions (see Studies on unconditional basic income).

Another approach is microsimulation (see Behavioral microsimulation of benefit and tax reforms). A comprehensive behavioral microsimulation analysis of income support policies in Italy focuses on social welfare rather than labor supply [5], [6]. Besides Italy’s current policy (a set of categorical and strongly selective means-tested transfers), five types of reforms are evaluated: guaranteed minimum income, unconditional basic income, wage subsidy, and two mixed types, guaranteed minimum income plus wage subsidy and unconditional basic income plus wage subsidy. The simulations assume that the reforms are financed by canceling all current social assistance policies and, if necessary, proportionally increasing the current marginal tax rates on personal incomes above a certain threshold. The optimal policy turns out to be an unconditional basic income equal to 70–100% of the poverty line (depending on how equalitarian the social evaluation criterion is), requiring a top marginal tax rate of 50–60%. These figures are high but not unrealistic. For example, in 2009 the top marginal tax rate was around 62% in Denmark and 57% in Sweden.

But even if such tax rates are judged infeasible, the menu of other welfare-improving reforms is large. For example, when combined with a flat tax instead of a progressive tax, the unconditional basic income (70% of the poverty line) would require a 42% flat rate. Moreover, alternative sources (wealth, consumption, externalities) of tax revenue could be considered. The effects on labor supply are negligible for men and modest for women. The unconditional basic income pays average benefits three times larger than the guaranteed minimum income, and yet the effect on hours worked is essentially the same because of the poverty-trap effects of the guaranteed minimum income. The substitution effect of higher taxes on high incomes is modest because estimated labor supply elasticities are essentially nil for high-income earners. While recent estimates of large elasticities of taxable income (rather than labor supply) among high-income earners received considerable attention, there is evidence suggesting that a large part of this response consists of tax evasion—relabeling income sources. This might be relevant for the public budget constraint but not for efficiency.

Other behavioral microsimulation exercises addressing unconditional basic income or related reforms have been performed for Australia, Canada, and Germany, [8], [9], [10]. For Canada and Germany, the focus of the studies is on labor supply effects; for Australia, the study also adopts a social welfare criterion, as in the analysis for Italy [5], [6]. The reduction in labor supply (for secondary workers) is found to be larger than in the Italian case. Besides differences in labor market institutions and possibly in preferences, differences in modeling approach may also explain some of the differences in labor supply effects. In any case, the negative effects on labor supply are serious enough to raise doubts about the viability of unconditional basic income-like policies. Yet, the Australian study reveals that unconditional basic income might be social welfare-enhancing despite the reduction in labor supply.

Understandably, concern about labor supply effects is central in a short-term perspective. However, in a longer-term perspective, the simple effects on hours of work and participation lose their prominence. A reduction in labor supply is precisely what one might (favorably) expect from a redistribution of the gains from automation and globalization. If automation increases output with less labor and if globalization pushes mature economies toward more advanced and labor-saving processes, the redistribution of the gains might indeed imply a reduction in (market-based) work. In practice, this means that when reforms are evaluated, evaluation criteria based only on changes in labor supply or income might be misleading in view of one of the main purposes of the reform itself. The value of time and resources allocated to non-labor market activities must be taken into account, as in [5] and [6]. Ultimately, the possibly negative impact on labor supply of unconditional basic income policies boils down to asking about how serious the trade-off is between efficiency and equality. At the macro level, econometric analyses find little evidence of a trade-off [11]. Moreover, behavioral microsimulation exercises show that some reforms and combinations of reforms are both efficiency- and equality-enhancing [12].

Limitations and gaps

Economists have given much less attention to analyzing unconditional basic income than to policies such as tax credits or conditional cash transfers. Some experiments are being done in developing countries but not in developed countries (at least recently). Experiments are important because they permit the direct identification of causal effects. The analysis of long-term dimensions of labor supply, such as education and occupation choices, would also benefit from experiments and the use of long-term panel data.

Still missing, except for a few individual estimates, is a systematic comparison of administrative costs (monitoring, delivery, litigation) of unconditional basic income compared with conditional or means-tested policies.

There is abundant—although not univocal—evidence of the substitution effects of income-related taxes and benefits on labor supply. The evidence for income effects is more controversial and less robust. Yet, such evidence is crucial for comparing unconditional basic income with alternative policies. In addition, relatively little is known about the labor supply effects of taxing wealth rather than income.

Summary and policy advice

The theoretical and empirical evidence is sufficient to suggest that unconditional basic income might be a viable alternative, or a complement, to selective and conditional social assistance policies. Unconditional basic income appears to be an especially sound approach for redistributing the gains from automation and globalization, by building an efficient and transparent buffer against global volatility and systemic risks, generating positive incentives, and avoiding recurrent risks of falling into poverty.

Compared with means-tested and conditional policies, unconditional basic income is likely to be a winner under most criteria used for comparison. A possible exception is the cost of an unconditional basic income policy (relative to the cost of means-tested policies) and the distortions that might be introduced by raising taxes to cover the cost of the program. Alternatives to progressive income taxation should be investigated, such as a flat tax, wealth tax, consumption taxes, or environmental taxes. There may also be room to combine unconditional and conditional benefits, to some degree, as in [5] and [6]. Along the same lines, cash transfers conditional on recipients taking certain education or health steps might represent an interesting and less extreme version of unconditional basic income.

Unconditional basic income policies could initially be introduced as a partial substitute for current means-tested and other conditional transfers, possibly limiting it to segments of the population identified on the basis of exogenous characteristics, such as age and gender.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Ugo Colombino

Automation, globalization, and basic income

Sources: Hughes, J. J. “A strategic opening for a basic income guarantee in the global crisis created by AI, robots, desktop manufacturing and biomedicine.” Journal of Evolution and Technology 24:1 (2014): 45–61.

Krugman, P. “Sympathy for the Luddites.” The New York Times, June 13, 2013.

Marchant, G. E., Y. A. Stevens, and J. M. Hennessy. “Technology, unemployment & policy options: Navigating the transition to a better world.” Journal of Evolution and Technology 24:1 (2014): 26–44.

Sachs, J. D., and L. J. Kotlikoff. Smart Machines and Long Term Misery. NBER Working Paper No. 18629, 2012.

Spence, M. “Globalization and unemployment: The downside of integrating markets.” Foreign Affairs, July/August 2011.

Standing, G. “Responding to the crisis: Economic stabilization grants.” Policy & Politics 39:1 (2012): 9–25.

Studies on unconditional basic income

Sources: Blattman, C., N. Fiala, and S. Martinez. Employment Generation in Rural Africa: Mid-Term Results from an Experimental Evaluation of the Youth Opportunities Program in Northern Uganda. DIW Berlin Discussion Paper No. 1201, 2012.

Imbens, G., D. Rubin, and B. Sacerdote. Estimating the Effect of Unearned Income on Labor Supply, Earnings, Savings and Consumption: Evidence from a Survey of Lottery Players. NBER Working Paper No. 7001, 1999.

Marx, A., and H. Peeters. “An unconditional basic income and labor supply: Results from a pilot study of lottery winners.” The Journal of Socio-Economics 37:4 (2008): 1636–1659.

Pasma, C. Basic Income Programs and Pilots. Calgary: Basic Income Canada Network, 2014.

Widerquist, K. “A failure to communicate: What (if anything) can we learn from the negative income tax experiments?” Journal of Behavioral and Experimental Economics 34:1 (2005): 49–81.

Behavioral microsimulation of benefit and tax reforms

Sources: Aaberge, R., and U. Colombino. “Labour supply models.” In: O’Donoghue, C. (ed.). Handbook of Microsimulation Modelling. Bingley, UK: Emerald Group Publishing Limited, 2014.

Aaberge, R., and U. Colombino. “Using a microeconometric model of household labour supply to design optimal income taxes.” Scandinavian Journal of Economics 115:2 (2013): 448–475.