Elevator pitch

In the presence of rigid prices, movements in the exchange rate help to absorb external shocks and to reduce changes in net exports. However, they also affect firms’ competitiveness, marginal costs, and labor demand. In countries where labor market institutions hinder wage adjustment (for example due to high union density or more rigid collective bargaining agreements), firms are less competitive: labor demand is then more sensitive to external shocks, increasing the risk of unemployment.

Key findings

Pros

When prices are rigid, flexible exchange rates help to absorb external shocks and stabilize net exports.

In choosing its optimal interest rate, the monetary authority of a currency area should assign larger weights to economic fluctuations in countries with weaker labor market institutions (i.e. those more vulnerable to external shocks).

Cons

Changes in exchange rates amplify variability in firms’ marginal costs and labor demand, thereby impacting employment and unemployment.

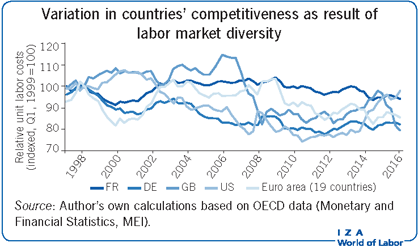

Labor market institutions vary across countries and affect firms’ competitiveness differently; weaker labor market institutions increase wages and marginal costs and reduce firms’ competitiveness

Countries belonging to the euro area feature asymmetric labor market institutions, with peripheral countries being less able to cope with unfavorable external or other common shocks.