Elevator pitch

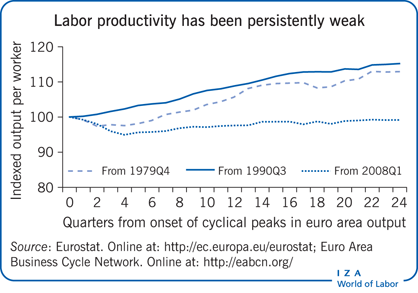

By supporting aggregate demand, including by easing financial constraints that affect businesses and households, accommodative monetary policy increased employment during the 2008 financial crisis and its aftermath. But, monetary policies that ease financial pressures also reduce necessary restructuring that normally contributes to productivity growth. One reason why productivity growth has been weaker in the aftermath of the crisis is that aggressive monetary policy actions have weakened underlying supply-side performance and labor productivity.

Key findings

Pros

Policy loosening by central banks initially raises demand for labor by reducing the effect of financial constraints on employment through lower interest expenses.

A severe fall in labor demand and reductions in employment can weaken an economy’s supply-side performance through increased long-term unemployment and loss of potentially productive businesses; such effects reinforce the benefits of accommodative monetary policy during a downturn, at least initially.

Cons

Budget constraints necessitate the reallocation of resources to more productive uses; highly accommodative monetary policies that reduce financial pressures may mitigate this effect and thus weaken the underlying supply side of the economy.

Monetary policy easing may reduce the positive effects of resource allocation to a greater degree in economies whose financial systems are bank-based as opposed to market-based.