Elevator pitch

In the presence of rigid prices, movements in the exchange rate help to absorb external shocks and to reduce changes in net exports. However, they also affect firms’ competitiveness, marginal costs, and labor demand. In countries where labor market institutions hinder wage adjustment (for example due to high union density or more rigid collective bargaining agreements), firms are less competitive: labor demand is then more sensitive to external shocks, increasing the risk of unemployment.

Key findings

Pros

When prices are rigid, flexible exchange rates help to absorb external shocks and stabilize net exports.

In choosing its optimal interest rate, the monetary authority of a currency area should assign larger weights to economic fluctuations in countries with weaker labor market institutions (i.e. those more vulnerable to external shocks).

Cons

Changes in exchange rates amplify variability in firms’ marginal costs and labor demand, thereby impacting employment and unemployment.

Labor market institutions vary across countries and affect firms’ competitiveness differently; weaker labor market institutions increase wages and marginal costs and reduce firms’ competitiveness

Countries belonging to the euro area feature asymmetric labor market institutions, with peripheral countries being less able to cope with unfavorable external or other common shocks.

Author's main message

Exchange rate fluctuations affect firms’ competitiveness and, hence, countries’ employment and output dynamic. If the detrimental effects of exchange rate fluctuations on the labor market prevail, then the monetary authority should smooth exchange rate fluctuations. In the euro area, weaker labor market institutions reduce the competitiveness of peripheral countries. In the short term, expansionary monetary policies help improve peripheral countries’ competitiveness by inducing devaluation of the common currency, which entails positive spillovers for the entire euro area.

Motivation

Following the collapse of Bretton Woods—which established the rules for commercial and financial relations among the US, Canada, Western Europe, Australia, and Japan after World War II—(which dissolved between 1968 and 1973), fluctuations in nominal and real exchange rates have become the norm. In recent years, movements in the real exchange rate have also included two prominent episodes of large and sudden appreciations: the Swiss franc between 2008 and 2012 and the Norwegian krone in the early 2000s.

Changes in the exchange rate affect firms’ competitiveness. This is due to two main reasons. First, movements in exchange rates affect firms’ export’ prices, hence revenues. Second, in imperfectly competitive markets, changes in real exchange rates affect profit’ margins (mark-ups), which, in turn, affect firms’ marginal costs. Changes in the latter induce firms to adjust their labor demand (hiring and firing), which subsequently impacts countries’ employment/unemployment and output dynamic. Amplifications in exchange rate fluctuations, coupled with the advent of globalization, which increased firms’ exposure to external shocks, have further widened variations in firms’ competitiveness. For these reasons, the link between exchange rates and the labor market should hold a prominent role in determining short-term policies, such as monetary policies.

Discussion of pros and cons

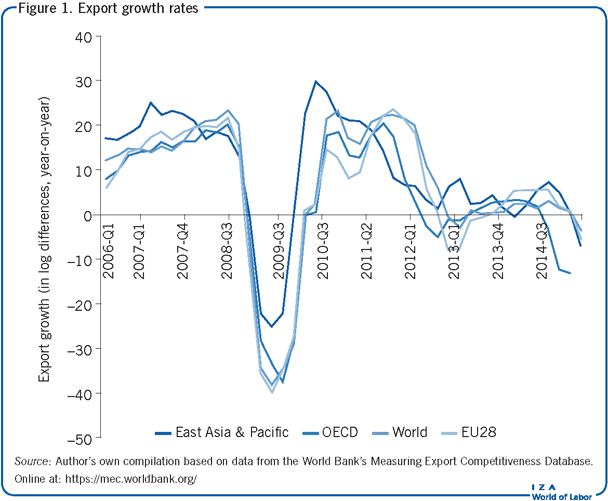

The extent of fluctuations in countries’ competitiveness in recent years can be well appreciated by examining Figure 1, which shows export growth (which is a proxy for country competitiveness) over the last decade worldwide and for a set of countries, namely the OECD, the EU28, and the East Asia and Pacific countries. Each region is compared to export growth at the global level. Fluctuations in the competitive index are, to a large extent, due to cyclical fluctuations common at the global level. In the aftermath of the 2007–2008 crisis, for instance, exports had been falling worldwide.

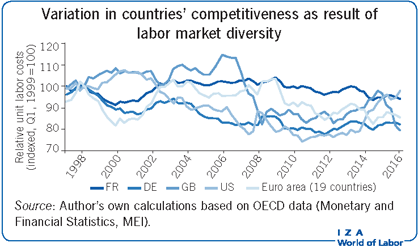

Despite the fact that countries have experienced similar patterns of competitiveness, firms’ costs have reacted very differently to the 2007–2008 crisis. The Illustration plots the competition-weighted relative unit labor costs for selected developed countries, namely the US, Germany, France, the UK, and the euro area (19 countries), over the sample period 1998–2016 (see also [1] for a similar metric). The patterns show that, once adjusted for competitiveness, labor costs change significantly over time and across countries. Firms in different countries react differently to changes in competitiveness since they face different labor market institutions, which affect their ability to adjust wages and labor costs in response to external shocks.

Greater fluctuations in exchange rates (coupled with increased trade globalization) have amplified variations in firms’ competitiveness, which, in turn, affects firms’ labor unit costs. In some countries labor market institutions are associated with higher labor market frictions. In those countries, higher wages or wages that adjust less to external shocks deteriorate firms’ competitiveness. The impact of exchange rate fluctuations on the labor market has always played a prominent role in the policy debate as well as in the trade and monetary literatures, which have studied the above-mentioned links extensively.

Impact of exchange rates on firms’ competitiveness

One relevant study shows empirically that the impact of exchange rate changes on firms’ market shares and prices increases with higher trade globalization [2]. As foreign firms enter domestic markets, competition increases, making market shares and prices (hence firms’ revenues and margins) more responsive to changes in the exchange rate.

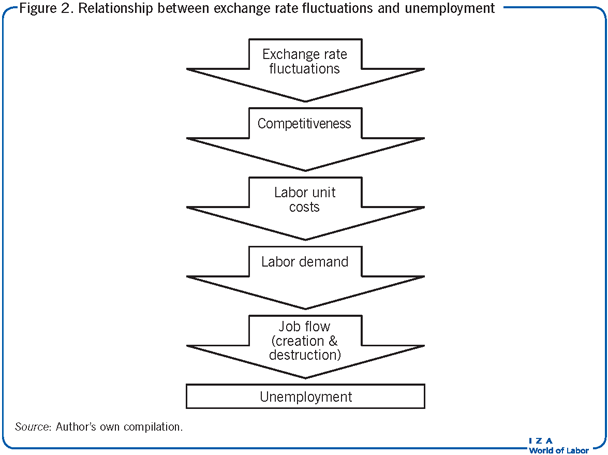

A long-standing literature has also shown that by affecting firms’ marginal labor costs, changes in competitiveness alter firms’ labor demand, which, in turn, impacts the variability of job flows (job creation and destruction, hence employment and unemployment). Consider an increase in the exchange rate (appreciation): this makes exports more expensive relative to imports, hence it reduces the first and increases the second. The fall in exports reduces exporting firms’ profit margins. If firms cannot adjust wages, hence their cost margins, they will instead reduce their demand for workers, hence employment. The larger the increase in the exchange rate is, the larger the drop in employment is. Several studies have shown that variability in exchange rates has a significant impact on the variability of US employment and wages [3], [4]. Another study also empirically documents the link between firms’ openness to trade and employment volatility [5]. Figure 2 presents a flow diagram outlining the general relationships linking exchange rate fluctuations to unemployment.

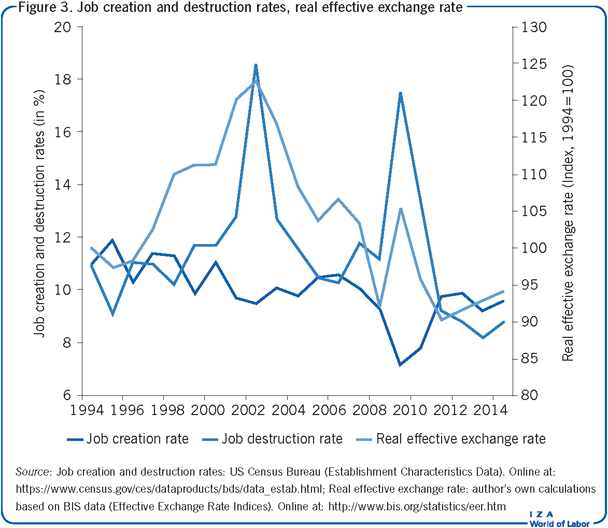

Employment variability is mainly driven by variability in job flows, namely job creation and destruction. If exchange rate variability affects employment variability, it is also important to establish a link between exchange rates and job flows. Figure 3 confirms the link between fluctuations in exchange rates (hence in firms’ competitiveness) and job flows by looking at US data. The figure plots the patterns of job creation and job destruction against fluctuations in the real exchange rate for the US over the sample period 1994–2014. The strong co-movement between job destruction and the real exchange rate confirms the importance of the link between competitiveness, job flows, and unemployment. Consider, as before, an increase in the exchange rate. This reduces exports, hence firms’ profit margins. As firms need to adjust their cost margins they will partly reduce their demand for workers, hence employment.

As countries exhibit different labor market institutions, and thus different labor market frictions, fluctuations in the exchange rate, hence in firms’ competitiveness, will have different impacts on how firms will adjust labor demand, thereby affecting the elasticity of labor demand. For example, one study documents the impact of labor market institutions on the elasticity of labor demand to trade [6]. Notice that the more a country is open to trade, the more its firms experience the consequences of variability in exchange rates.

In the trade literature, a group of researchers tackled the above question by using a model with exporting firms that can decide to enter and exit foreign markets and that face labor market frictions (in the form of search frictions). They show that different labor market rigidities provide a form of Ricardian competitive advantage, meaning that firms are more competitive, hence more resilient to external shocks, in the presence of lower labor market frictions [7]. As a result, in countries with weaker labor market institutions, increasing openness to trade might increase unemployment. Along similar lines, another study shows that international differences in labor market regulations affect how firms can adjust to shocks [8].

Likewise, it has been shown that labor market institutions matter for the adjustment of wages and job flows to external shocks [9]. The main channel is the one highlighted so far. External shocks or shocks to the exchange rate affect firms’ competitiveness and profit margins. Firms shall, in turn, adjust labor costs, hence labor demand. Using data for a sample of euro area countries, the authors show that wage (as well as inflation) volatility is negatively related to unemployment benefits and union density. This implies two things. First, that in countries with high union density or high unemployment benefits, wages adjust less in response to external shocks. Second, that firms, wishing to reduce their labor costs, will adjust labor demand, hence employment. The authors use a model and rationalize this empirical link in a more specific way, as follows. High unemployment benefits or high workers’ bargaining power (due, for instance, to high union density) compress firms’ profits and increase wages in the long term. In the short term, wages respond less while firms’ profits respond more to external shocks. Hence, in the face of adverse external shocks, firms’ profits fall sharply, wages remain stable and rigid, and firms fire more workers.

The empirical channels highlighted above pose two important questions for monetary policy, which can deal, in the short term, with exchange rate management. First, if changes in the exchange rate have a detrimental impact on the labor market (the more so the weaker its institutions), it is important to know to what extent the monetary policy should target currency fluctuations. Second, if countries belonging to a currency area (a system of credibly fixed exchange rates) exhibit different labor market institutions (hence differential responses to third-country shocks), it is important to know to what extent the common monetary authority should take those asymmetries into account.

When should authorities intervene to smooth exchange rates?

Two considerations are important in establishing whether a country’s monetary authority should smooth exchange rate fluctuations—by changing the interest rate or the money supply—because of their detrimental effect on the labor market. First, the authority should consider if and to what extent exchange rate fluctuations may have beneficial effects. Second, the monetary authority should target exchange rate fluctuations only to the extent that the ensuing labor market fluctuations are inefficient.

With respect to the first issue, it is well established in the traditional theory of exchange rate regimes that, in the presence of price rigidities, flexibility in the exchange rate helps to absorb external shocks, which might otherwise produce large changes in net exports. Consider as before an increase in the exchange rate. If domestic prices are fully flexible, they can adjust to compensate for the changes in the exchange rate so that exports do not change. This effect is known as the “insulating property” of the flexible exchange rate [10]. However, in practice, prices, but also wages, are not fully flexible and, as stated before, labor market frictions can hinder the adjustment of firms’ labor costs. Under those conditions, exchange rate fluctuations induce fluctuations in firms’ profits, and, in turn, in labor demand. The resulting increase in employment variability is detrimental to output growth. To the extent that workers and consumers are risk-averse, variability in output and employment might reduce their welfare. In designing the optimal policy response to external shocks, policymakers must consider the above trade-off and choose an exchange rate response by balancing those two effects.

One recent study tackles this question by examining the optimal exchange rate regime (namely the optimal response of the monetary authority to exchange rate fluctuations) using a model where countries are open to trade and experience labor market frictions in the form of “congestion externalities” [11]. Two main results emerge from the analysis. First, in response to external shocks that change terms of trade across countries, it is optimal for the monetary authority to change interest rates so as to reduce fluctuations in the exchange rate. Furthermore, as external shocks modify exchange rates and exports, hence firms’ labor demand, changing interest rates to reduce variability in the exchange rate will, in turn, help stabilize employment variability. Second, the response to the exchange rate should be larger for countries with stronger labor market frictions (due to weaker labor market institutions). If larger labor market frictions hinder the ability of firms to cope with external shocks, the monetary authority has higher incentives to reduce exchange rate fluctuations.

At this stage, it is important to clarify to what extent labor market institutions might induce inefficient fluctuations in employment. One relevant study shows that unemployment fluctuations are inefficient whenever workers’ bargaining power in negotiations is too large compared to the efficient share of the surplus that workers should receive from production. Under these circumstances, workers extract large wages relative to their contribution in production. This increases firms’ marginal labor costs and can reduce production. Additionally, since workers can extract large wages, too many of them (relative to available vacancies) search for a job. This reduces the likelihood of finding a job and induces a congestion externality into the labor market. In this case, it might be optimal for the monetary authority to reduce the interest rate and increase demand, hence production.

Exchange rate effects within a currency area

As discussed above, when labor market frictions induce inefficient fluctuations in employment/unemployment and when firms change their labor demand in response to external shocks, it is optimal to smooth or fix the exchange rate. This is the choice made by countries that form or choose to belong to a currency area, as this is effectively a means of establishing a stable exchange rate. However, countries belonging to a currency area might still be exposed to other external shocks that change their relative price (even as the nominal exchange rate is fixed). Consider the case of the euro area. All countries are exposed to the same worldwide external shocks. However, since they have different labor market institutions they react differently to the same external shock [9]. Since the European Central Bank decides on a common monetary policy, the question arises as to whether it should take into account those differences across countries and how they affect the various countries’ responses to external shocks.

One study examines this question using a currency area model with different labor market frictions [11]. The authors show that the monetary authority acting optimally and in the interest of all countries (i.e. maximizing the total sum of all member countries’ aggregate utility) should choose the interest rate by taking into consideration the weighted average of the inflation and output gaps of all area members. Furthermore, monetary authorities should assign different weights to the countries depending on the strength of their labor market institutions. In particular, the authors find that the central monetary authority should assign higher weights to countries with higher labor market frictions, as their firms are more vulnerable to external shocks. Stabilizing the labor markets of more vulnerable countries also has positive reverse effects on the other area members. If, in response to external shocks, output falls more in vulnerable countries, their citizens will decrease their consumption demand of goods produced in the rest of the area. If this happens, exports of other area members will fall, with negative repercussions for their firms.

Finally, it should be noted that while a monetary authority can help smooth asymmetries in the transmission of shocks and their spillover effects in the short term, in the long term, it is advisable for a currency area that labor market reforms are implemented to reduce labor market frictions and to make countries’ labor markets more similar. These reforms should include the adoption of individual bargaining agreements as opposed to collective bargaining agreements. Such reforms, by changing the landscape of labor market negotiations, will render wages more flexible and help firms to cope with external shocks.

Limitations and gaps

While it is well understood that countries with stronger labor market institutions exhibit a comparative advantage in trade and are more resilient to external shocks, there is much less evidence on the extent of cross-country spillovers. This issue is particularly relevant for the monetary authority of a currency area. If the impact of external shocks in vulnerable countries does not significantly affect their demand for goods produced in the currency area, the central monetary authority might have less of an interest to take the economic conditions of those countries into account in its decisions.

Summary and policy advice

With an increasing level of trade and firms’ globalization, fluctuations in competitiveness, triggered by changes in the real exchange rates, increasingly affect job flows and employment volatility. As the latter increases, the risk of unemployment increases too, and this reduces the welfare of risk-averse workers. Furthermore, different countries feature different labor market institutions, which affect the impact of exchange rate fluctuations on employment and output volatility. Generally speaking, in countries with stronger labor market frictions, wages are not very responsive, while employment and job flows (hiring and firing) are very responsive to external shocks. Those countries are more vulnerable (have higher risk of unemployment and face larger output drops) in the face of unfavorable external shocks.

Against this background, the question of whether monetary policy should respond to exchange rate fluctuations demands prominence. Traditional theories of the optimal exchange rate regimes stress the beneficial property of flexible exchange rates, which, in the presence of rigid prices, help to insulate net exports from external shocks. On the other hand, it has been argued here that real exchange rate fluctuations increase employment and job flow volatility, and that this is detrimental to the welfare of risk-averse workers. The extent to which a monetary authority should smooth exchange rate fluctuations thus depends upon the balance of these two effects. In countries with weaker labor market institutions, the detrimental effect tends to prevail, and the benefits of targeting the exchange rate via policy are larger.

Even as countries decide to form or join a monetary union, they are exposed to external (to the currency area) shocks, and they react differently to them due to differences in their own labor market institutions. Asymmetries in labor market institutions among euro area countries are well documented. A central monetary authority that optimally sets the common interest rate should therefore take those differences into consideration. Research shows that when choosing the optimal common interest rate (so as to maximize the sum of welfare of all currency area members), the central authority should assign a larger weight to the business cycle fluctuations (inflation, output, or unemployment gaps) of countries which have weaker labor market institutions, and are hence more vulnerable to shocks. This recommendation is made stronger by the prevalence of negative spillover effects that more vulnerable countries would have on the rest of the currency area if they were exposed to external shocks without the stabilizing effects of monetary interventions. As their employment and output would fall more heavily in response to adverse shocks, their net imports from the rest of the area would also fall, thereby further reducing area-wide aggregate demand. To the greatest possible extent, this knock-on effect should be avoided.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Previous work of the author contains a larger number of background references for the material presented here and has been used intensively in all major parts of this article [9], [11].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Ester Faia